The Complete Guide to Bachelor of Arts in Economics (BAEcon): International Career Blueprint for 2026

The Bachelor of Arts in Economics (BAEcon) is a high-ROI, globally respected undergraduate degree that blends economic theory, policy analysis, and interdisciplinary learning to prepare graduates for diverse international careers in finance, consulting, government, and industry.

Offering lifetime returns exceeding 1,700% and strong starting salaries across North America, Europe, and Asia-Pacific, the BA Economics emphasizes critical thinking and real-world application over heavy mathematics, distinguishing it from the more quantitative BSc Economics.

With a flexible curriculum, strong pathways to graduate study (MBA, MA Economics, public policy, law), and excellent employability from top global universities, BAEcon remains one of the most strategic and future-proof degree choices for students seeking analytical rigor, career mobility, and long-term earning potential in 2026.

Why BA Economics Remains One of the Highest-ROI Degrees in 2026

The Bachelor of Arts in Economics (BAEcon) has emerged as a premier undergraduate degree for students seeking analytical rigor combined with career flexibility in an increasingly data-driven global economy. With economics degrees delivering a lifetime ROI of 1,707.80%—surpassing most business and STEM programs—BA Economics graduates command starting salaries ranging from $45,000 to $76,000 internationally, with senior professionals earning well into six figures.

This comprehensive guide examines the BAEcon degree through an international lens, providing actionable insights for prospective students evaluating programs, comparing alternatives, and planning lucrative career trajectories across global markets.

What Is a Bachelor of Arts in Economics (BAEcon)?

A Bachelor of Arts in Economics is an undergraduate liberal arts degree that examines resource allocation, market behavior, and policy impacts through theoretical and qualitative frameworks. Unlike the BSc Economics, which emphasizes mathematical modeling and statistical techniques, the BA Economics integrates economic theory with humanities and social sciences, creating versatile graduates prepared for diverse professional pathways.

Core Program Structure

The typical BA Economics curriculum spans three years (six semesters) and comprises:

- 14 compulsory core subjects covering microeconomics, macroeconomics, econometrics, and economic history

- 4 discipline-specific electives (DSEs) in specialized areas like international trade, public policy, or financial economics

- Skill enhancement courses in data analysis, communication, and research methodology

The degree emphasizes critical thinking, policy analysis, and interdisciplinary understanding—skills that distinguish BA Economics graduates in consulting, government, and non-profit sectors.

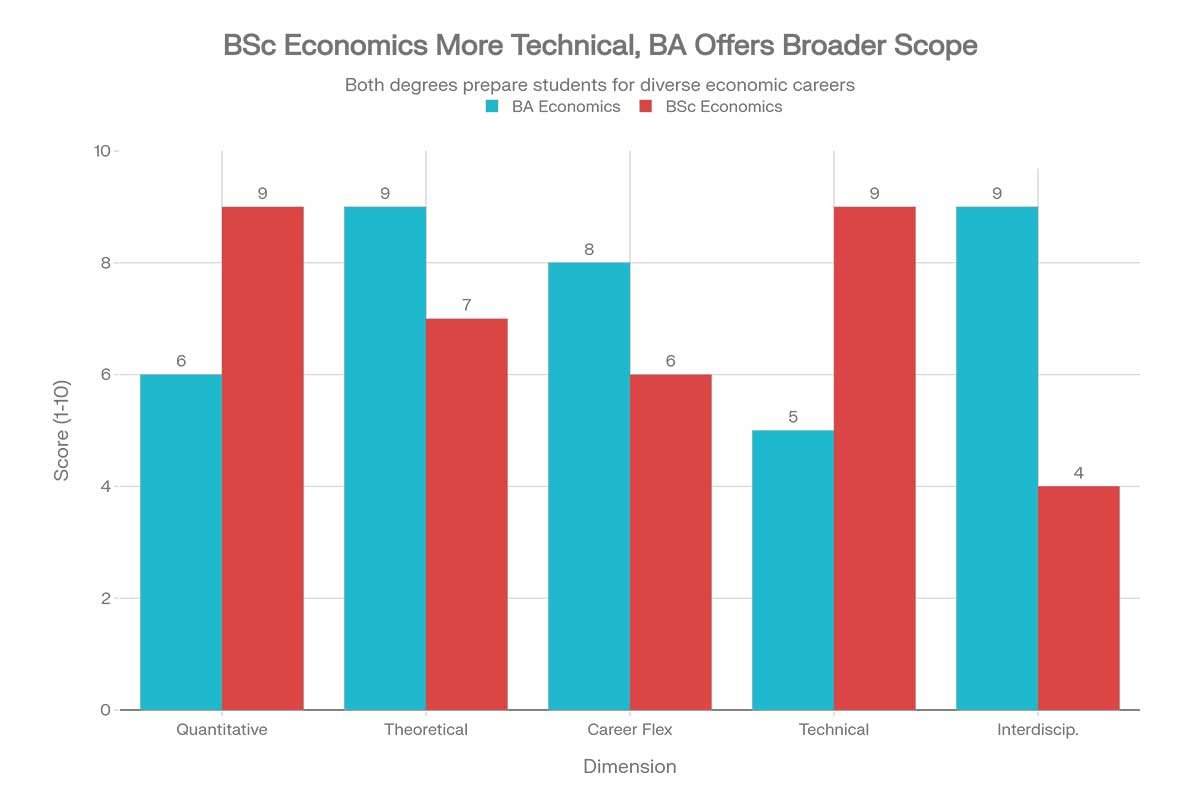

BA Economics vs BSc Economics: Strategic Differences

Choosing between BA and BSc Economics represents a critical decision that shapes career trajectory, skill development, and graduate school preparedness. The distinction extends beyond degree nomenclature to fundamentally different educational philosophies and outcomes.

Program Focus Comparison

BA Economics vs BSc Economics: Program Focus Comparison

BA Economics emphasizes theoretical frameworks, qualitative analysis, and policy applications. Students explore economic history, political economy, and development economics while developing strong communication and critical thinking skills. This approach suits careers in public policy, economic journalism, and management consulting.

BSc Economics prioritizes quantitative methods, mathematical modeling, and statistical techniques. The curriculum includes advanced calculus, linear algebra, and econometrics, preparing graduates for technical roles in data analysis, financial modeling, and specialized economic research.

Curriculum Distinctions

| Dimension | BA Economics | BSc Economics |

|---|---|---|

| Quantitative Focus | Moderate (statistics, basic econometrics) | Intensive (advanced calculus, mathematical economics) |

| Core Subjects | Economic History, Political Economy, Development Economics, International Economics | Mathematical Economics, Advanced Econometrics, Statistical Methods, Financial Economics |

| Elective Options | Humanities, social sciences, international relations | Advanced mathematics, computer science, business analytics |

| Skill Development | Policy analysis, qualitative research, interdisciplinary thinking | Data modeling, statistical programming, technical problem-solving |

| Ideal For | Policy roles, consulting, journalism, interdisciplinary graduate study | Data science, finance, technical research, PhD in economics |

Career Path Implications

BA Economics graduates excel in roles requiring big-picture thinking and stakeholder communication—economic consultants, policy analysts, and business strategists. BSc graduates dominate quantitative fields like financial risk analysis, econometrics, and data science.

Strategic Recommendation: Students with strong mathematical aptitude targeting finance or data careers should consider BSc Economics. Those seeking versatility, policy influence, or graduate study in law, public policy, or business should pursue BA Economics.

Global Curriculum Standards: What You’ll Study

International BA Economics programs follow broadly similar structures while allowing regional specialization. The curriculum develops progressively from foundational principles to advanced applications.

First Year: Foundational Principles

- Introductory Microeconomics: Consumer behavior, production theory, market structures

- Introductory Macroeconomics: National income, monetary policy, fiscal frameworks

- Mathematical Methods: Differential calculus, optimization, basic game theory

- Data Analysis: Statistical fundamentals and economic data interpretation

Second Year: Intermediate Theory

- Intermediate Microeconomics: Advanced consumer theory, general equilibrium, welfare economics

- Intermediate Macroeconomics: Economic growth models, business cycles, monetary theory

- Econometrics: Regression analysis, hypothesis testing, model specification

- Public Economics: Taxation, public goods, government intervention

Third Year: Specialization & Application

- Development Economics: Growth strategies, poverty analysis, institutional economics

- International Economics: Trade theory, exchange rates, global financial systems

- Discipline-Specific Electives: Students choose from options like:

- Environmental Economics

- Financial Economics

- Political Economy

- Health Economics

- Applied Econometrics

Skill Enhancement Components

Modern programs integrate skill enhancement courses (SECs) focusing on:

- Statistical software (R, Stata, Python)

- Research methodology and dissertation writing

- Professional communication and presentation

- E-governance and digital economy applications

Top International Universities for BA Economics (2026 Rankings)

Global employers recognize specific institutions for economics excellence. These universities combine rigorous academics with powerful alumni networks and recruitment pipelines.

Tier 1: Elite Global Programs

| University | Region | Key Strengths | Estimated Annual Cost |

|---|---|---|---|

| Massachusetts Institute of Technology (MIT) | USA | Premier quantitative economics, strong research focus, exceptional employability | $55,000-$60,000 |

| Harvard University | USA | Unmatched faculty reputation, interdisciplinary opportunities, global finance recruitment | $55,000-$60,000 |

| Stanford University | USA | Economics + data science + tech integration, Silicon Valley connections | $56,000-$61,000 |

| University of Cambridge | UK | Classical economics tradition, strong policy focus, excellent graduate prospects | $35,000-$40,000 |

| University of Oxford | UK | Economics & Politics combination, tutorial system, prestigious brand | $35,000-$40,000 |

| London School of Economics (LSE) | UK | Specialist social sciences, London finance proximity, international student body | $30,000-$35,000 |

Tier 2: Excellent Value & Specialization

- University of California, Berkeley: Top public university economics program, strong research culture, West Coast finance access

- Columbia University: NYC location advantage, business economics integration, consulting recruitment

- National University of Singapore (NUS): Asia-Pacific economic perspective, strong government and corporate ties, excellent ROI

- Australian National University (ANU): Research-intensive, Asia-Pacific focus, high quality of life

- Bocconi University (Italy): Economics + management track, continental European reputation, strong finance placement

Regional Excellence

Europe: Erasmus University Rotterdam, University of Warwick, Catholic University of Leuven offer strong economics training with lower tuition costs than US/UK peers.

Asia-Pacific: NUS, University of Tokyo, and University of Melbourne provide world-class economics education with regional market expertise.

Selection Strategy: Prioritize universities with strong employer reputation, active alumni networks in your target industry, and locations aligning with your geographic career goals.

Career Prospects & Salary Analysis: International Market Data

BA Economics graduates access diverse, high-paying career pathways across sectors. The degree’s versatility explains its strong ROI and persistent employer demand.

Core Employment Sectors

Financial Services & Banking

- Investment Analyst: Analyze market trends, evaluate securities, recommend investment strategies

- Financial Risk Analyst: Assess portfolio risks, develop mitigation strategies, regulatory compliance

- Commercial Banker: Manage corporate relationships, structure loans, evaluate creditworthiness

Consulting & Advisory

- Economic Consultant: Provide policy impact analysis, market entry strategy, regulatory assessment

- Management Consultant: Apply economic frameworks to business problems, optimize operations, strategic planning

- Market Research Analyst: Study consumer behavior, forecast demand, competitive intelligence

Public Sector & Policy

- Public Policy Analyst: Evaluate government programs, assess policy alternatives, legislative analysis

- International Development Specialist: Design aid programs, monitor economic outcomes, stakeholder coordination

- Central Bank Researcher: Monetary policy analysis, economic forecasting, financial stability assessment

Corporate & Industry

- Business Strategist: Competitive analysis, market positioning, growth strategy development

- Data Analyst: Economic data interpretation, business intelligence, performance metrics

- Operations Manager: Supply chain optimization, cost analysis, process improvement

International Salary Benchmarks

Salary prospects vary significantly by geography, experience, and sector. North America offers the highest compensation, while Asia-Pacific and Western Europe provide strong earning potential with different lifestyle considerations.

Entry-Level Salaries (0-2 years experience)

| Region | Average Starting Salary | Top Employers |

|---|---|---|

| North America | $55,000 – $75,000 | Goldman Sachs, McKinsey, Federal Reserve, Deloitte |

| Western Europe | €35,000 – €50,000 | ECB, OECD, Big Four, major banks |

| Asia-Pacific | $40,000 – $60,000 | DBS, UBS, Singapore government, MNC regional offices |

| UK | £28,000 – £40,000 | Bank of England, LSE-affiliated think tanks, consulting firms |

Mid-Career Salaries (5-10 years experience)

- Financial Analyst: $76,000 – $120,000 (median $76,000)

- Economic Consultant: $65,000 – $110,000

- Policy Analyst: $60,000 – $95,000

- Senior Data Analyst: $70,000 – $105,000

Senior-Level Compensation (10+ years)

Senior economists in North America earn average annual salaries of $112,164, with private sector roles commanding premiums up to 47% above academic positions. Senior management in industry can exceed $190,000 annually, particularly in the US market.

Gender Salary Analysis

International data reveals persistent gaps: 32% of female economics graduates earn between INR 1,92,121 – 8,94,397 ($2,300 – $10,700), while 68% of male graduates earn INR 2,22,844 – 10,02,882 ($2,700 – $12,000) in Indian markets. Western markets show similar proportional disparities, emphasizing the importance of negotiation skills and transparent compensation practices.

Return on Investment (ROI): The Economics Degree Advantage

Economics degrees deliver exceptional financial returns, ranking among the highest-ROI undergraduate programs globally. The comprehensive ROI analysis incorporates tuition costs, forgone earnings, and lifetime earnings premiums.

Lifetime ROI by Major

| Degree Major | Lifetime ROI | Payback Period |

|---|---|---|

| Finance | 1,842.38% | 5 years |

| Computer Science | 1,752.59% | 5 years |

| Computer Engineering | 1,743.81% | 5 years |

| Economics | 1,707.80% | 5-6 years |

| Chemical Engineering | 1,226.32% | 7 years |

| Accounting | 1,286.62% | 7 years |

| Business (General) | 1,033.41% | 8 years |

Economics vs. Liberal Arts ROI

Economics dramatically outperforms traditional liberal arts degrees. While English degrees yield 208.23% ROI over 22 years, and education degrees show negative ROI (-55.43%), economics degrees generate positive returns within 5-6 years and exceed 1,700% lifetime returns.

Geographical ROI Variations

North America: Highest absolute returns due to salary levels, though tuition costs are substantial. ROI remains strong despite $200,000+ total degree costs.

Europe: Lower tuition (especially continental Europe) combined with strong salaries creates excellent ROI. UK programs offer similar ROI to US programs at lower cost.

Asia-Pacific: Emerging as high-ROI destinations with quality programs at competitive tuition rates and growing salary levels in financial hubs.

Break-Even Analysis

The average economics degree pays for itself after 5-6 years in the workforce. Graduates entering high-paying finance or consulting roles can achieve break-even in 3-4 years, while public sector roles may extend to 7-8 years.

Advanced Career Pathways & Further Education

BA Economics provides a versatile foundation for graduate study and specialized career tracks.

Graduate Study Options

Master of Arts (MA) in Economics: Deepens theoretical knowledge and research skills, essential for academic careers and senior policy roles.

Master of Business Administration (MBA): Most popular progression, combining economics analytical rigor with management training. MBA graduates access C-suite pipelines and entrepreneur finance.

Master of Finance / Financial Economics: Specialized quantitative training for investment banking, asset management, and fintech roles.

Public Policy (MPP): Ideal for government, NGO, and international organization careers focusing on program design and evaluation.

Law (LLB): Economics + law combination creates powerful corporate law, regulatory, and antitrust career opportunities.

Professional Certifications

- Chartered Financial Analyst (CFA): Gold standard for investment management

- Financial Risk Manager (FRM): Specialized risk management credential

- Certified Business Analysis Professional (CBAP): Consulting and strategy roles

- Data Science Certifications: Python, R, machine learning for analytics roles

Entrepreneurship & Startups

Economics graduates increasingly launch ventures, applying market analysis and strategic thinking to identify opportunities and secure funding. The degree’s analytical framework proves invaluable for business model validation and financial planning.

Maximizing Your BA Economics Experience: Strategic Recommendations

During Your Degree

- Develop Quantitative Complement: Take additional statistics, programming, or data science courses to enhance technical capabilities without sacrificing BA’s breadth.

- Intern Strategically: Target internships in your desired sector—banking for finance, think tanks for policy, consulting firms for strategy. Multiple internships significantly improve graduate employment outcomes.

- Build Analytical Portfolio: Complete research projects, econometric analyses, or policy papers that demonstrate applied skills to employers.

- Network Actively: Join economics societies, attend guest lectures, and connect with alumni in target industries. LSE, Harvard, and Stanford alumni networks provide exceptional career access.

- Master Statistical Software: Proficiency in R, Stata, or Python separates candidates in competitive job markets.

Post-Graduation Strategy

- Geographic Arbitrage: Consider starting careers in high-salary markets (US, UK, Singapore) before transitioning to other regions with savings and experience.

- Sector Selection: Finance and consulting offer highest starting salaries, while public policy and international development provide meaningful work with moderate pay.

- Continuous Learning: Economics evolves rapidly. Stay current with fintech, behavioral economics, and data analytics trends through professional development.

- Brand Building: Publish analyses on LinkedIn, contribute to policy blogs, or speak at conferences to establish thought leadership.

Frequently Asked Questions (FAQ)

Q: What is the main difference between BA Economics and BSc Economics?

A: BA Economics emphasizes theoretical frameworks, policy analysis, and qualitative understanding through a liberal arts approach. BSc Economics focuses on quantitative methods, mathematical modeling, and statistical techniques. BA offers broader career flexibility; BSc provides deeper technical specialization.

Q: Which is better for investment banking: BA or BSc Economics?

A: Both can lead to investment banking, but BSc may provide a slight advantage for quantitative roles. However, BA Economics from a top-tier university (Harvard, LSE, Oxford) with strong internships and modeling skills can be equally competitive.

Q: What is the average salary for BA Economics graduates internationally?

A: Entry-level salaries range from $45,000-$75,000 in North America, €35,000-€50,000 in Western Europe, and $40,000-$60,000 in Asia-Pacific. Senior economists can earn $112,000+ annually.

Q: Is BA Economics worth the investment?

A: Absolutely. Economics degrees deliver 1,707.80% lifetime ROI, paying for themselves within 5-6 years. The degree’s versatility and analytical rigor provide exceptional career flexibility and earning potential.

Q: Can I do an MBA after BA Economics?

A: Yes, BA Economics provides an excellent foundation for MBA programs. Many top MBA students have economics backgrounds, and the analytical skills are highly valued in business school admissions.

Q: What jobs can I get with a BA Economics degree?

A: Career options include investment analyst, economic consultant, policy analyst, data analyst, management consultant, financial risk analyst, and business strategist across finance, consulting, government, and corporate sectors.

Q: Which country is best for studying BA Economics?

A: The US and UK host the highest-ranked programs (MIT, Harvard, LSE, Oxford). For value, consider continental European universities or Asia-Pacific institutions like NUS. Choose based on career goals, budget, and desired location.

Q: Do I need advanced math for BA Economics?

A: BA Economics requires basic calculus and statistics but less intensive mathematics than BSc. Programs typically include mathematical methods courses to build necessary quantitative skills.

Q: How competitive is admissions to top BA Economics programs?

A: Extremely competitive. Top programs (MIT, Harvard, LSE, Oxford) require exceptional academic records, standardized test scores, and demonstrated analytical aptitude. Strong quantitative background and extracurricular leadership improve chances.

Q: What is the difference in curriculum between US and UK BA Economics programs?

A: US programs typically offer broader general education plus major requirements over four years. UK programs focus intensely on economics over three years with fewer electives outside the discipline. Both provide excellent economics training but differ in breadth versus depth approaches.

Leave a Reply

You must be logged in to post a comment.