-

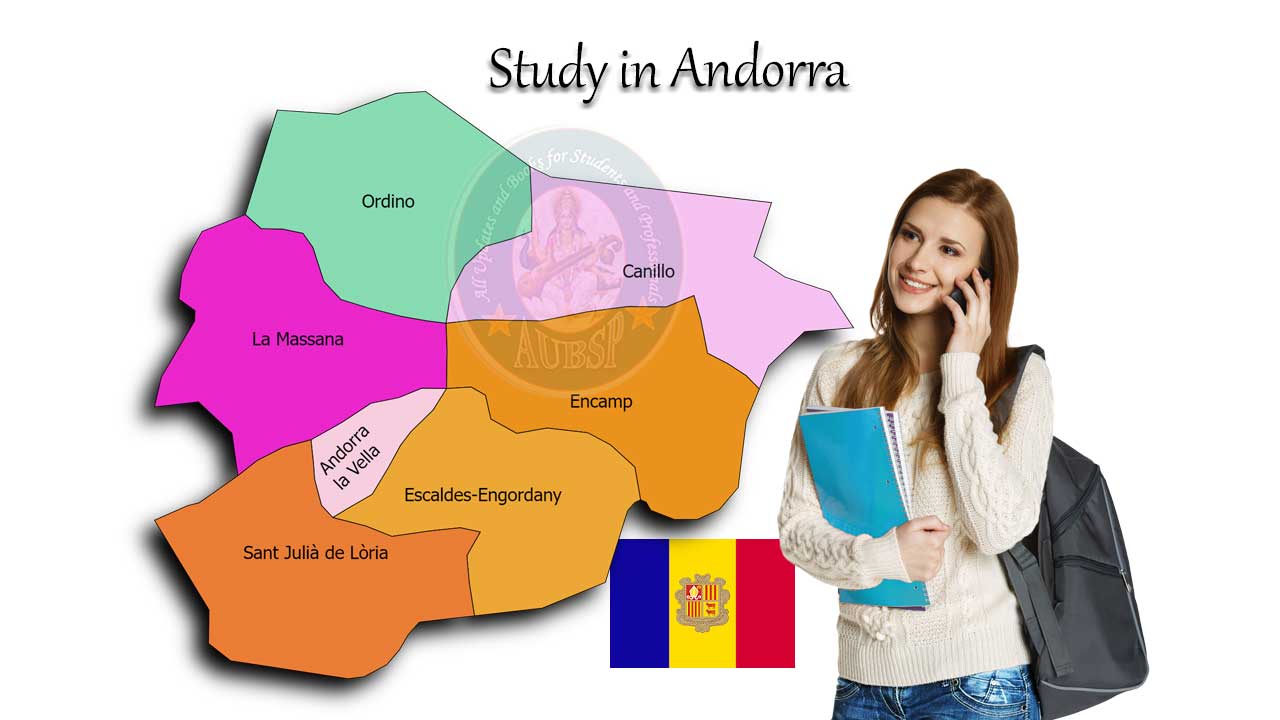

List of All Top Universities in Andorra to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Andorra with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Angola to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Angola with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Argentina to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Argentina with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Armenia to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Armenia with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Australia to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Australia with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Austria to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Austria with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Azerbaijan to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Azerbaijan with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Bahamas to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Bahamas with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Bahrain to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Bahrain with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Bangladesh to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Bangladesh with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.