India’s GST collections in January 2026 underscore steady economic momentum amid structural transition, with gross revenues of ₹1.93 lakh crore (up 6.2% YoY) and cumulative FY26 collections of ₹18.43 lakh crore (up 8.3%), reflecting resilient compliance and an expanded tax base despite moderated domestic consumption.

Growth is increasingly import-led, as import GST rose over 10% while domestic revenues grew a more subdued 4.8%, highlighting a bifurcated recovery. The September 2025 GST 2.0 reforms—featuring rate rationalization, faster refunds, and the phase-out of the compensation cess alongside higher sin taxes—have improved administrative efficiency, supported exporters, and aimed to stimulate consumption while maintaining revenue neutrality.

However, GST revenues remain highly concentrated in industrialized states, with weaker performance in several resource-dependent regions, pointing to persistent federal and regional imbalances. Overall, the data signals a GST system in transition: fiscally stable, structurally streamlined, and increasingly oriented toward consumption support and long-term equity rather than short-term revenue maximization.

| Metric | January 2026 | YoY Growth |

|---|---|---|

| Gross GST Collection | ₹1,93,384 crore | 6.2% |

| Net GST Revenue (after refunds) | ₹1,70,719 crore | — |

| Domestic GST Collection | ₹1,41,132 crore | 4.8% |

| Import GST Collection | ₹52,253 crore | 10.1% |

| Total Refunds (Jan) | ₹22,665 crore | — |

| FY26 GST Collection (Apr–Jan) | ₹18,43,423 crore | 8.3% |

| FY26 Total Refunds (Apr–Jan) | ₹2,47,672 crore | 18.9% |

| Number of GST Registrations | 1.51 crore | +126% since 2017 |

India’s GST Collections Signal Steady Economic Momentum Amid Structural Reforms

India’s Goods and Services Tax (GST) collections reached ₹1,93,384 crores in January 2026, marking a robust 6.2% year-on-year growth and delivering a net revenue of ₹1,70,719 crores after accounting for refunds.

On a cumulative basis, gross GST collections for the April–January period of FY26 reached ₹18,43,423 crores, reflecting an 8.3% increase over the corresponding period of the previous year. While the headline figures underscore sustained fiscal buoyancy, a deeper examination reveals a bifurcated growth narrative: domestic consumption remains stable but subdued, while import-driven revenues are emerging as the primary growth engine.

Simultaneously, landmark GST reforms implemented in September 2025 are reshaping the revenue landscape through rate rationalization and structural simplification, with compensating implications for federal revenue distribution and sectoral competitiveness.

The Current State of GST Collections: A Tale of Two Economies

Monthly Performance and Sequential Trends

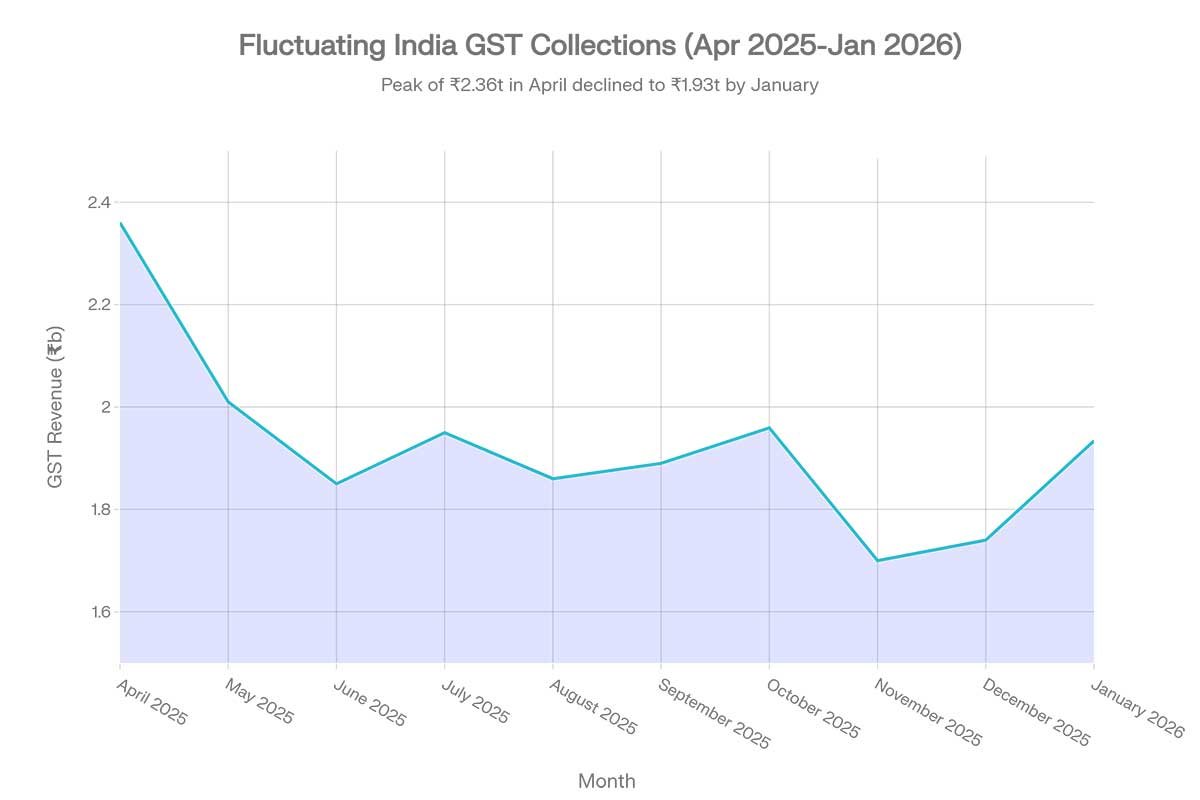

The January 2026 collection, while strong in absolute terms, represents a moderation from the exceptional collections witnessed earlier in the fiscal year. April 2025 recorded the highest-ever monthly GST collection at ₹2,36,000 crores, driven by financial year-end filings and accelerated invoicing cycles. Subsequent months settled into a more sustainable range of ₹1,70,000–₹1,95,000 crores, with November 2025 showing relative weakness at ₹1,70,000 crores, attributed partly to the transitional effects of GST rate rationalization implemented on September 22, 2025.

Key observation: Despite the initial post-reform volatility, collections have stabilized above the ₹1.70 lakh crore threshold for over 10 consecutive months, signaling the resilience of India’s tax compliance framework and the gradual broadening of the tax base.

Domestic Versus Import-Led Growth: Divergent Trajectories

The composition of January 2026’s growth reveals critical structural dynamics. Domestic GST revenue rose a modest 4.8% year-on-year to ₹1,41,132 crores, reflecting stable but moderated consumption trends. In contrast, GST collections from imports surged 10.1% to ₹52,253 crores, emerging as the primary driver of overall revenue growth. On a cumulative basis, import-related GST revenue for April–January FY26 reached ₹4,93,628 crores, reflecting a robust 13.4% increase compared to the previous year.

This divergence carries macroeconomic implications. While robust import growth reflects strong domestic demand—suggesting businesses and consumers are purchasing more goods—the slower domestic collection growth indicates that underlying consumption is expanding at a measured pace. This pattern is consistent with an economy navigating post-pandemic normalization and global uncertainty.

Refunds: A Barometer of Compliance and Export Activity

Refund dynamics in January 2026 merit close attention. While domestic refunds declined 7.1% year-on-year to ₹13,119 crores, export-related refunds rose 2.9% to ₹9,546 crores, indicating resilient outbound trade activity. Cumulatively, refunds for April–January FY26 increased 18.9% to ₹2,47,672 crores, a significant uptick that reflects improved compliance, faster processing, and a broadened export base.

The 18.9% increase in cumulative refunds is noteworthy because it outpaces the 8.3% growth in gross collections, suggesting that the government has successfully accelerated refund mechanisms—a key improvement in the post-GST 2.0 administrative environment. This trend is favorable for exporters and import-dependent manufacturers, reducing working capital pressures and improving cash flow dynamics.

Component-wise Breakdown: CGST, SGST, and IGST Performance

A detailed examination of the three components of GST—Central GST (CGST), State GST (SGST), and Integrated GST (IGST)—reveals nuanced growth patterns:

| Component | January 2026 (₹ Cr) | YoY Growth (%) | FY26 Cumulative (₹ Cr) | YoY Growth (%) |

|---|---|---|---|---|

| CGST | 38,792 | 7.5% | 3,66,288 | 7.6% |

| SGST | 47,817 | 6.3% | 4,52,133 | 7.0% |

| IGST | 1,06,775 | 5.9% | 10,25,002 | 9.3% |

IGST, which comprises both domestic inter-state transactions and international trade, grew 9.3% cumulatively, outpacing both CGST and SGST. This reflects the outsized contribution of import-driven revenues and inter-state commerce to overall tax collections. The more modest growth in SGST (7.0% cumulative) underscores the relatively measured expansion of state-level consumption, a trend with implications for state fiscal health and the revenue-sharing mechanism under the GST framework.

State-wise Performance: Concentration and Divergence

Leading Contributors and Concentration Patterns

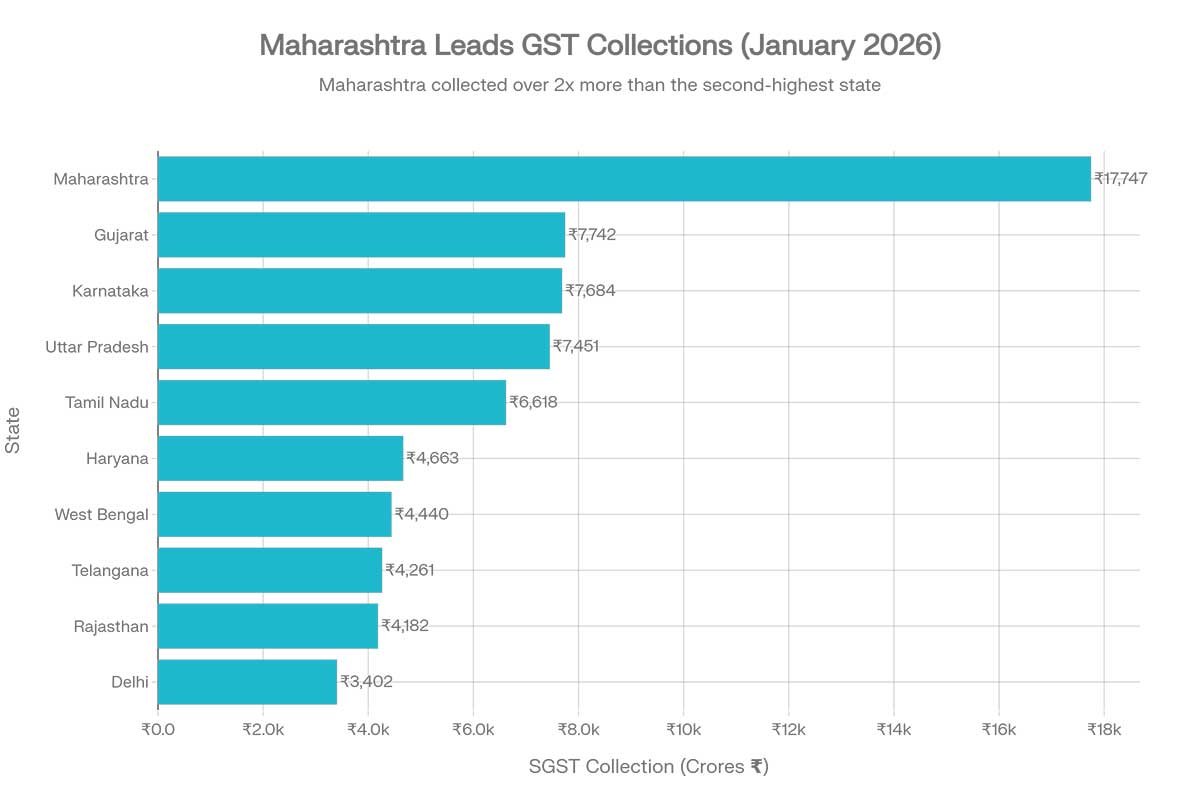

The state-wise data reveals a pronounced concentration of GST revenue. Maharashtra, Karnataka, Gujarat, and Tamil Nadu together contributed approximately 45% of India’s total GST collections, with Maharashtra alone generating ₹17,747 crores in post-settlement SGST during January 2026.

Maharashtra’s dominance: With cumulative collections of ₹1,01,122 crores for FY26 (till January), Maharashtra’s contribution underscores the outsized role of a single state. The state’s diversified economic base—encompassing financial services, manufacturing, pharmaceuticals, and retail—makes it the de facto economic engine of India’s GST system.

Other high performers: Gujarat (₹7,742 crores), Karnataka (₹7,684 crores), and Tamil Nadu (₹6,618 crores) collectively reinforce the pattern that industrial and service-oriented states dominate the tax base. These states benefit from strong manufacturing sectors, IT hubs, and significant inter-state trade volumes.

Regional Disparities and the Equity Question

While industrialized states surge ahead, state-wise data reveals uneven recovery across the federation. Post-settlement SGST data for January 2026 shows:

- High growth states: Arunachal Pradesh (+24%), Puducherry (+15%), Haryana (+27% cumulative for FY26), and Meghalaya (+11%) posted strong month-on-month gains, often reflecting the normalization of economic activity in less-developed regions.

- Contracting states: Jharkhand (−46% cumulative), Odisha (−10% cumulative), Chhattisgarh (−23% cumulative), and Madhya Pradesh (−15% cumulative) recorded significant reversions in cumulative collections, indicating structural challenges or sectoral headwinds in these regions.

This bifurcation underscores a persistent challenge in India’s federal fiscal architecture: While the GST system is designed to provide equalizing transfers to less-developed states, the concentration of tax generation in industrial hubs creates fiscal asymmetries that complicate resource allocation and development planning.

The September 2025 GST Reforms: Structural Transformation and Revenue Implications

The Architecture of GST 2.0

On September 22, 2025, the Indian government implemented a landmark GST rate rationalization, simplifying the four-tiered structure (5%, 12%, 18%, 28%) into a streamlined two-rate system:

- Merit Rate (5%): Essential goods and services, including specified healthcare, food items, and agricultural machinery

- Standard Rate (18%): Core manufacturing, services, and consumption items

- Sin Rate (40%): Luxury goods, alcohol, and tobacco-related products

This reform reduced compliance complexity, lowered the tax burden on essentials, and was strategically timed to coincide with Navratri and the festive season—periods of peak consumer spending.

Macroeconomic Impact Projections

Economists project that the GST reforms will contribute 20–30 basis points (0.2–0.3 percentage points) to India’s GDP growth in FY26, primarily through enhanced consumption. The Chief Economic Adviser estimated that the reforms would counter an estimated 60 basis points tariff headwind, providing a net boost to growth.

Additionally, the rate cuts are expected to moderate Consumer Price Index (CPI) inflation by 50–90 basis points over the next 12 months, contingent on full pass-through of tax benefits to consumers. This disinflationary impact, combined with the reduced cost of living for millions of households—particularly for middle-income consumers—addresses a critical policy objective: inclusive growth through affordability.

Compensation Cess and Tobacco Taxation: A Structural Pivot

A critical but often overlooked aspect of GST 2.0 involves the discontinuation of the GST compensation cess. Originally introduced to offset state revenue losses following GST implementation, the compensation cess is scheduled to expire on February 1, 2026.

Net cess revenue in January 2026 fell dramatically to ₹5,768 crores from ₹13,009 crores a year earlier—a 55.7% collapse—reflecting the September 2025 narrowing of cess application to tobacco and tobacco-related products. To maintain revenue neutrality and prevent an unintended tax reduction on sin goods, the government enacted the Central Excise (Amendment) Act, 2025, which restructures tobacco taxation through two mechanisms:

- Elevated GST Rate: Tobacco products and pan masala moved from the 28% slab to a new 40% GST slab, a 43% rate increase.

- Enhanced Basic Excise Duty (BED): Duty on cigarettes increased to ₹2,700 per 1,000 sticks (from ₹200), while chewing tobacco duty escalated from 25% to 100%.

The combined effect maintains the overall tax incidence on tobacco products while replacing the compensation cess mechanism with a more durable excise framework. This transition aligns with broader public health objectives while ensuring predictable fiscal contributions.

Refund Velocity and Administrative Efficiency

One of the understated successes of the recent fiscal year is the acceleration of GST refund processing. Cumulative refunds for April–January FY26 reached ₹2,47,672 crores, a 18.9% increase over the prior year, while gross collections grew 8.3%. This suggests that:

- Improved processing infrastructure: Digitization and streamlined GSTN operations have reduced refund processing timelines.

- Export competitiveness: Faster refund clearance improves the cash flow position of exporters, enhancing India’s export competitiveness.

- Compliance confidence: Higher refund processing rates reflect greater transparency and trust in the GST administration.

The ratio of refunds to gross collections (approximately 13.4% of gross collections in FY26) remains within historical norms but shows acceleration, indicating that the administration has prioritized refund fulfillment—a critical metric for assessing the health of the GST ecosystem.

Fiscal Trajectory and Year-End Expectations

Finance ministry officials have indicated expectations for gross GST revenue growth to accelerate to 9% on a monthly basis by March 2026, with the growth figures reflected in April 2026 collections. This projection accounts for:

- Normalization of GST 2.0 effects: The transitional volatility from rate rationalization is expected to dissipate by Q4 FY26.

- Strong consumption momentum: Economic growth projections of 6.5–7% for FY26 suggest that income levels and purchasing power remain resilient.

- Year-end filing surge: Historically, March and April see elevated collections as businesses complete annual filings and adjust invoicing cycles.

If realized, 9% growth would signal a return to pre-reform growth trajectories, validating the government’s contention that GST 2.0 reforms are revenue-neutral to positive on a medium-term basis.

Structural Insights: Tax Base Expansion and Compliance

Since GST implementation in July 2017, the taxpayer base has expanded from 66.5 lakh registrations in 2017 to 1.51 crore in 2025. This 126% increase reflects:

- Formalization of the economy: Greater enforcement and digital connectivity have brought informal businesses into the tax net.

- Business digitization: E-way bills, e-invoicing, and GSTN integration have reduced evasion and simplified compliance.

- Broader supply chains: Inter-state commerce and export-import linkages have widened the GST base.

The sustained growth in collections, even during transitional reform periods, suggests that the tax base has become sufficiently deep to absorb policy changes without significant disruption. However, the concentration of collections in a handful of states indicates that the base, while expanding in absolute terms, remains regionally uneven.

Sectoral and Consumer Implications

FMCG and Consumer Durables: Positive Tailwinds

The reduction of GST rates on essential goods—including select food items, healthcare products, and consumer durables—is expected to drive significant volume growth in these sectors. Rate reductions on items previously taxed at 12% and 18% now fall under the 5% merit rate, directly lowering consumer prices and stimulating demand.

Export-Oriented Manufacturing: Refund Acceleration

Faster refund processing and improved compliance mechanisms benefit export-oriented sectors, including textiles, pharmaceuticals, and electronics. The 2.9% growth in export-related refunds, coupled with the 18.9% acceleration in overall refund processing, suggests that exporters face fewer working capital constraints.

Tobacco and Sin Goods: Structural Headwinds

While the compensation cess discontinuation maintains tax neutrality, the 43% increase in the GST rate on tobacco products (from 28% to 40%) coupled with enhanced excise duties may depress volumes in the short term. However, the change aligns with public health objectives and does not materially impact the broader tax ecosystem.

Risks and Limitations

Sequential Moderation in Monthly Growth

While year-over-year growth remains solid at 6.2% in January 2026, the sequential comparison with December 2025 (₹1.74 lakh crore net) suggests that monthly collections are plateauing. If this trend persists beyond February, it could indicate that the consumption stimulus from GST 2.0 reforms has been partially exhausted, requiring policy reassessment.

Regional Fiscal Stress

The significant contractions in states like Jharkhand (−46%), Chhattisgarh (−23%), and Odisha (−10%) raise concerns about the sustainability of state-level revenues and the adequacy of the compensation mechanism. States dependent on natural resources or agriculture face particular headwinds, as GST collections correlate with industrial and service-sector activity.

Global Trade Uncertainty

Import-driven GST growth, while robust at 10.1% in January, is vulnerable to global supply chain disruptions, tariff escalations, and currency volatility. A contraction in import demand would materially impact overall collection growth, given its 26.6% contribution to gross GST revenue.

Conclusion: Momentum with Structural Transitions

India’s GST system demonstrated sustained fiscal buoyancy in January 2026, with gross collections of ₹1,93,384 crores reflecting a solid 6.2% year-on-year growth. The cumulative FY26 performance of ₹18,43,423 crores (8.3% growth) underscores the resilience of tax compliance and the continued broadening of the tax base.

However, the divergence between domestic and import-driven growth, the concentration of collections in a handful of industrialized states, and the transitional effects of GST 2.0 reforms collectively suggest that India is navigating a period of structural evolution. The simplification of rate structures, acceleration of refund processing, and elimination of the compensation cess represent significant administrative improvements and signal a shift toward a more predictable, equitable, and growth-oriented tax regime.

Looking ahead, the government’s expectation of 9% growth by March 2026 appears achievable, contingent on sustained consumer demand, export momentum, and the normalization of GST 2.0 effects. However, policymakers must remain attentive to regional disparities, export competitiveness, and the impact of global trade dynamics on import-driven collections.

In aggregate, the data suggests that India’s GST system is transitioning from a revenue-maximization framework to a consumption-stimulation and equity-focused regime—a structural shift with profound implications for economic growth, federal finance, and the trajectory of India’s broader fiscal architecture.

FAQs

What was India’s GST collection in January 2026?

India’s gross GST collection in January 2026 stood at ₹1,93,384 crore, registering a 6.2% year-on-year growth.

What was the net GST revenue after refunds in January 2026?

After accounting for refunds, the net GST revenue in January 2026 was ₹1,70,719 crore.

How did GST collections perform cumulatively in FY26 so far?

Cumulative gross GST collections from April to January FY26 reached ₹18,43,423 crore, reflecting an 8.3% increase over the same period last year.

What drove GST growth in January 2026?

GST growth was primarily driven by imports, with import-related GST rising 10.1% year-on-year, while domestic GST grew at a slower 4.8%.

What does the divergence between domestic and import GST indicate?

It indicates stable but moderate domestic consumption alongside stronger demand for imported goods, reflecting measured economic expansion.

How much GST was collected from domestic transactions in January 2026?

Domestic GST collections in January 2026 amounted to ₹1,41,132 crore.

How much GST revenue came from imports in January 2026?

GST collections from imports stood at ₹52,253 crore in January 2026.

What were the total refunds issued in January 2026?

Total GST refunds in January 2026 were ₹22,665 crore.

How did export-related refunds perform?

Export-related refunds rose 2.9% year-on-year, indicating resilient export activity.

What was the cumulative refund amount in FY26 so far?

Cumulative refunds from April to January FY26 reached ₹2,47,672 crore, an increase of 18.9%.

Why is the rise in refunds significant?

The faster growth in refunds compared to collections signals improved administrative efficiency and better cash-flow support for businesses.

How did CGST perform in January 2026?

CGST collections stood at ₹38,792 crore, growing 7.5% year-on-year.

How did SGST collections fare in January 2026?

SGST collections reached ₹47,817 crore, reflecting a 6.3% year-on-year growth.

What was the IGST collection in January 2026?

IGST collections amounted to ₹1,06,775 crore, showing a 5.9% year-on-year increase.

Which GST component showed the strongest cumulative growth?

IGST showed the strongest cumulative growth at 9.3%, driven by imports and inter-state trade.

Which states contribute the most to GST revenue?

Maharashtra, Karnataka, Gujarat, and Tamil Nadu together contribute about 45% of total GST collections.

Why is Maharashtra the largest GST contributor?

Maharashtra’s diversified economy, strong services sector, and large manufacturing base make it the largest GST contributor.

Are GST collections evenly distributed across states?

No, GST collections are highly concentrated in industrialized states, with several resource-dependent states showing weaker performance.

Which states showed strong growth despite smaller bases?

States like Arunachal Pradesh, Puducherry, Haryana, and Meghalaya recorded strong growth rates.

Which states recorded declining GST collections?

Jharkhand, Chhattisgarh, Odisha, and Madhya Pradesh showed significant cumulative declines.

What were the key GST reforms implemented in September 2025?

The reforms simplified GST into a two-rate structure with an additional sin rate and rationalized tax slabs.

What are the new GST rates under GST 2.0?

The system now includes a 5% merit rate, an 18% standard rate, and a 40% sin rate.

How do GST 2.0 reforms impact consumers?

They lower taxes on essential goods, reduce prices, and support consumption growth.

How do the reforms affect inflation?

Economists estimate the reforms could reduce CPI inflation by 50–90 basis points over 12 months.

What happened to the GST compensation cess?

The compensation cess has been phased out and is set to expire on February 1, 2026.

How is tobacco taxation handled after cess removal?

Tobacco is now taxed through a higher 40% GST rate and increased excise duties.

Why was excise duty on tobacco increased?

To maintain revenue neutrality and align taxation with public health objectives.

How has GST refund processing improved?

Digitization and streamlined GSTN systems have significantly reduced refund timelines.

Why are faster refunds important for exporters?

They ease working capital pressure and improve export competitiveness.

What is the size of India’s GST taxpayer base now?

GST registrations have grown to about 1.51 crore taxpayers.

How has the GST taxpayer base changed since 2017?

The taxpayer base has expanded by over 120% since GST was introduced.

What does the expanding tax base indicate?

It reflects increased formalization, better compliance, and stronger digital enforcement.

What risks remain for GST collections?

Risks include slowing consumption, regional disparities, and global trade uncertainty affecting imports.

Is GST revenue growth expected to improve by year-end?

The government expects monthly GST growth to accelerate to around 9% by March 2026.

What does the overall GST trend suggest about India’s economy?

It suggests stable growth, improving tax administration, and a shift toward consumption-led and equitable fiscal policy.

Leave a Reply

You must be logged in to post a comment.