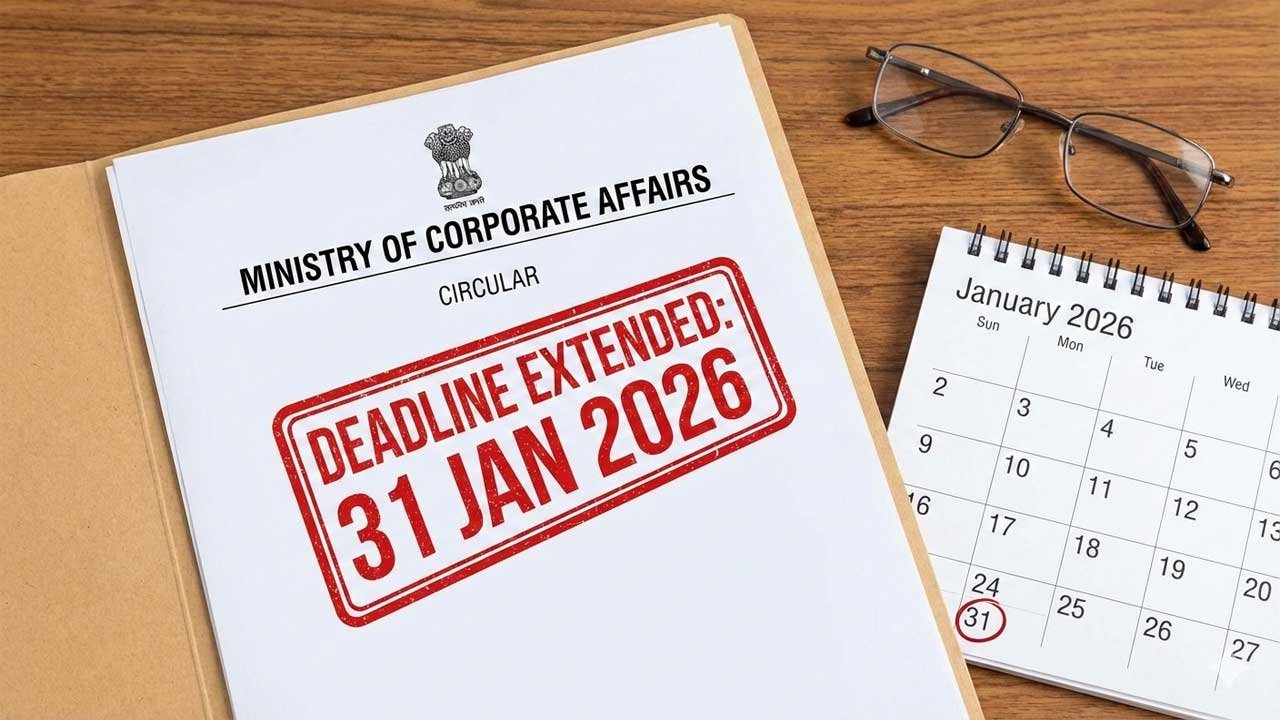

Ministry of Corporate Affairs | General Circular No. 08/2025 | December 30, 2025

In a significant regulatory update aimed at promoting ease of doing business and reducing compliance burdens, the Ministry of Corporate Affairs (MCA), Government of India, has announced a one-month extension for the filing of financial statements and annual returns for the Financial Year 2024-25.

This relief comes via General Circular No. 08/2025, issued on December 30, 2025, from the MCA headquarters at Shastri Bhawan, New Delhi.

Executive Summary of the Relief

The core directive of the circular is the relaxation of additional fees for companies that have not yet filed their annual statutory documents for FY 2024-25. The Competent Authority has officially extended the deadline, allowing companies to complete these filings up to 31st January, 2026, without incurring any penalties or additional fees.

Scope of Applicability: Eligible e-Forms

The extension is specific to the “Annual Filings” category. The circular explicitly enumerates the e-Forms eligible for this fee waiver, covering a wide range of corporate entities, from One Person Companies (OPCs) to Non-Banking Financial Companies (NBFCs).

A. Annual Returns (MGT Series)

- Form MGT-7: The standard Annual Return form.

- Form MGT-7A: The Abridged Annual Return applicable to OPCs and Small Companies.

B. Financial Statements (AOC Series)

- Form AOC-4: Filing of standard Financial Statements.

- Form AOC-4 CFS: Filing of Consolidated Financial Statements.

- Form AOC-4 NBFC (Ind AS): Financial Statements for NBFCs compliant with Indian Accounting Standards.

- Form AOC-4 CFS NBFC (Ind AS): Consolidated Financial Statements for NBFCs under Ind AS.

- Form AOC-4 (XBRL): Filing of Financial Statements in eXtensible Business Reporting Language format.

Context and Rationale

This circular serves as a continuation of General Circular No. 06/2025, which was previously issued on October 17, 2025.

- Stakeholder Representations: The Ministry explicitly noted that the decision was driven by representations received from various stakeholders. This suggests the government is actively listening to the challenges faced by the corporate sector regarding the original timelines.

- Continuity of Compliance: The MCA has clarified that aside from the specific relaxation of fees and the date extension mentioned in this document, all other requirements mandated in the previous General Circular No. 06/2025 remain unchanged and in full force.

Official Authority and Implementation

The circular has been issued with the approval of the Competent Authority and signed by Dr. Amit Kumar, Deputy Director at the Ministry of Corporate Affairs.

To ensure widespread dissemination, copies have been forwarded to:

- The Director General of Corporate Affairs (DGCoA)

- All Regional Directors and Registrars of Companies

- The E-Governance Section for website publication

Actionable Takeaway for Corporates

Companies that have not yet finalized their filings for FY 2024-25 should utilize this extension immediately. While the deadline is now January 31, 2026, stakeholders are advised to file well before the last date to avoid last-minute technical glitches often associated with high server traffic.

Leave a Reply

You must be logged in to post a comment.