What is HS Code for Articles of Iron or Steel?

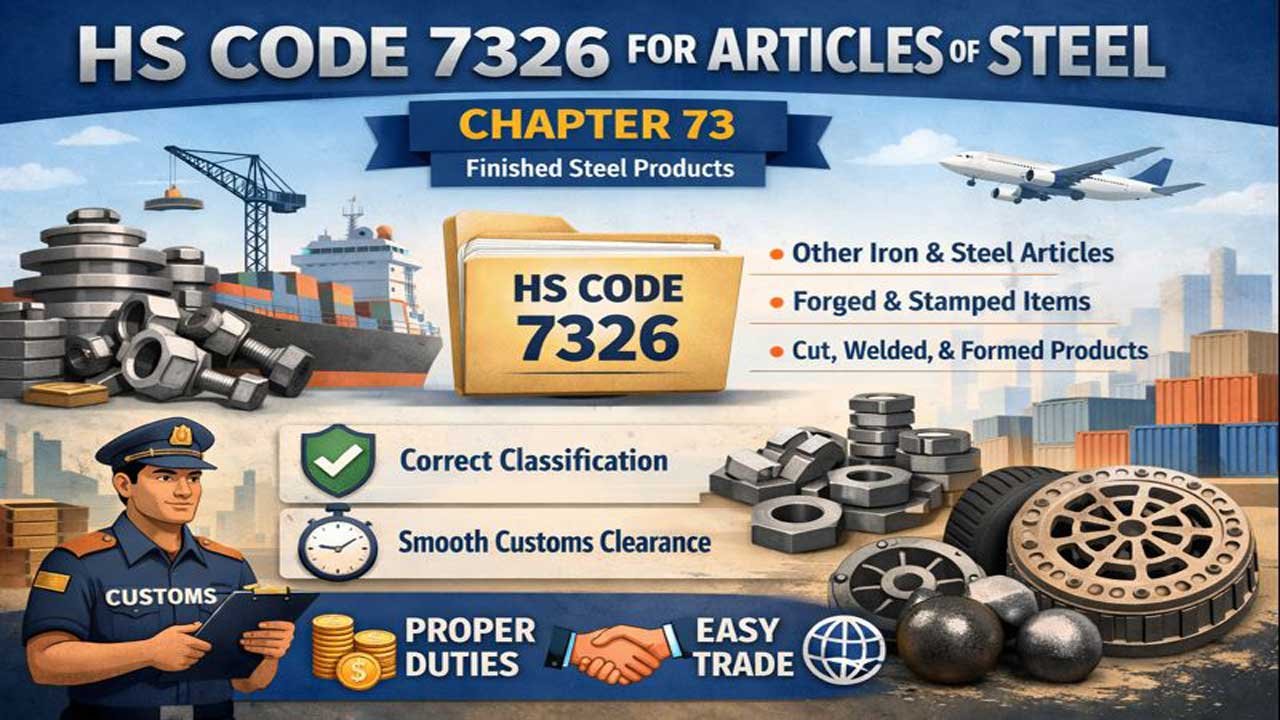

HS Code stands for Harmonized System Code. It is a standardized classification system used worldwide. Every product has its own HS code. The code helps classify goods accurately. It makes international trade easier. It applies to all countries.

Articles of iron or steel fall under Chapter 73. This chapter is specific to finished and semi-finished products. Raw materials like iron and steel come under Chapter 72. Understanding this difference is crucial. It determines your import-export duties. It affects your customs clearance time. It impacts your overall trading costs.

HS Code 7326: The Primary Classification

HS Code 7326 covers “Other Articles of Iron or Steel.” This is the main heading. It includes forged and stamped items. It includes articles obtained by cutting and welding. It includes items created through folding and perforating. It does not include items covered in other chapters.

This code is highly specific. It requires careful product identification. Misclassification can result in penalties. It can delay your shipments significantly. It can increase your customs duties unexpectedly.

Why HS Code 7326 Matters for Your Business

HS Code 7326 is essential for traders. It applies to thousands of products. These products are used in multiple industries. They are needed for automobiles. They are required for machinery. They are used in construction. They are essential for manufacturing.

Getting the right code saves money. It accelerates your customs clearance. It ensures compliance with regulations. It protects your business reputation. It helps you qualify for trade benefits.

Complete List of HS Code 7326 Subheadings

73261100 – Grinding Balls and Mill Articles

Grinding balls are essential industrial products. They are used in grinding mills. They are used in mineral processing. They are critical for cement production. They are needed for chemical processing.

Key specifications:

- Spherical in shape

- Made from forged or stamped iron/steel

- Various sizes for different mills

- High durability required

- Designed for heavy-duty use

Import data for grinding balls is significant. Demand remains high globally. India exports grinding balls extensively. Prices vary by quality and size.

73261910 – Automobile Parts & Earth-Moving Equipment

Automobile components are crucial for the automotive industry. These items are forged or stamped. They meet strict quality standards. They require precise engineering. They undergo rigorous testing.

Common automobile parts include:

- Suspension system components

- Steering system parts

- Engine mounting brackets

- Structural reinforcements

- Specialized bearings

Earth-moving equipment parts include:

- Bucket teeth and adapters

- Pins and bushings

- Structural frames

- Wear plates

- Connection links

This HS code carries significant trade value. Import volumes are substantial. Export opportunities are excellent. Tariff rates vary by destination country.

73262010 – Tyre Bead Wire Rings

Tyre bead wire rings are specialized products. They are used in tyre manufacturing. They are essential for bicycle tyres. They are critical for motorcycle tyres. They are needed for cycle rickshaw tyres.

These rings must meet specific standards. They provide structural integrity. They ensure tyre safety. They maintain proper bead sealing. They guarantee long-term performance.

Specifications for tyre bead rings:

- High tensile strength required

- Precise diameter measurements

- Uniform wire thickness

- Corrosion-resistant coating

- Certified quality assurance

Manufacturing these rings is specialized work. Import-export of these products is profitable. India is a major exporter. Global demand is consistent.

73262090 – Other Steel Wire Articles

Steel wire articles encompass numerous products. They include wire forms. They include wire combinations. They include specialized wire assemblies. They include reinforced wire structures.

Examples of steel wire articles:

- Coiled spring wire

- Braided wire rope

- Twisted wire strands

- Reinforcement cages

- Structural wire bundles

These products serve multiple industries. Construction uses them extensively. Manufacturing relies on them. Infrastructure projects require them. They have diverse applications.

Tariff classifications may vary. Detailed product descriptions are necessary. Destination countries affect duty rates. Documentation must be precise.

73269010 – Belt Lacing of Steel

Belt lacing is used in machinery. It connects belt segments. It strengthens belt connections. It provides durability. It ensures proper operation.

Steel belt lacing is industrial-grade. It handles high-speed equipment. It resists mechanical stress. It maintains its integrity. It requires precision installation.

Uses include:

- Conveyor belt systems

- Power transmission systems

- Heavy machinery systems

- Mining equipment

- Manufacturing facilities

Quality standards are strict. Import regulations are clear. Export documentation is essential.

73269020 – Belt Fasteners for Machinery

Machinery belt fasteners are essential components. They secure belt connections. They maintain proper tension. They prevent belt slippage. They ensure safety during operation.

These fasteners must be strong. They must resist corrosion. They must maintain grip. They must last long. They must be cost-effective.

Applications include:

- Conveyor systems

- Mining equipment

- Manufacturing machinery

- Agricultural equipment

- Industrial production systems

Fastener quality directly impacts equipment performance. Incorrect fasteners cause downtime. They can damage equipment. They pose safety risks. They increase maintenance costs.

73269030 – Drain Covers and Sewage Plates

Drain covers are essential infrastructure products. They protect underground systems. They prevent accidents. They manage water flow. They provide structural support.

These covers must be durable. They must handle traffic loads. They must resist corrosion. They must be easy to maintain. They must meet safety standards.

Types of drain covers:

- Sewage system covers

- Water drainage covers

- Storm drain covers

- Inspection chamber covers

- Industrial drain covers

Municipal corporations purchase these products. Infrastructure projects require them. Construction companies need them. Export opportunities are growing. Demand remains steady.

73269040 – Enamelled Iron Ware

Enamelled iron ware is decorative and functional. It includes cookware. It includes serving dishes. It includes storage containers. It includes traditional kitchen items.

Enamel coating provides:

- Non-stick properties

- Corrosion resistance

- Easy cleaning

- Aesthetic appeal

- Durability

Products in this category:

- Cooking pans

- Serving platters

- Storage jars

- Decorative dishes

- Kitchen utensils

This category has strong consumer demand. Retail markets value these products. Export markets are expanding. Traditional cookware remains popular. Modern designs drive sales.

73269050 – Grinding Media Balls and Cylpebs

Grinding media includes specialized spheres. It includes cylindrical bodies. These are used in grinding. They are used in milling. They are used in processing.

Types of grinding media:

- Steel balls (various sizes)

- Cylpebs (cylindrical shapes)

- Hybrid media

- Specialty shapes

- High-performance variants

Industries using grinding media:

- Cement manufacturing

- Mineral processing

- Chemical production

- Metallurgy

- Paint manufacturing

These products have consistent demand. Quality standards are strict. Export markets are substantial. Prices fluctuate with raw material costs.

73269060 – Stainless Steel Manufactures

Stainless steel articles offer superior properties. They resist corrosion. They maintain appearance. They last longer. They cost more initially. They provide long-term value.

Stainless steel products include:

- Fasteners and hardware

- Structural components

- Decorative items

- Industrial equipment parts

- Specialized applications

Stainless steel is premium material. Market prices are higher. Quality standards are strict. Applications are specialized. Demand is growing.

73269070 – Articles of Clad Metal

Clad metal articles combine different metals. They offer cost efficiency. They provide specific properties. They reduce material waste. They enable unique applications.

Clad metal consists of:

- Base metal layer

- Coating metal layer

- Multiple layer combinations

- Specialized interfaces

- Engineered properties

Applications include:

- Industrial components

- Specialized equipment

- High-performance parts

- Cost-optimized products

- Corrosion-resistant items

This is a specialized category. Technical knowledge is required. Proper classification is essential. Documentation must be detailed.

73269080 – Parts of Ships and Vessels

Marine equipment parts are specialized products. They are used in ship construction. They are used in vessel repair. They are used in marine infrastructure. They exclude hulls and propellers.

Parts included:

- Structural reinforcements

- Connection systems

- Support structures

- Specialized brackets

- Installation components

Maritime industry regulations apply. International standards are required. Quality certifications are necessary. Documentation is extensive. Inspections are mandatory.

73269091 – Shanks

Shanks are connector components. They attach tools. They hold equipment. They transfer force. They provide stability.

Types of shanks:

- Drill shanks

- Machine tool shanks

- Equipment adapters

- Connection pieces

- Specialized fittings

These products are industrial-grade. Precision is critical. Quality standards are high. Applications are specialized.

73269099 – Forged Steel Rings for Special Bearings

Forged steel rings are high-precision components. They are used in special bearings. They are used in wind turbines. They are used in power generation. They have specialized applications.

These rings must meet strict specifications:

- Precise tolerances

- High-grade material

- Specialized heat treatment

- Quality certifications

- Performance testing

Wind industry is a major user. Energy sector relies on them. Export demand is substantial. Prices reflect quality requirements.

Why Correct HS Code Classification Matters

Impact on Import Duties

Incorrect HS codes cost money. They increase your duties. They add to your expenses. They reduce your profit margins. They affect your competitiveness.

Correct classification ensures:

- Accurate duty calculation

- Proper tax assessment

- Fair trade treatment

- Compliance with regulations

- Reduced administrative burden

Customs Clearance Speed

Wrong codes delay shipments. They cause customs holds. They require re-documentation. They involve government inquiries. They add time to delivery.

Proper classification enables:

- Quick customs processing

- Faster delivery times

- Reduced storage costs

- On-time delivery

- Customer satisfaction

Trade Agreement Benefits

Correct codes unlock benefits. They qualify products for trade agreements. They enable preferential tariff rates. They reduce import duties. They improve competitiveness.

Benefits include:

- Lower tariff rates

- Expedited processing

- Reduced compliance burden

- Access to trade programs

- Cost savings

Regulatory Compliance

Classification affects compliance. Different products have different regulations. Some require special licenses. Some need quality certifications. Some demand safety approvals. Incorrect coding creates legal risks.

Compliance ensures:

- Legal operation

- Regulatory approval

- Avoided penalties

- Business reputation

- Long-term success

How to Find the Right HS Code

Step 1: Describe Your Product

Start with clear product description. Be specific about what the product is. Describe what it’s made of. Explain how it’s used. State its purpose clearly. Don’t use marketing terms.

Example: “Forged steel balls. Used for grinding minerals. Diameter: 40mm. Material: Carbon steel.”

Step 2: Check Product Material

Material classification is crucial. Your product is iron or steel. Articles of iron/steel go to Chapter 73. Raw iron/steel goes to Chapter 72. This distinction is important.

Step 3: Determine the Product Form

Form affects classification. Finished articles go to 7326. Semi-finished products differ. Specific items go to specific codes. Accuracy matters.

Step 4: Use Official Resources

Use authoritative sources:

- WCO Harmonized System database

- National tariff schedules

- Official government websites

- Customs authority databases

- Professional classification services

Step 5: Consult Experts if Needed

Complex products need expertise. Customs brokers help with classification. Trade consultants provide guidance. Tariff experts offer advice. Professional help ensures accuracy.

Step-by-Step HS Code Classification Guide

For Import-Export Professionals

Proper procedure includes:

- Get detailed product specifications

- Review relevant HS code chapters

- Read all applicable notes

- Apply General Rules of Interpretation

- Cross-check with similar products

- Verify with customs databases

- Document your classification reasoning

- Keep records for audit purposes

Using Online Tools

Multiple tools are available:

- DGFT ITC-HS Lookup (India)

- Tariff Schedule databases

- Customs online portals

- Commercial classification software

- Trade information websites

Documentation Requirements

Keep complete documentation:

- Product specifications

- Certificates of origin

- Supplier information

- Quality certifications

- Technical drawings

- Usage information

- Classification reasoning

Common Mistakes to Avoid

Mistake 1: Using Old Codes

Codes change regularly. Don’t use outdated codes. Check current regulations. Verify with official sources. Update your codes annually.

Mistake 2: Vague Product Description

Be specific, not general. “Metal parts” is not enough. “Forged steel rings for wind turbine bearings” is correct. Vague descriptions cause problems. Detailed descriptions enable accuracy.

Mistake 3: Wrong Product Category

Material matters. Iron or steel articles go to Chapter 73. Aluminum articles go elsewhere. Plastic-coated items differ. Composite products need specific codes. Know your materials.

Mistake 4: Ignoring Country Differences

Codes extend beyond six digits. Base codes are universal. Extended codes vary by country. Destination country matters. Import country regulations apply.

Mistake 5: Overlooking Special Conditions

Some items have conditions. Certain goods need licenses. Some products require certifications. Some have restrictions. Read all notes carefully.

HS Code Chapter 73: Complete Breakdown

| HS Code | Product Category | Use Case |

|---|---|---|

| 7301-7305 | Tubes & Pipes | Construction, plumbing |

| 7306 | Girders, beams, columns | Building structures |

| 7307 | Tube fittings | Pipe connections |

| 7308 | Structural assemblies | Building frameworks |

| 7309 | Storage tanks | Industrial storage |

| 7310 | Tanks, cans, drums | Container products |

| 7311 | Boilers, pressure vessels | Industrial equipment |

| 7312 | Stranded wire, rope | Industrial cables |

| 7313 | Barbed wire | Fencing materials |

| 7314 | Wire mesh, fences | Enclosure systems |

| 7315 | Chains | Connecting hardware |

| 7316 | Anchors, hooks | Fastening equipment |

| 7317 | Nails, bolts, screws | Fasteners |

| 7318 | Other fasteners | Hardware items |

| 7319 | Needles, pins | Textile tools |

| 7320 | Springs | Mechanical components |

| 7321 | Stoves, heaters | Heating appliances |

| 7322 | Radiators | Heat transfer equipment |

| 7323 | Tableware, cookware | Kitchen items |

| 7324 | Sanitary ware | Bathroom fixtures |

| 7325 | Cast articles | Casting products |

| 7326 | Other articles | Miscellaneous items |

Steel Market Trends and HS Code Impact

2026 Steel Market Overview

Steel prices remain competitive. Hot-rolled coil prices: ₹46,000-49,000/tonne in Q1 2026. Global steel demand grows 1.3% in 2026. India’s steel demand grows 8% in FY2026.

These trends affect:

- Raw material costs

- Finished product pricing

- Export competitiveness

- Profit margins

- Investment decisions

Trade Volume Implications

Higher trade volumes mean more HS codes. Import-export data grows yearly. Articles of iron/steel maintain steady demand. Chapter 73 products have consistent requirements. Proper classification becomes increasingly important.

Tariff Changes and Compliance

Tariffs fluctuate based on market conditions. Safeguard duties apply to certain steel products. Trade agreements offer preferences. Country-specific rates apply. Staying updated is essential.

Best Practices for HS Code Classification

For Importers

Importers should:

- Maintain updated code database

- Train staff on classification rules

- Use consistent documentation

- Work with customs brokers

- Keep detailed records

- Plan for tariff changes

- Negotiate better rates with correct codes

For Exporters

Exporters should:

- Get accurate product codes

- Understand destination country rules

- Prepare proper documentation

- Verify codes with customs

- Maintain compliance records

- Plan for varying tariff rates

- Communicate codes clearly with buyers

For Manufacturers

Manufacturers should:

- Know HS codes for products

- Design products considerately

- Document specifications clearly

- Understand code implications

- Plan manufacturing accordingly

- Maintain quality standards

- Support export/import operations

Advanced HS Code Topics

General Rules of Interpretation (GRI)

GRI 1: Classification is determined by headings and notes. Section and chapter notes apply.

GRI 2: Unfinished goods are classified as finished if they have the finished article’s essential character.

GRI 3: When multiple headings apply, choose the most specific. If equal, choose the last applicable heading.

GRI 6: Subheadings follow heading logic. All notes apply.

Customs Valuation

Customs value affects duties. Value includes transportation costs. Insurance costs apply. Packaging materials count. Correct valuation is essential. Undervaluation causes penalties.

Rules of Origin

Product origin matters for trade. Country of origin determines rates. Some agreements apply only to specific countries. Documentation proves origin. Certificates of origin are required.

Trade Agreements and Preferences

Many trade agreements apply:

- SAFTA (South Asia Free Trade Area)

- Bilateral agreements with major partners

- Regional preferential agreements

- Specific product exemptions

- Time-limited benefits

Frequently Asked Questions

Q: What’s the difference between HS Code Chapter 72 and 73?

A: Chapter 72 covers raw iron and steel. Chapter 73 covers finished articles and products made from iron/steel.

Q: Can HS codes change?

A: Yes. Codes are updated periodically. Always check current sources.

Q: What happens if I use the wrong code?

A: You may face penalties. Your shipment could be delayed. You’ll pay incorrect duties. Regulatory issues may arise.

Q: How do I verify my HS code is correct?

A: Use official government databases. Consult with customs brokers. Check with trade authorities. Cross-reference multiple sources.

Q: Is HS code the same worldwide?

A: Base codes (first 6 digits) are universal. Extended codes vary by country.

Q: Who determines HS codes for my product?

A: Typically, the exporter or importer. Customs authorities can review or correct codes.

Q: Where do I find the official HS codes?

A: Check your country’s tariff schedule. WCO website provides international codes. Customs websites list official codes.

Q: Do HS codes affect product taxes?

A: Yes. Different codes have different tax rates. Correct classification ensures proper tax calculation.

Conclusion

HS Code 7326 is essential for iron and steel articles. Proper classification ensures smooth trade. It reduces costs. It ensures compliance. It speeds up customs clearance.

Understanding HS codes is an investment. It protects your business. It ensures profitability. It enables growth.

Next steps:

- Identify your product type

- Find the correct HS code

- Maintain accurate documentation

- Train your staff

- Stay updated on changes

- Consult experts when needed

Success in import-export depends on accuracy. HS code classification is foundational. Get it right from the start. It pays dividends for years.