BCom in Business Technology Management: A Gateway to Digital Leadership and Tech-Driven Business Careers

Why Study Sustainable Business? Courses, Jobs, and Global Demand

March 2026 Edition Updated Corporate Law Book PDF

GST Book PDF March 2026: Download Updated GST Law eBook New Edition

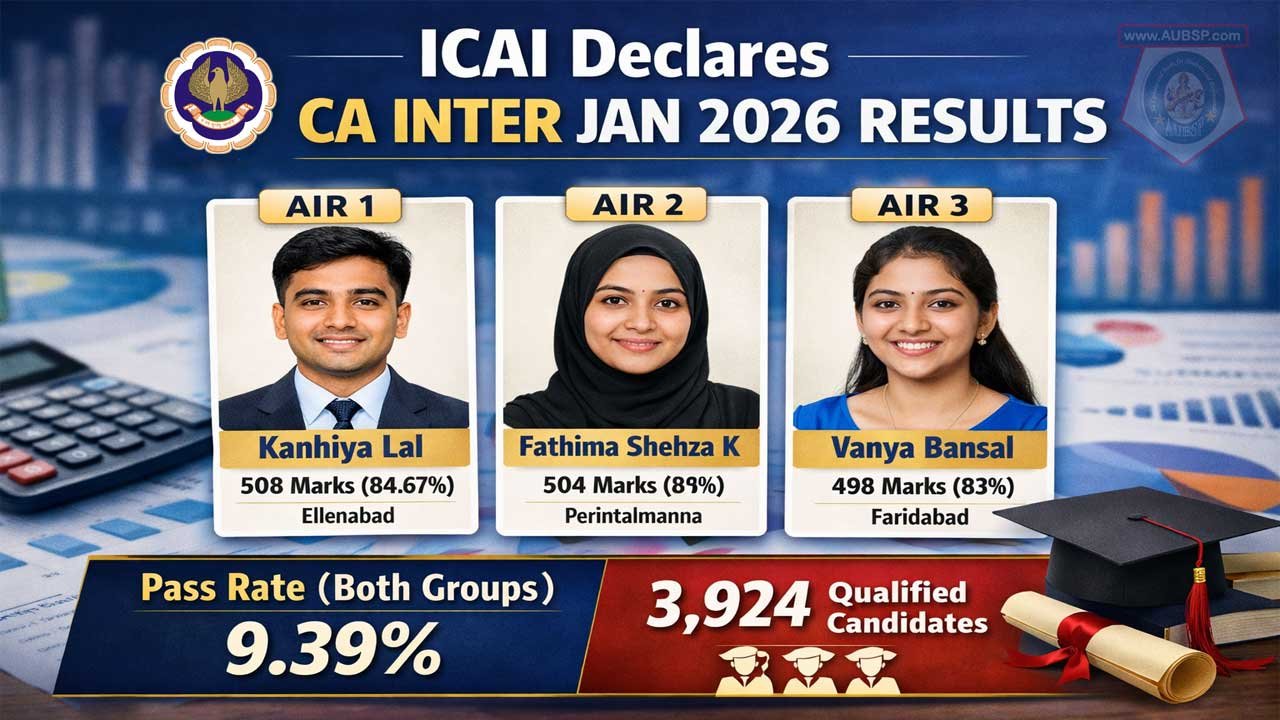

ICAI Announces CA Inter Jan 2026 Results; Kanhiya Lal, Fathima Shehza K, Vanya Bansal Top

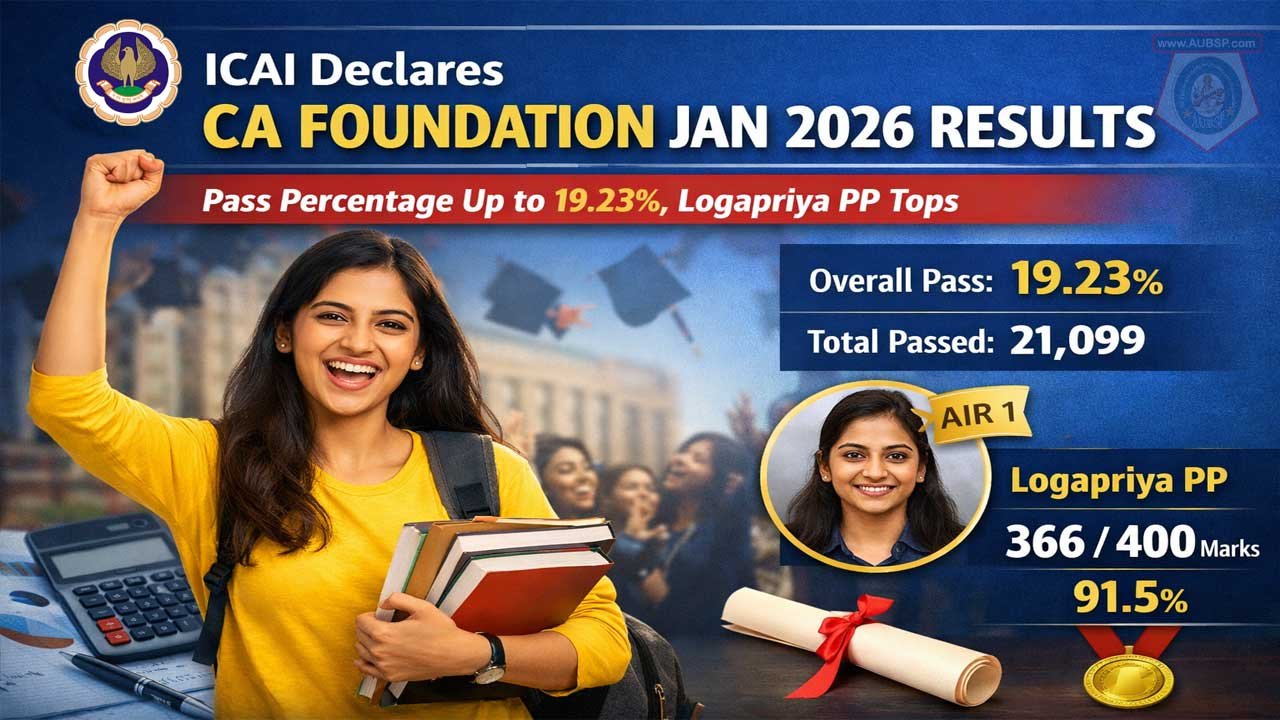

ICAI Declares CA Foundation Jan 2026 Results; Pass Percentage Rises to 19.23%, Logapriya PP Tops

BBIE Degree: The New Global Pathway for Innovation and Entrepreneurial Leaders

Bachelor of Business in Healthcare Management (BBHM): Complete Guide to Course, Universities, Admission, and Career Opportunities

Bachelor of Business in Supply Chain and Logistics (BBSCL): Building Careers in Global Trade and Logistics

BBIB Degree Guide: Curriculum, Global Careers, Top Universities & Opportunities

Global Demand Rises for Bachelor of Business in Sports Management as Sports Industry Becomes a High-Tech Business Sector

BBDM Degree Gains Global Demand as Digital Marketing Skills Drive Careers in 2026

Types of Loans in India (2026): Complete Guide to Personal, Home, Business & Gold Loans

Looking for a loan in India? Explore the various types of loan options available and find the best fit for your financial needs.

Cheapest Car Insurance for College Students in 2026: Best Rates & Discounts

Student Credit Cards 2026: How to Build Excellent Credit from Zero (Global Guide)

AI Wealth Management in 2026: The Best Robo-Advisors, Stock Pickers, and Finance Tools

Top 7 Agentic AI Tools for Automated Savings & Money Management in 2026

ICAR–IARI Announces Walk-in Interview for Young Professional-II Post at Water Technology Centre

ICAR–IARI WTC, New Delhi invites applications for one Young Professional-II post via walk-in interview on 18 March 2026, offering ₹42,000 monthly salary.

Assam Rifles Public School Jalukie Recruitment 2026–27: TGT English, TGT Maths & IT Teacher Vacancies

GAIL Director (Projects) Recruitment 2026: PESB Board-Level Vacancy, Eligibility, Salary & Apply Online

Central Bank of India SO Recruitment 2026: Apply Online for Specialist Officer Posts

NPCIL Trade Apprentice Recruitment 2026: 245 ITI Vacancies at Rawatbhata Rajasthan – Apply Before March 18

Kalyan Singh Super-Specialty Cancer Institute CMO Recruitment 2026: SC MBBS Doctors Apply by March 31 | Salary ₹56,100

TG ICET 2026 Registration Open: Dates, Eligibility, Fees, Exam Pattern & How to Apply Online

TG ICET 2026 registration is open for MBA & MCA admissions. Apply by March 16 without late fee. Exam on May 13–14; check eligibility, fees & pattern.

MAH MCA CET 2026 Registration Extended to Feb 18: Dates, Eligibility, Exam Pattern & Top Colleges

AFCAT 1 Admit Card 2026 Released: Download Link, Exam Date, Dress Code & Cut-Off Strategy

JEECUP 2026 Online Application Form: Complete Guide to Polytechnic Admission in Uttar Pradesh

GATE 2026 Admit Card Released: Download Hall Ticket Now

JEE Main Admit Card 2026: Release Date, City Intimation Slip, Download Steps & Exam Day Guidelines

Institute of Advanced Research (IAR), Gandhinagar: Courses, Fees, Research & Placements

Institute of Advanced Research (IAR), Gandhinagar is a UGC-recognized private research university known for affordable fees, strong research, and global collaborations.

The Chicago School of Professional Psychology: Accredited, Practitioner-Focused Psychology Education

Fielding Graduate University: Accredited Distributed Learning for Working Professionals

Charles R. Drew University of Medicine and Science: Advancing Health Equity in South Los Angeles

The Master’s University: Christ-Centered Education Rooted in Scripture

ICAI Announces CA Inter Jan 2026 Results; Kanhiya Lal, Fathima Shehza K, Vanya Bansal Top

Institute of Chartered Accountants of India declared the CA Inter Jan 2026 results. Kanhiya Lal topped with 508 marks; overall pass rate for both groups stands at 9.39%.

ICAI Declares CA Foundation Jan 2026 Results; Pass Percentage Rises to 19.23%, Logapriya PP Tops

ICAI CA Final January 2026 Result Date Announced: Mark Your Calendars for March 1st

ICAI Observer Empanelment for May 2026 CA Exams

CMA Inter Result Dec 2025 घोषित: ICMAI Intermediate Results Out at icmai.in, Check Toppers & Passing Criteria

ICMAI CMA Final Dec 2025 Result Declared: AIR 1 Md Faizan Tops, Check Scorecard at icmai.in

March 2026 Edition Updated Corporate Law Book PDF

Download the March 2026 Edition of Company Law Book PDF with all Acts, Rules and Schedules. Get the Corporate Law eBook for ₹799. Ideal for CA, CS, CMA professionals and students.

GST Book PDF March 2026: Download Updated GST Law eBook New Edition

Who is Required to Help GST Officers? Understanding CGST Section 72

Knock, Knock: What Happens When the GST Department Uses Section 71?

The Enduring Power of Print: Why GST Professionals Still Prefer Physical Books Over PDFs in 2026

GST 2.0: The Era of Automated Compliance & “Zero-Tolerance” Audits