Category: Income Tax

-

Form 15C Amended – TDS on Payments to Non Residents

Form 15C for application by banking company or insurer for certificate u/s 195 of Income tax Act for receipt of interest without TDS.

-

New Income Tax Rates for Individual and HUF from FY 2022-23

New income tax rates is effective for Financial Year (FY) 2022-23 relevant to the Assessment Year (AY) 2023-24.

-

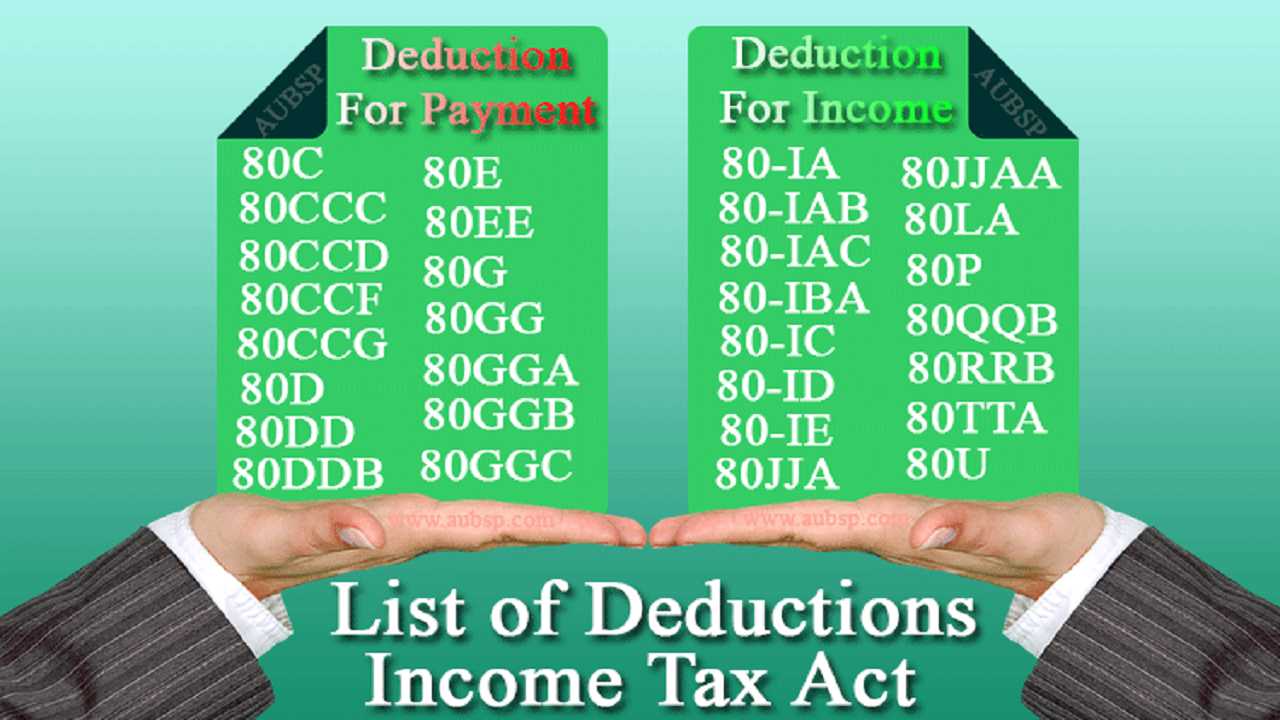

List of Income Tax Deductions for Individuals 2023-24

Chapter VIA deductions specified in sections 80C to 80U of Income-tax Act to be allowed while computing taxable income for Financial years 2022-23 onwards.

-

Complete list of sections of Income Tax Act for AY 2023-24

Download the list of all sections i.e. section 1 to section 298 of the Income Tax Act, 1961 as amended by the relevant Finance Act 2022.

-

Section 1 of Income Tax Act for AY 2023-24

Amended notes on section 1 of Income Tax Act 1961 amended by Finance Act 2022 and rules related to short title, extent and commencement.

-

Section 2 of Income tax Act for AY 2023-24

Amended and updated notes on section 2 of The Income Tax Act 1961 as amended by The Finance Act 2022 related to definitions.

-

Section 3 of Income tax Act for AY 2023-24

Amended and updated notes on section 3 of Income Tax Act 1961. Detail discussion on provisions and rules related to Previous Year.

-

Section 4 of Income tax Act for AY 2023-24

Amended and updated notes on section 4 of Income Tax Act 1961. Detail discussion on provisions and rules related to charge of income-tax.

-

Section 5 of Income tax Act for AY 2023-24

Amended and updated notes on section 5 of Income Tax Act 1961. Detail discussion on provisions and rules related to scope of total income.

-

Section 5A of Income tax Act for AY 2023-24

Amended and updated notes on section 5A of Income Tax Act 1961 by Finance Act 2022 and Income-tax Rules related to apportionment of income.

-

Section 6 of Income Tax Act for AY 2023-24

Amended and updated notes on Residence in India section 6 of Income Tax Act 1961 as amended by Finance Act 2022 and Income-tax Rules, 1962.

-

Section 7 of Income Tax Act for AY 2023-24

Amended notes on income deemed to be received section 7 of Income Tax Act 1961 as amended by Finance Act 2022 and Income-tax Rules 1962.