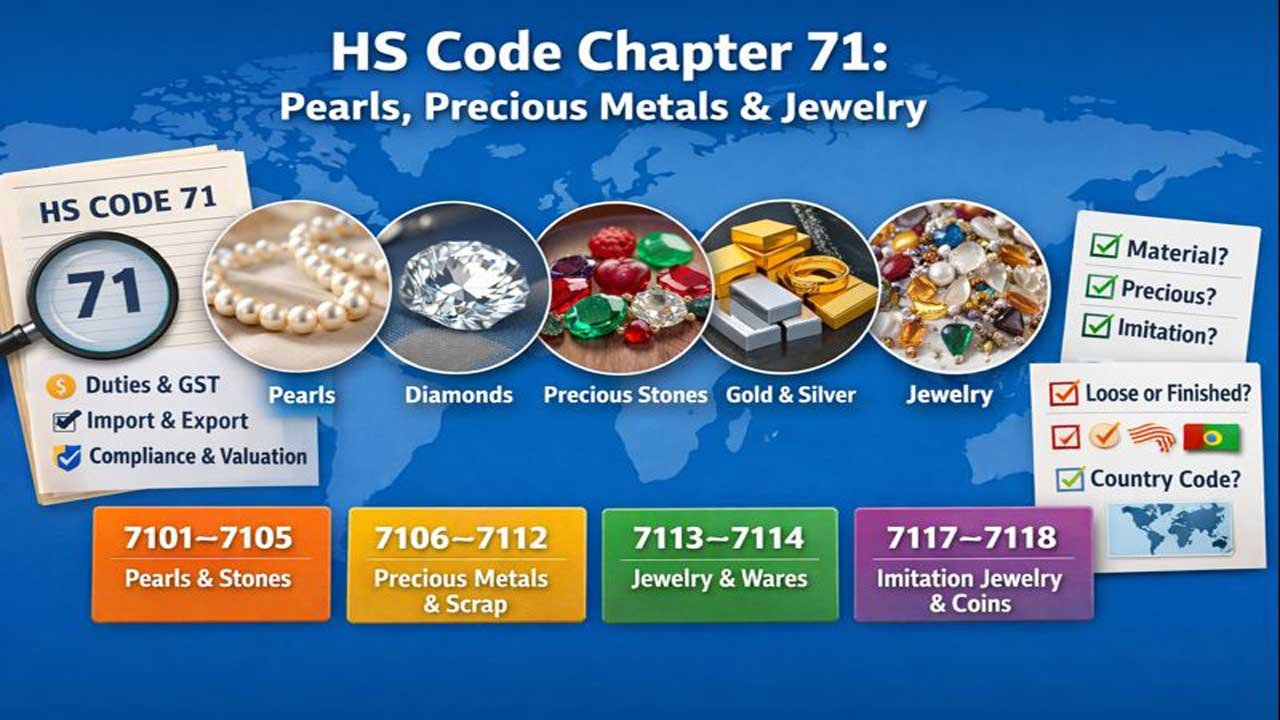

HS Code Chapter 71 of the Harmonized System covers pearls, precious and semi-precious stones, precious metals, metals clad with precious metals, jewellery, imitation jewellery and coins, and plays a critical role in determining customs duty, GST, valuation and compliance in international trade.

The chapter follows a clear structure from 2-digit chapter level (71) to 4-digit headings, 6-digit global subheadings and country-specific extensions, with key headings ranging from 7101–7105 for loose pearls and stones, 7106–7112 for silver, gold, platinum group metals and scrap, and 7113–7118 for finished articles such as jewellery, goldsmiths’ wares, stone articles, imitation jewellery and coins.

Correct classification depends on identifying the primary material, whether the item is loose or a finished article, and whether it is precious or imitation, followed by checking national tariff extensions, making Chapter 71 especially important for importers, exporters, customs brokers and freight forwarders handling high-value goods.

1. What Is HS Code Chapter 71?

HS Code is the Harmonized System used across the world for classifying goods in international trade. Each product gets a numeric code. Customs officers use this code to decide customs duty, GST, import restrictions and export benefits.

Chapter 71 of the HS Code covers:

- Natural or cultured pearls

- Precious and semi‑precious stones

- Precious metals and metals clad with precious metal

- Articles made from these materials

- Imitation jewellery

- Coins

Chapter 71 is very important for importers, exporters, customs brokers and freight forwarders. It directly affects customs duty amount, valuation and compliance risk.

2. Structure of HS Code Chapter 71

Chapter 71 uses a simple structure:

- 2‑digit: Chapter number → 71

- 4‑digit: Heading → broad category (e.g., 7101 for pearls)

- 6‑digit: HS subheading → used globally

- 8+ digit: National level (e.g., ITC‑HS in India, HTS in USA)

Below is a short view of key headings in Chapter 71.

| Category | 4‑Digit Heading | What It Covers (short) |

|---|---|---|

| Pearls, natural or cultured | 7101 | Pearls, natural or cultured, worked or unworked, not mounted or set; temporary strings |

| Diamonds | 7102 | Diamonds, worked or unworked, not mounted or set |

| Other precious and semi‑precious stones | 7103 | Rubies, sapphires, emeralds and other stones, worked or unworked, not mounted or set |

| Synthetic or reconstructed stones | 7104 | Synthetic or reconstructed stones, worked or unworked, not mounted or set |

| Dust and powder of stones | 7105 | Dust and powder of natural or synthetic stones |

| Silver | 7106 | Silver, unwrought, semi‑manufactured or in powder form |

| Base metals clad with silver | 7107 | Base metals clad with silver, semi‑manufactured |

| Gold | 7108 | Gold, unwrought, semi‑manufactured or powder (non‑monetary) |

| Base metals or silver clad with gold | 7109 | Base metals or silver clad with gold, semi‑manufactured |

| Platinum group | 7110 | Platinum and related metals, unwrought or semi‑manufactured or in powder form |

| Base metals, silver or gold clad with platinum | 7111 | Base metals, silver or gold clad with platinum |

| Waste and scrap of precious metal | 7112 | Waste and scrap of precious metal or metal clad with precious metal |

| Jewellery of precious metal | 7113 | Articles of jewellery and parts thereof of precious metal or metal clad with precious metal |

| Goldsmiths’ and silversmiths’ wares | 7114 | Household and decorative wares of precious metal |

| Other articles of precious metal | 7115 | Other articles of precious metal or metal clad with precious metal |

| Articles of pearls and stones | 7116 | Articles of natural or cultured pearls or precious or semi‑precious stones |

| Imitation jewellery | 7117 | Imitation jewellery, often of base metal |

| Coin | 7118 | Coins of any metal, not legal tender classification only |

3. HS Code for Natural or Cultured Pearls

Main Heading for Pearls

Natural or cultured pearls fall under heading 7101.

Typical coverage:

- Natural pearls

- Cultured pearls

- Worked or unworked

- Graded or ungraded

- Temporarily strung only for easy transport (not jewellery)

Examples of global and Indian style codes:

- 7101 – Pearls, natural or cultured (heading)

- 710110 – Natural pearls (6‑digit)

- 710121 – Cultured pearls, unworked (6‑digit)

- 710122 – Cultured pearls, worked (6‑digit)

Different countries then add more digits for duty rate, GST rate and control purpose.

4. HS Code for Precious or Semi‑Precious Stones

Precious and semi‑precious stones sit mainly in 7102 to 7105.

4.1 Diamonds – Heading 7102

Heading 7102 covers diamonds:

- Natural or synthetic diamonds

- Worked or unworked

- Not mounted or set (loose stones)

These goods are often used as high‑value imports. Correct HS classification is critical for customs duty, valuation and transfer pricing.

4.2 Other Precious and Semi‑Precious Stones – Heading 7103

Heading 7103 covers stones like:

- Rubies

- Sapphires

- Emeralds

- Amethyst, garnet and many other stones

They can be worked or unworked, graded or ungraded, but must not be mounted or set.

4.3 Synthetic or Reconstructed Stones – Heading 7104

Heading 7104 covers synthetic or reconstructed stones.

This includes lab‑grown stones that imitate diamonds or coloured stones.

This heading is very important for:

- Lab‑grown diamond exporters

- Manufacturers of synthetic stones for jewellery and industry

4.4 Dust and Powder – Heading 7105

Heading 7105 covers dust and powder of natural or synthetic stones.

These materials are often used in abrasives or industrial tools.

5. HS Code for Precious Metals and Metals Clad with Precious Metal

Precious metals and related materials are a core part of Chapter 71.

5.1 Silver – Heading 7106

Heading 7106 covers silver:

- Unwrought silver

- Semi‑manufactured silver (bars, rods, wire, sheets)

- Silver powder

This code is used to calculate import duty and GST on bullion and semi‑finished silver products.

5.2 Gold – Heading 7108

Heading 7108 covers gold:

- Unwrought gold

- Semi‑manufactured gold

- Gold powder

- Usually non‑monetary gold for trade purposes

High‑CPM content can target:

- HS code for gold

- Import duty on gold bars

- HS code for gold coins vs coin heading 7118

- HSN code for gold under GST

5.3 Platinum and Other PGM – Heading 7110

Heading 7110 covers platinum and related metals such as palladium, rhodium, iridium, osmium and ruthenium.

They may be unwrought, semi‑manufactured or powdered.

5.4 Waste and Scrap – Heading 7112

Heading 7112 covers waste and scrap of precious metal or of metal clad with precious metal.

This is important for refiners and recycling companies.

6. HS Code for Jewellery of Precious Metal (Heading 7113 and 7114)

6.1 Articles of Jewellery – Heading 7113

Heading 7113 covers articles of jewellery and parts thereof made of precious metal or of metal clad with precious metal.

Typical examples:

- Gold rings, chains, bangles, earrings

- Silver jewellery

- Platinum jewellery

- Parts of jewellery (clasps, findings) made of precious metal

The chapter notes define jewellery as small objects of personal adornment and certain personal items carried on the person (like powder boxes or chain purses) when made of precious metal.

6.2 Goldsmiths’ and Silversmiths’ Wares – Heading 7114

Heading 7114 covers other wares of precious metal, such as:

- Tableware

- Kitchenware

- Decorative items

- Frames and similar wares of gold or silver

This heading is useful for luxury homeware brands and exporters.

7. HS Code for Articles of Pearls and Stones (Heading 7116)

Heading 7116 covers articles made of:

- Natural or cultured pearls

- Precious stones

- Semi‑precious stones

- Synthetic or reconstructed stones

The items are not jewellery in the legal sense, but still made predominantly from these materials. Examples include:

- Carved stone statuettes

- Decorative stone objects

- Prayer beads of precious stones

8. HS Code for Imitation Jewelry – Heading 7117

Imitation jewellery is a very popular search topic with high ad revenue potential. Heading 7117 covers imitation jewellery.

Key features:

- Articles of jewellery that do not contain real pearls, real precious stones or real precious metal, except as minor fittings or plating

- Products often made from base metals, plastics, glass or other non‑precious materials

Subheadings include:

- Cuff‑links and studs of base metal

- Other imitation jewellery of base metal

- Other imitation jewellery of other materials

9. HS Code for Coin – Heading 7118

Coins fall under heading 7118.

This heading includes:

- Coins of any metal

- Legal tender coins and collector coins, depending on national rules

- Coins that are not classified under gold bullion headings

Differences that often matter:

- Some gold coins may be treated as bullion under headings for gold, but ordinary coins used as money are usually under 7118.

10. How to Choose the Correct HS Code in Chapter 71

To select the correct HS or HSN code:

- Identify the main material

Check if the item is made mainly of pearls, stones, precious metal, base metal or other material. - Check if it is loose material or finished article

Loose pearls or stones use headings 7101–7105.

Finished jewellery or articles use headings 7113–7117. - Determine if it is precious or imitation

Real pearls, real stones and real precious metal go to Chapter 71 headings for precious material.

Imitation jewellery without real precious content goes to heading 7117. - Confirm country‑specific expansion

Every country expands HS codes beyond six digits.

For example, India uses ITC‑HS and HSN for GST, and provides 8‑digit and more‑digit codes under Chapter 71 headings.

Always check your national customs tariff or GST rate schedule. - Use official tools You can use:

- National customs tariff search portals

- HS code finder tools for Chapter 71

- WCO HS documentation for global classification notes

HS Code Chapter 71 covers pearls, stones, precious metals, jewellery, imitation jewellery and coins, defining duties, GST and compliance in global trade.

FAQs

What is HS Code Chapter 71?

HS Code Chapter 71 is a classification chapter under the Harmonized System that covers pearls, precious and semi-precious stones, precious metals, jewellery, imitation jewellery and coins used in international trade.

Why is HS Code Chapter 71 important?

It determines customs duty, GST, valuation rules, import restrictions, export incentives and compliance risk for high-value goods.

What products are covered under Chapter 71?

It includes natural and cultured pearls, diamonds, precious and semi-precious stones, gold, silver, platinum group metals, jewellery, imitation jewellery and coins.

What is the HS code structure used in Chapter 71?

It follows a 2-digit chapter (71), 4-digit heading, 6-digit global subheading and country-specific extensions like ITC-HS or HTS.

Which HS code is used for natural or cultured pearls?

Natural or cultured pearls are classified under heading 7101.

Are temporarily strung pearls treated as jewellery?

No, temporarily strung pearls for transport are still classified as loose pearls under heading 7101.

What HS code applies to diamonds?

Diamonds, whether worked or unworked and not mounted or set, fall under heading 7102.

Where are rubies, sapphires and emeralds classified?

These precious and semi-precious stones are classified under heading 7103.

What is the HS code for lab-grown or synthetic stones?

Synthetic or reconstructed stones are classified under heading 7104.

Which HS code covers stone dust and powder?

Dust and powder of natural or synthetic stones fall under heading 7105.

What HS code is used for silver?

Silver in unwrought, semi-manufactured or powder form is classified under heading 7106.

What is the HS code for gold bars and semi-manufactured gold?

Non-monetary gold in unwrought or semi-manufactured form is classified under heading 7108.

Where are platinum and palladium classified?

Platinum and other platinum group metals are classified under heading 7110.

What HS code applies to precious metal scrap?

Waste and scrap of precious metal or metal clad with precious metal fall under heading 7112.

Which HS code covers gold and silver jewellery?

Articles of jewellery made of precious metal are classified under heading 7113.

What is the difference between 7113 and 7114?

Heading 7113 covers personal jewellery, while 7114 covers goldsmiths’ and silversmiths’ household or decorative wares.

Where are articles made from pearls or stones but not jewellery classified?

Such items are classified under heading 7116.

What is the HS code for imitation jewellery?

Imitation jewellery made without real precious metal or stones is classified under heading 7117.

Which HS code applies to coins?

Coins of any metal are generally classified under heading 7118, subject to national rules.

How do I choose the correct HS code under Chapter 71?

You must identify the main material, determine whether the item is loose or finished, check if it is precious or imitation, and confirm country-specific tariff codes.