Current Scheme: ICAI New Scheme of Education and Training

If you are preparing for the CA Intermediate exams in January, May, or September 2026, you will be tested under the New Scheme introduced by the ICAI. This curriculum focuses on international standards, technology, and practical application.

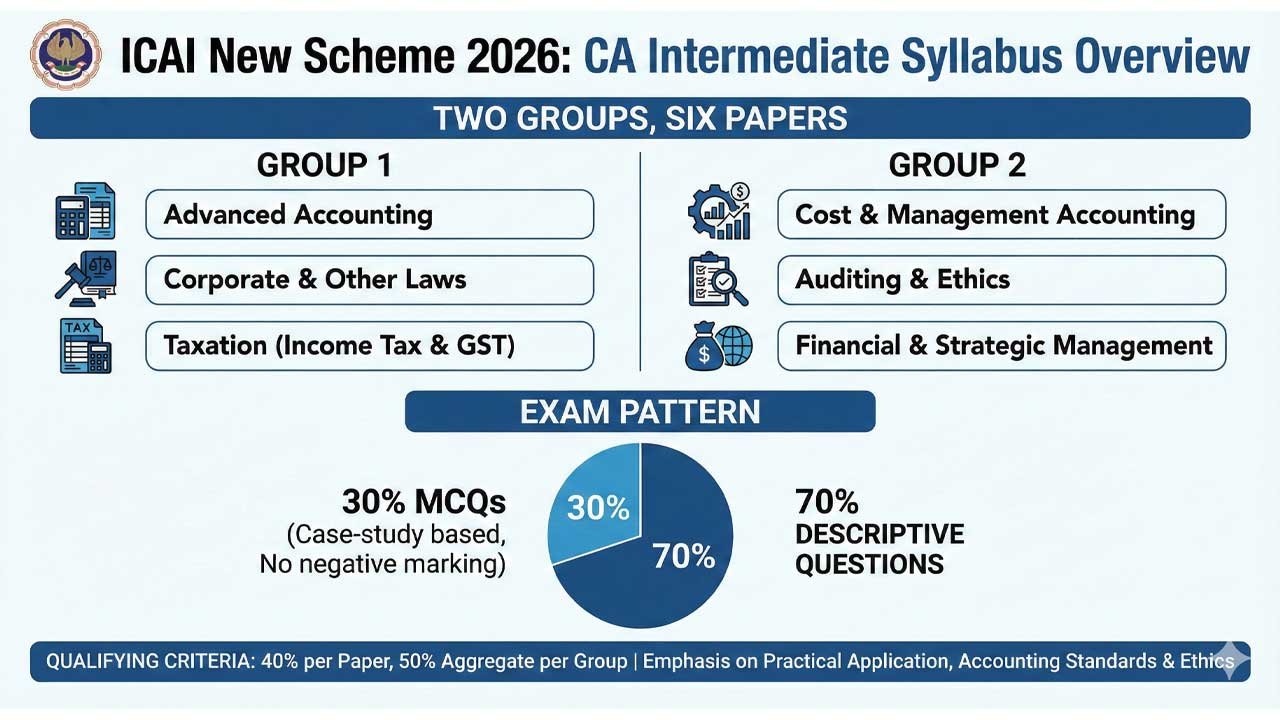

Under the ICAI New Scheme for 2026, the CA Intermediate syllabus is streamlined into six papers across two groups, covering core subjects like Advanced Accounting, Corporate & Other Laws, Taxation (Income Tax & GST), Cost & Management Accounting, Auditing & Ethics, and Financial & Strategic Management. The exam pattern features a 30:70 split, where 30% of the marks are dedicated to case-study based MCQs (with no negative marking) and the remaining 70% to descriptive questions.

To qualify, candidates must secure a minimum of 40% in each individual paper and an aggregate of 50% per group, with the curriculum heavily emphasizing practical application, accounting standards, and ethical frameworks to align with modern global practices.

This guide breaks down the syllabus, exam pattern, and marking scheme to help you strategize effectively.

The “Big Picture” Changes (New Scheme)

Before diving into the subjects, you must understand how the exam structure has evolved for 2026:

- Reduced Papers: The total number of papers has been reduced from 8 to 6.

- Groups: There are still 2 Groups, but now with 3 papers each.

- MCQ Integration: All 6 papers now have 30% marks dedicated to Case Study-based MCQs.

- No Negative Marking: There is NO negative marking for MCQs at the Intermediate level (unlike the Foundation level).

- Passing Criteria: 40% in each individual paper and 50% in the aggregate of the Group.

Course Structure & Syllabus Breakdown

The syllabus is divided into two groups. You can attempt either one group or both groups together.

Group 1

| Paper No. | Subject Name | Marks | Key Focus Areas |

|---|---|---|---|

| Paper 1 | Advanced Accounting | 100 | Accounting Standards (AS), Company Accounts, Branch Accounts, Buyback, Amalgamation. |

| Paper 2 | Corporate & Other Laws | 100 | Part I: Company Law & LLP (70 Marks) Part II: Other Laws (30 Marks) |

| Paper 3 | Taxation | 100 | Section A: Income Tax Law (50 Marks) Section B: GST (50 Marks) |

Group 2

| Paper No. | Subject Name | Marks | Key Focus Areas |

|---|---|---|---|

| Paper 4 | Cost & Management Accounting | 100 | Cost Sheet, Standard Costing, Marginal Costing, Budgetary Control, ABC. |

| Paper 5 | Auditing and Ethics | 100 | Standards on Auditing (SAs), Audit Evidence, Risk Assessment, Professional Ethics. |

| Paper 6 | Financial Management & Strategic Management | 100 | Section A: Financial Management (50 Marks) Section B: Strategic Management (50 Marks) |

Detailed Subject Insights

Paper 1: Advanced Accounting

- What changed? The old “Accounting” (Paper 1) and “Advanced Accounting” (Paper 5) have been merged into one mega-subject.

- Syllabus: It is heavily dominated by Accounting Standards (AS). You must master all applicable AS as they form the backbone of this paper. Other topics include Financial Statements of Companies, Buyback of Securities, and Amalgamation/Reconstruction.

Paper 2: Corporate and Other Laws

- Corporate Law (70%): Detailed study of The Companies Act, 2013 (Sections 1–148) and The Limited Liability Partnership Act, 2008.

- Other Laws (30%): Includes The General Clauses Act, 1897; Interpretation of Statutes; and The Foreign Exchange Management Act (FEMA), 1999 (Introductory concepts).

- Note: The focus is on interpreting the law rather than rote memorization.

Paper 3: Taxation

- Income Tax (50%): Covers the five heads of income (Salary, House Property, PGBP, Capital Gains, Other Sources), deductions, and TDS.

- GST (50%): Covers the entire GST mechanism—Supply, Charge, Exemptions, Time & Value of Supply, Input Tax Credit (ITC), and Returns.

- Tip: The weightage for GST has increased to 50% (previously 40%), making it a high-scoring area.

Paper 4: Cost and Management Accounting

- Focus: Ascertaining costs and decision-making.

- Key Topics: Activity Based Costing (ABC), Standard Costing, Marginal Costing, and Budgetary Control are “A-Category” topics that appear frequently.

Paper 5: Auditing and Ethics

- What changed? The subject is now explicitly named “Auditing and Ethics,” highlighting the increased focus on the Code of Ethics for Chartered Accountants.

- Content: Nature/Scope of Audit, Audit Strategy, Internal Control, Automated Environment, and the crucial Standards on Auditing (SAs).

Paper 6: Financial Management & Strategic Management

- FM (50%): Practical questions on Ratios, Cost of Capital, Capital Structure, Leverage, and Working Capital Management.

- SM (50%): Theoretical framework covering Strategic Analysis (SWOT/PESTLE), Strategic Choices, and Implementation.

- Tip: SM is concise and high-scoring if you use ICAI technical terminology.

Exam Pattern: The 30-70 Rule

For all 6 papers, the exam format is standard:

- Part I (30 Marks):Objective (MCQs). These are mostly Case Study-based, requiring you to apply concepts to a practical scenario.

- Good News: No Negative Marking.

- Part II (70 Marks): Descriptive. These are traditional subjective questions (solve practical problems, write theory answers, draft audit reports, etc.).

Strategic Preparation Tips for 2026

- Prioritize Accounting Standards: In Paper 1, AS is king. Do not skip a single standard.

- Master GST & SM: These are the “mark-fetchers.” The syllabus is smaller compared to Income Tax or FM, but the weightage is significant (50 marks each).

- Written Practice is Non-Negotiable: With 70% descriptive marks, you must practice writing answers, especially for Law and Audit, to ensure you use the correct technical language.

- Use the New Study Material: Ensure you are using the New Scheme Study Material (SM) from the ICAI Board of Studies (BoS). Old books will miss critical updates (especially in Tax and Law).

- Mock Tests: Since the MCQ portion is case-study based, practice solving these specifically. They are not simple “tick the box” questions; they require reading 1-2 pages of a scenario.