GST for CA professionals is not optional anymore. The Indian tax system has evolved. Chartered Accountants must understand GST compliance. This applies to your practice too. Whether you file tax returns or audit accounts, GST rules apply to your services. Failure to comply costs money. Penalties are steep. Interest accrues at 18% annually. Non-filing blocks your business operations.

This guide explains everything. We cover GST registration. We explain filing requirements. We list penalties. We provide deadlines. We give you compliance checklists. Read on.

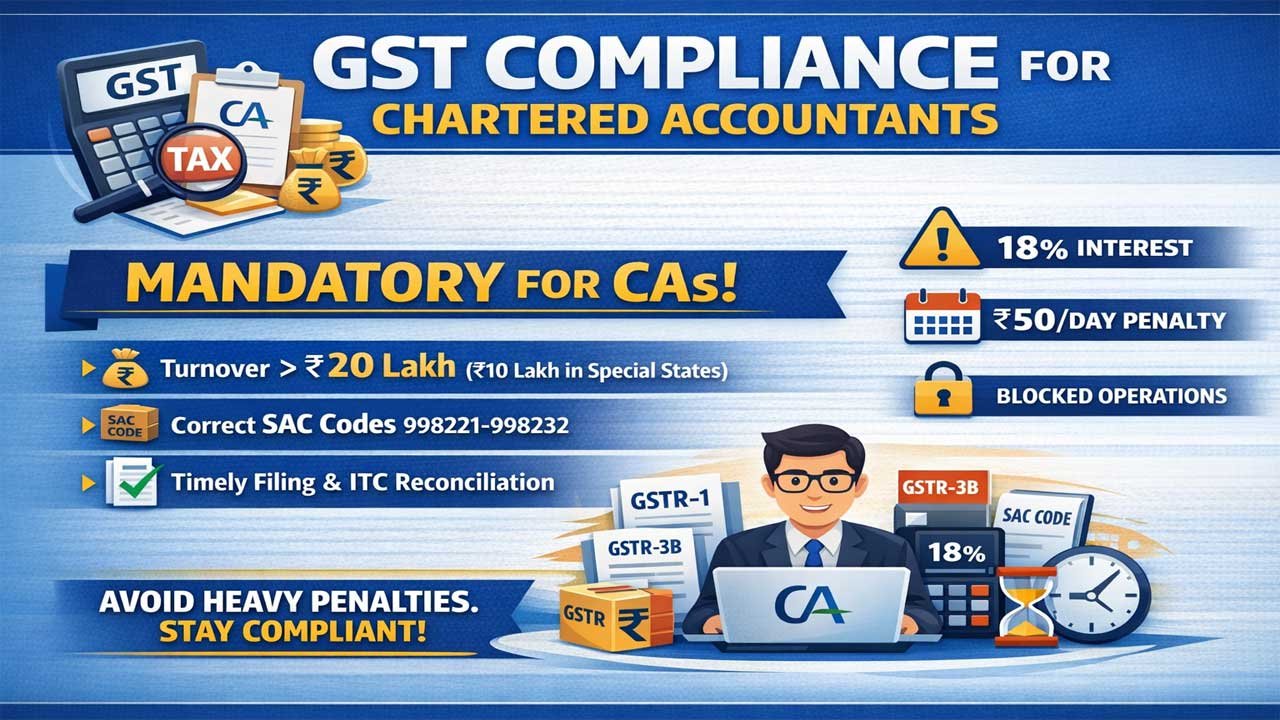

GST compliance is now mandatory for Chartered Accountants. CAs must register if turnover exceeds ₹20 lakh (₹10 lakh in special states). Correct SAC codes, timely filing, and ITC reconciliation are crucial to avoid 18% interest, ₹50/day penalties, and blocked operations.

Part 1: Do You Need GST Registration?

Who Needs to Register

Not all CAs need GST registration initially. Your turnover determines this. The threshold is important. It affects your business.

The Key Threshold Limits:

- Annual turnover crosses ₹20 lakh: Registration is mandatory

- Special category states (Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Tripura, Uttarakhand): ₹10 lakh threshold applies

- Interstate supplies: Mandatory even below threshold

- Services via e-commerce platforms: Mandatory regardless of turnover

- Reverse charge applicability: Mandatory registration required

Important: Even if you are below the threshold, you can register voluntarily. This option gives you benefits. You can claim Input Tax Credit (ITC). You appear more professional to clients.

Registration Timeline

GST registration is an 11-step process. It requires document submission. Biometric verification is now mandatory. The GSTN (GST Network) verifies your details. Physical verification of your office is required. This takes time. Apply early. Don’t delay.

Part 2: Essential Documents for GST Registration

Required Documents Checklist

Before applying for GST registration, gather these documents:

- Personal Documents: PAN card, Aadhaar card, passport-size photographs (2)

- Business Documents: CA certificate of practice or FRN (Firm Registration Number), Partnership deed (if partnership)

- Identity & Address Proof: Voter ID, driving license, or passport

- Office Proof: Electricity bill, rent agreement, lease deed, property tax receipt

- Bank Details: Cancelled cheque or bank statement showing your name and account number

- Digital Signature: Class 2 or Class 3 digital signature certificate (DSC)

- Authorization Letter: If applying through an authorized representative

Process Tip: Upload scanned copies in PDF format. File size must not exceed 5 MB per document. Keep originals for verification. The GST portal accepts only specific formats.

Part 3: GST Registration Numbers and Service Codes

What is a GSTIN?

A GSTIN is your 15-digit GST Identification Number. It’s unique to your practice. The format is: 2 digits (state code) + 10 digits (PAN) + 1 digit (entity type) + 2 digits (registration sequence).

Example: 19ABCDE1234F1Z0

The GSTIN appears on every invoice. Clients use it to claim ITC. Mismatched GSTIN details cause audit issues. Keep your GSTIN confidential.

SAC Codes for CA Services

SAC stands for Service Accounting Code. It classifies your service type. GST rate depends on SAC selection. Correct coding is critical.

SAC Codes for Chartered Accountants:

| Service Type | SAC Code | GST Rate |

|---|---|---|

| Accounting and Bookkeeping Services | 998222 | 18% |

| Financial Auditing Services | 998221 | 18% |

| Corporate Tax Consulting and Preparation | 998231 | 18% |

| Individual Tax Preparation and Planning | 998232 | 18% |

| Payroll Services | 998223 | 18% |

| Statutory Certification Services | 998224 | 18% |

| GST/VAT/Service Tax Appeals | 998212 | 18% |

| Other Similar Services (Business Consultation) | 998224 | 18% |

Why This Matters: Wrong SAC code leads to wrong GST charging. Clients cannot claim ITC. Your invoices become invalid. Audits flag incorrect codes. Always use the right code.

Part 4: Invoicing Requirements Under GST

What Every CA Invoice Must Contain

Your invoice is legally binding. It must follow GST rules. Missing details invite penalties. Clients cannot claim ITC without proper invoices.

Mandatory Invoice Details:

- Your GSTIN and business name

- Client’s GSTIN (if registered) or their name and address

- Invoice number and date of issue

- Description of service provided (detailed)

- Applicable SAC code

- Service value (excluding GST)

- CGST amount (if intra-state supply)

- SGST amount (if intra-state supply)

- IGST amount (if inter-state supply)

- Total amount including GST

- Your digital signature or authorized representative’s signature

- HSN/SAC code classification

Timing Requirement: Issue invoices within 30 days from the service completion date. Late invoicing complicates ITC claims. It also triggers GST notices.

Invoice Example:

AUBSP Chartered Accountants

GSTIN: 19ABCDE1234F1Z0

Date: 18th January 2026

Bill To:

AUBSP Private Limited

GSTIN: 27HIJKL5678G2Z1

| Description | SAC Code | Amount | Rate | GST |

|---|---|---|---|---|

| Tax Audit Services for FY 2024-25 | 998231 | ₹10,000 | 18% | ₹1,800 |

| Total (including GST) | ₹11,800 |

Part 5: Input Tax Credit (ITC) for Chartered Accountants

What is Input Tax Credit?

ITC is the GST you paid on your business expenses. You can claim this against your output GST. This reduces your actual tax liability. ITC is your competitive advantage.

Example: You pay ₹18,000 GST on office rent and software. You charge ₹50,000 as GST on your CA fees. You only pay ₹32,000 GST to the government (₹50,000 – ₹18,000).

ITC Eligibility Conditions

You can claim ITC only if:

- The supplier issued a valid tax invoice

- The supplier has paid GST to the government

- You received the goods or services

- You filed GSTR-3B claiming the credit

- You claim ITC within the prescribed time limit

- The invoice matches GSTR-2B auto-generated data

Blocked ITC (You Cannot Claim):

- Motor vehicles and fuel (unless used for specific business purposes)

- Food, beverages, and personal care services

- Goods or services for personal consumption

- Supplies used for exempt services

- Invoices where supplier did not file their GSTR-1

ITC Claim Process

Step 1: Download GSTR-2B from the GST portal (auto-generated purchase return)

Step 2: Reconcile this with your purchase register and received invoices

Step 3: Follow up with suppliers for any missing invoices

Step 4: Match invoice details in GSTR-2B

Step 5: Reverse any ineligible ITC

Step 6: Claim eligible ITC in your GSTR-3B form

Time Limit for ITC Claim: Earlier of the due date of GSTR-3B filing for September following the FY or annual return filing date.

Pro Tip: Regular reconciliation prevents last-minute surprises. Monthly ITC matching saves audit stress.

Part 6: GST Return Filing for CA Professionals

Return Filing Requirements

CAs file different GST returns based on business structure. Each return has a specific purpose. Deadlines vary. Missing deadlines costs you.

Types of GST Returns

| Return Form | Purpose | Filing Frequency | Deadline |

|---|---|---|---|

| GSTR-1 | Report outward (output) supplies | Monthly or Quarterly | 11th-13th of next month |

| GSTR-3B | Summary of tax liability and payment | Monthly or Quarterly | 20th, 22nd, 24th of next month |

| GSTR-2B | Inward supplies (auto-generated) | For reference only | Monitor regularly |

| GSTR-6 | Input Service Distributor returns | Monthly | 13th of next month |

| GSTR-9 | Annual return (FY 2025-26) | Once per year | 31st December 2026 |

| GSTR-9C | Audit certificate (if applicable) | Once per year | 31st December 2026 |

GSTR-1 Filing

GSTR-1 reports your outward supplies (CA fees charged). You list every invoice issued. This is supply-side reporting.

GSTR-1 Filing Rules:

- File monthly or quarterly (based on your turnover and scheme choice)

- Include all invoices above ₹200 issued to registered persons

- Do not include invoices to unregistered persons

- Match your records with client data uploaded by them

- File by due date to avoid blocks on e-way bills

Monthly Filing Due Date: 11th or 13th of the following month (based on turnover)

GSTR-3B Filing

GSTR-3B is your main compliance return. You declare output GST, ITC claims, and tax liability. You pay the balance GST due.

GSTR-3B Contents:

- Output GST (GST you charged on your fees)

- Input GST (GST you paid and want to claim)

- ITC claimed from GSTR-2B

- Tax liability (Output – ITC)

- Tax payment details

- Balance of tax due

Monthly Filing Due Date: 20th, 22nd, or 24th depending on your registration state

Payment Requirement: Pay tax along with GSTR-3B filing. Late payment attracts 18% annual interest.

Annual Returns (GSTR-9 & GSTR-9C)

GSTR-9 is your annual return. GSTR-9C is the audit certificate (if your turnover exceeds ₹2 crore).

Filing Rules:

- GSTR-9 must be filed by 31st December of the following FY

- GSTR-9C is mandatory if your annual turnover exceeds ₹2 crore

- GSTR-9C must be filed by a practicing CA

- Non-filing results in blocked registration and GST credit lock-in

Part 7: GST Penalties and Late Fees

Late Filing Penalties

Late filing carries significant penalties. The GST system is automated. Penalties are instant. You cannot avoid them once you miss the deadline.

| Penalty Type | Amount | Details |

|---|---|---|

| Late Filing (GSTR-1/GSTR-3B) | ₹50 per day | Maximum ₹5,000 |

| Late Filing (Nil Return) | ₹20 per day | Maximum ₹5,000 |

| Late Annual Return (GSTR-9) | ₹100 per day | Maximum 0.04% of turnover |

| Interest on Delayed Tax Payment | 18% per annum | Calculated from due date |

Example Calculation:

If you file GSTR-3B on the 25th of the month (due on 20th), you are 5 days late.

Penalty = ₹50 × 5 days = ₹250

Plus interest on unpaid tax = 18% per annum

Combined Impact: Penalties + interest + blocked credit operations = severe business disruption.

Non-Filing Consequences

Missing GST deadlines has cascading effects:

- GST Portal blocks your ability to file subsequent returns

- E-way bills cannot be generated

- ITC gets locked and cannot be carried forward

- Your registration faces cancellation risk

- The system blocks all downstream filings

- Recovery notices are issued automatically

- Criminal prosecution may be initiated

Reality Check: One missed filing date can paralyze your entire practice for months.

Tax Evasion Penalties

Intentional GST evasion attracts severe penalties:

- Wrong ITC claims: 10% of tax due (minimum ₹10,000)

- Fraudulent ITC: 100% of tax evaded (minimum ₹10,000) + imprisonment up to 3-5 years

- Non-registration (when mandatory): Equal to tax due or ₹10,000 (whichever is higher)

- False invoicing: 100% of tax + imprisonment

- Suppressing turnover: Up to 5 years imprisonment with fine

Warning: Even small intentional errors get detected by GST analytics engines.

Part 8: GST Compliance Checklist for CA Professionals

Monthly Checklist

Every month, follow this sequence:

- Issue Invoices: Ensure all invoices are issued within 30 days

- Collect GSTIN: Obtain client’s GSTIN before invoice issuance

- Record Supplies: Upload details in GSTR-1 before due date

- Reconcile Inputs: Download and review GSTR-2B for accuracy

- Claim ITC: Match GSTR-2B with purchase register

- Follow Up: Contact suppliers for missing invoices

- File GSTR-3B: File return and pay GST by due date

- E-Way Bill: Generate bills for interstate supply (if applicable)

- Maintain Records: Keep digital copies of all invoices and documents

- Monitor Notices: Check GST portal daily for incoming notices

Quarterly Checklist

Every three months, perform these tasks:

- Reconcile all quarterly invoices

- Verify GSTR-1 and GSTR-3B alignment

- Review ITC claims for errors

- Identify blocked credits and resolve them

- Update clients on GST filing status

- Backup all GST documents

- Prepare quarterly compliance summary

- Check for any audit notices

Annual Checklist (Before 31st December)

- Compile full-year financial statements

- Prepare GSTR-9 (annual return) documentation

- Reconcile profit & loss statement with GST returns

- Verify annual turnover calculation

- If eligible, arrange CA audit for GSTR-9C

- Prepare GST audit certificate

- Gather all supporting documents

- File GSTR-9 and GSTR-9C on time

- Keep signed audit report

- Maintain master copy of annual filing

Part 9: Recent GST Changes Effective January 2026

New Compliance Requirements

The GST system has shifted to technology-driven enforcement (effective 1st January 2026).

Key Changes:

- Stricter Verification: Biometric verification is now mandatory for registration

- System-Driven Matching: Automatic GSTR-1 to GSTR-2B matching

- E-Invoicing Expansion: More businesses required to use e-invoicing

- ITC Restrictions: Tighter blocking rules for ineligible credits

- Late Fee Revision: No change in rates, but enforcement is stricter

- Reverse Charge Expansion: More transactions now attract reverse charge

- Enhanced Scrutiny: AI-based mismatch detection is more aggressive

Impact on CA Practices

For your practice, these changes mean:

- Faster registration processing but stricter verification

- Increased pressure to maintain accurate GSTR-1 data

- Higher likelihood of ITC denials for incorrect invoices

- More frequent mismatch resolution requirements

- Automated penalty calculation (no manual appeals for penalties)

Part 10: Common Compliance Mistakes (And How to Avoid Them)

Mistake #1: Wrong SAC Code Selection

Problem: Using 998232 (Individual tax) when you meant 998231 (Corporate tax)

Impact: ITC denial for clients, invoice invalidation, audit notices

Solution: Maintain a checklist of SAC codes for each service type

Mistake #2: Delayed Invoice Issuance

Problem: Issuing invoice after 30 days from service completion

Impact: Clients cannot claim ITC, your credit gets blocked, notices issued

Solution: Issue invoices immediately after service delivery (same day if possible)

Mistake #3: Missing GSTIN on Invoice

Problem: Invoicing a registered client without their GSTIN

Impact: Client cannot claim ITC, your GSTR-1 gets rejected

Solution: Always collect GSTIN before invoice issuance (obtain digital consent)

Mistake #4: Not Reconciling GSTR-2B

Problem: Claiming ITC without checking GSTR-2B data

Impact: ITC mismatch notice, credit reversal, penalty

Solution: Monthly reconciliation of GSTR-2B with purchases

Mistake #5: Claiming Blocked Credit

Problem: Claiming ITC on motor vehicle fuel or personal services

Impact: ITC disallowance, penalty interest, audit reopening

Solution: Maintain blocked credit list, verify before claiming

Mistake #6: Late GSTR-3B Filing

Problem: Filing GSTR-3B 5 days late

Impact: ₹250 penalty, 18% interest on unpaid tax, subsequent filing block

Solution: File before 20th of every month (no exceptions)

Mistake #7: Non-Filing of Prior Returns

Problem: Missing one month’s GSTR-3B filing

Impact: Entire subsequent return filing blocked until prior return is filed

Solution: Maintain disciplined filing calendar, file on time every month

Mistake #8: Incorrect Turnover Declaration

Problem: Underreporting annual turnover in GSTR-9

Impact: Audit reopening, fraud investigation, criminal charges

Solution: Align GSTR-9 with financial statements and GST returns

Part 11: GST Registration Numbers to Remember

Important Dates for CAs (FY 2025-26)

| Deadline | Form | Applicability |

|---|---|---|

| 11th-13th of next month | GSTR-1 | Monthly/Quarterly filers |

| 20th-24th of next month | GSTR-3B | All registered CAs |

| 13th of next month | GSTR-6 | Input Service Distributors |

| 31st December 2026 | GSTR-9 | Annual return |

| 31st December 2026 | GSTR-9C | Annual audit certificate |

Emergency Contact Information

If you miss a deadline:

- File the return immediately (late penalty applies anyway)

- Attach a letter explaining the delay (optional, may not help)

- Pay all pending GST dues with interest

- Wait for system to process

- Monitor for cascading compliance breaks

Better Option: Use GST compliance software with automated reminders.

Part 12: GST Software Recommendations for CAs

Manual GST compliance is risky. Automation is essential.

Must-Have Features in GST Software

- Automatic invoice-to-GSTR-1 mapping

- GSTR-2B reconciliation tools

- ITC eligibility checking

- Blocked credit identification

- Compliance calendar with reminders

- Penalty calculation warnings

- Multi-branch management

- Digital audit trail

- Mobile app for on-the-go compliance

- Integration with accounting software

Benefits of Using GST Software

- Reduces manual errors by 95%

- Automatic due date reminders

- Real-time ITC tracking

- Audit-ready documentation

- Faster filing process

- Better client communication

- Reduced penalties and interest

- Peace of mind

Frequently Asked Questions (FAQs)

Q1: What happens if my turnover is exactly ₹20 lakh?

A: You must register. The threshold is “exceeds ₹20 lakh” = ₹20,00,001 or above. At exactly ₹20 lakh, you’re at the limit. To be safe, register.

Q2: Can I claim ITC if my supplier did not file GSTR-1?

A: No. If the supplier’s invoice doesn’t appear in your GSTR-2B (auto-generated), the ITC is blocked. You must follow up with the supplier to file their GSTR-1.

Q3: What is the penalty for filing GSTR-3B 10 days late?

A: ₹50 per day × 10 days = ₹500 (late fee). Plus 18% interest on unpaid GST due. The combined impact can exceed ₹1,000 easily.

Q4: Do I need to register if I’m only providing audit services?

A: Yes, if your turnover exceeds ₹20 lakh (or ₹10 lakh in special states). Audit services are taxable under GST at 18%.

Q5: What if a client asks for an invoice without GSTIN?

A: If they are registered, you must include their GSTIN. If they insist on omitting it, they will not be able to claim ITC. It’s their loss, not yours. Always collect GSTIN.

Q6: Can I charge GST on tax audit services to an unregistered person?

A: GST applies regardless of client registration. You charge 18% on audit fees to both registered and unregistered clients. Unregistered clients cannot claim ITC—this is their responsibility.

Q7: What is the deadline for annual GST audit (GSTR-9C)?

A: 31st December of the following financial year. For FY 2024-25, the deadline is 31st December 2025.

Q8: Do I need separate GST registration for each state office?

A: Yes. Unlike service tax, GST requires separate registration for each state. If you have offices in Delhi, Mumbai, and Bangalore, you need three separate GST registrations.

Q9: What documents should I keep for GST audit?

A: All GST returns (GSTR-1, GSTR-3B, GSTR-9), invoices issued and received, bank statements, payment receipts, ITC records, e-way bills, correspondence with GST authorities, and supporting financial statements.

Q10: Is it possible to get penalty waived off?

A: In rare cases (genuine errors, force majeure, system failures), the GST department may consider waiver requests. But don’t depend on this. File on time always.

Conclusion

GST compliance for CA professionals is non-negotiable. The system has zero tolerance for delays. Penalties are automatic. Interest compounds. Your registration is at constant risk.

Key Takeaways:

- Register if your turnover exceeds ₹20 lakh (or ₹10 lakh in special states)

- Use correct SAC codes: 998221-998232 for different CA services

- Issue invoices within 30 days with all required details

- Reconcile GSTR-2B monthly and claim eligible ITC

- File GSTR-1 and GSTR-3B before deadlines without fail

- Maintain proper records for audit readiness

- Use GST compliance software to reduce errors

- Stay updated with GST notifications and amendments

- Pay GST on time to avoid interest penalties

- File annual returns (GSTR-9 & GSTR-9C) by 31st December

The cost of compliance is far less than the cost of non-compliance.

Start today. Set up proper systems. Train your staff. Use technology. Protect your practice.

Additional Resources

- Official GST Portal: https://www.gst.gov.in

- GST Manual: https://tutorial.gst.gov.in

- CBIC Notifications: https://www.cbic.gov.in

- GST Council Decisions: Latest compliance updates

- Your State GST Website: For state-specific requirements

Disclaimer: This article provides general information about GST for CA professionals in India as of January 2026. Tax laws change frequently. Always consult with a qualified CA or tax professional for specific advice related to your practice. This article should not be considered legal or tax advice.

Leave a Reply

You must be logged in to post a comment.