India’s Labour Codes Effective 21 November 2025: What Auditors Need to Know

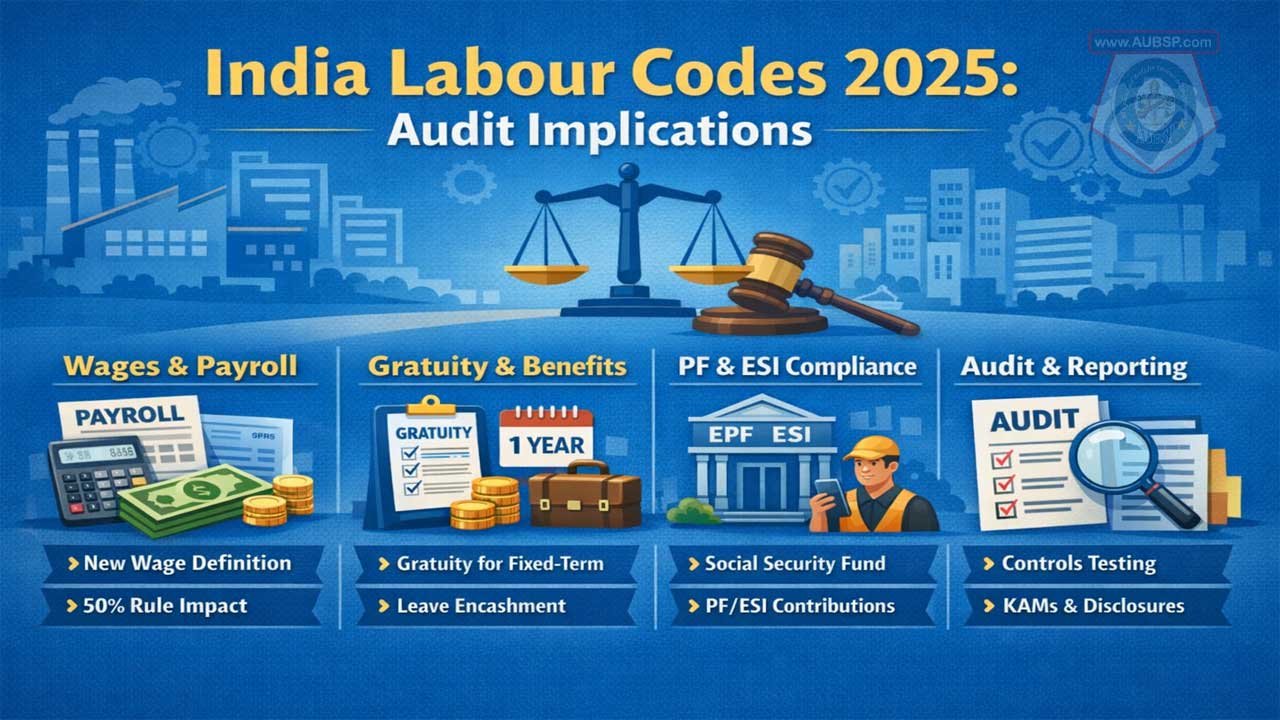

The coming into force of India’s four consolidated Labour Codes marks the most significant overhaul of employment law in decades. From an audit perspective, the change is not merely legal or procedural—it directly affects payroll costs, employee benefit obligations, statutory dues, internal controls and financial statement disclosures.

With the Codes effective from 21 November 2025, auditors must now plan and execute engagements in an environment where the parent legislation is operative, but large parts of the subordinate rule framework are still evolving.

This AUBSP article analyses the changes through an auditor’s lens and sets out how statutory auditors should respond in planning, execution and reporting.

| Area | Key Information / Audit Relevance |

|---|---|

| Effective date | Four Labour Codes effective 21 Nov 2025, replacing 29 central labour laws |

| Rules status | Many Central/State Rules pending; old rules apply only if not inconsistent |

| Wages definition | Basic + DA + retaining allowance; exclusions capped at 50%; in-kind benefits up to 15% included |

| Coverage widened | “Employee” includes managerial/supervisory staff; “worker” expanded; “employer” includes persons with ultimate control |

| Minimum wages | National Floor Wage introduced; State minimum wages cannot be lower |

| Gratuity | Based on new wage definition; fixed-term employees eligible after 1 year |

| PF / ESI | Clear applicability thresholds; wage base impacted by new definition |

| Gig/platform workers | Covered under Social Security Fund funded by aggregators |

| IR Code impact | Retrenchment compensation + Worker Reskilling Fund (15 days’ wages) |

| OSH Code impact | Min 18 days leave, carry-forward 30 days, mandatory encashment |

| Accounting impact | Increase in gratuity/leave = plan amendment / past service cost |

| Timing of recognition | Recognise impact from 21 Nov 2025; earlier periods = non-adjusting event |

| Audit risk areas | Payroll, statutory dues, gratuity/leave provisions, controls, disclosures |

| Reporting impact | CARO, IFC, possible SA 705 modification or SA 706 EoM |

Big picture – what has changed

From 21 November 2025, the following four Labour Codes are in force:

- Code on Wages, 2019

- Industrial Relations Code, 2020

- Code on Social Security, 2020

- Occupational Safety, Health and Working Conditions Code, 2020

Together, these Codes subsume 29 central labour laws, replacing a fragmented compliance framework with a unified structure.

A critical transitional feature is that although the Codes are effective, many Central and State Rules remain at draft or pending stages. In this interim period, the existing rules under repealed laws continue to apply only to the extent they are not inconsistent with the Codes. This creates judgement-heavy compliance scenarios and elevates audit risk.

For auditors, the most direct impact areas are:

- Payroll computation and classification

- Employee benefit liabilities (gratuity, leave, PF, ESI, bonus)

- Statutory dues and timelines

- Financial statement disclosures and reporting under CARO and IFC

Key legal and conceptual changes relevant for audits

Expanded and redefined concepts

The Codes substantially widen the scope of several foundational definitions:

Wages

“Wages” is now defined as Basic Pay + Dearness Allowance + Retaining Allowance, with specified exclusions such as HRA, overtime, employer PF contribution and certain allowances. However, if total exclusions exceed 50% of total remuneration, the excess is automatically pulled back into wages. Additionally, benefits provided in kind (up to 15% of total remuneration) are also included in wages.

This definition has a cascading effect on PF, ESI, gratuity, leave encashment and retrenchment compensation.

Employee, worker and employer

- “Employee” explicitly includes managerial, supervisory and administrative staff, removing ambiguity that existed earlier.

- “Worker” now includes sales promotion employees and working journalists, with a higher supervisory wage threshold of ₹18,000 per month (earlier ₹10,000).

- “Employer” is broadened to include persons with ultimate control, contractors and legal representatives, increasing accountability in complex group and contractor-led structures.

Wage Code highlights

- Introduction of a National Floor Wage, below which no State can fix minimum wages.

- Removal of any wage ceiling for payment-of-wages provisions, extending protection to all employees, including senior management.

- Bonus coverage threshold of ₹21,000 per month continues until revised by appropriate Governments.

Social Security Code highlights

- Gratuity continues but is now computed using the new wages definition.

- Fixed-term employees become eligible for gratuity after one year of service, compared to five years for permanent employees.

- Clear applicability thresholds for PF, ESI, gratuity, maternity benefits, etc.

- Extension of social security coverage to gig and platform workers, funded through a Social Security Fund financed by aggregators (1–2% of turnover, capped at 5% of payouts).

IR Code and OSH Code – high-impact provisions

- Establishment of a Worker Reskilling Fund, funded by employer contributions equal to 15 days’ last drawn wages per retrenched worker.

- Retrenchment compensation generally set at 15 days’ average pay per completed year of service, subject to Government notification.

- OSH Code mandates:

- Minimum 18 days of annual leave

- Carry-forward up to 30 days

- Mandatory encashment of excess leave

- Codified rules on working hours, overtime and shift patterns

Penalty framework

The Codes significantly increase monetary penalties, introduce compounding mechanisms, and restrict imprisonment to serious or repeat offences. While primarily legal in nature, this affects auditors’ assessment of contingent liabilities and compliance risk.

Core audit responsibilities and planning implications

Auditors must treat the Labour Codes as laws and regulations directly affecting material amounts and disclosures under SA 250. Compliance cannot be viewed as a peripheral HR matter; it directly impacts employee costs, provisions and statutory liabilities.

Key responsibilities include evaluating whether management has:

- Determined code-wise and state-wise applicability

- Recognised liabilities in accordance with the Codes and relevant ICAI FAQs

- Made adequate disclosures, including treatment as non-adjusting events for periods ending before 21 November 2025

Audit strategies should be updated to address:

- Increased Risk of Material Misstatement (RoMM) in payroll, statutory contributions and actuarial provisions

- The stage and quality of implementation, including late changes to systems and controls near reporting dates

- The need for specialists (actuarial, labour law, tax) where interpretations or valuations are complex

Analytical procedures become especially powerful, including:

- Ratio of allowances to total remuneration (to assess the 50% wage rule)

- PF/ESI contributions as a percentage of gross wages under the new definition

- Period-on-period trends and budget comparisons

Understanding the entity and management’s response

When understanding the entity and assessing RoMM, auditors should focus on:

Workforce mix

- Geographic spread across States

- Permanent, fixed-term and contract employees

- Workers engaged through contractors or managed service providers

- Gig or platform workers, if applicable

Remuneration structures

- Composition of salary (basic, DA, allowances)

- Benefits in kind and variable pay

- Mapping of all components to the new “wages” definition

Management actions and governance

- Legal evaluations and interpretations of “wages”

- Legal opinions obtained and their scope

- Changes to payroll systems, configurations and IT general controls

- Re-estimation of actuarial liabilities using the revised wage base

- Inclusion of fixed-term employees in benefit valuations

- Updates to IFC over financial reporting under Section 143(3)(i)

- SEBI LODR disclosures for listed entities

Engagement team discussions should explicitly address areas of complex judgement, incentives for misstatement (such as salary restructuring or under-provisioning), management override risks during transition and the need for specialist involvement.

Key audit procedures to build into engagements

(a) Controls testing

Auditors should test the design and operating effectiveness of controls over:

- Governance of payroll configuration changes

- Reconciliation of HR masters with payroll and statutory returns

- Automated statutory calculations using the new wage definition

Sampling should cover employees across categories—permanent, fixed-term, contract and gig/platform workers—to:

- Verify wage computation under the new definition

- Reconcile PF, ESI and other contributions with challans

- Confirm inclusion of all eligible employees in actuarial data

Where payroll is outsourced, procedures aligned with SA 402 are required, including review of SOC 1 Type 1/Type 2 reports or alternative procedures, and reconciliation of service-provider reports with the client’s general ledger and challans.

(b) Substantive procedures

Substantive testing should include:

- Review of revised employment contracts for compliance with the Codes

- Cut-off testing of wages and statutory dues at period end

- Analysis of pre- and post-implementation pay structures to detect artificial restructuring aimed at minimising wage-based impacts

For actuarial valuations:

- Reconcile actuarial data to HR masters

- Sample-test join dates, service periods, ages and classifications

- Ensure the actuary has applied the correct wage definition

- Evaluate assumptions for consistency and reasonableness, with attention to potential management bias

(c) Legal opinions, representations and TCWG communication

Auditors should:

- Evaluate the competence and independence of legal counsel

- Assess consistency of legal opinions with notifications and FAQs

- Obtain specific management representations covering compliance responsibility, completeness of impact assessments, actuarial data integrity and disclosure of all legal advice

With those charged with governance, auditors should discuss the overall impact assessment, high-risk areas, major judgements, effects on actuarial liabilities, control deficiencies and how these influenced the audit response and Key Audit Matters.

Accounting, financial reporting and tax – high-yield areas

ICAI’s Annexure FAQs provide clear guidance for both advisory and audit purposes.

Gratuity (Ind AS 19 / AS 15)

Increases in obligation due to the Codes—arising from the new wage definition or one-year eligibility for fixed-term employees—constitute a plan amendment:

- Under Ind AS: recognised immediately in profit or loss as past service cost

- Under AS 15: vested past service cost recognised immediately; unvested cost amortised over the vesting period

Salary restructuring

Auditors must distinguish between:

- Genuine actuarial assumption changes (e.g., higher increments), and

- Plan amendments resulting from re-weighting pay components to meet the 50% rule

These require separate accounting treatment.

Timing of recognition

Since the Codes are effective from 21 November 2025, impacts must be recognised in interim results such as the quarter ended 31 December 2025. Deferral to 31 March 2026 is not appropriate.

For periods ending before 21 November 2025, the Codes represent a non-adjusting event, requiring disclosure under Ind AS 10 / AS 4, including estimated impact where practicable.

Leave obligations

Changes in leave entitlements under the Codes are treated as past service cost for long-term leave benefits and are recognised immediately in profit or loss under both Ind AS 19 and AS 15.

Exceptional items

Additional expenses arising from the Codes may be presented as exceptional items if material and non-recurring, but in all cases, clear and separate disclosure of the impact is expected.

Tax implications

There are no special tax rules for Code-related provisions. Normal rules apply:

- Immediate deductions affect current tax

- Remaining amounts create deductible temporary or timing differences, leading to DTA recognition subject to prudence under Ind AS 12 / AS 22

Reporting considerations for statutory audits

Under SA 705, failure to comply with the Codes or inability to obtain sufficient appropriate evidence may result in qualified, adverse or disclaimer opinions, depending on materiality and pervasiveness.

An Emphasis of Matter under SA 706 may be appropriate where management has properly recognised liabilities and provided extensive disclosures that are fundamental to user understanding.

Under CARO 2020 and IFC reporting, auditors must specifically assess:

- Regularity of deposit of statutory dues under the new regime

- Design and operating effectiveness of controls over wage determination, statutory contributions and supporting IT systems, particularly where implementation remains incomplete at the reporting date

Conclusion

The Labour Codes are not merely a compliance update; they reshape the economics of employment and the audit landscape around employee costs and benefits. For auditors, the challenge lies in navigating legal uncertainty, heightened judgement and compressed implementation timelines while maintaining audit quality.

Early engagement with management, robust planning, disciplined use of specialists and clear communication with those charged with governance will be critical in auditing the first years under India’s new labour law regime.

FAQs about New Labour Codes 2025

When did the four Labour Codes become effective?

The Code on Wages, Industrial Relations Code, Code on Social Security and OSH Code became effective from 21 November 2025.

Do the Labour Codes apply even though many Rules are still pending?

Yes. The Codes are fully in force. Existing Central and State Rules continue only to the extent they are not inconsistent with the Codes.

Why are the Labour Codes important from an audit perspective?

They directly affect payroll costs, statutory contributions, gratuity and leave liabilities, internal controls and financial statement disclosures.

What is the new definition of “wages”?

Wages include basic pay, dearness allowance and retaining allowance, with specified exclusions. If exclusions exceed 50% of total remuneration, the excess is added back to wages. Benefits in kind up to 15% are also included.

Why is the 50% wage rule significant for audits?

It can materially increase the wage base for PF, ESI, gratuity, leave encashment and retrenchment compensation, increasing liabilities and expenses.

Does the Code on Wages apply to senior management?

Yes. There is no wage ceiling for payment-of-wages provisions, so protections extend to all employees, including senior management.

Has the definition of employee changed?

Yes. “Employee” now explicitly includes supervisory, managerial and administrative staff.

Who is considered a “worker” under the new Codes?

Workers include sales promotion employees and working journalists, with a higher supervisory wage threshold of ₹18,000 per month.

How has the definition of “employer” changed?

It now includes persons with ultimate control, contractors and legal representatives, increasing accountability in complex structures.

What is the National Floor Wage?

It is a minimum benchmark wage fixed by the Central Government below which State minimum wages cannot fall.

Has the bonus eligibility threshold changed?

The monthly wage threshold of ₹21,000 continues until revised by the appropriate Government.

How does the Social Security Code impact gratuity?

Gratuity is now calculated using the new wages definition, which may increase the obligation.

Are fixed-term employees eligible for gratuity?

Yes. Fixed-term employees become eligible for gratuity after one year of service.

How do the Codes affect PF and ESI contributions?

Applicability thresholds are clarified, and the contribution base may increase due to the revised wages definition.

Are gig and platform workers covered under the Codes?

Yes. They are covered through a Social Security Fund funded by aggregators.

How is the Social Security Fund financed?

Aggregators contribute 1–2% of their turnover, capped at 5% of payouts to gig and platform workers.

What is the Worker Reskilling Fund?

It is a fund requiring employer contributions equal to 15 days’ last drawn wages for every retrenched worker.

How has retrenchment compensation changed?

It is generally set at 15 days’ average pay for each completed year of service, subject to Government variation.

What are the key OSH Code changes affecting employee benefits?

Minimum 18 days of annual leave, carry-forward up to 30 days and mandatory encashment of excess leave.

Have penalties changed under the new regime?

Yes. Monetary penalties are higher, compounding is allowed and imprisonment is limited to serious offences.

How should auditors treat the Labour Codes under auditing standards?

They should be treated as laws directly affecting material amounts and disclosures under SA 250.

What are the main audit risk areas arising from the Codes?

Payroll computation, statutory contributions, gratuity and leave provisions, controls and disclosures.

What analytical procedures are useful for auditing Labour Code impacts?

Allowance-to-pay ratios, PF/ESI ratios to gross wages, trend analysis and budget comparisons.

Why is understanding workforce mix critical for audits?

Different categories such as fixed-term, contract and gig workers have different compliance and liability implications.

What payroll system risks arise during implementation?

Late or incorrect configuration changes, weak change governance and control overrides during transition.

Why are actuarial valuations particularly high risk?

They rely on correct wage definitions, employee data completeness and management assumptions.

How should increases in gratuity liability due to the Codes be accounted for?

They are treated as plan amendments resulting in past service cost.

What is the accounting treatment under Ind AS for such increases?

Past service cost is recognised immediately in profit or loss.

How does AS 15 treat past service cost?

Vested past service cost is recognised immediately; unvested cost is amortised over the vesting period.

How should changes in leave entitlements be accounted for?

They are treated as past service cost and recognised immediately in profit or loss.

Can Labour Code-related expenses be shown as exceptional items?

Yes, if they meet materiality and incidence criteria, with clear disclosure of impact.

When should the impact of the Labour Codes be recognised in accounts?

From 21 November 2025, including interim periods such as the quarter ended 31 December 2025.

How should periods ending before 21 November 2025 be treated?

The Codes are a non-adjusting event requiring disclosure under Ind AS 10 or AS 4.

Do the Labour Codes have special tax treatment?

No. Normal tax rules apply for gratuity and leave provisions.

How do the Codes affect deferred tax accounting?

They may create deductible temporary or timing differences leading to DTA recognition, subject to prudence.

What audit procedures are critical for outsourced payroll?

SA 402 procedures, review of SOC 1 reports and reconciliation of service-provider data with client records.

Why are legal opinions important in auditing Labour Code compliance?

They support management’s interpretation of complex provisions but must be evaluated for competence and consistency.

What management representations should auditors obtain?

Representations on compliance responsibility, completeness of impact assessment, actuarial data integrity and disclosure of legal advice.

How should auditors communicate Labour Code impacts to TCWG?

By discussing key judgements, high-risk areas, control gaps, impact on liabilities and audit responses.

Can non-compliance with the Codes affect the audit opinion?

Yes. Depending on materiality and pervasiveness, it can lead to qualified, adverse or disclaimer opinions under SA 705.

When is an Emphasis of Matter appropriate?

When the impact is significant and well disclosed but does not warrant a modified opinion.

How do the Labour Codes affect CARO reporting?

Auditors must assess regularity of statutory dues and compliance under the new regime.

What is the impact on IFC reporting?

Auditors must evaluate design and operating effectiveness of controls over wages, contributions and related IT systems.

What is the biggest practical challenge for auditors under the new Codes?

Balancing evolving legal interpretations with the need to obtain sufficient appropriate audit evidence within reporting timelines.

Leave a Reply

You must be logged in to post a comment.