Tag: GST

-

Section 23 of GST Act: Persons not liable for registration

Amended and updated notes on section 23 of CGST Act, 2017. Detail discussion on provisions and rules related to persons not liable for registration.

-

Section 24 of GST Act: Compulsory registration in certain cases

Amended and updated notes on section 24 of CGST Act, 2017. Detail discussion on provisions and rules related to compulsory registration in certain cases.

-

Section 25 of GST Act: Procedure for GST Registration

Amended and updated notes on section 25 of CGST Act, 2017. Detail discussion on provisions and rules related to procedure for registration.

-

Section 26 of GST Act: Deemed GST Registration

Amended and updated notes on section 26 of CGST Act, 2017. Detail discussion on provisions and rules related to deemed registration.

-

Section 27 of GST Act: Casual and Non-Resident Taxable Person

Amended and updated notes on section 27 of CGST Act, 2017. Special provisions relating to casual taxable person and non-resident taxable person.

-

Section 28 of GST Act: Amendment of GST Registration

Amended and updated notes on section 28 of CGST Act, 2017. Detail discussion on provisions and rules related to amendment of registration.

-

Section 29 of GST Act: Cancellation or Suspension of Registration

Amended and updated notes on section 29 of CGST Act, 2017. Detail discussion on provisions and rules related to cancellation or suspension of registration.

-

Section 30 of GST Act: Revocation of cancellation of registration

Amended and updated notes on section 30 of CGST Act, 2017. Detail discussion on provisions and rules related to revocation of cancellation of registration.

-

Section 31 of GST Act: GST Tax Invoice

Amended and updated notes on section 31 of CGST Act, 2017. Detail discussion on provisions and rules related to GST tax invoice.

-

Section 31A of GST Act: Facility of digital payment to recipient

Amended and updated notes on section 31A of CGST Act, 2017. Detail discussion on provisions and rules related to facility of digital payment to recipient.

-

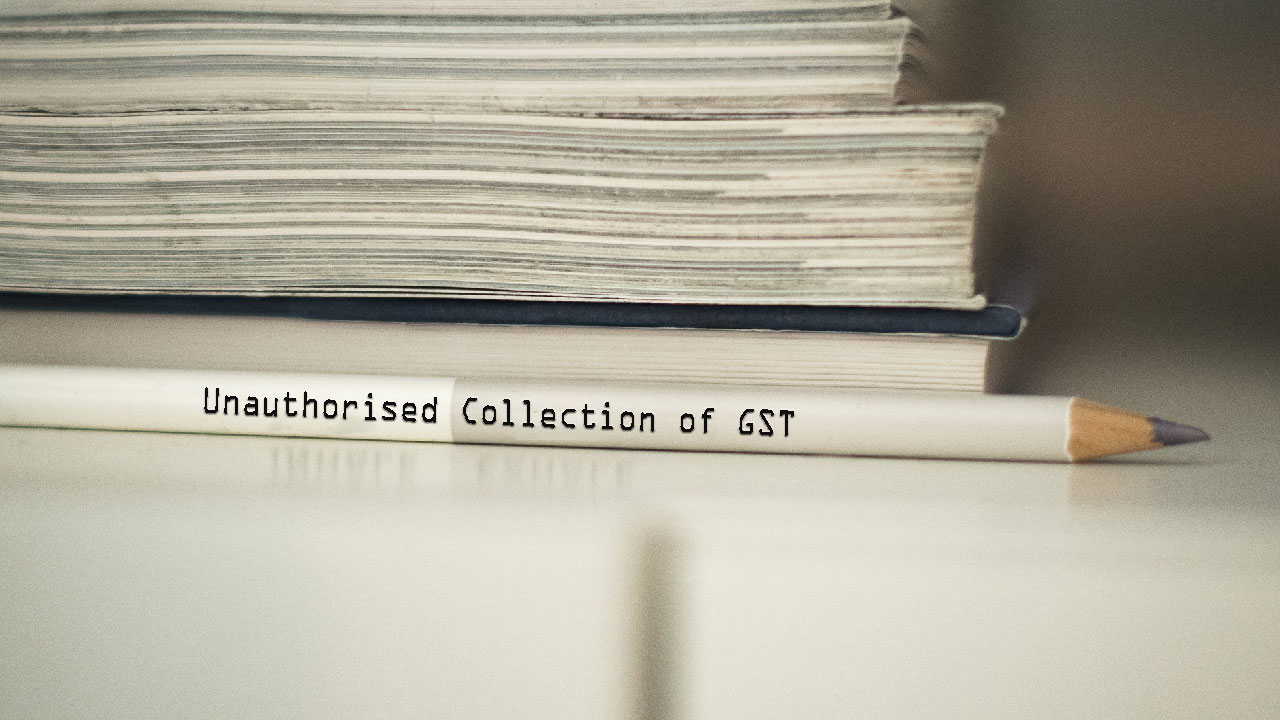

Section 32 of GST Act: Unauthorised Collection of GST

Amended and updated notes on section 32 of CGST Act, 2017. Discussion on provisions and rules related to prohibition of unauthorised collection of tax.

-

Section 33 of GST Act: GST indicated in tax invoice

Amended and updated notes on section 33 of CGST Act, 2017. Discussion on provisions and rules related to GST indicated in tax invoice and other documents.