Financial aid offices streamline enrollment but rarely teach strategic borrowing. You don’t have to take the full loan amount offered—borrow only what you truly need. The “cost of attendance” is flexible, so cut living costs to reduce debt.

Before turning to private loans, explore cheaper education paths or work gaps. If your finances change, request a “Professional Judgment” review for better aid. After graduation, your loan servicer—not your school—controls repayment, so choose income-driven plans wisely. Avoid default by using deferment, forbearance, or consolidation, and always submit the FAFSA annually to stay eligible for aid and grants.

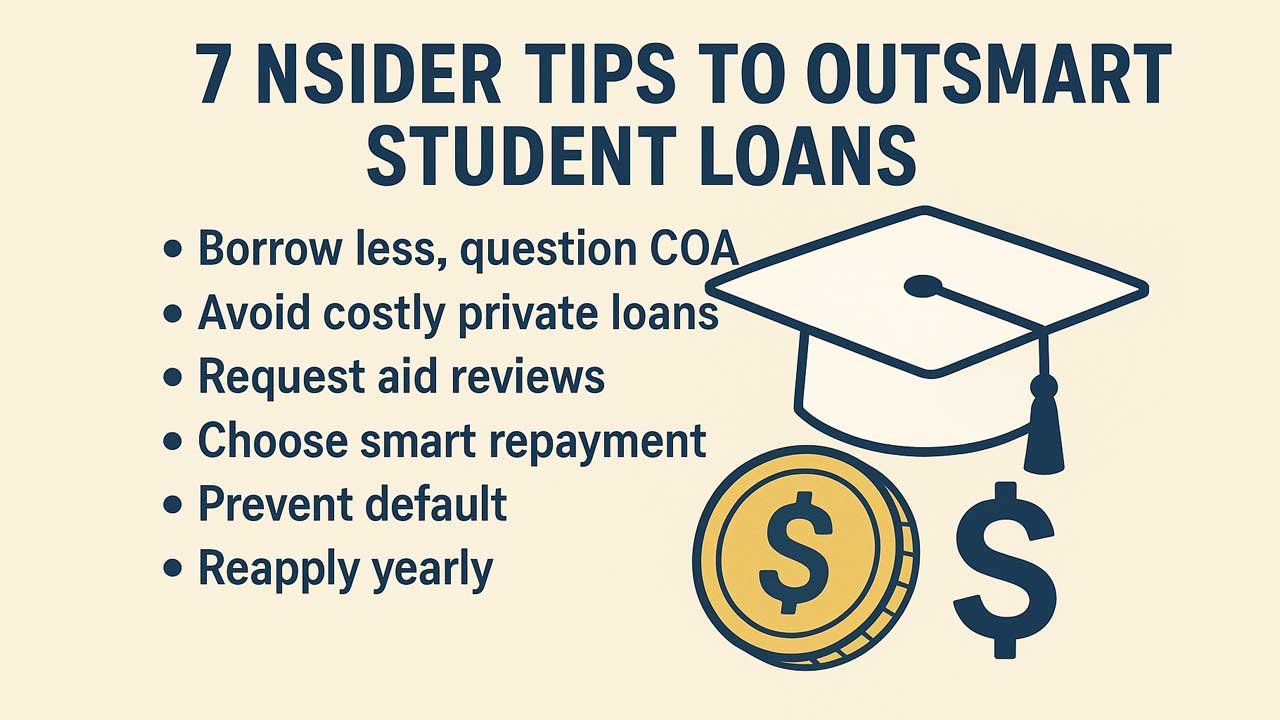

Unlocking the Real Financial Aid Playbook: Your Guide to Strategic Borrowing

The financial aid office plays a crucial role in managing the logistics of paying for college. However, their primary focus is often institutional efficiency and getting you enrolled. When it comes to student loans, their standard procedure may overlook critical, strategic moves that can save you tens of thousands of dollars and years of repayment.

This is the insider knowledge you need to become a proactive, informed borrower.

1. 🤯 You Don’t Have to Take the Full Amount Offered

Your financial aid award letter isn’t a bill for the loan amount; it’s an eligibility notification. It lists the maximum you are allowed to borrow in federal subsidized and unsubsidized loans.

- The Secret: The financial aid office automatically packages the maximum loan amount because it standardizes their process. They assume you need it, but every dollar you accept is a dollar you pay back with interest.

- The Power Move: Treat the loan amount as a line of credit, not a necessary expense. Calculate your true need by subtracting scholarships, grants, and your expected contribution from the actual cost (tuition, fees, and affordable room/board). Then, only accept that exact, lower amount.

- Actionable Tip: On the acceptance form, specify a dollar amount lower than the maximum. If you realize later in the semester you need more, you can often request the remaining funds up to your original eligibility limit.

2. 💰 The “Cost of Attendance” (COA) is Inherently Flexible

The COA is the figure your entire aid package is based on. It’s a sum of direct costs (tuition/fees) and indirect costs (books, living expenses, transportation).

- The Secret: The estimated “indirect” costs, particularly for living expenses, are often generous averages based on market rates, not frugal student spending. They are inflated to give students with minimal resources the highest possible borrowing capacity.

- The Power Move: Focus on aggressively minimizing your personal and living costs. If the COA estimates $3,000 for books and personal expenses, aim to spend $1,500. That $1,500 difference is $1,500 you don’t have to borrow. Live off-campus with roommates, buy used textbooks, or rent them.

- Context: If your actual necessary costs exceed the COA (e.g., you have a specific, higher childcare cost), you can appeal to the financial aid office to raise your COA, which may increase your loan eligibility or need-based aid.

3. 📉 Private Loans Are Not the Only Alternative to Federal Loans

When federal loan limits are exhausted, or the PLUS Loan is denied, the conversation often shifts immediately to private student loans. These loans lack the crucial protections of federal loans, such as Income-Driven Repayment (IDR) plans and loan forgiveness options.

- The Secret: The biggest, and best, alternative to expensive private debt is actually a strategic shift in your educational path that avoids debt altogether.

- The Power Move: Exhaust every non-loan option first:

- Community College Transfer: Complete your general education requirements at a fraction of the cost.

- Public University: Pivot to a lower-cost state school instead of a higher-cost private school.

- Gap Year/Part-Time Work: Take time to save money and work to pay the first year’s tuition out-of-pocket, significantly reducing the debt burden.

4. 🔄 You Can Always Ask for a “Professional Judgment” Review

If your family’s financial situation has changed significantly since you filed the FAFSA (e.g., job loss, severe medical bills, divorce/separation), the financial aid office has the authority, under federal rules, to use their “Professional Judgment” (PJ) to adjust the data on your FAFSA.

- The Secret: They rarely advertise this option, as it requires manual review and documentation. They will not initiate the process for you.

- The Power Move: Write a formal, concise appeal letter to the Director of Financial Aid. Clearly explain the change in circumstances and provide all necessary documentation (e.g., termination notice, letter from a doctor, court documents). A successful PJ review can dramatically lower your Expected Family Contribution (EFC) and potentially increase your grant and subsidized loan eligibility.

- Pro Tip: Frame the request around a change in untaxed income or assets that no longer exist, as these are the core factors they can adjust.

5. 🗓️ Your Servicer, Not the School, Dictates Your Repayment Life

The financial aid office is your contact while in school, but the moment you graduate or drop below half-time, your federal loan is assigned to a loan servicer (like MOHELA, Nelnet, etc.). This servicer is your true long-term financial partner—or adversary.

- The Secret: The servicer’s goal is to keep you in repayment with the least amount of administrative effort. They may steer you toward the standard 10-year plan, even if an Income-Driven Repayment (IDR) plan is a better fit for your post-graduation salary.

- The Power Move: Do your own research on Federal Student Aid’s website. If your income is low relative to your debt, an IDR plan like SAVE (Saving on a Valuable Education) can cut your monthly payments substantially, potentially lowering them to $0, and provides a path to forgiveness. Do not accept the servicer’s first suggestion.

6. 🛑 Default is a Nuclear Option with Alternatives

Defaulting on a federal loan is devastating—it can lead to wage garnishment, tax refund seizure, and a permanent destruction of your credit score.

- The Secret: There are multiple forbearance and deferment options that can temporarily stop or reduce your payments before you default, and the servicer is required to offer them if you qualify.

- The Power Move: If you’ve lost your job, immediately contact your servicer and request an Unemployment Deferment (if you qualify) or an Economic Hardship Forbearance. Crucially, you can also consolidate your loans and select an IDR plan which can immediately set your payment to $0 if your income is low enough—this is often the best alternative to forbearance.

- Warning: Interest usually accrues during forbearance and deferment, so use them only as a temporary safety net, not a long-term strategy.

7. 🎁 You Should Apply for Aid Every Single Year

Many upperclassmen assume their financial aid award will carry over or that they no longer qualify, leading them to skip the annual FAFSA (Free Application for Federal Student Aid).

- The Secret: Financial aid eligibility is determined annually based on the previous year’s tax data. Skipping the FAFSA means automatically forfeiting your access to grants (free money) and federal subsidized loans for that academic year.

- The Power Move: Commit to submitting the FAFSA every single year you are enrolled. Your family’s income or asset picture might change, and the formulas may shift in your favor. Furthermore, many state and institutional scholarships require a current FAFSA to maintain eligibility.

The Real Goal: Becoming a Strategic Debt Manager

The financial aid office is an access point, but you are the owner of your future debt. By understanding these seven secrets and using these power moves, you shift control from the institution to yourself, ensuring that your education is an investment, not a burden.

Template: Professional Judgment Appeal Letter

This letter should be submitted to the Director of Financial Aid or the designated appeals officer at your university.

[Your Name]

[Your Student ID Number]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

Director of Financial Aid

[Name of University/College]

[Financial Aid Office Address]

Subject: Formal Request for Professional Judgment Review – [Student’s Full Name], ID #[Student ID Number] – Change in Financial Circumstances

Dear Director [Director’s Last Name, or Financial Aid Office],

I am writing to formally request a Professional Judgment (PJ) review of my Free Application for Federal Student Aid (FAFSA) for the [Academic Year, e.g., 2026-2027] academic year.

The financial data reported on the FAFSA does not accurately reflect our current or projected ability to contribute to my education, as a significant and sustained change in financial circumstances has occurred since the tax year used for the application.

I. Description of Circumstance Change

The adverse change in our financial situation is due to [Choose the most accurate category and delete the others]:

- [CATEGORY 1: Loss of Income/Employment] My parent/guardian, [Parent’s Full Name], experienced an involuntary loss of employment/reduction in work hours beginning [Date]. [He/She/They] lost [Job Title/Company] and the resulting income reduction is substantial and anticipated to be long-term.

- [CATEGORY 2: Medical/Dental Expenses] Our family incurred significant out-of-pocket medical expenses that were not covered by insurance. The total unexpected and unreimbursed cost was approximately [$ Amount], which has severely depleted our liquid assets and income.

- [CATEGORY 3: Separation/Divorce] My parents separated/divorced on [Date]. The resulting change in household structure and income support is not reflected on the current FAFSA.

- [CATEGORY 4: Death or Disability] The primary wage earner, [Parent’s Full Name], passed away/became permanently disabled on [Date], resulting in the immediate loss of [$ Amount] of annual income.

II. Financial Impact

The actual income earned in the previous tax year (used on the FAFSA) was [$ Amount]. Due to the circumstance outlined above, our projected current (or most recent 12-month) income is estimated to be [$ Projected New Annual Amount].

This represents a projected income reduction of approximately [Calculate the percentage or dollar difference].

III. Requested Adjustment

I respectfully request that your office use its discretion and Professional Judgment authority to adjust my FAFSA data based on our new, lower projected income figures for the [Current Year] calendar year. This adjustment is vital for accurately assessing our financial need and eligibility for need-based grants, scholarships, and subsidized federal loans.

IV. Attached Documentation

Please find the following documentation enclosed to verify this change in circumstance:

- [Relevant Document, e.g., Termination Letter, Layoff Notice, or Severance Letter]

- [Relevant Document, e.g., Signed letter from parent’s former employer confirming loss of income/hours]

- [Relevant Document, e.g., Parent’s most recent pay stubs (past 3 months)]

- [Relevant Document, e.g., Copies of unreimbursed medical/dental bills]

- [Relevant Document, e.g., Final Divorce/Separation Decree]

Thank you for your time, consideration, and careful review of my appeal. I am prepared to provide any additional documentation required to complete this process promptly.

Sincerely,

[Your Signature]

[Your Typed Full Name]

💡 Quick Tips for Your Appeal

- Be Professional and Concise: Stick to the facts, dates, and dollar amounts. Do not include excessive emotional language.

- Follow Up: Call the financial aid office a week after submission to ensure they received the letter and documents and to ask about the timeline for review.

- Use the Right Year: Make sure your appeal focuses on the disparity between the tax year used on the FAFSA and your current/projected year financial reality.

Leave a Reply

You must be logged in to post a comment.