What Is HS Code for Aluminum?

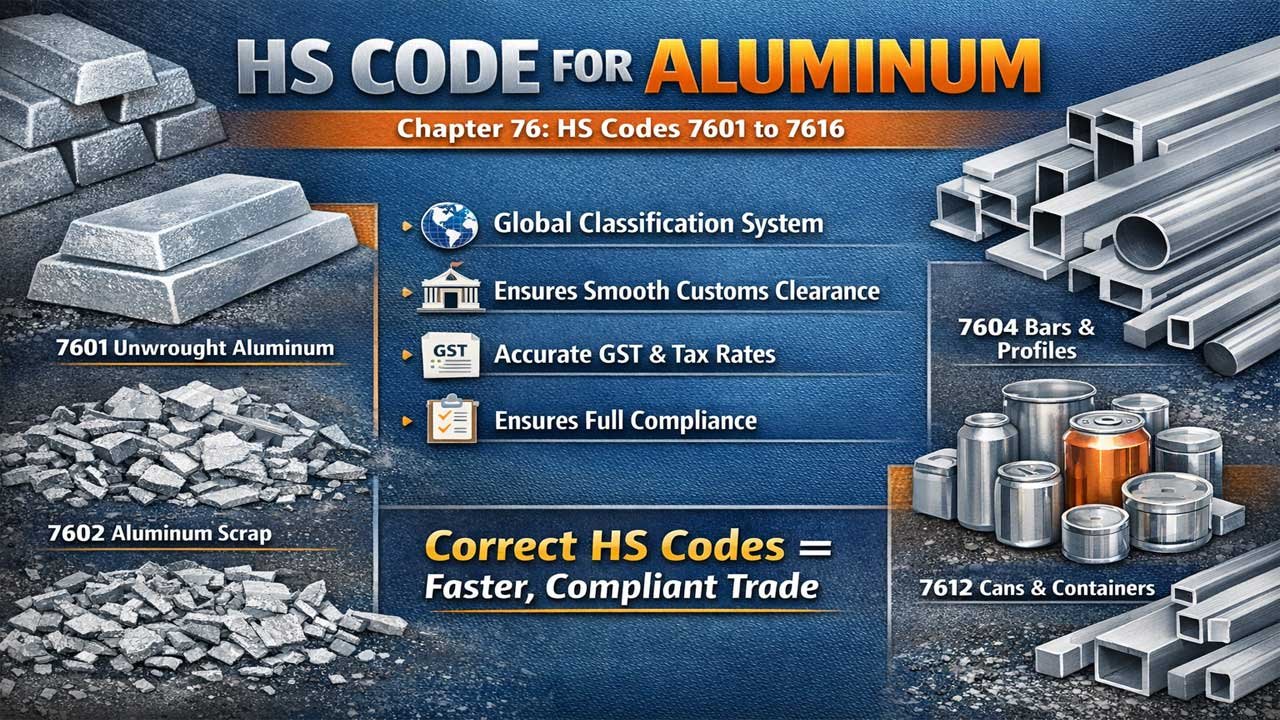

The HS code for aluminum is Chapter 76. It covers all aluminum products. HS codes are used worldwide. They classify goods for customs and trade. Aluminum products have codes from 7601 to 7616.

Understanding the correct HS code matters greatly. It ensures smooth import and export operations. It helps with customs clearance. It determines your GST rate correctly. Wrong classification leads to penalties. It causes delays in shipment. Compliance becomes easier with proper codes.

Why HS Code Aluminum Matters for Your Business

Every aluminum business needs correct HS codes. Importers and exporters use them daily. Manufacturers must know these codes. Traders rely on accurate classification. Tax authorities verify codes during audits.

The right code prevents costly mistakes. It avoids customs delays completely. Input Tax Credit (ITC) claims become valid. Your GST returns file smoothly. Business operations run without interruption.

India imports enormous quantities of aluminum. The country is the world’s largest importer of aluminum scrap. Global aluminum market value reached huge figures. It continues growing rapidly. Understanding codes helps capture opportunities. It keeps your business compliant.

Complete List: HS Codes for Aluminum Products

HS Code 7601 – Unwrought Aluminum (Primary & Alloys)

What is HS Code 7601? This covers raw aluminum ingots. It includes aluminum alloys. Products are in unwrought form. They are primary products from smelting.

GST Rate: 18% applies uniformly.

Key Sub-codes:

- 76011000 – Aluminum not alloyed

- 76012000 – Aluminum alloys

- 7601.10 – Not alloyed unwrought aluminum

- 7601.20 – Aluminum alloys unwrought

Business Use: This code applies to traders. It applies to manufacturers buying raw material. Industrial buyers use this code frequently.

HS Code 7602 – Aluminum Waste and Scrap

What is HS Code 7602? This covers waste aluminum. It includes scrap material. These materials get recycled. India is the top global importer.

GST Rate: 18% standard rate applies.

Key Details:

- 76020090 – Other waste and scrap

- Includes shredded material

- Covers powdered aluminum waste

Business Opportunity: Recycling businesses need this code. Scrap dealers use it constantly. Environmental companies benefit from this classification.

HS Code 7603 – Aluminum Powders and Flakes

What is HS Code 7603? This covers fine aluminum powder. It includes aluminum flakes. These are industrial materials. They are used in manufacturing processes.

GST Rate: 18% applies to all powder products.

Business Application: Chemical manufacturers use this code. Paint producers need powders. Aerospace industries require fine flakes. Additive manufacturers order these materials.

HS Code 7604 – Aluminum Bars, Rods & Profiles

What is HS Code 7604? This covers shaped aluminum products. It includes bars of various sizes. Rods come in multiple dimensions. Profiles serve construction purposes.

GST Rate: 18% applies uniformly.

Key Sub-codes:

- 76041010 – Aluminum bars, rods, profiles

- 7604.21 – Hollow profiles (alloys)

- 7604.29 – Other alloy profiles

Business Uses: Construction companies buy these products. Manufacturing plants order bars. Building contractors use profiles. Fabrication shops stock bars and rods.

HS Code 7605 – Aluminum Wire

What is HS Code 7605? This covers aluminum wires. Wire comes in various gauges. It can be alloyed or unalloyed. Products are ready for industrial use.

GST Rate: 18% applies to all wire.

Industry Applications: Electrical industries use aluminum wire. Power transmission requires extensive quantities. Electrical contractors purchase wire regularly. Cable manufacturers buy in bulk.

HS Code 7606 – Aluminum Plates, Sheets & Strip

What is HS Code 7606? This covers flat-rolled aluminum. Thickness exceeds 0.2mm always. Products are rectangular or square. Sheet metal fabrication uses these materials.

GST Rate: 18% applies uniformly.

Key Sub-codes:

- 76061110 – Aluminum plates sheets strips

- 7606.12 – Alloyed rectangular plates

- 7606.91 – Non-alloyed varieties

Common Uses: Automotive manufacturing demands these products. Construction projects use aluminum sheets. Packaging companies need flat stock. Metal fabricators buy continuously.

HS Code 7607 – Aluminum Foil (Thin Material)

What is HS Code 7607? This covers thin aluminum foil. Thickness cannot exceed 0.2mm. It may be backed or unbacked. Foil is rolled but not further worked.

GST Rate: 18% applies to all foil.

Key Sub-codes:

- 76071190 – Aluminum foil unbacked varieties

- 76071995 – Non-backed foil (non-alloyed)

- 7607.11 – Rolled foil unworked

Market Demand: Pharmaceutical companies use foil extensively. Food packaging industry requires huge quantities. Beverage producers need foil continuously. Cigarette manufacturers are major buyers.

HS Code 7608 – Aluminum Tubes and Pipes

What is HS Code 7608? This covers hollow aluminum products. Tubes and pipes serve different purposes. Products can be seamless or welded. Both alloyed and unalloyed versions exist.

GST Rate: 18% applies uniformly.

Key Types:

- 7608.100030 – Seamless aluminum tubes (not alloyed)

- 7608.200030 – Seamless tubes (alloyed)

- 7608.100090 – Non-seamless unalloyed tubes

Industrial Applications: HVAC systems use aluminum tubes. Hydraulic systems require specific pipes. Plumbing applications use aluminum products. Heat exchangers demand quality tubes.

HS Code 7609 – Aluminum Tube or Pipe Fittings

What is HS Code 7609? This covers aluminum fittings. Includes couplings for connections. Elbows change pipe direction. Sleeves join multiple sections.

GST Rate: 18% applies uniformly.

Uses: Industrial assembly requires fittings. Construction projects need connecting pieces. Manufacturing plants stock fittings. Maintenance operations use replacements constantly.

HS Code 7610 – Aluminum Structures and Parts

What is HS Code 7610? This covers prefabricated structures. Includes doors and window frames. Covers bridges and framework components. Balustrades and railings included.

GST Rate: 18% standard rate applies.

Key Categories:

- 7610.10 – Doors and windows

- 7610.90 – Other structures and components

Market Applications: Building contractors use constantly. Window manufacturers stock components. Door suppliers need frames. Bridge construction requires heavy quantities.

HS Code 7611 – Large Aluminum Containers (>300L)

What is HS Code 7611? This covers large storage containers. Capacity exceeds 300 liters always. May be lined or insulated. Compressed gas containers excluded.

GST Rate: 18% applies uniformly.

Uses: Industrial storage facilities need these. Chemical manufacturers use large tanks. Water storage projects require containers. Liquid transport needs specific tanks.

HS Code 7612 – Aluminum Cans, Drums & Small Containers

What is HS Code 7612? This covers small packaging containers. Capacity does not exceed 300 liters. Includes cans, drums, and boxes. Collapsible tubular containers included.

GST Rate: 18% applies uniformly.

Key Types:

- 7612.10 – Collapsible tubular containers

- 7612.90 – Other container varieties

Business Importance: Beverage industry depends on cans. Chemical manufacturers need containers. Paint producers use drums constantly. Food packaging requires safe containers.

HS Code 7615 – Household Aluminum Articles

What is HS Code 7615? This covers kitchen and household items. Includes utensils and cookware. Sanitary ware products included. Pot scourers and polishing pads covered.

GST Rate: 12% applies to household utensils.

Product Categories:

- Aluminum cookware and tiffin boxes

- Kitchen utensils and serving pieces

- Sanitary ware products

Market Potential: Households buy constantly. Restaurants need quality cookware. Hotels purchase bulk quantities. Institutional kitchens stock regularly.

HS Code 7616 – Other Aluminum Articles

What is HS Code 7616? This covers miscellaneous aluminum products. Items don’t fit other codes. Includes industrial fabricated parts. Expanded metal and chains included.

GST Rate: 18% applies uniformly.

Covered Products:

- 76169100 – Aluminum wire cloth and grill

- 76169920 – Chains made of aluminum

- 76169990 – Other fabricated articles

Uses: Specialized industrial applications. Custom fabricated items. Industrial protective equipment. Screening and fencing products.

Understanding GST Rates for Aluminum Products

Standard GST Rate: 18%

Most aluminum products attract 18% GST. This applies to industrial products. Raw materials follow this rate. Semi-finished goods taxed uniformly.

Products under 18% GST:

- Unwrought aluminum (7601)

- Aluminum waste and scrap (7602)

- Powders and flakes (7603)

- Bars, rods, profiles (7604)

- Aluminum wire (7605)

- Plates, sheets, strip (7606)

- Aluminum foil (7607)

- Tubes and pipes (7608)

- Pipe fittings (7609)

- Structures (7610)

- Large containers (7611)

- Drums and cans (7612)

- Other articles (7616)

Lower GST Rate: 12%

Household aluminum utensils get 12% GST. Kitchen articles qualify for reduction. This rate reduces consumer costs. Government supports kitchen items.

Products under 12% GST:

- Table and kitchen articles

- Household utensils

- Cookware products

Reason for Lower Rate: These are essential household items. Government promotes domestic consumption. Lower taxes benefit common people. Kitchen equipment becomes affordable.

Import Duty and Customs Clearance

Import Duty on Aluminum Products

Primary aluminum: 7.5% import duty applies.

Aluminum scrap: 2.5% import duty charged.

These duties vary by product category. Some items may have different rates. Tariff agreements affect duties. Trade agreements modify rates.

Additional Charges:

- Basic customs duty applies

- Additional duties possible

- GST added to CIF value

- Clearance fees required

Customs Clearance for Aluminum Imports

Required Documents:

- Commercial invoice from supplier

- Packing list with product details

- Bill of lading or airway bill

- HS code declaration

- GST registration certificate

Clearance Process:

- Submit documents to customs

- Pay applicable duties

- Obtain import clearance

- Receive goods

Important Compliance:

- Mandatory BIS certification for many products

- Quality testing may be required

- Inspection of goods mandatory

- Storage at authorized warehouses

Import-Export Data and Market Opportunities

India’s Position in Global Aluminum Trade

India is a major aluminum nation. The country imports huge quantities. It also exports significant amounts. Market opportunities continue growing.

Import Statistics:

- India imports 506,864 shipments of aluminum scrap yearly

- 60% of world market in Asia Pacific

- Growing infrastructure demands aluminum

- Manufacturing sectors expanding rapidly

Import Sources:

- China supplies 40% of imports

- United States supplies 15-20%

- Germany supplies 10-15%

- UAE, UK, Japan, Russia also supply

Global Aluminum Market Growth

Market Size: USD 159.32 billion in 2021.

Expected Growth: USD 255.91 billion by 2029.

Growth Drivers:

- Construction and infrastructure development

- Automotive and EV manufacturing

- Packaging industry expansion

- Electrical and power transmission

- Renewable energy projects

How to Find and Verify HS Codes

Official Sources for HS Code Information

GST Portal (India):

- Visit official GST website

- Use “Search HSN Code” feature

- Enter product name

- Get complete details

Trade Websites:

- ExportImportData.in

- Seair.co.in

- Flexport.com

- Trade government websites

Tools and Calculators:

- HSN code finders online

- GST rate calculators

- Munim tool

- ClearTax HSN lookup

Steps to Classify Aluminum Products

Step 1: Identify the exact product type.

Step 2: Check raw material composition.

Step 3: Measure thickness or dimensions if needed.

Step 4: Search official HS code database.

Step 5: Verify with trade experts if needed.

Common Mistakes to Avoid:

- Confusing similar product codes

- Ignoring thickness specifications

- Not checking alloyed vs. non-alloyed

- Missing backed vs. unbacked designations

Business Benefits of Correct HS Code Classification

For Importers

Advantages:

- Accurate duty calculation

- Faster customs clearance

- Reduced shipment delays

- Proper documentation

- Avoided penalties

Financial Impact:

- Lower operational costs

- Improved cash flow

- Better business planning

- Competitive pricing ability

For Exporters

Benefits:

- Compliant shipments

- International market access

- Proper documentation

- Avoided rejections

- Smoother trade

Market Opportunities:

- Access to new markets

- Better business relationships

- Increased export volumes

- Higher profits

For Tax Compliance

GST Advantages:

- Correct tax calculation

- Valid ITC claims

- Error-free returns

- Audit confidence

Operational Benefits:

- Simplified invoicing

- Automated compliance

- Reduced manual work

- Quick problem resolution

Practical Tips for Aluminum Business Operations

Invoice Requirements with HSN Codes

Mandatory Information:

- Correct HSN code

- Product description clearly stated

- Quantity and unit mentioned

- HSN code matching product exactly

Turnover-Based Requirements:

- Below ₹1.5 crore: HSN optional

- ₹1.5-5 crore: 2-digit HSN required

- Above ₹5 crore: 4-digit HSN mandatory

- Imports/Exports: 8-digit HSN required

Claiming Input Tax Credit (ITC)

ITC Benefits:

- Reduces tax liability significantly

- Improves cash flow

- Increases profitability

- Simplifies tax planning

Requirements for Valid ITC:

- Correct HSN code on invoice

- GST paid properly documented

- Supply was taxable

- Invoice details are accurate

Conclusion: Next Steps for Your Aluminum Business

Understanding HS codes is essential. It simplifies import and export operations. Correct classification prevents costly mistakes. Your business stays compliant always.

Action Items:

- Identify all your aluminum products

- Find correct HS codes for each

- Verify codes through official sources

- Update your systems and invoices

- Train your team on code usage

- Maintain updated documentation

The aluminum business offers great opportunities. Global demand continues increasing. India plays a major role. Correct HS code knowledge gives competitive advantage. Take the first step today.