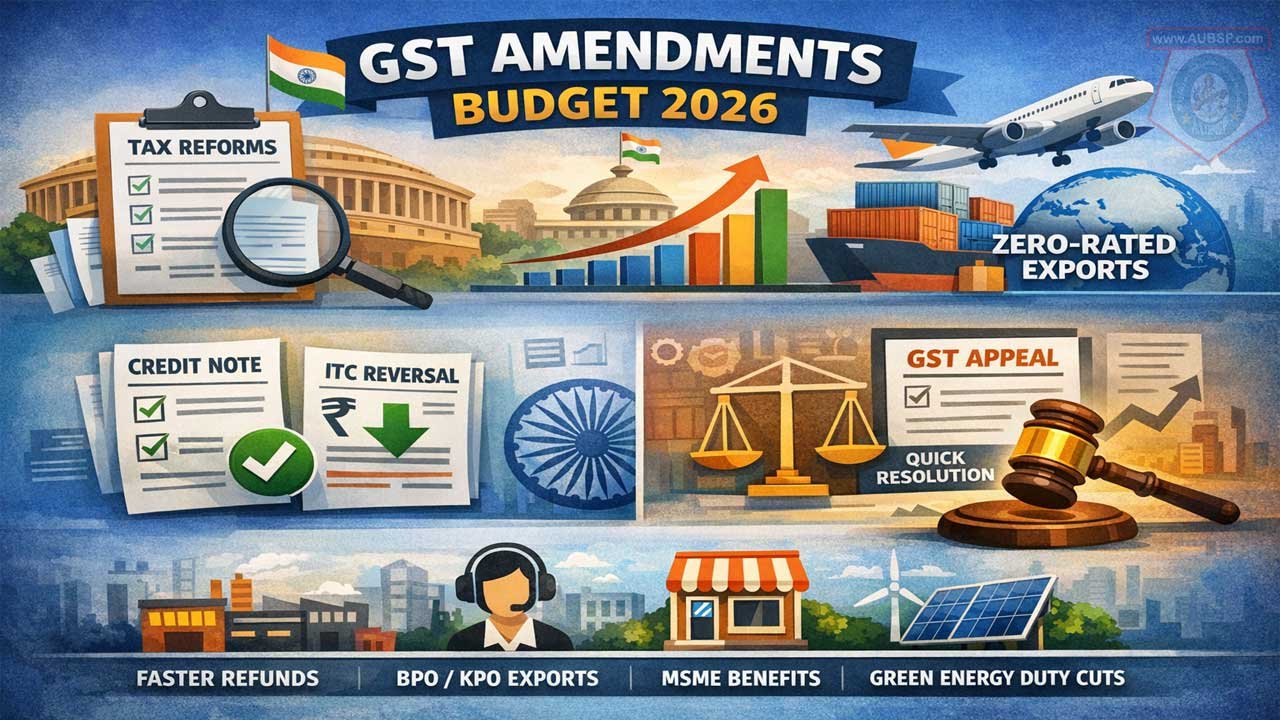

GST Amendments in Budget 2026: The Union Budget 2026 marks a mature phase in India’s GST regime, focusing on compliance simplification and litigation reduction through key amendments to the CGST and IGST Acts.

A major reform removes the requirement for pre-existing agreements to claim post-sale discounts, allowing suppliers to issue credit notes and reduce tax liability if recipients reverse proportionate ITC—benefiting sectors like FMCG, pharma, and auto components. The omission of the “intermediary” clause under Section 13(8)(b) of the IGST Act reclassifies many BPO/KPO services as zero-rated exports, significantly boosting global competitiveness.

Refund reforms under Section 54 enable 90% provisional refunds for inverted duty structures and remove minimum thresholds for export refunds, improving liquidity for manufacturers and MSMEs. A new provision ensures appeals against Advance Rulings can be heard despite GSTAT delays, closing a dispute-resolution gap. Customs changes further reduce duties on personal imports, mobile components, cancer drugs, and green energy equipment. Overall, Budget 2026 enhances flexibility, eases cash flow pressures, strengthens export competitiveness, and streamlines GST compliance across sectors.

| Amendment Area | Section Affected | Key Change | Impact | Beneficiaries |

|---|---|---|---|---|

| Post-Sale Discounts | Sec 15(3) & Sec 34 (CGST) | No need for pre-existing agreement; ITC reversal by recipient required | Reduces litigation & compliance burden | FMCG, Pharma, Auto Components |

| Intermediary Services | Sec 13(8)(b) omitted (IGST) | Place of Supply shifted to recipient’s location | Services qualify as zero-rated exports | BPO, KPO, IT/ITeS |

| Inverted Duty Refunds | Sec 54(6) (CGST) | 90% provisional refund allowed | Faster working capital access | Textiles, Footwear, Fertilizers, Solar |

| Export Refund Threshold | Sec 54(14) (CGST) | ₹1,000 minimum refund limit removed | Easier small export refunds | MSME Exporters, E-commerce sellers |

| Advance Ruling Appeals | New Sec 101A(1A) | Govt can authorize authority to hear appeals | Immediate dispute resolution | All GST taxpayers |

| Personal Imports | Customs Act | Duty reduced from 20% to 10% | Lower landed cost | Individual importers |

| Healthcare Imports | Customs | 17 cancer & rare disease drugs exempted | Reduced treatment cost | Pharma & Patients |

| Green Energy | Customs | Duty exemption for Lithium-ion cell capital goods | Boost to domestic manufacturing | EV & Battery Manufacturers |

Amendments, Updates, and Changes in GST: The Comprehensive Budget 2026 Guide

The Union Budget 2026, presented on February 1, 2026, signals a definitive maturity in India’s Goods and Services Tax (GST) regime. Moving beyond the teething troubles of implementation, the Finance Bill 2026 focuses on “Compliance Simplification” and “Litigation Reduction.”

While tax rates remain the domain of the GST Council, the legislative amendments proposed in the CGST and IGST Acts are set to fundamentally alter how businesses handle valuation, exports, and disputes. This AUBSP guide breaks down every critical amendment, offering sector-specific analysis and actionable compliance strategies.

The Valuation Paradigm Shift: Post-Sale Discounts

Perhaps the most significant relief for the domestic trade sector is the amendment to Section 15(3) and Section 34 of the CGST Act.

The Old Regime (Pre-2026)

Previously, post-sale discounts (like year-end volume rebates) could only be excluded from the taxable value if:

- They were established in a pre-existing agreement known at the time of supply.

- They could be specifically linked to relevant original invoices.

This created a massive compliance burden, forcing companies to draft rigid contracts and track invoice-level mapping for every discount, often leading to litigation during audits.

The New Rule (Budget 2026)

The requirement for a pre-existing agreement has been removed.

- New Condition: A supplier can issue a Credit Note for any post-sale discount, and the tax liability can be reduced, provided:

- The supplier issues a valid Credit Note under Section 34.

- The recipient reverses the proportionate Input Tax Credit (ITC) attributable to that discount.

Impact Analysis: This is a boon for FMCG, Pharma, and Auto Components sectors. It legitimizes “commercial credit notes” for ad-hoc performance bonuses or “turnover discounts” decided at year-end, without the need for complex pre-contracts.

Service Exports: The “Intermediary” Fix

For years, the BPO and KPO industry has battled the “Intermediary” classification which denied them export status. Budget 2026 resolves this by omitting Section 13(8)(b) of the IGST Act.

Understanding the Shift

- Previously: Intermediary services (arranging/facilitating supply between two others) had a special “Place of Supply” rule: the location of the supplier. This meant an Indian agent serving a US client was liable to pay 18% GST, as the service was deemed to be performed in India.

- Now: With the omission, the Place of Supply falls back to the default rule (Section 13(2)), which is the location of the recipient.

- Result: If the recipient is outside India, the service qualifies as an Export of Service (Zero-rated).

Strategic Win: This makes Indian service providers roughly 18% more competitive in the global market, leveling the playing field with competitors in the Philippines and Vietnam.

Liquidity & Cash Flow: Refund Reforms

The Budget introduces targeted amendments to Section 54 of the CGST Act to unblock working capital for manufacturers and small exporters.

| Section Amended | The Change | Who Benefits? |

|---|---|---|

| Sec 54(6) | Provisional Refunds for Inverted Duty: The government will now grant 90% provisional refund for claims arising from an Inverted Duty Structure (where tax on inputs > tax on output). Previously, this speed-track facility was mostly for zero-rated exporters. | Textiles, Footwear, Fertilizers, & Solar Power developers who accumulate huge credit balances. |

| Sec 54(14) | No Floor for Export Refunds: The minimum threshold of ₹1,000 for processing refund claims has been removed for exports made with payment of tax. | MSME Exporters and e-commerce sellers with small but frequent international shipments. |

Dispute Resolution: Bridging the Appellate Gap

With the Goods and Services Tax Appellate Tribunal (GSTAT) still in the process of becoming fully operational across all benches, a legal vacuum existed for appeals against Advance Rulings.

- New Section 101A(1A): Empowering the Government (on GST Council recommendation) to authorize any existing authority or tribunal to hear appeals against Advance Rulings.

- Why it matters: It ensures that taxpayers aggrieved by an unfavorable Advance Ruling have immediate legal recourse effective April 1, 2026, rather than waiting indefinitely for the National Appellate Authority (NAA).

Customs & Indirect Tax Updates

While technically under the Customs Act, these changes directly impact the “Landed Cost” for importers.

- Personal Imports: Duty on goods imported for personal use reduced from 20% to 10%.

- Mobile Manufacturing: Duty reduced on chargers, adapters, and PCBA to deepen domestic value addition.

- Healthcare: Full duty exemption on 17 specific cancer drugs and rare disease medicines.

- Green Energy: Duty exemptions extended for capital goods used in manufacturing Lithium-ion cells.

Sector-Specific Impact Matrix

| Sector | Impact Rating | Key Takeaway |

|---|---|---|

| IT / ITeS / BPO | ⭐⭐⭐⭐⭐ (Excellent) | “Intermediary” fix makes services zero-rated exports. Huge cost saving. |

| FMCG / Retail | ⭐⭐⭐⭐ (Positive) | Simplified discount mechanism reduces litigation and compliance costs. |

| Textiles / Footwear | ⭐⭐⭐⭐ (Positive) | Faster access to cash via 90% provisional refunds on inverted duty. |

| Stock Broking | ⭐⭐ (Mixed) | Benefit from “Intermediary” fix for foreign clients, but hit by increased STT on Futures (0.05%) and Options. |

Practical Tool: The New Compliant “Credit Note”

With the amendment to Section 34, your Credit Note must be robust to ensure the tax deduction is allowed. Below is a recommended format structure.

Draft Credit Note Structure (Post-Budget 2026 Compliance)

CREDIT NOTE

Issued Under: Section 34 of CGST Act, 2017 (as amended)

Supplier Details: [Name, GSTIN, Address]

Recipient Details: [Name, GSTIN, Address]

CN No: CN/2026/001 | Date: [Date]

Reference Invoice(s): [Invoice No(s) against which discount is given]

Particulars:

“Year-end Turnover Discount / Volume Rebate for FY 2025-26”

Value Calculation:

- Taxable Value of Discount: ₹ 1,00,000

- CGST @ 9%: ₹ 9,000

- SGST @ 9%: ₹ 9,000

- Total Value: ₹ 1,18,000

Mandatory Declaration by Supplier:

“We hereby declare that the tax liability shown above is being reduced from our output liability. The recipient is required to reverse the proportionate Input Tax Credit (ITC) of ₹ 18,000 in their GSTR-3B.”

Recipient Acknowledgement (Recommended):

“We confirm reversal of ITC vide entry in GSTR-3B of [Month/Year].”

Strategic Action Plan: Next Steps

- Review Dealer Contracts: Remove clauses that were inserted solely to satisfy the old “pre-existing agreement” condition. You now have commercial flexibility.

- Re-assess Export Status: If you are a consultant, agent, or broker serving foreign clients, consult your tax advisor to switch from “Taxable” to “Zero-Rated” under the new Place of Supply rules.

- Update ERP Systems: Ensure your accounting software can generate Credit Notes that specifically flag ITC reversal requirements for the recipient.

- Cash Flow Planning: If you are in an inverted duty sector, factor in the faster 90% refund inflow into your Q1 2026 working capital projections.

FAQs

What is the main objective of GST amendments in Union Budget 2026?

The primary objective is compliance simplification and litigation reduction by easing valuation rules, improving refund mechanisms, resolving export classification disputes, and strengthening appellate remedies.

Has the GST rate structure changed in Budget 2026?

No, GST rate changes are decided by the GST Council. Budget 2026 focuses on legislative amendments rather than altering tax rates.

What is the major change in post-sale discount treatment under GST?

The requirement for a pre-existing agreement to claim post-sale discounts has been removed. Suppliers can now issue credit notes and reduce tax liability if the recipient reverses proportionate ITC.

Which sections were amended for post-sale discounts?

Sections 15(3) and 34 of the CGST Act have been amended.

Is a pre-agreed contract required to issue a GST credit note for discounts?

No, suppliers can now issue credit notes for post-sale discounts without a prior agreement, subject to ITC reversal by the recipient.

What condition must be fulfilled to reduce tax liability through a credit note?

The supplier must issue a valid credit note under Section 34 and ensure the recipient reverses the proportionate Input Tax Credit.

Which sectors benefit most from the new discount provisions?

FMCG, pharma, auto components, and retail sectors benefit significantly.

What was the issue with intermediary services before Budget 2026?

Intermediary services were taxed based on the supplier’s location, making many export services taxable in India.

What change has been made to intermediary services?

Section 13(8)(b) of the IGST Act has been omitted.

How does the omission of Section 13(8)(b) benefit service exporters?

The place of supply now defaults to the recipient’s location, allowing services provided to foreign clients to qualify as zero-rated exports.

Which industries gain from the intermediary amendment?

BPO, KPO, IT/ITeS, consultants, brokers, and agents serving overseas clients.

What does zero-rated export status mean?

Zero-rated exports are not taxed, and businesses can claim refunds of input tax credit.

What change has been made to inverted duty structure refunds?

90% provisional refund is now allowed for inverted duty structure cases.

Who benefits from faster inverted duty refunds?

Textiles, footwear, fertilizers, and solar energy sectors.

Has the minimum threshold for export refunds been changed?

Yes, the ₹1,000 minimum threshold for export refund processing has been removed.

How does removing the refund threshold help MSMEs?

It allows small exporters and e-commerce sellers to claim refunds on small but frequent shipments.

What is the new provision regarding appeals against Advance Rulings?

New Section 101A(1A) allows the government to authorize an existing authority or tribunal to hear appeals.

Why is the new appellate provision important?

It ensures taxpayers have legal recourse without waiting for the full operationalization of GSTAT.

When do these GST amendments become effective?

They are effective from April 1, 2026, unless otherwise notified.

Has there been any relief for personal imports under Customs?

Yes, customs duty on personal imports has been reduced from 20% to 10%.

What changes have been made for the healthcare sector?

Full customs duty exemption has been granted on 17 cancer and rare disease medicines.

How does Budget 2026 support green energy manufacturing?

Duty exemptions have been extended for capital goods used in lithium-ion cell manufacturing.

What impact do GST refund reforms have on working capital?

They improve liquidity by accelerating refund processing and reducing blocked input tax credit.

Does the amendment eliminate commercial credit notes?

No, it legitimizes commercial credit notes by allowing tax adjustments subject to ITC reversal.

Is ITC reversal mandatory for recipients when discounts are given?

Yes, recipients must reverse proportionate ITC to enable supplier tax reduction.

Will ERP systems need updates due to these changes?

Yes, businesses should update systems to properly issue compliant credit notes and track ITC reversals.

Do these amendments reduce GST litigation?

Yes, especially in areas of valuation, discounts, and export classification.

Does Budget 2026 affect stock brokers?

Stock brokers benefit from export classification changes for foreign clients but may face increased STT on derivatives.

Are these changes applicable to both goods and services?

Yes, amendments impact valuation, exports, refunds, and dispute resolution across goods and services.

Does the removal of intermediary provisions make Indian services more competitive globally?

Yes, it reduces tax costs and aligns India with global export norms.

What strategic steps should businesses take after Budget 2026?

Review contracts, reassess export status, update ERP systems, and adjust cash flow planning based on refund reforms.

Leave a Reply

You must be logged in to post a comment.