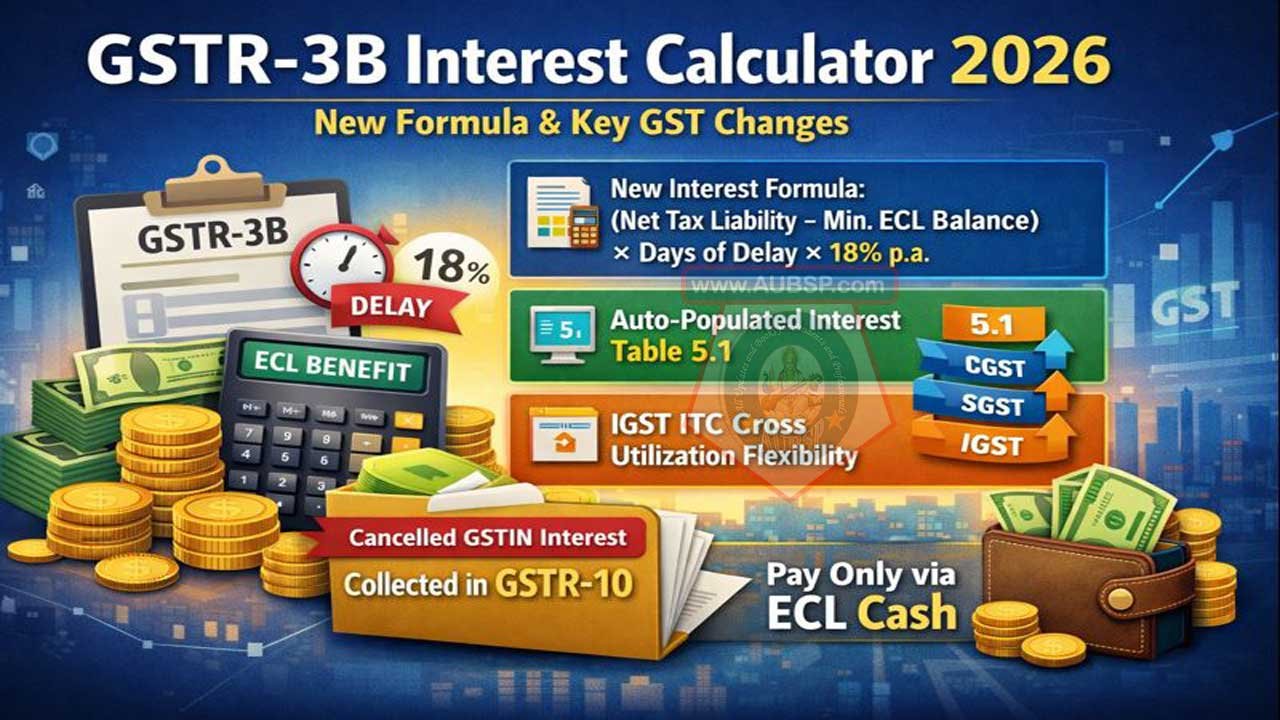

From January 2026, GSTN has overhauled GSTR-3B interest computation by introducing a new automated formula that calculates interest only on net tax liability reduced by the minimum Electronic Cash Ledger (ECL) balance maintained from the due date to the date of payment, offering genuine interest relief to taxpayers with sufficient cash balances.

Interest (generally at 18% p.a.) is now auto-populated in Table 5.1 as a non-reducible minimum liability, while taxpayers must increase it if actual interest is higher. The portal also auto-populates the Tax Liability Breakup Table for prior-period liabilities, improves transparency, and ensures accurate interest calculation.

Additional changes include flexible IGST ITC cross-utilization (allowing CGST/SGST ITC to pay IGST after IGST ITC is exhausted), collection of interest for cancelled registrations through GSTR-10, and strict rules that interest and penalties can be paid only via ECL cash (not ITC). Overall, the updates enhance automation, fairness, and cash-flow efficiency but require careful ECL management, validation of system-computed values, and updated compliance processes by taxpayers.

| Topic | Effective Jan 2026 |

|---|---|

| Applicable Return | GSTR-3B |

| Effective Period | January 2026 tax period onwards |

| Legal Basis | Section 50 of CGST Act, 2017 & Rule 88B(1) of CGST Rules |

| New Interest Formula | (Net Tax Liability − Minimum ECL Balance) × (Days of Delay / 365) × Interest Rate |

| Interest Rate (Late Tax Payment) | 18% per annum |

| Interest Rate (Excess ITC Availment) | 24% per annum |

| Key Benefit Introduced | Deduction of minimum Electronic Cash Ledger (ECL) balance for interest calculation |

| Old Method | Interest on full tax liability |

| New Method | Interest only on net liability after ECL minimum balance |

| Auto-Populated Table | Table 5.1 of GSTR-3B |

| Edit Restriction | Interest cannot be reduced below system-computed value |

| Upward Amendment | Allowed if actual interest is higher |

| Interest Payment Mode | Cash only through Electronic Cash Ledger (ITC not allowed) |

| Tax Liability Breakup Table | Auto-populated based on document dates (GSTR-1 / GSTR-1A / IFF) |

| ITC Utilization Change | After IGST ITC exhaustion, CGST/SGST ITC can offset IGST in any order |

| Cancelled GSTIN Interest | Collected through GSTR-10 (Final Return) |

| First Auto-Population | February 2026 GSTR-3B |

| Nil Return Interest | Not applicable (only late fee applies) |

GSTR-3B Interest Calculator: Complete Guide to January 2026 Updates & New Formula

What Changed in GSTR-3B Interest Calculation?

The Goods and Services Tax Network (GSTN) announced significant updates to the GSTR-3B interest calculation mechanism starting January 2026. These changes fundamentally alter how taxpayers calculate and pay interest on delayed GST payments, introducing benefits through Electronic Cash Ledger minimum balances and enhanced system automation.

For GST-registered businesses, understanding these changes is critical. Interest calculations directly impact your tax liability and cash flow. This comprehensive guide breaks down the new formula, practical implications, and step-by-step filing procedures.

Key Changes in GSTR-3B Interest Calculation (January 2026)

Understanding the New Interest Computation Formula

The GSTN has replaced the previous interest calculation method with a revised formula that accounts for your Electronic Cash Ledger (ECL) minimum balance. This change aligns with the proviso to Rule 88B(1) of the CGST Rules, 2017, and Section 50 of the CGST Act, 2017.

The New Interest Formula:

Interest = (Net Tax Liability – Minimum Cash Balance in ECL from due date to date of debit)

× (No. of days delayed / 365) × Applicable Interest Rate (18% p.a.)What This Means for Taxpayers

Unlike previous calculations that charged interest on the full tax liability, the new system offers a crucial advantage: it deducts the minimum ECL balance maintained between the GSTR-3B due date and the actual tax payment date. This provides genuine interest relief for businesses that maintain adequate cash reserves on the GST portal.

Example Scenario:

- Net Tax Liability: ₹50,000

- Minimum ECL Balance (due date to payment date): ₹20,000

- Days Delayed: 30 days

- Interest Rate: 18% per annum

Old Method: ₹50,000 × 18% × (30/365) = ₹739.73

New Method: (₹50,000 – ₹20,000) × 18% × (30/365) = ₹443.84

Savings: ₹296

Table 5.1: System-Computed Interest in GSTR-3B

How Auto-Population Works

From January 2026 onwards, the GST portal automatically calculates and populates interest in Table 5.1 of GSTR-3B using the revised formula. This automation reduces manual errors and ensures consistency across filings.

Important Restrictions on System-Computed Interest

Non-Editable Values:

The auto-populated interest in Table 5.1 is non-editable in the downward direction. The system prevents taxpayers from reducing the calculated interest below the minimum required amount.

Key Points to Remember:

- System-computed interest represents the minimum interest liability only

- Taxpayers must self-assess their actual interest obligation

- If your records indicate higher interest liability, you can and must amend values upward

- Downward amendments trigger a red-flag warning, though taxpayers can proceed at their own risk (not recommended)

Timeline for Interest Auto-Population

The revised interest computation applies to:

- Delayed returns filed for January 2026 tax period

- Interest auto-populated in February 2026 GSTR-3B

This staggered approach gives taxpayers one month to understand the new calculations before they appear in their returns.

Tax Liability Breakup Table: Auto-Population Feature

What is the Tax Liability Breakup Table?

The Tax Liability Breakup Table in GSTR-3B captures supplies from previous tax periods that are being reported and paid for in the current period. This commonly occurs when:

- Returns were filed late but tax is paid subsequently

- Liability from prior months is declared in the current month’s return

- Invoices from previous periods are reported with current filings

How the Portal Auto-Populates This Table

Effective January 2026, the GST portal automatically populates the Tax Liability Breakup Table based on the date of documents (from GSTR-1, GSTR-1A, or IFF) pertaining to previous tax periods, where corresponding tax liability is discharged in the current period’s GSTR-3B.

Viewing Your Tax Liability Breakup

Navigation Path:

Login → GSTR-3B Dashboard → Table 6.1 (Payment of Tax) → Tax Liability BreakupWhy This Matters

Auto-population of the Tax Liability Breakup Table ensures:

- Accurate tracking of period-wise tax payments

- Correct interest calculation for delayed period liabilities

- Simplified compliance documentation

- Reduced disputes with tax authorities

Input Tax Credit (ITC) Utilization: IGST Flexibility Updates

New IGST Cross-Utilization Rules (January 2026)

Previously, strict ordering requirements limited how taxpayers could use Input Tax Credit. The new update introduces flexibility in Table 6.1 of GSTR-3B for IGST liability payment.

Updated ITC Utilization Sequence

Effective January 2026 onwards:

Once the available IGST ITC is fully exhausted, taxpayers can now pay remaining IGST liability using available CGST and SGST ITC in any sequence of their choice.

Previous Rule:

- IGST ITC offset against IGST liability only

- Remaining IGST paid in cash

New Rule:

- IGST ITC still offsets IGST liability first

- After IGST exhaustion: CGST/SGST ITC can offset IGST in any order

- Flexibility in sequencing reduces cash payment requirements

Practical Benefits

- Improved Cash Flow: Taxpayers can strategically sequence ITC utilization

- Lower Effective Tax: Better credit utilization reduces net cash outflow

- Reduced Disputes: Flexible sequencing aligns with taxpayer business cycles

Interest Collection in GSTR-10: Final Return for Cancelled Taxpayers

What is GSTR-10?

GSTR-10 is the Final Return filed by taxpayers when canceling their GST registration or at the end of the financial year for cancelled registrations.

New Interest Collection Mechanism

For cancelled taxpayers, if the last applicable GSTR-3B return is filed after the due date, the interest applicable on such delayed filing is now collected through GSTR-10 (Final Return) rather than the original period’s return.

Why This Change Matters

- Streamlines Closure Process: Interest collection is consolidated in the final return

- Prevents Pending Liabilities: Ensures interest is captured at cancellation

- Improves Record Keeping: Centralizes all outstanding interest in one document

Important Compliance Note

Cancelled taxpayers must:

- File all outstanding GSTR-3B returns (even if delayed)

- File final GSTR-10 return

- Ensure interest is paid before registration closure

- Verify interest calculations in the final return statement

Interest Rate Details and Payment Requirements

Current Interest Rates (January 2026)

| Situation | Interest Rate | Payment Method |

|---|---|---|

| Late tax payment | 18% per annum | Cash/ECL only (not ITC) |

| Excess ITC claimed | 24% per annum | Cash payment |

| Delayed return filing | 18% per annum | Cash/ECL only |

Electronic Cash Ledger Payment Rules

Critical Compliance Point: Interest, penalties, and late fees can ONLY be paid from your Electronic Cash Ledger (ECL) in cash—not from Input Tax Credit (ITC).

- ITC Usage: Tax payment only

- ECL Usage: Tax, interest, penalties, late fees, and all other liabilities

This distinction is crucial for your monthly cash flow planning.

Step-by-Step Guide: Filing GSTR-3B with New Interest Calculations

Step 1: Login and Navigate to GSTR-3B

Login to GST Portal → Dashboard → GSTR-3B → Select Tax PeriodStep 2: Review Table 5.1 (Interest Calculation)

- Auto-populated interest will appear based on the new formula

- Verify the Electronic Cash Ledger minimum balance used in calculation

- Check: Was the ECL balance truly maintained from due date to payment date?

Step 3: Validate Tax Liability Breakup (Table 6.1)

- Review auto-populated Tax Liability Breakup Table

- Confirm period-wise liability matches your records

- Verify dates and amounts are accurate

Step 4: Assess ITC Utilization (Table 6.1)

- Check available IGST, CGST, and SGST credits

- If IGST exhausted: Select optimal CGST/SGST sequence for payment

- Calculate minimum cash requirement

Step 5: Amend Interest Upward If Required

If your calculations show higher interest liability:

- Click on the interest cell in Table 5.1

- System warning appears (ignore if you’re correcting upward)

- Enter the correct interest amount

- Proceed with filing

Step 6: File and Make Timely Payment

- Submit GSTR-3B before the due date

- Process payment through ECL or direct cash deposit

- Obtain CIN (Challan Identification Number) or payment confirmation

Common Interest Calculation Scenarios

Scenario 1: Delayed Return Filing with ECL Balance

Given:

- January tax liability: ₹100,000

- Due date: February 20, 2026

- Return filed: March 15, 2026 (24 days delayed)

- ECL balance from Feb 20 to Mar 15: ₹30,000 minimum

Calculation:

Interest = (₹100,000 – ₹30,000) × (24/365) × 18%

Interest = ₹70,000 × 0.0658 × 0.18

Interest = ₹827.40

Scenario 2: Multiple Period Liability in Current Return

Given:

- Previous period tax (January): ₹50,000 – unpaid

- Current period (March): Filed Jan on March 15

- Days delayed: 54 days (February 20 to March 15)

- ECL minimum balance: ₹10,000

Calculation:

Interest on Jan liability = (₹50,000 – ₹10,000) × (54/365) × 18%

Interest = ₹40,000 × 0.1479 × 0.18

Interest = ₹1,064.65

Scenario 3: Nil Liability with No Interest

Given:

- Tax liability: ₹0 (Nil return)

- Late fee applies (₹20 per day)

- Days late: 5 days

- Interest: ₹0

Calculation:

Late Fee = ₹20 × 5 = ₹100

Interest = ₹0 (only applies to positive tax liability)

Electronic Cash Ledger (ECL): Strategic Management Tips

Maximizing ECL Benefits for Interest Relief

Since the new interest formula considers ECL minimum balance, strategic ECL management becomes crucial for interest optimization.

Best Practices for ECL Management

1. Maintain Sufficient Balance Before Due Date

- Deposit cash in ECL before GSTR-3B due date

- Ensures minimum balance calculation benefits you

- Reduces interest during delayed filing scenarios

2. Document ECL Balance Carefully

- Take screenshots of ECL statements on the due date

- Download ECL history from the portal

- Maintain for compliance and dispute resolution

3. Plan for Multiple Liabilities

- If you anticipate delayed filings, maintain higher ECL balance

- ECL balance benefits all delayed periods in that filing cycle

- Pro-rata distribution across all delayed supplies

4. Reconcile ECL with Payment Schedule

- Coordinate ECL deposits with your tax payment calendar

- Avoid unnecessary cash pile-up in ECL

- Plan withdrawals for other business needs (within compliance limits)

Key Compliance Changes and Takeaways

What Taxpayers Must Do Immediately

- Update Internal Processes

- Train accounting team on new interest formula

- Update spreadsheets and calculations software

- Document ECL balance tracking procedures

- Review Auto-Populated Values Carefully

- Don’t assume system calculations are 100% accurate

- Verify ECL balance figures used in calculations

- Cross-check with your financial records

- Prepare for First Filing Cycle (January 2026)

- Expect interest auto-population in February GSTR-3B

- Allocate time to review and validate calculations

- Plan cash for interest payment before due date

- Maintain Accurate ECL Records

- Save statements and payment confirmations

- Track minimum balance periods

- Document any ECL transfers or adjustments

Benefits of the New System

✓ Interest Relief: Minimum ECL balance reduces interest burden

✓ Automation: Reduced manual calculation errors

✓ Transparency: Clear formula and calculation methodology

✓ Fairness: Accounts for taxpayer liquidity situation

✓ Compliance: Aligns with statutory provisions

Potential Challenges

⚠ System Learning Curve: New processes require adaptation

⚠ ECL Dependency: Interest savings depend on ECL balance maintenance

⚠ Technical Issues: Portal glitches may affect auto-population accuracy

⚠ Upward Amendment Required: Some taxpayers may need to manually increase interest

Disclaimer and Official Reference

This advisory has been prepared based on the GSTN official advisory on interest collection and related enhancements in GSTR-3B. While comprehensive, this AUBSP guide is educational in nature and not legal advice.

For official compliance:

- Refer to CGST Rules, 2017 – Rule 88B

- Consult CGST Act, 2017 – Section 50

- Review GSTN official advisory on the GST portal

- Consult a qualified GST professional for your specific situation

Always verify with:

- Official GST Portal announcements

- Your GST-registered CPA or tax consultant

- Latest CBIC notifications and circulars

Frequently Asked Questions

Q: Can I reduce the auto-populated interest in GSTR-3B?

A: No. System-computed interest in Table 5.1 cannot be edited downward. You can only increase it if your actual liability is higher.

Q: How is the minimum ECL balance calculated?

A: The portal identifies the lowest ECL balance maintained from the GSTR-3B due date until the date you actually pay the tax (make the debit from ECL).

Q: What if I don’t have an ECL balance?

A: Interest is calculated on the full net tax liability. The benefit applies only if you have maintained ECL balance during the relevant period.

Q: Will cancelled taxpayers pay interest twice – in GSTR-3B and GSTR-10?

A: No. Interest is collected in GSTR-10 (Final Return) for delayed last applicable GSTR-3B filings. It’s consolidated, not duplicated.

Q: Can ITC be used for interest payment?

A: No. Interest, penalties, and late fees must be paid from Electronic Cash Ledger (ECL) cash balance only, not from Input Tax Credit (ITC).

Q: When do the new rules apply to my return?

A: From January 2026 tax period onwards. Delayed returns filed after January 26, 2026 will see auto-populated interest in February 2026 GSTR-3B.

Conclusion: Preparing for January 2026 GSTR-3B Changes

The January 2026 updates to GSTR-3B interest calculation represent a significant positive development for GST taxpayers. The new formula recognizes liquidity management and provides genuine interest relief through ECL balance considerations.

However, success depends on:

- Understanding the revised formula completely

- Maintaining accurate ECL records

- Validating auto-populated calculations before filing

- Planning cash flow for interest payment obligations

By implementing the strategies outlined in this AUBSP guide and maintaining compliance with the new procedures, GST-registered businesses can optimize their tax position while ensuring full statutory adherence.

Leave a Reply

You must be logged in to post a comment.