December 2025 GST data shows a mixed picture, with gross collections rising 6.1% year-on-year to ₹1.74 lakh crore, indicating steady economic activity, but net revenue growing only 2.2% to ₹1.46 lakh crore due to a sharp surge in refunds.

Import-related GST was the main growth driver, jumping nearly 20%, while gross domestic collections grew a muted 1.2%. The key drag came from domestic refunds, which surged 62%, pulling net domestic revenue down by 5.1% and offsetting much of the headline gains.

Strong growth in net customs revenue helped prevent an overall decline, and on a year-to-date basis the picture remains positive, with gross GST up 8.6% and net GST up 6.8%, suggesting the fiscal year remains broadly on track despite month-specific pressures.

Gross Collections Rise 6.1% to ₹1.74 Lakh Cr; Surge in Refunds Moderates Net Gains

December 2025 proved to be a mixed month for India’s Goods and Services Tax (GST) landscape. While headline gross collections demonstrated robust economic activity with a 6.1% year-on-year growth, a sharp spike in tax refunds—particularly in the domestic sector—significantly dampened the net revenue accrual for the government.

This analysis breaks down the key components of the December data, highlighting the disparity between robust gross inflows and the tempered net realizations.

Executive Summary: The Big Picture

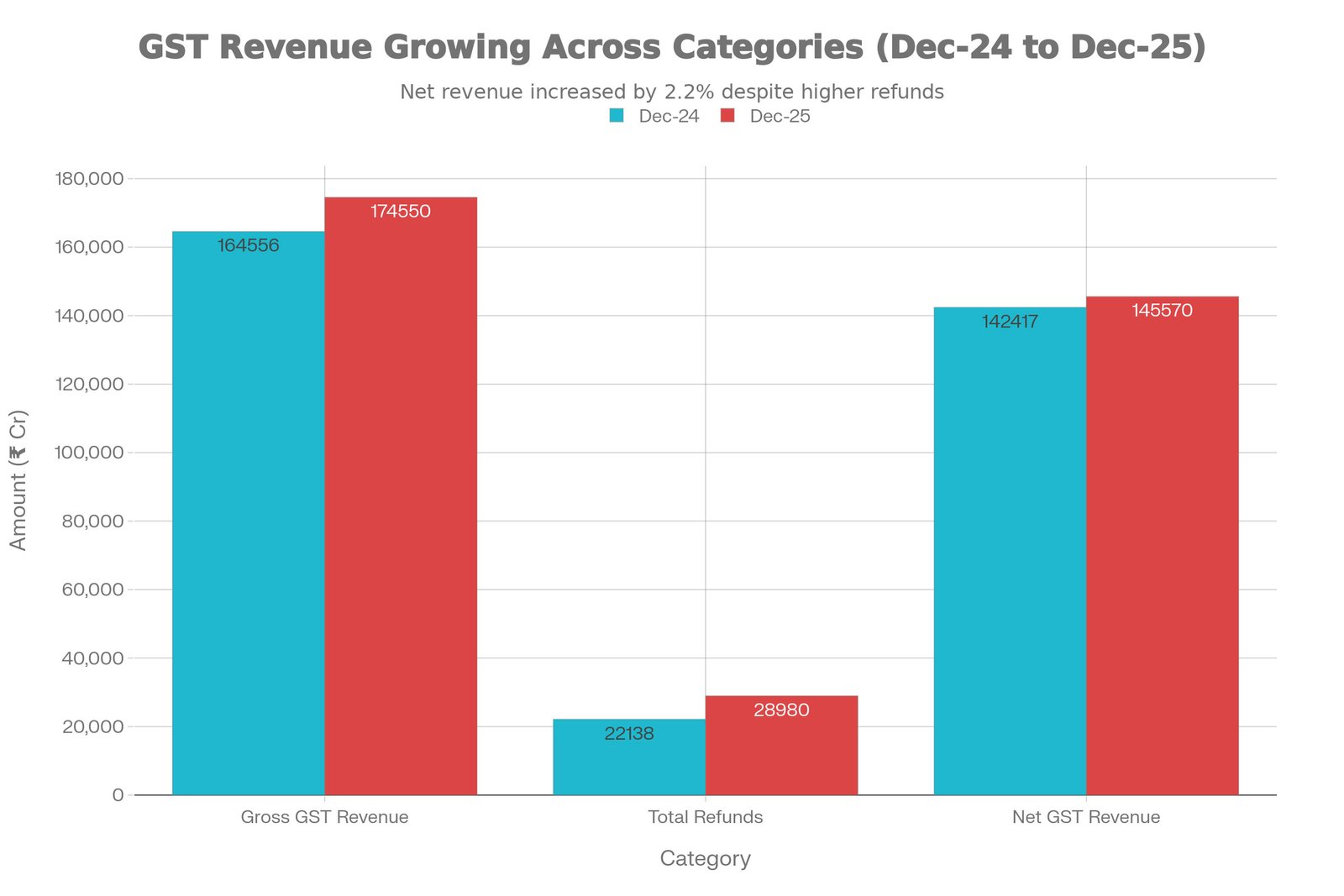

- Gross GST Revenue: Reached ₹1,74,550 crore, up from ₹1,64,556 crore in Dec 2024.

- Net GST Revenue: Stood at ₹1,45,570 crore, a modest growth of 2.2% due to higher refunds.

- Key Driver: Import revenue surged significantly, outperforming domestic revenue growth.

- The Drag Factor: Domestic refunds skyrocketed by 62%, pulling domestic net revenue into negative growth territory.

Gross Revenue Trends: Imports Outpace Domestic Consumption

The total gross GST revenue for December 2025 stood at ₹1,74,550 crore, reflecting a healthy 6.1% increase over the previous year. However, a deeper look reveals a divergence between domestic consumption and external trade.

Domestic vs. Import Growth

- Domestic Revenue: Gross domestic collections (CGST + SGST + IGST on domestic) grew by a marginal 1.2%, rising to ₹1,22,574 crore.

- Import Revenue: In contrast, revenue from imports (IGST on imports) saw a stellar jump of 19.7%, reaching ₹51,977 crore.

This suggests that while domestic consumption demand remained stable, import activity accelerated sharply, contributing significantly to the exchequer’s top line.

| Component | Dec 2024 (₹ Cr) | Dec 2025 (₹ Cr) | Growth (%) |

|---|---|---|---|

| Gross Domestic | 1,21,118 | 1,22,574 | 1.2% |

| Gross Import | 43,438 | 51,977 | 19.7% |

| Total Gross GST | 1,64,556 | 1,74,550 | 6.1% |

Comparison of GST Revenue and Refunds: December 2024 vs. December 2025

The Refund Effect: A 62% Surge

The most critical narrative in the December 2025 data is the aggressive disbursement of refunds. Total refunds granted during the month increased by 30.9% to ₹28,980 crore.

The primary driver was Domestic Refunds, which surged by an unprecedented 62.0% to ₹18,422 crore.

- CGST Refunds: Increased from ₹2,906 cr to ₹4,274 cr.

- IGST Refunds: Nearly doubled from ₹4,813 cr to ₹8,709 cr.

While efficient refund processing improves liquidity for businesses, such a massive year-on-year jump directly impacts the government’s cash in hand for the month.

Net Revenue Analysis: The Real Income

Net revenue—calculated as Gross Revenue minus Refunds—offers a clearer picture of the government’s actual fiscal position. Due to the high volume of refunds, the Total Net GST Revenue grew by only 2.2% to ₹1,45,570 crore.

The Domestic Deficit

One of the most concerning statistics is the contraction in Net Domestic Revenue.

- Net Domestic Revenue fell by 5.1%, dropping from ₹1.09 lakh crore in Dec 2024 to ₹1.04 lakh crore in Dec 2025.

- This decline was offset by Net Customs Revenue, which grew by a robust 26.8%.

This indicates that without the strong performance of import taxes, the overall net GST collections for the month would have likely been in the red compared to last year.

Year-to-Date Performance (FY 2025-26)

Looking at the cumulative data for the fiscal year up to December, the trends remain positive, smoothing out monthly volatilities.

- Total Gross Revenue (YTD): Stands at ₹16,50,039 crore, an 8.6% growth over the same period last year.

- Total Net Revenue (YTD): Stands at ₹14,25,006 crore, registering a 6.8% growth.

- Refunds (YTD): Total refunds for the year are up 21.7%, crossing the ₹2.25 lakh crore mark.

Conclusion

The December 2025 GST figures present a nuanced economic story. The 6.1% growth in gross collections signals that the broader economy is holding steady, bolstered significantly by strong import activity. However, the 5.1% dip in net domestic revenue warrants attention. It implies that while businesses are paying taxes, they are also claiming credits and refunds at a much faster rate than before, potentially due to year-end adjustments or accumulated credit clearings.

For policymakers, the robust 8.6% YTD growth remains the key takeaway, suggesting that despite monthly fluctuations, the fiscal year is on track to deliver healthy revenue gains.

Leave a Reply

You must be logged in to post a comment.