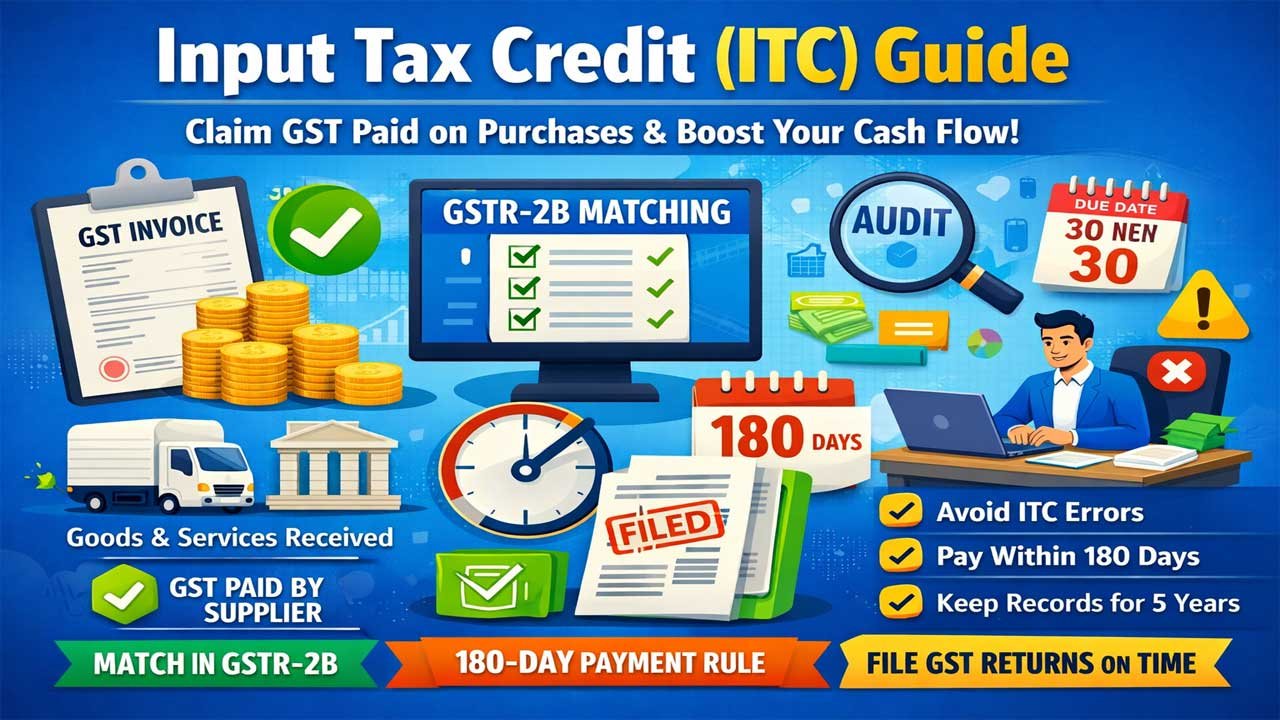

Input Tax Credit (ITC) is a GST mechanism that allows businesses to reduce their tax liability by claiming back the GST paid on purchases used for business purposes, thereby avoiding double taxation and improving cash flow.

To claim ITC, a business must meet four key conditions: possess a valid tax invoice from a registered supplier, receive the goods or services, ensure the supplier has uploaded and paid the GST (reflected in GSTR-2B), and file its own GST returns on time. ITC can only be claimed for invoices appearing in GSTR-2B, and payments to suppliers must be made within 180 days or the credit is reversed (with interest), though it can be reclaimed once payment is made.

Businesses must also avoid claiming blocked credits such as personal expenses, certain motor vehicles, and inputs for exempt supplies, and must meet the annual ITC deadline of November 30 of the following financial year. Accurate monthly reconciliation of purchase registers with GSTR-2B, proper handling of debit/credit notes, and maintaining documentation for five years are essential for audit defense. Using reliable GST software helps automate matching, track reversals, and ensure compliance, making ITC management more efficient and protecting businesses from penalties.

What is Input Tax Credit (ITC)?

Input Tax Credit is your business lifeline. It reduces your tax burden. ITC lets you claim back the GST you paid on purchases. This prevents double taxation. Your business saves money when you claim ITC correctly.

Why ITC Matters for Your Business

Claiming ITC correctly improves cash flow. It reduces your tax liability significantly. Many businesses lose eligible ITC due to simple mistakes. You need to understand ITC rules to maximize your tax credits. Incorrect claims lead to GST audits and penalties.

4 Mandatory Conditions to Claim ITC

Your GST compliance depends on meeting all four conditions. Missing even one condition blocks your ITC claim.

1. You Must Have a Valid Tax Invoice

A valid tax invoice is the foundation of ITC claims. The invoice must be issued by a registered supplier. It must contain all mandatory details. These details include the supplier’s GSTIN. They also include your GSTIN. The invoice must show the GST amount clearly. Keep this document safe. You need it for reconciliation and GST audits.

2. You Must Receive the Goods or Services

Receipt is non-negotiable. Physical receipt of goods matters. For services, actual delivery must happen. You cannot claim ITC for goods in transit. You cannot claim credits for services not yet delivered. Document the receipt date on all invoices. This date proves when you received supplies. Timing matters for your GST returns filing.

3. Your Supplier Must Have Paid GST to the Government

This is critical for ITC eligibility. Your supplier must file their GST returns. They must upload the invoice in GSTR-1. Only then can you claim ITC. Non-compliant suppliers create problems for you. Their tax evasion blocks your legitimate ITC claims. Always verify supplier compliance before claiming credits.

4. You Must File Your GST Returns

Filing GST returns is mandatory for ITC claims. You must file Form GSTR-3B within the deadline. This form is where you report ITC. Without filing returns, you cannot claim any credits. Timely filing ensures your ITC eligibility. Late filing or missing returns void your claims.

The Critical GSTR-2B Matching Rule

GSTR-2B changed everything for ITC claims. This auto-generated form is your source of truth. GSTR-2B shows invoices your suppliers have uploaded. You can claim ITC only for invoices in GSTR-2B. Manual invoices not in GSTR-2B cannot be claimed. This rule prevents fraudulent ITC claims.

How GSTR-2B Works

GSTR-2B is auto-populated from your suppliers’ GSTR-1 filings. You do not enter this data manually. The system generates it automatically. It shows all taxable invoices received by you. It also shows debit notes from suppliers. Non-GST invoices do not appear here.

Why GSTR-2B Matching is Essential

Matching GSTR-2B prevents GST disputes. Auditors verify your GSTR-3B against GSTR-2B. Mismatches trigger detailed scrutiny. You may lose eligible ITC if there are discrepancies. Reconciliation must happen before you file returns.

The 180-Day Payment Rule You Must Know

You must pay your supplier within 180 days. This starts from the invoice date. Failure to pay within 180 days reverses your ITC. The reversed amount is added to your tax liability. You also pay interest on reversed ITC. This rule applies to all GST-registered suppliers.

What Happens if You Exceed 180 Days

Your ITC gets automatically reversed. You lose the credit benefit. You must pay tax on that amount instead. Interest accrues on the reversed amount. Late payments cost you significantly. Always track payment due dates carefully.

Reclaiming ITC After Payment

You can reclaim reversed ITC after you pay the supplier. The reclaim happens in the month you make payment. It appears in your next GSTR-3B filing. Ensure you report the payment correctly. Maintain proof of payment for audits.

Common Mistakes That Cost You ITC

Mistake 1: Claiming ITC Without GSTR-2B Verification

Many businesses claim invoices not yet in GSTR-2B. This is the biggest ITC claim mistake. The invoice might be in your books. But if it is not in GSTR-2B, you cannot claim it. Your supplier may have filed their return late. Or they may have filed it with errors. You lose the credit until they correct it.

Mistake 2: Not Checking for Blocked Credits

Certain ITC is blocked by GST law. Personal expenses have blocked ITC. Motor vehicles carry restrictions. Expenses for exempt supplies are blocked. Free samples cannot claim ITC. These blocked credits must be excluded. Claiming blocked ITC invites penalties.

Mistake 3: Supplier Non-Compliance Issues

If your supplier is unregistered, you cannot claim ITC. If they have not paid GST, you lose your credit. If they filed returns incorrectly, your claim fails. Always verify supplier registration status. Check their GST compliance records. Non-compliant suppliers create compliance risks for you.

Mistake 4: Missing the ITC Claim Deadline

The ITC claim deadline is November 30. This is November 30 of the year after the invoice was issued. Or it is the date you file your annual return (GSTR-9). Whichever comes first. Missing this deadline forfeits your ITC forever. Mark these dates on your calendar.

Mistake 5: Incorrect Treatment of Debit and Credit Notes

Debit notes increase your ITC entitlement. Credit notes reduce it. Mishandling these documents creates discrepancies. A missing debit note understates your claim. An uncorrected credit note overstates it. Both trigger GST notices.

How to Claim ITC: Step-by-Step Process

Step 1: Collect and Organize Your Documents

Gather all GST invoices from the filing period. Organize them supplier-wise. Separate taxable from exempt supplies. Sort them by invoice date. Create a purchase register with invoice details. This organization saves time during reconciliation.

Step 2: Log Into the GST Portal

Visit the official GST portal. Log in with your GSTIN and credentials. Navigate to the Returns section. Select the relevant month or quarter. Click on “Prepare Online GSTR-3B.” The portal opens your return filing page.

Step 3: Verify Your GSTR-2B

GSTR-2B auto-populates from supplier filings. Check all invoices in GSTR-2B carefully. Identify invoices that are missing from GSTR-2B. Note any discrepancies in amounts or tax rates. Prepare a list of items to be followed up with suppliers.

Step 4: Reconcile Purchase Register with GSTR-2B

Match each invoice in your books with GSTR-2B. Look for invoice number, supplier GSTIN, and amount. Identify invoices in your books but not in GSTR-2B. These are your “Not Yet in GSTR-2B” invoices. They cannot be claimed in the current period.

Step 5: Filter Out Blocked ITC

Review each purchase for blocked credit eligibility. Exclude personal expenses from ITC claims. Remove motor vehicle expenses (if blocked). Exclude supplies used for exempt outputs. Separate business-use goods from personal use. Create a blocked ITC register.

Step 6: Check Supplier Payment Status

Verify you paid each supplier within 180 days. Maintain proof of payment. Check your bank statements. Match payments with invoice dates. Flag invoices where payment exceeds 180 days. These invoices lose ITC eligibility.

Step 7: Report ITC in GSTR-3B Form

Open GSTR-3B for filing. Navigate to Table 4 (ITC Details). Report eligible ITC from GSTR-2B. Report ineligible ITC separately. Report ITC reversed during the period. Report ITC reclaimed after supplier payment. Ensure figures match your reconciliation.

Step 8: File Your Return

Review all entries in GSTR-3B carefully. Check for calculation errors. Verify that Table 4 aligns with GSTR-2B. Ensure tax liability is calculated correctly. Click on “Save” and then “Submit.” Pay any tax due before filing.

Step 9: Maintain Reconciliation Records

Keep reconciliation working papers for 5 years. Document why certain invoices were excluded. Note supplier-wise discrepancies found. Record follow-ups with suppliers regarding missing invoices. Maintain proof of supplier compliance checks.

What to Do If ITC is Missing from GSTR-2B

Invoices may not appear in GSTR-2B for several reasons. Your supplier may have filed their return late. They may have filed with incorrect details. They may not have filed at all. You need to take action quickly.

Contact Your Supplier Immediately

Reach out to your supplier without delay. Ask them to verify their GSTR-1 filing. Request they check their return filing status. Provide invoice details if they cannot locate it. Request urgent correction if there are errors. Keep written communication for compliance records.

Verify Supplier Registration

Check your supplier’s GSTIN on the GST portal. Verify their registration is active. Confirm they are authorized to issue invoices. Check if they have filed returns for the relevant period. An unregistered supplier means no ITC for you.

Claim ITC in the Correct Period

Once the invoice appears in GSTR-2B, you can claim it. This happens after your supplier files their return. You claim it in your next return filing. The claim is made in the month it appears in GSTR-2B. Do not wait for a notice if the invoice is genuinely delayed.

Document Everything for Audit Defense

Maintain email correspondence with suppliers. Keep copies of their GSTR-1 filings. Document the dates you followed up. Record when the invoice finally appeared in GSTR-2B. This documentation defends you during GST audits.

ITC Reversal Rules Every Business Must Know

ITC reversal happens in specific situations. Understanding these rules protects your credits.

When ITC is Reversed

Non-payment within 180 days reverses ITC. Change in usage of inputs reverses ITC. Goods or services used for exempt supply reverse ITC. Goods damaged or destroyed reverse ITC. Personal use of business supplies reverses ITC. Blocked categories always have reversed ITC.

How to Reclaim Reversed ITC

Payment within 180 days allows reclaim. Change of usage back to taxable supplies allows reclaim. Goods replaced or returned allow reclaim. The month of reclaim is when you claim back the credit. Report it in Table 4 of GSTR-3B.

Interest on Reversed ITC

Interest accrues on reversed amounts. The rate is typically 18% per annum. Interest calculation begins from the original claim date. It continues until the reversal month. Payment of interest is mandatory if applicable.

Blocked Input Tax Credit: What You Cannot Claim

Certain supplies have permanently blocked ITC. These are categories where GST rules prohibit credit claims. Understanding blocked credits prevents compliance violations.

Motor Vehicles (With Exceptions)

Personal cars cannot claim ITC. Two-wheelers cannot claim ITC. Commercial vehicles and heavy vehicles can claim ITC. Ambulances can claim ITC. Vehicles used for stock transfer can claim ITC. Precise usage documentation is required.

Personal Consumption Expenses

Employee meals and entertainment are blocked. Personal vehicle maintenance is blocked. Employee housing allowances are blocked. Staff uniforms may or may not qualify. Review each expense carefully against GST law.

Exempt Supply Inputs

Goods used for making exempt supplies have blocked ITC. Banking services are exempt. Insurance premiums are partially exempt. Educational services are exempt. If your supply is exempt, related ITC is blocked.

Free Samples and Gifts

Samples provided to customers have blocked ITC. Gifts to employees have blocked ITC. Promotional items may or may not qualify. Gifts to customers are generally blocked. Maintain clear documentation of the purpose.

GSTR-2B vs. Purchase Register: The Reconciliation

Reconciliation is the foundation of accurate ITC claims. It ensures your books match the tax system’s records.

What to Reconcile

Match invoice-by-invoice from your books against GSTR-2B. Check invoice numbers, dates, and amounts. Verify supplier GSTIN matches exactly. Confirm GST amounts are correctly shown. Identify all discrepancies without exception.

Common Discrepancies and Solutions

Missing in GSTR-2B: Supplier has not filed return or filed late. Action: Follow up with supplier for filing status.

Amount Mismatch: Supplier filed wrong amount. Action: Request supplier to file amended return (ANX-1).

GST Rate Difference: Invoice shows one rate, GSTR-2B shows another. Action: Verify correct rate applicable and request correction.

Supplier GSTIN Error: Wrong GSTIN reported. Action: Obtain correct GSTIN and request amendment from supplier.

Duplicate Invoices: Same invoice appears twice. Action: Contact supplier to ensure single filing.

Documentation You Must Maintain for 5 Years

GST law requires 5-year document retention. Audits and notices may demand proof anytime during this period.

Essential ITC Documents

Original tax invoices from all suppliers. Debit notes and credit notes received. Proof of payment to suppliers. Bank statements showing supplier payments. Reconciliation working papers. Purchase register maintained month-wise. GSTR-2B statements for each filing period. GSTR-3B returns filed. ITC reversal and reclaim documentation. Supplier verification records.

Digital vs. Physical Records

Digital records must be in an auditable format. PDF copies of invoices are acceptable. Email confirmations of supplier communications are evidence. Bank statements in soft copy are valid. Maintain backup copies of all digital records. Physical originals should be kept safely.

Digital Tools for Accurate ITC Management

GST software solutions streamline ITC management. They reduce manual errors significantly. Many affordable options are available.

Features to Look For

Auto-matching of invoices with GSTR-2B. Real-time discrepancy alerts. ITC calculation and reversal tracking. Blocked credit identification. Payment deadline reminders. Audit-ready reconciliation reports. Multi-GSTIN support for large businesses. Integration with accounting software.

Popular Solutions in India

ClearTax GST offers comprehensive ITC features. TallyPrime has GST compliance modules. Zoho Books provides GST integration. Busy ERP supports full GST management. Optotax specializes in ITC reconciliation. Gen GST offers unlimited return filing. Saral GST provides affordable solutions for small businesses.

Common Questions About ITC Claims

Q: Can I claim ITC for goods still in transit?

A: No. ITC can be claimed only after actual receipt of goods or services. Transit does not qualify.

Q: What if my supplier is unregistered?

A: You cannot claim ITC from unregistered suppliers. Ensure all suppliers are GST-registered.

Q: Can I claim ITC if I pay the supplier after 180 days?

A: No. Payment must be within 180 days of invoice date. Late payment voids the ITC.

Q: Is ITC available for supplies used for personal consumption?

A: No. ITC is only available for business use. Personal expenses are blocked.

Q: What happens if the supplier’s invoice is wrong?

A: You cannot claim that invoices incorrect ITC. The supplier must issue a corrected invoice or credit note.

Q: Can I claim ITC for goods that were damaged?

A: ITC must be reversed for damaged goods. You cannot claim credit for goods not used in business.

Q: When is the deadline to claim ITC?

A: November 30 of the next financial year, or your GSTR-9 filing date, whichever is earlier.

Conclusion: Master ITC Compliance for Business Growth

Claiming ITC correctly is a financial necessity. It directly impacts your cash flow and profitability. The process requires attention to detail. Follow the four mandatory conditions religiously. Always match your purchases with GSTR-2B. File your returns on time without fail. Maintain comprehensive documentation for audits.

Most ITC claims are rejected due to avoidable mistakes. Reconcile your books monthly, not annually. Track the 180-day payment deadline. Identify blocked credits proactively. Follow up with suppliers for missing invoices. Use GST software to eliminate human errors.

Your tax liability decreases when you claim eligible ITC. Your cash flow improves immediately. Compliance becomes stress-free with proper systems. Start your ITC reconciliation process today. Build a culture of GST compliance in your organization. The effort you invest now saves you from future penalties and audit hassles.

Leave a Reply

You must be logged in to post a comment.