-

List of All Top Universities in Belarus to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Belarus with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Belgium to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Belgium with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

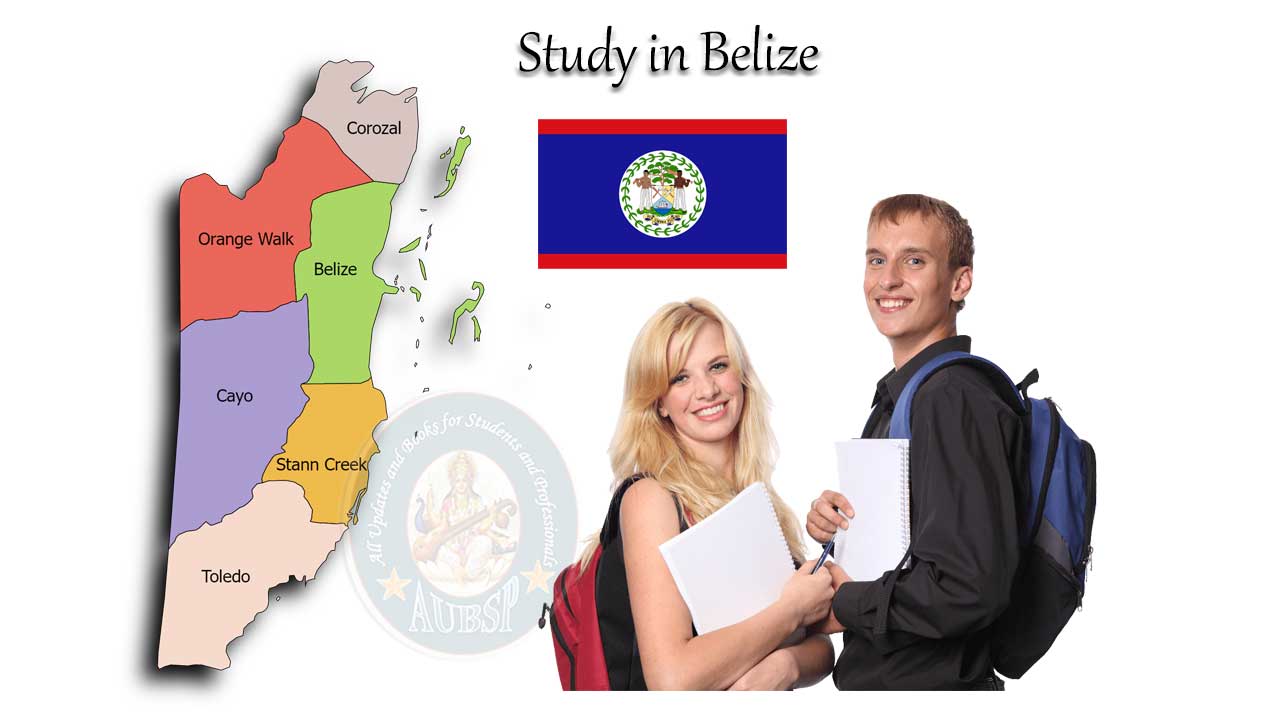

List of All Top Universities in Belize to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Belize with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Benin to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Benin with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

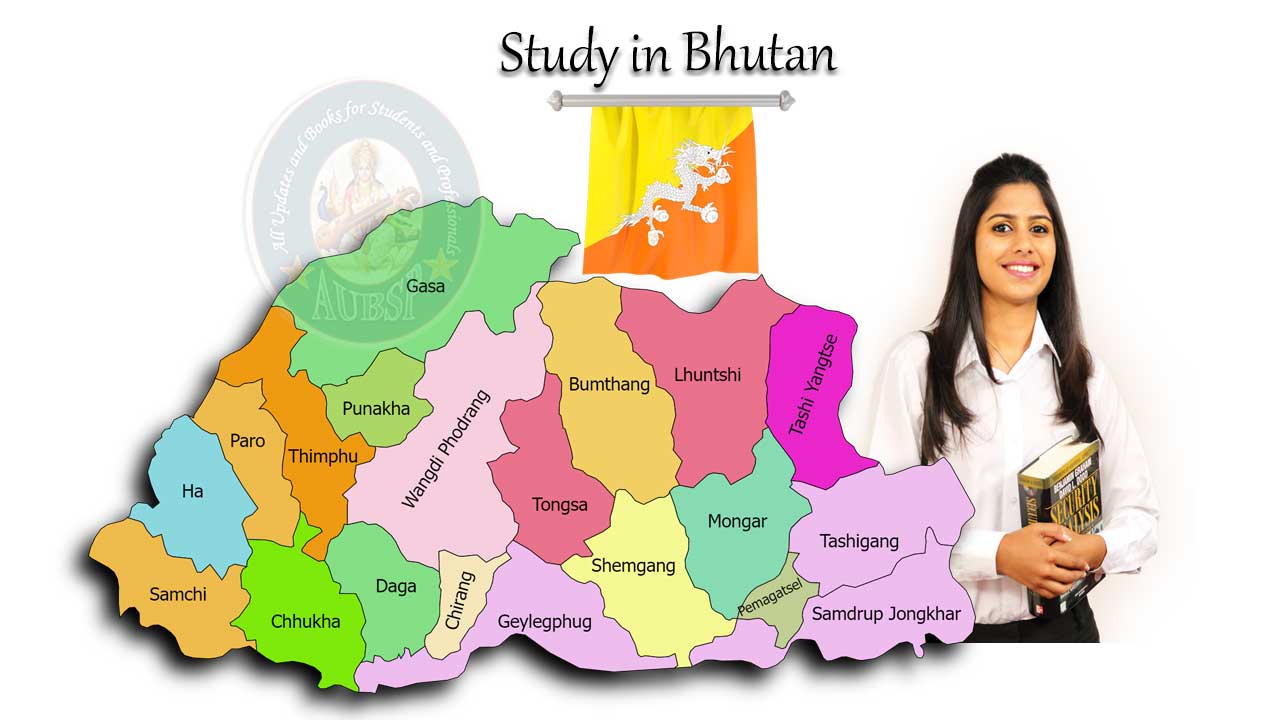

List of All Top Universities in Bhutan to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Bhutan with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Bolivia to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Bolivia with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Bosnia and Herzegovina to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Bosnia and Herzegovina with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Botswana to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Botswana with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Brazil to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Brazil with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Brunei to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Brunei with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Bulgaria to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Bulgaria with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.

-

List of All Top Universities in Burkina Faso to Study Abroad 2024: Admission, Syllabus, Exam, Result

Best School, Colleges and Universities to Study in Burkina Faso with Student visa, Curriculum, Scholarships, Course Fees, Job placement and Cost of living.