The Goods and Services Tax framework provides a structured mechanism for taxpayers and tax authorities to obtain clarity on tax liabilities before undertaking transactions. The Advance Ruling system enables businesses to operate with certainty and reduces litigation.

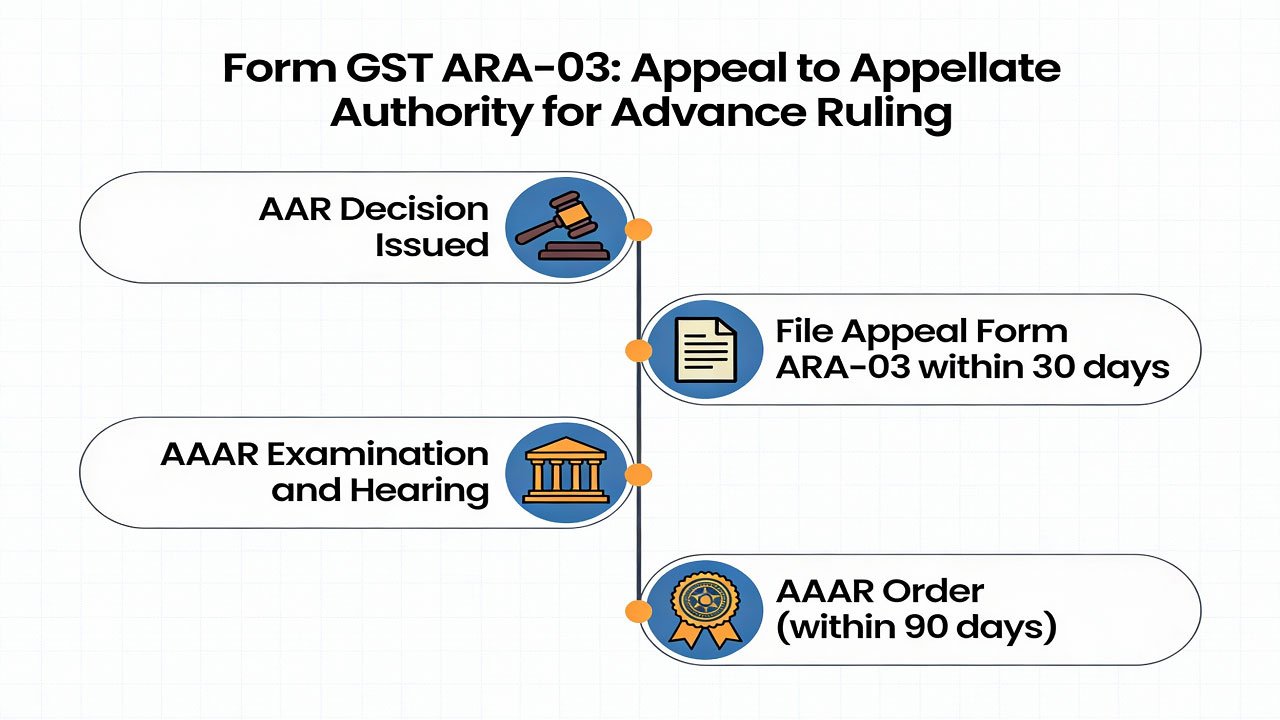

However, when parties disagree with an Authority for Advance Ruling (AAR) decision, Form GST ARA-03 provides the statutory pathway for appealing to the Appellate Authority for Advance Ruling (AAAR). This comprehensive guide explores Form ARA-03, its purpose, procedural requirements, and practical implementation.

Understanding the Advance Ruling Framework

Before examining Form ARA-03 specifically, understanding the broader advance ruling mechanism is essential. Under Section 97 of the Central Goods and Services Tax (CGST) Act, 2017, both registered taxpayers and persons desirous of registration can seek an advance ruling from the AAR on matters affecting their tax liability.

The advance ruling system serves four critical objectives: providing certainty in tax liability before initiating business activities, attracting foreign direct investment through transparent tax administration, reducing litigation, and delivering expeditious decisions with transparency.

An advance ruling issued by the AAR becomes binding on the applicant who sought it, as well as on the concerned officer and jurisdictional officer in respect of the specific transaction or activity mentioned in the application.

The scope of matters on which rulings can be obtained encompasses seven distinct categories: classification of goods or services, applicability of notifications affecting tax rates, determination of time and value of supply, admissibility of input tax credit, tax liability determination, registration requirement, and characterization of activities as supplies.

What is Form GST ARA-03?

Form GST ARA-03, referenced under Rule 106(2) of the Central Goods and Services Tax Rules, 2017, is the prescribed statutory form for filing appeals against advance rulings issued by the Authority for Advance Ruling. This form is exclusively filed before the Appellate Authority for Advance Ruling (AAAR) when the concerned officer or jurisdictional officer seeks to challenge an AAR decision.

A critical distinction exists between appeal forms used in the GST ecosystem: Form ARA-02 is filed by applicants (taxpayers) seeking to appeal an advance ruling, while Form ARA-03 is filed exclusively by tax authorities. This separation reflects the asymmetric procedural framework established under Section 100 of the CGST Act, where the right to appeal rests with three distinct categories of parties—the original applicant, the concerned officer, and the jurisdictional officer—each with specific rights and obligations.

The form represents the formal channel through which tax authorities can seek modification or annulment of AAR decisions they believe contain errors of law, misinterpretation of facts, or improper application of GST provisions. Unlike the ARA-02 form filed by applicants, no fee is payable when officers file ARA-03 appeals.

Eligibility and Authority to File

Only two categories of persons may file Form GST ARA-03: the concerned officer and the jurisdictional officer, both as defined under Section 100 of the CGST Act and corresponding State Goods and Services Tax Acts. These officers must act in their official capacity and the appeal must be signed and authorized according to the procedural requirements specified in Rule 7 of the CGST Rules, 2017.

The “concerned officer” typically refers to the tax authority conducting inquiries or assessments, while the “jurisdictional officer” is the officer in whose jurisdiction the applicant conducting the transaction is located. When a concerned officer or jurisdictional officer is aggrieved by an AAR decision, the appeal filed in Form ARA-03 carries the same legal significance as applications filed by taxpayers, subject to specific timelines and procedural formalities.

Timeline and Filing Deadline

The filing of Form GST ARA-03 is governed by strict statutory timelines that cannot be overlooked. According to Section 100(2) of the CGST Act, an appeal against an advance ruling must be filed within a period of thirty days from the date on which the ruling sought to be appealed against is communicated to the concerned officer, the jurisdictional officer, and the applicant. The critical starting point is the latest date on which all three parties—applicant, concerned officer, and jurisdictional officer—receive communication of the AAR decision.

For illustration, if an advance ruling is pronounced on July 10, 2017, the applicant receives it on July 12, 2017, the concerned officer receives it on July 13, 2017, and the jurisdictional officer receives it on July 15, 2017, the statutory period begins on July 15, 2017, despite earlier receipt by other parties. This ensures all parties have equal notice and opportunity to appeal.

The AAAR may, at its discretion, permit extension of the appeal period for an additional thirty days if the concerned officer or jurisdictional officer demonstrates sufficient cause for the delay. The burden lies with the officer to establish that circumstances beyond their control prevented timely filing. However, this extension authority is discretionary and limited to a single thirty-day period.

Form Structure and Essential Fields

Form GST ARA-03 is structured to capture comprehensive information necessary for appellate consideration. The form contains the following key sections:

Identification Section: Fields 1-3 require the advance ruling number, the date of communication of the ruling (in DD/MM/YYYY format), and the GSTIN or user ID of the person who originally sought the advance ruling.

Party Details: Fields 4-7 require the legal name of the original applicant, the name and designation of the appellate officer, the email address of the officer, and the mobile number of the officer.

Hearing Preference: Field 8 requires specification of whether the concerned officer or jurisdictional officer seeks to be heard in person during appellate proceedings, with Yes/No options.

Factual Recitation: Field 9 requires a brief statement of facts relevant to the case. This section should concisely articulate the transaction or activity in question, the issues raised before the AAR, and the context in which the advance ruling was sought. Brevity must not sacrifice clarity or completeness of critical facts.

Grounds of Appeal: Field 10 contains the substantive core of the appeal—detailed grounds upon which the applicant seeks modification or annulment of the AAR decision. These grounds constitute the legal arguments and factual disputes that warrant appellate reconsideration.

Prayer Section: Following the grounds of appeal, the prayer section formally specifies the relief sought. Standard language requests that the AAAR “set aside/modify the impugned advance ruling passed by the Authority for Advance Ruling as prayed above, grant a personal hearing, and pass any such further or other orders as may be deemed fit and proper in the facts and circumstances of the case.”

Verification: The form concludes with a statutory verification in which the signing officer solemnly declares, under penalty of perjury, that the statements made are true to the best of their knowledge and belief, that they are authorized to make the application, and that they are competent to verify the submission.

Filing Procedure and Documentation Requirements

Filing Form GST ARA-03 involves both electronic and physical components, reflecting the hybrid procedural framework currently operational in the GST system.

Online Portal Filing: The appeal must be filed on the common GST portal maintained by the Goods and Services Tax Network (GSTN). The officer accesses the portal through www.gst.gov.in, navigates to Services > User Services > My Applications, and selects “Appeal to Appellate Authority for Advance Ruling” as the application type. The completed form is uploaded in the prescribed format, and the portal assigns an acknowledgment number upon successful submission.

Physical Copy Submission: Concurrently with electronic filing, four identical printed copies of the completed Form ARA-03 must be submitted to the Appellate Authority for Advance Ruling serving the jurisdiction. These physical copies serve as the official record and must be identical to the electronically filed version.

Digital Signature: All submissions—both the form itself and accompanying documents—must be digitally signed using a valid Digital Signature Certificate (DSC) or electronic signature as specified under the Information Technology Act, 2000. For officers, DSC utilization is typically mandatory, though e-signature alternatives may be available under specific circumstances.

Supporting Documentation: The appeal must be accompanied by all relevant supporting documents, including a certified copy of the impugned advance ruling order. Copies of factual documents, correspondence, invoices, agreements, and other materials substantiating the grounds of appeal should be attached as annexures.

Attestation Requirements: All documents accompanying the appeal, including annexures and verification pages, must be self-attested. Self-attestation involves the signing officer placing their signature on document copies alongside a dated certification that the copies are true reproductions of originals.

Document Transmission: According to procedure outlined in various State/Union Territory guidelines, a copy of the appeal application and all accompanying documents should be transmitted as email attachments in .doc and .docx formats to the designated email address of the Appellate Authority for Advance Ruling serving that jurisdiction. This electronic transmission supplements the physical filing and aids in initial processing.

Grounds of Appeal

The grounds specified in Form ARA-03 represent the crux of appellate consideration and must be articulated with precision and legal rigor. Acceptable grounds include:

Error of Law: Where the AAR misinterpreted provisions of the CGST Act, State GST Acts, or related rules, or misapplied established legal principles to the facts of the case.

Misapplication of Facts: Where the AAR drew inferences from factual circumstances that are patently unreasonable, or failed to consider material facts that would alter the outcome of the ruling.

Procedural Irregularities: Where the AAR failed to follow prescribed procedures, denied natural justice, or acted without authority in rendering the ruling.

Novel Questions of Law: Where the advance ruling touches upon questions that have not been definitively settled by judicial precedent or clarifications from the GST Council, particularly when varying interpretations are plausible.

Changed Circumstances: Where facts or law affecting the basis of the ruling have materially changed since the AAR decision.

The grounds must be specific and particularized rather than blanket assertions of disagreement. Vague or conclusory statements without supporting legal argument or factual detail typically do not withstand appellate scrutiny. Each ground should reference the specific error, the legal authority contradicted, and the correct interpretation or factual conclusion that should apply.

Appellate Authority Decision Process and Timeline

Upon receipt of the Form ARA-03 appeal, the AAAR initiates a structured examination process. The Appellate Authority first verifies compliance with procedural requirements, including timely filing, proper fee (or confirmation of fee waiver for officer appeals), correct form utilization, and completeness of documentation.

Substantive examination follows, during which the AAAR reviews the AAR decision, the grounds of appeal raised by the officer, any response or counter-appeal filed by the original applicant (if applicable), and all relevant documentary evidence. The AAAR possesses authority to call for additional information, conduct hearings, and examine both parties.

The AAAR has broad remedial powers. It may confirm the AAR ruling entirely, modify the ruling while maintaining its operative effect, or annul the ruling completely. The order passed by the AAAR becomes binding on the applicant, concerned officer, and jurisdictional officer in respect of the matter determined, unless the underlying facts or applicable law subsequently change.

Decision Timeline: The statutory mandate requires the AAAR to pass an order after hearing the parties within a period of ninety days from the filing of the appeal. If two members of the AAAR differ on any point referred to in the appeal, the matter is deemed to have received no appellate consideration, and the AAR’s original ruling stands.

Common Mistakes and Defects to Avoid

Practitioners and officers filing Form GST ARA-03 commonly encounter specific deficiencies that delay processing or result in rejection:

Failure to Meet the 30-Day Deadline: This is the single most critical mistake. Failure to file within thirty days (plus any discretionary extension) results in the appeal being time-barred, rendering it legally incompetent regardless of merit. Officers should maintain calendars and track the communication date of the AAR ruling meticulously.

Incomplete or Inaccurate Party Details: Errors in spelling, designation, or contact information of the concerned officer or jurisdictional officer can impede service of notice and correspondence. All names must match official records, and designations must be current.

Insufficient Grounds of Appeal: Appeals containing only blanket assertions—such as “the AAR’s decision is erroneous” or “we respectfully disagree”—without substantive legal or factual argumentation are vulnerable to dismissal. Each ground must be developed with reference to specific legal provisions, judicial precedent, or factual considerations.

Missing or Defective Digital Signatures: Form ARA-03 cannot be processed without valid DSC signatures. Expired certificates, incorrect passphrase entries, or signature placement errors create technical barriers to filing. Officers should verify DSC status before initiating submission.

Inconsistency Between Physical and Electronic Copies: The quadruplicate physical copies submitted must be identical to the electronically filed version. Discrepancies between versions—particularly in grounds of appeal or factual statements—create confusion and may be grounds for rejection or delay.

Incomplete Documentation: Failure to attach the certified copy of the AAR order or relevant supporting documents results in deficiency notices. Officers must assemble complete document packages before filing.

Improper Verification: The verification section requires specific language and must be signed by the authorized officer. Generic or incomplete verification language may be deemed defective.

Jurisdictional Considerations

Form GST ARA-03 appeals are filed before Appellate Authorities for Advance Ruling (AAARs) established under respective State Goods and Services Tax Acts and Union Territory Acts, not under the Central Act. This creates an important jurisdictional principle: the AAAR serving the jurisdiction where the original applicant is located or conducts business has authority to hear the appeal.

Contact details of all State and Union Territory AAARs are maintained on the GST Council website (www.gstcouncil.gov.in), and practitioners should verify the correct authority before filing. Filing with an incompetent authority—even if the form is otherwise complete—may result in dismissal or remand.

Binding Effect and Subsequent Recourse

An order passed by the AAAR is binding on the applicant, concerned officer, and jurisdictional officer in respect of the matter decided, unless the facts or law materially change subsequently. The advance ruling remains effective for the applicant’s transaction, subject to the caveat that it applies only to the specific facts and circumstances described in the ruling.

If an officer or applicant remains aggrieved by the AAAR’s order, further recourse depends on the nature of the dispute. If the order involves a substantial question of law that affects tax administration across multiple jurisdictions, petition for review under Section 102 of the CGST Act may be possible within six months if apparent errors on the face of the record are demonstrable. However, such reviews are narrowly construed and require compelling legal or factual errors.

Ultimately, for disputes involving questions beyond advance ruling scope, the GST Appellate Tribunal (GSTAT) provides the next forum, though GSTAT jurisdiction operates under different procedural and temporal frameworks applicable to demand orders and adjudication decisions rather than advance rulings specifically.

Conclusion

Form GST ARA-03 provides the statutory mechanism through which tax authorities challenge advance rulings they believe to be erroneous. Understanding its structure, filing requirements, procedural deadlines, and substantive grounds is essential for officers responsible for appellate advocacy in GST matters.

The thirty-day filing window is immovable, complete documentation is non-negotiable, and grounds of appeal must articulate clear legal or factual arguments. Practitioners assisting officers should maintain meticulous attention to procedural compliance while ensuring that substantive legal arguments are developed with reference to statutory provisions, judicial precedent, and the factual record. Proper utilization of Form ARA-03 enhances the likelihood of successful appellate review and reinforces the transparent, rule-based character of GST administration that the advance ruling mechanism was designed to establish.

Leave a Reply

You must be logged in to post a comment.