List of revised minimum chartered accountant fees charged for professional assignments done by CA in Practice as prescribed by ICAI. ICAI fee structure 2023-2024 for practicing chartered accountants in India. ICAI has prescribed the minimum fee to be charged by CA in practice in India.

The Committee for Capacity Building of Members in Practice (CCBMP) of the Institute of Chartered Accountants of India (ICAI) has prescribed the minimum recommended scale of fees for the professional assignments done by the members of CA Institute.

The prescribed Minimum Recommended Scale Fees will enhance the productivity and Capacity Building of Practitioners and CA Firms and will largely benefit the Small and Medium Practitioners (SMP) segment.

Accordingly, all Chartered Accountants who are in practice may consider these recommendations while charging fee for the work performed for various professional assignments.

The Capacity Building of Members in Practice was formed under regulatory provisions of Chartered Accountants Act, 1949 for CA Firms/LLP and members in practice. The ultimate objective of the Committee is to address the issues of profession and challenges faced by the CA Firms and enhancing their competence through capacity building and improving their visibility amongst the business community.

Revised Minimum Fees for Professional Assignments done by CA

CCBMP has recommended the chartered accountant fees separately for Class A and Class B Cities. Therefore the amount charged will be based on the location of the service provider. Class A Cities includes Delhi, Mumbai, Calcutta, Chennai, Pune, Hyderabad, Bangalore and Ahmedabad whereas Class B Cities includes all other cities not included in Class A.

The Committee also recommends that the bill for each service should be raised separately and immediately after the services are rendered. Further, Service Tax should be collected separately wherever applicable.

Following are the recommended minimum chartered accountant fees which has been recommended by the Committee for Capacity Building of CA Firms & Small and Medium Practitioners (CCBCAF&SMP) of ICAI and duly considered by the Council.

The Committee for Members in Practice (CMP) of ICAI has recommended the fee separately for Class A, Class B and Class C cities.

Class A Cities are Delhi, Greater Mumbai, Kolkata, Chennai, Pune, Hyderabad, Bengaluru and Ahmedabad.

Class B Cities are Agra, Ajmer, Aligarh, Allahabad, Amravati, Amritsar, Asansol, Aurangabad, Bareilly, Belgaum, Bhavnagar, Bhiwandi, Bhopal, Bhubaneswar, Bikaner, Bokro Stell City, Chandigarh, Coimbatore, Cuttack, Dehradun, Dhanbad, Durgapur, Durg-Bhilai Nagar, Erode, Faridabad, Firozabad, Ghaziabad, Gorakhpur, Greater Visakhapatnam, Gulbarga, Guntur, Gurgaon, Guwahati, Gwalior, Hubli-Dharwad, Indore, Jabalpur, Jaipur, Jalandhar, Jammu, Jamnagar, Jamshedpur, Jhansi, Jodhpur, Kannur, Kanpur, Kochi, Kolhapur, Kollam, Kota, Kozhikode, Lucknow, Ludhiana, Madurai, Malappuram, Malegaon, Mangalore, Meerut, Moradabad, Mysore, Nagpur, Nansws-Waghala, Nashik, Nellore, Noida, Patna, Puducherry/ Pondicherry, Raipur, Rajkot, Ranchi, Rourkela, Saharanpur, Salem, Sangli, Siliguri, Solapur, Srinagar, Thiruvanathapuram, Thrissur, Tiruchirappalli, Tiruppur, Ujjain, Vadodara Surat, Varanasi, Vasai-Virar City, Vijayawada and Warangal.

Class C Cities are those cities which are not covered in the Class A and B above.

1) Advising on Drafting of Deeds/Agreements:

ICAI members who are holding COP may charge the following minimum fee for advising on Drafting of Deeds/Agreements.

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| Partnership Deed | ₹15,000 | ₹10,000 | ₹8,000 |

| Partnership Deed (With Consultation & Tax Advisory) | ₹20,000 | ₹15,000 | ₹10,000 |

| Filling of Forms with Registrar of Firms | ₹7,000 | ₹5,000 | ₹3,000 |

| Supplementary / Modification in Partnership Deed | ₹12,000 | ₹9,000 | ₹6,000 |

| Joint Development Agreements/ Joint Venture Agreements | ₹12,000 | ₹9,000 | ₹6,000 |

| Others Deeds such as Power of Attorney, Will , Gift Deed etc. | ₹5,000 | ₹4,000 | ₹3,000 |

2) Income Tax:

CA in practice may charge these revised minimum recommended fees for Income-tax related matters viz. Income-tax return filing, attending for rectifications / refunds, and filing of appeals etc.

Filling of Return of Income

I) For Individuals/HUFs

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| a. Filling of Return of Income with Salary/Other Sources/Share of Profit | ₹8,000 | ₹6,000 | ₹4,000 |

| b. Filling of Return of Income with detailed Capital Gain working | |||

| i) Less than 10 Transactions (For Shares & Securities) | ₹11,000 | ₹8,000 | ₹5,000 |

| ii) More than 10 Transactions (For Shares & Securities | ₹17,000 | ₹12,000 | ₹8,000 |

| c. Filling on Return of Income for Capital Gain on Immovable property | ₹32,000 | ₹12,000 | ₹8,000 |

| d. Filling on Return of Income with Preparation of Bank Summary, Capital A/c & Balance Sheet. | ₹12,000 | ₹22,000 | ₹15,000 |

II) For others

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| a. Partnership Firms/Sole Proprietor with Advisory Services | ₹15,000 | ₹10,000 | ₹8,000 |

| b. Minor’s I.T. Statement | ₹8,000 | ₹6,000 | ₹4,000 |

| c. Private Ltd. Company: | |||

| i) Active | ₹25,000 | ₹18,000 | ₹12,000 |

| ii) Defunct | ₹12,000 | ₹9,000 | ₹6,000 |

| d. Public Ltd. Company | |||

| i) Active | ₹65,000 | ₹45,000 | ₹30,000 |

| ii) Defunct | ₹25,000 | ₹18,000 | ₹12,000 |

Filling of Forms

If you are a Chartered Accountant, you may charge the following minimum quarterly fee for the respective services related to Form filling:

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| a. Filling of TDS/TCS Return (per Form) | |||

| i) With 5 or less Entries | ₹4,000 | ₹3,000 | ₹2,000 |

| ii) With more than 5 entries | ₹9,000 | ₹7,000 | ₹5,000 |

| b. Filling of Form No. 15-H/G (per Set) | ₹4,000 | ₹3,000 | ₹2,000 |

| c. Form No. 49-A/ 49-B | ₹4,000 | ₹3,000 | ₹2,000 |

| d. Any other Forms filed under the Income Tax Act | ₹4,000 | ₹3,000 | ₹2,000 |

Certificate

Obtaining Certificate from Income Tax Department:

- For class ‘A’ Cities: ₹14,000

- For class ‘B’ Cities: ₹10,000

- For class ‘C’ Cities: ₹7,000

Filling of Appeals

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| First Appeal Preparation of Statement of Facts, Grounds of Appeal, Etc. | ₹32,000 | ₹22,000 | ₹15,000 |

| Second Appeal (Tribunal) | ₹65,000 | ₹45,000 | ₹30,000 |

Assessments

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| Attending Scrutiny Assessment/Appeal | |||

| (i) Corporate | See Note 1 | See Note 1 | See Note 1 |

| (ii) Non Corporate | ₹32,000 | ₹22,000 | ₹15,000 |

| Attending before Authorities | ₹10,000 /Per Visit | ₹7,000 /Per Visit | ₹5,000 /Per Visit |

| Attending for Rectifications/ Refunds/Appeal effects Etc. | ₹7,000 /Per Visit | ₹5,000 /Per Visit | ₹3,000 /Per Visit |

| Income Tax Survey | ₹80,000 | ₹55,000 | ₹35,000 |

| T.D.S. Survey | ₹50,000 | ₹35,000 | ₹25,000 |

| Income Tax Search and Seizure | See Note 1 | See Note 1 | See Note 1 |

| Any other Consultancy | See Note 1 | See Note 1 | See Note 1 |

3) Charitable Trust:

Following are the minimum prescribed fees charged by CA in practice for the respective services related to charitable trust.

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| Registration Under Local Act | ₹25,000 | ₹18,000 | ₹12,000 |

| Societies Registration Act | ₹32,000 | ₹22,000 | ₹15,000 |

| Registration Under Income Tax Act | ₹25,000 | ₹18,000 | ₹12,000 |

| Exemption Certificate under section 80G of Income Tax Act | ₹20,000 | ₹15,000 | ₹10,000 |

| Filing Objection Memo/other Replies | ₹10,000 | ₹7,000 | ₹5,000 |

| Filing of Change Report | ₹10,000 | ₹7,000 | ₹5,000 |

| Filing of Annual Budget | ₹10,000 | ₹7,000 | ₹5,000 |

| Attending before Charity Commissioner including for Attending Objections | ₹8,000 | ₹6,000 | ₹4,000 |

| F.C.R.A. Registration | ₹35,000 | ₹25,000 | ₹18,000 |

| F.C.R.A. Certification | ₹8,000 | ₹6,000 | ₹4,000 |

4) Company Law and LLP Work:

Members of ICAI in practice shall consider the following recommended fee while doing assignment related to Company Law and LLP work.

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| Filing Application for Name Approval | ₹8,000 | ₹6,000 | ₹4,000 |

| Incorporation of a Private Limited Company/LLP | ₹35,000 | ₹25,000 | ₹18,000 |

| Incorporation of a Public Limited Company | ₹65,000 | ₹45,000 | ₹30,000 |

| Advisory or consultation in drafting MOA, AOA | ₹15,000 | ₹11,000 | ₹8,000 |

| (i) Company’s/LLP ROC Work, Preparation of Minutes, Statutory Register & Other Secretarial Work | See Note 1 | See Note 1 | See Note 1 |

| (ii) Certification (Per Certificate) | ₹15,000 | ₹11,000 | ₹8,000 |

| Filing Annual Return Etc. | ₹10,000 | ₹7,000 | ₹5,000 |

| Filing Other Forms Like : F-32, 18, 2 etc. | ₹5,000 | ₹4,000 | ₹3,000 |

| Increase in Authorised Capital Filing of F-5, F-23, preparation of Revised Memorandum of Association/Article of Association/ LLP Agreement | ₹25,000 | ₹20,000 | ₹14,000 |

| DPIN/DIN per Application | ₹4,000 | ₹3,000 | ₹2,000 |

| Company Law Consultancy including Petition drafting | See Note 1 | See Note 1 | See Note 1 |

| Company Law representation including LLP before RD and NCLT | See Note 1 | See Note 1 | See Note 1 |

| ROC Representation | See Note 1 | See Note 1 | See Note 1 |

5) Audit and Other Assignments:

CA Audit Fees: Rate per day would depend on the complexity of the work and the number of days spent by each person.

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| (i) Principal | ₹18,000 | ₹12,000 | ₹8,000 |

| (ii) Qualified Assistants | ₹10,000 | ₹7,000 | ₹5,000 |

| (iii) Semi Qualified Assistants | ₹5,000 | ₹4,000 | ₹3,000 |

| (iv) Other Assistants | ₹3,000 | ₹2,000 | ₹1,000 |

Subject to minimum indicative Fees as under: –

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| Tax Audit | ₹40,000 | ₹30,000 | ₹22,000 |

| Company Audit | |||

| (a) Small Pvt. Ltd. Co. (Turnover up to ₹2 crore) | ₹50,000 | ₹35,000 | ₹25,000 |

| (b) Medium Size Pvt. Ltd. Co./ Public Ltd. Co | ₹80,000 | ₹55,000 | ₹35,000 |

| (c) Large Size Pvt. Ltd. Co./ Public | See Note 1 | See Note 1 | See Note 1 |

| Review of TDS Compliance | ₹25,000 | ₹18,000 | ₹12,000 |

| Transfer Pricing Audit | See Note 1 | See Note 1 | See Note 1 |

6) Investigation, Management Services or Special Assignments:

Rate per day would depend on the complexity of the work and the number of days spent by each person.

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| Principal | ₹35,000/- & Above + per day charge | ₹25,000/- & Above + per day charge | ₹18,000/- & Above per day charge |

| Qualified Assistant | ₹18,000/- & Above + per day charge | ₹12,000/- & Above + per day charge | ₹8,000/- & Above per day charge |

| Semi Qualified Assistant | ₹10,000/- & Above + per day charge | ₹7,000/- & Above + per day charge | ₹5,000/- & Above per day charge |

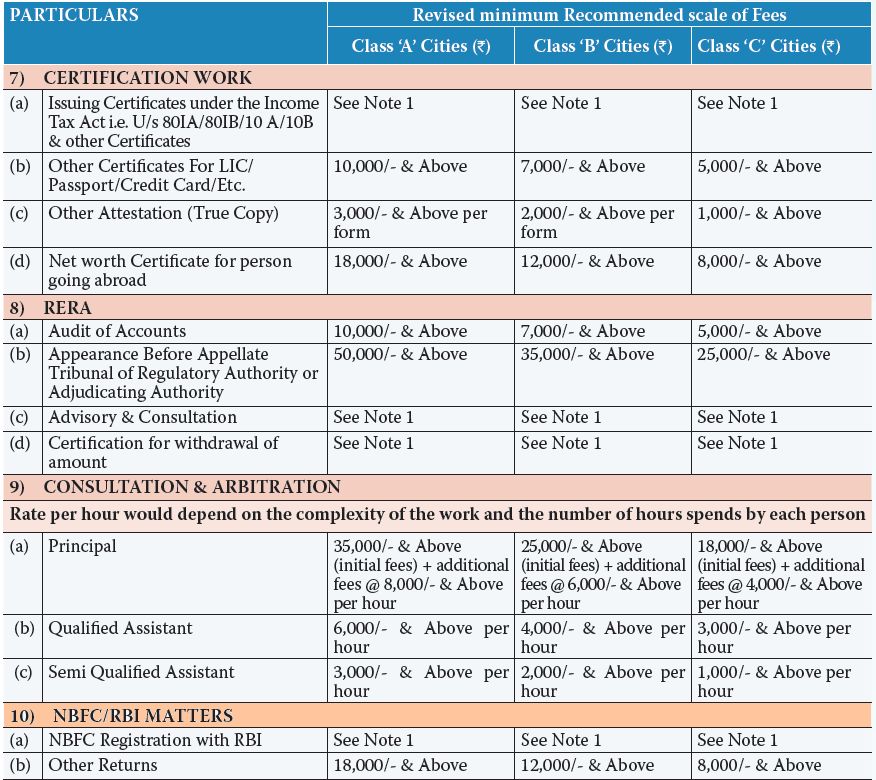

CA in Practice may charge the following recommended fee for the respective work.

11) Goods and Services Tax (GST):

Following chartered accountant fees has been recommended for Goods and Services Tax (GST) related services made by members of CA Institute who are in practice .

| Particulars | Class ‘A’ Cities | Class ‘B’ Cities | Class ‘C’ Cities |

|---|---|---|---|

| Registration | ₹20,000 | ₹15,000 | ₹10,000 |

| Registration with Consultation | See Note 1 | See Note 1 | See Note 1 |

| Tax Advisory & Consultation i.e. about value, taxability, classification, etc. | See Note 1 | See Note 1 | See Note 1 |

| Challan/Returns | ₹15,000/- & Above + (₹4,000/- Per Month) | ₹10,000/- & Above + (₹3,000/- Per Month) | ₹8,000/- & Above + (₹2,000/- Per Month) |

| Adjudication/Show Cause notice reply | ₹30,000 | ₹20,000 | ₹15,000 |

| Filing of Appeal / Appeals Drafting | ₹30,000 | ₹20,000 | ₹15,000 |

| Furnish details of inward/outward supply | See Note 1 | See Note 1 | See Note 1 |

| Misc. services i.e. refund, cancellation/revocation registration, maintain electronic cash ledger etc. | See Note 1 | See Note 1 | See Note 1 |

| Audit of accounts and reconciliation Statement | ₹40,000 | ₹20,000 | ₹12,000 |

| Any Certification Work | ₹10,000 | ₹7,000 | ₹5,000 |

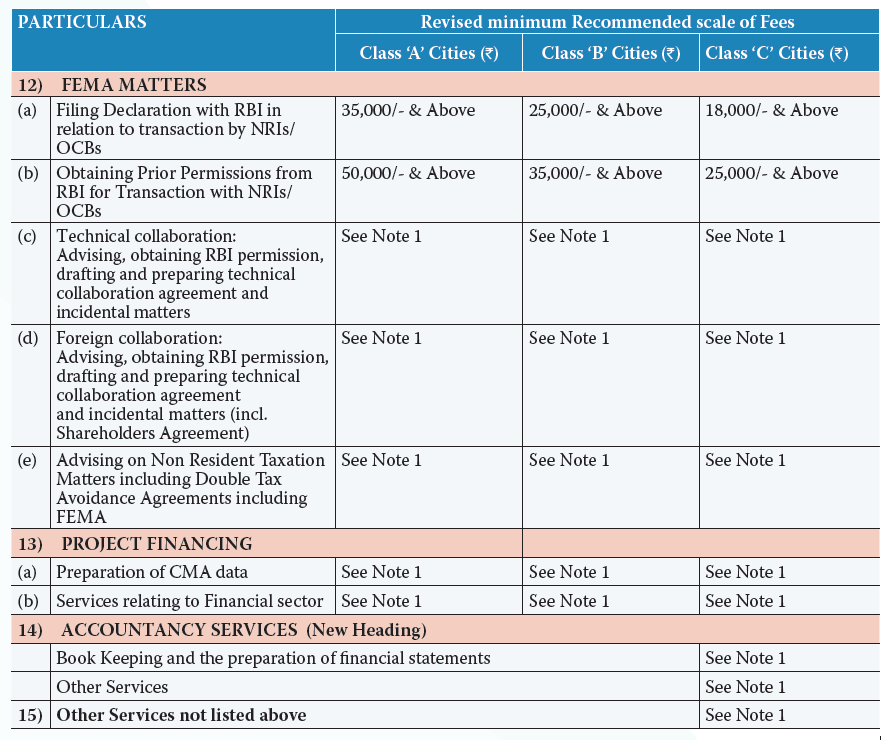

12) FEMA Matters:

Notes:

- Fees to be charged depending on the complexity and the time spent on the particular assignment.

- The above recommended minimum scale of fees is as recommended by the Committee for Members in Practice (CMP) of ICAI

- The aforesaid table states recommendatory minimum scale of fees works out by taking into account average time required to complete such assignments. However, members are free to charge varying rates depending upon the nature and complexity of assignment and time involved in completing the same.

- Office time spent in travelling & out-of-pocket expenses would be chargeable. The Committee issues for general information the above recommended scale of fees which it considers reasonable under present conditions. It will be appreciated that the actual fees charged in individual cases will be matter of agreement between the member and the client.

- GST should be collected separately wherever applicable.

- The Committee also recommends that the bill for each service should be raised separately and immediately after the services are rendered.

- The amount charged will be based on the location of the service provider.

Note that the aforesaid fees are recommendatory and therefore chartered accountants are free to charge varying rates depending upon the nature and complexity of assignment and time involved in completing the same.

For any Query please contact:

- Ph: 0120-3045994

- E-mail : sambit.mishra@icai.in