You can earn higher cumulative interest money within 7 days through investing in State Bank of India (SBI) online tax free scheme of e-TDR/ e-STDR.

Almost all of us keep our money in the saving bank accounts of the nearest bank branch for safety purpose and get a little amount of interest from that deposit money. Did you know? You can get some more interests through Term Deposit (TDR) and Special Term Deposits (STDR).

Today, we will learn the process and steps to open online e-TDR (Cumulative – Interest paid at maturity) and e-STDR (Non-Cumulative – Interest paid at selected intervals) with State Bank of India (SBI) from your Personal Internet Banking account which will give you more interests than your usual savings, current, or OD accounts.

You can make safely some more interests money with a minimum amount of ₹1,000 within 7 days through online State Bank of India online e-TDR/ e-STDR.

Process to open Online SBI e-TDR or e-STDR Accounts

Follow the below mentioned steps to open an online term deposit bank account by debiting your State Bank of India Savings a/c, Current a/c or OD accounts.

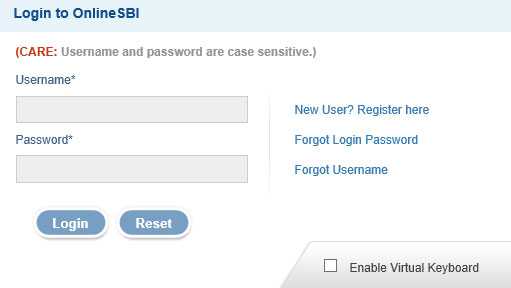

Step-1 (SBI INB Account Login):

First of all, visit online SBI website at OnlineSBI.com and login to your personal Internet Banking Account.

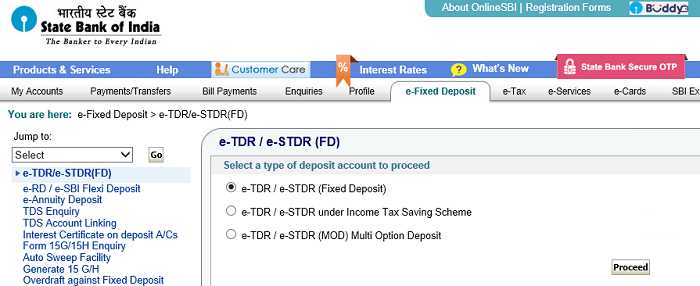

Step-2 (Select Type of Term Deposit Account):

After successful login to your SBI account, click on e-Fixed Deposit menu and select a type of deposit account from the three different deposit accounts including e-TDR/ e-STDR under Income Tax Saving Scheme and click on proceed button.

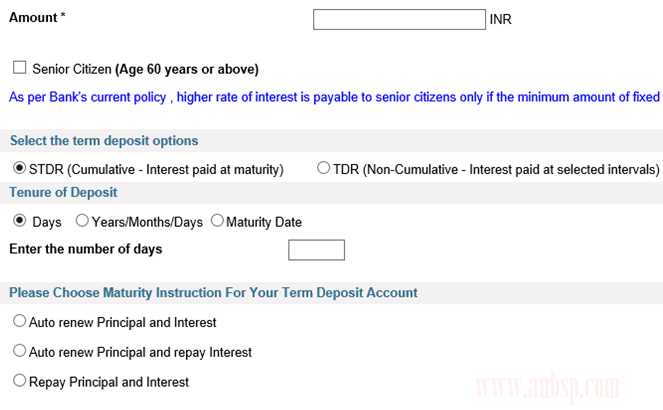

Step-3 (Fill Up Term Deposit Form):

Now, fill the amount you want to deposit, type of deposit account i.e. either e-TDR (Cumulative) or e-STDR (Non-Cumulative) and other required fields such as tenure of deposit and maturity instructions etc.

Step-4 (e-TDR/e-STRD Created):

Finally, proving all required data and instructions click on submit button and after final review confirm it. You have successfully created an e-TDR/ e-STDR account.

You may take a print out of your term deposit account details for future references. There is no need to contact your bank branch account at the time of opening online term deposit account as well as at its maturity as the maturity amount will automatically be credited to your savings account.

Frequently Asked Questions (FAQs) on Term Deposit Accounts

Revised Interest Rates for Domestic Term Deposits

Term Deposit below ₹2 Crore:

The revised interest rates for Retail Domestic Term Deposits (Below Rupees Two Crore) effective from the 15th February 2023 would be as under:

| Tenors | Rates for General Public From 15-Feb-2023 | Rates for Senior Public From 15-Feb-2023 |

|---|---|---|

| 7 days to 45 days | 3.00 | 3.50 |

| 46 days to 179 days | 4.50 | 5.00 |

| 180 days to 210 days | 5.25 | 5.75 |

| 211 days to less than 1 year | 5.75 | 6.25 |

| 1 Year to less than 2 years | 6.80 | 7.30 |

| 2 years to less than 3 years | 7.00 | 7.50 |

| 3 years to less than 5 years | 6.50 | 7.00 |

| 5 years and up to 10 years | 6.50 | 7.50@ |

# Compounded Quarterly

@ Including additional premium of 50 bps under ”SBI We-care” deposit scheme.

Bank has also introduced specific tenor scheme of “400 days” (Amrit Kalash) at Rate of Interest of 7.10 % w.e.f 15- Feb- 2023. Senior Citizens are eligible for rate of interest of 7.60%. The Scheme will be valid till 31-Mar-2023.

Let me know if it helps you to earn some extra interest income from risk free investment.