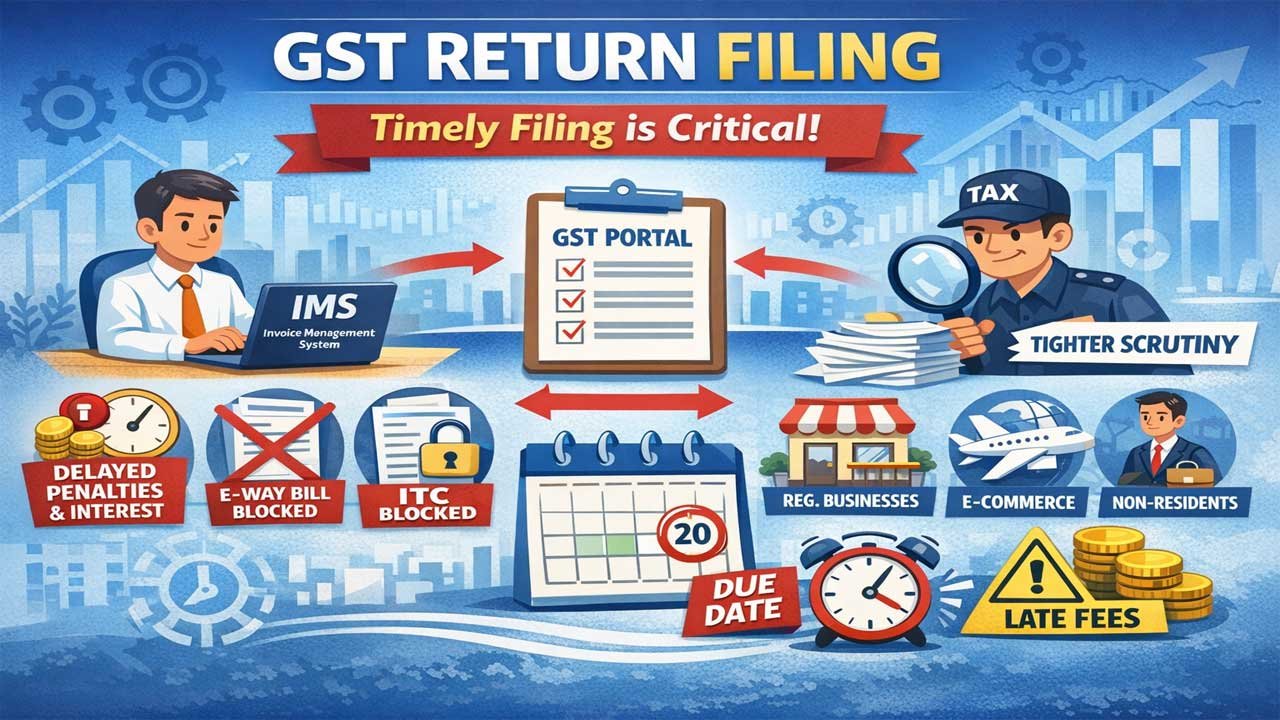

GST return filing is the backbone of tax compliance for registered businesses in India. With the introduction of the Invoice Management System (IMS) and stricter automated scrutiny in late 2025, the process has changed. Missing a deadline doesn’t just cost money—it can now block your ability to generate E-way bills or pass on credit to your buyers.

What is GST Return Filing?

GST return filing is the process of reporting your business’s “outward supplies” (sales) and “inward supplies” (purchases) to the government via the GST Portal.

- For the Government: It is a tool to track transaction trails and collect tax.

- For You: It is the only way to pay your tax liability and claim Input Tax Credit (ITC) so you don’t pay tax on the same value twice.

Who Must File GST Returns?

If you hold a GST registration, filing is mandatory, even if you have had zero business activity.

- Regular Taxpayers: Manufacturers, traders, service providers.

- Composition Dealers: Small businesses paying a flat rate on turnover.

- E-Commerce Operators: Platforms like Amazon/Flipkart (for TCS).

- Input Service Distributors (ISD): Offices that distribute credit to branches.

- Non-Resident Taxpayers: Foreigners doing business in India.

Crucial Note: If you have no sales and no purchases, you must file a “Nil Return.” Failure to do so attracts late fees and may lead to cancellation of registration.

Types of GST Returns (2026 Update)

The forms have evolved. Below is the current landscape for the financial year 2025-26.

| Return Form | Frequency | Who Files It? | Purpose | Due Date |

|---|---|---|---|---|

| GSTR-1 | Monthly/Quarterly | Regular Taxpayers | Details of Sales (Outward Supplies) | 11th (Monthly) / 13th (Quarterly) |

| GSTR-1A | Optional | Regular Taxpayers | New: To amend GSTR-1 details before filing GSTR-3B | Before filing GSTR-3B |

| GSTR-3B | Monthly/Quarterly | Regular Taxpayers | Summary Return & Tax Payment | 20th, 22nd, or 24th |

| CMP-08 | Quarterly | Composition Dealers | Challan for tax payment | 18th of month after quarter |

| GSTR-4 | Annually | Composition Dealers | Annual Return | April 30 of next FY |

| GSTR-9 | Annually | Regular Taxpayers | Annual Consolidated Return | Dec 31 of next FY |

| GSTR-9C | Annually | Taxpayers > ₹5 Cr Turnover | Reconciliation Statement | Dec 31 of next FY |

The New Game Changer: Invoice Management System (IMS)

Introduced in late 2024/2025

The old method of simply looking at GSTR-2B is updated. You now have the Invoice Management System (IMS).

- What it is: A dashboard where you can view invoices uploaded by your suppliers in their GSTR-1.

- Your Action: You can Accept, Reject, or keep invoices Pending before they auto-populate into your GSTR-3B.

- Why it matters: If you don’t “Accept” an invoice in the IMS (or let it auto-accept), you might face friction in claiming that ITC.

Step-by-Step GST Return Filing Process

Step 1: Login with 2FA

Visit services.gst.gov.in. Enter credentials. You must now enter a One Time Password (OTP) sent to your registered mobile/email (Two-Factor Authentication is mandatory).

Step 2: Dashboard Navigation

Go to Services > Returns > Returns Dashboard. Select Financial Year 2025-26 and the relevant month (e.g., December 2025).

Step 3: File GSTR-1 (Sales)

- Enter B2B invoices (business-to-business).

- Enter B2C summaries (business-to-consumer).

- Tip: If you have e-Invoicing enabled (turnover > ₹5 Cr), these details auto-populate. Verify them carefully.

- Submit and File using EVC (OTP) or DSC (Digital Signature).

Step 4: Check IMS / GSTR-2B (Purchases)

- Navigate to the Invoice Management System.

- Review invoices uploaded by suppliers. Take action (Accept/Reject).

- This generates your final GSTR-2B statement, which determines your eligible ITC.

Step 5: File GSTR-3B (Payment)

- Auto-Population: Your Sales (from GSTR-1) and ITC (from IMS/GSTR-2B) will be pre-filled.

- Tax Liability: The system calculates tax payable.

- Offset: Use your available Input Tax Credit to pay the liability.

- Cash Payment: If liability exceeds ITC, create a challan and pay the balance via Netbanking/UPI/NEFT.

- Submit & File.

Current Due Dates (Action Required Now)

Since today is January 18, 2026, here is your immediate filing schedule for the December 2025 period:

| Return Type | Category | Due Date | Status |

|---|---|---|---|

| GSTR-1 (Monthly) | Turnover > ₹5 Cr | Jan 11, 2026 | Overdue (Late fees apply) |

| GSTR-1 (Quarterly) | QRMP Scheme | Jan 13, 2026 | Overdue (Late fees apply) |

| GSTR-3B (Monthly) | All Monthly Filers | Jan 20, 2026 | DUE IN 2 DAYS |

| GSTR-3B (Quarterly) | State Group 1* | Jan 22, 2026 | Upcoming |

| GSTR-3B (Quarterly) | State Group 2** | Jan 24, 2026 | Upcoming |

State Group 1 (Jan 22): Chhattisgarh, MP, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, AP.

State Group 2 (Jan 24): Himachal, Punjab, Haryana, Rajasthan, UP, Bihar, West Bengal, Delhi, Seven Sisters states.

Penalties and Late Fees: The Cost of Delay

The government uses an automated system to debit late fees from your next return.

1. Late Fees (Administrative Cost)

- Nil Return: ₹20 per day (₹10 CGST + ₹10 SGST). Cap: ₹500.

- Regular Return: ₹50 per day (₹25 CGST + ₹25 SGST). Cap: ₹5,000 (varies based on turnover, max can go up to ₹10,000 for high turnover).

2. Interest (Financial Cost)

If you delay tax payment, you must pay interest on the cash component of the tax liability.

Interest = Net Tax Liability × 18% × (Days Delayed / 365)

3. The “Three-Year Block” (New Rule)

As of late 2025, the portal does not allow filing of returns older than 3 years. If you haven’t filed returns for 2021 or 2022 by now, you are permanently barred from filing them, meaning you cannot pass on ITC for those periods.

Common Mistakes to Avoid in 2026

- Ignoring the IMS: If you don’t reject an invalid invoice in the IMS, it might automatically be deemed as accepted, complicating future audits.

- Mismatched GSTR-1 and 3B: The system now sends an automated DRC-01B notice if your Sales in GSTR-1 exceed GSTR-3B by a defined percentage. You must reply within 7 days or your GSTR-1 for the next month is blocked.

- Wrong HSN Codes: 6-digit HSN codes are mandatory for turnover > ₹5 Cr. 4-digit for others. Incorrect HSN attracts a penalty of ₹50,000.

- Reclaiming Ineligible ITC: Claiming ITC on “Blocked Credits” (like personal cars, food for staff, etc.) is the most common reason for scrutiny notices.

Tools for GST Filing

While the GST Portal is free, third-party software is recommended for volume.

- Small Biz: Zoho Books, Vyapar (Good for simple invoicing + filing).

- Mid-to-Large: ClearTax (Clear), TallyPrime (Standard for accountants).

- Enterprise: SAP with GST integrations.

Professional Help:

If your annual turnover exceeds ₹5 Crore, or if you deal with refunds and exports, hiring a Chartered Accountant (CA) is highly recommended to handle the complexity of the new IMS and Rule 88C notices.

Frequently Asked Questions

Q: I missed the Jan 11th deadline for GSTR-1. Can I still file?

A: Yes, you can file today, but the system will add a late fee to your next month’s liability. File immediately to stop the counter.

Q: What is the Biometric Authentication update?

A: For new registrations and suspicious risky taxpayers, GST centers now require biometric Aadhaar authentication. If you are flagged, your return filing might be paused until verification.

Q: Can I revise a GSTR-3B filed yesterday?

A: No. GSTR-3B cannot be revised. However, you can use GSTR-1A to amend sales details before filing 3B, or make adjustments in the next month’s return (subject to circular restrictions).

Q: My supplier filed their return, but it’s not in my IMS. Why?

A: They may have filed it after the cut-off date (11th/13th). It will appear in the next month’s cycle. Do not claim ITC until it appears in your valid ITC statement.

What should you do right now?

Since today is January 18, your immediate focus should be GSTR-3B.

- Login to the portal.

- Check your auto-populated liability.

- Verify your ITC in the IMS/GSTR-2B.

- File before January 20th to avoid the interest clock starting.

Leave a Reply

You must be logged in to post a comment.