What Is HS Code for Zinc?

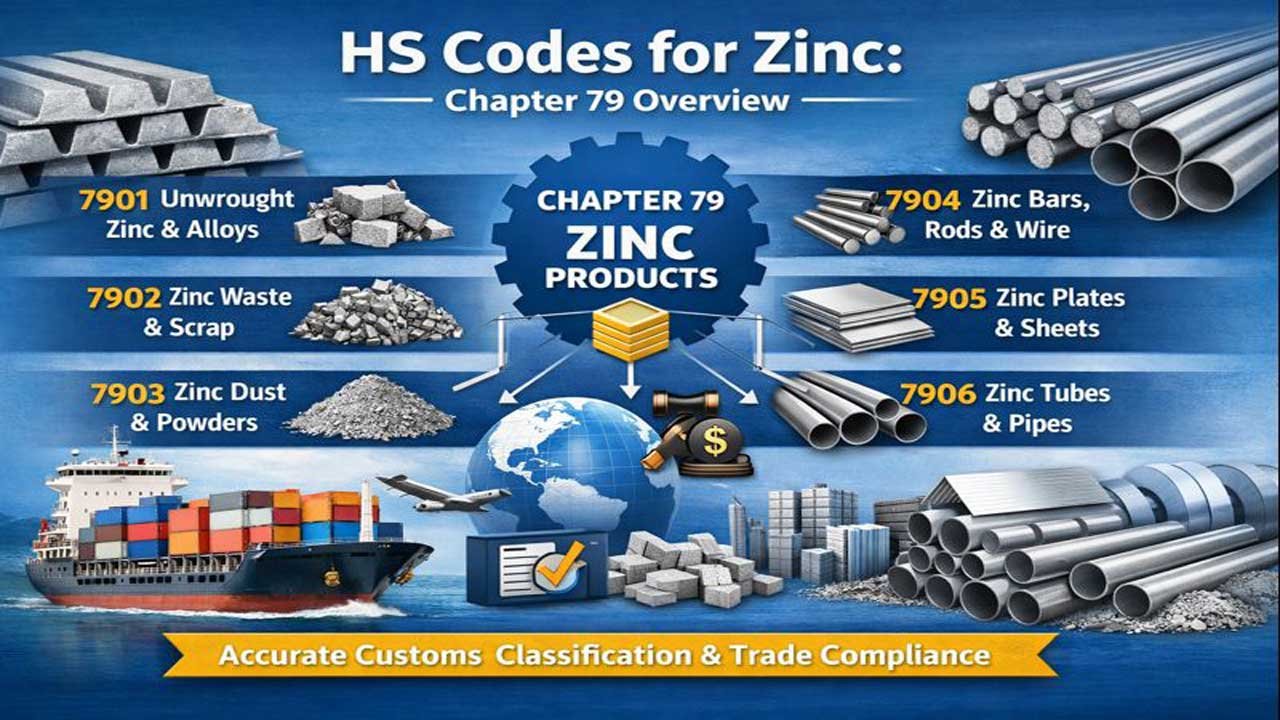

HS Code Chapter 79 covers zinc and articles thereof. This is the international classification system. It helps customs officials worldwide. It ensures smooth trade operations. It prevents shipping delays. It reduces costly penalties.

Zinc products fall under Section XV. This section covers base metals. Base metals are important commodities. They have high trade value. Import-export businesses depend on accurate codes.

HS Code 7901: Unwrought Zinc

HS Code 7901 is the primary heading. It classifies unwrought zinc products. Unwrought means pure metal form. It includes ingots, jumbo blocks, and pellets.

Sub-classifications for HS 7901

HS Code 7901.11: Zinc not alloyed. Contains 99.99% or more zinc by weight. This is high-grade zinc. Purity matters for quality products.

HS Code 7901.12: Zinc not alloyed. Contains less than 99.99% zinc. This grade costs less. It suits many industrial applications.

HS Code 7901.20: Zinc alloys. These contain aluminum, copper, or other metals. Mozak is a popular zinc-aluminum alloy. KZA3 and KZA4 are industry standards. These alloys have specific uses. They improve product performance.

Customs Duty in India: 18% GST applies. Basic duty is subject to trade agreements.

HS Code 7902: Zinc Waste and Scrap

HS Code 7902 classifies zinc waste materials. This includes scrap metal pieces. Old zinc products qualify here. Recycled zinc is valuable. It reduces production costs. It supports environmental sustainability.

Sub-codes for HS 7902

HS Code 7902.00.10: Zinc waste (specific varieties)

HS Code 7902.00.90: Other zinc scrap materials

Recycling zinc is profitable. Markets demand sustainable practices. Export opportunities exist globally.

HS Code 7903: Zinc Dust, Powders, and Flakes

HS Code 7903 covers zinc powder products. Zinc dust is finer than powder. It has specific industrial uses. Flakes are larger particles.

Zinc dust requirements:

- At least 80% particles pass through 63-micrometer mesh

- Minimum 85% metallic zinc content

- Used in chemical industries

- Applied in pharmaceuticals

- Required for paint and coating production

Application areas for HS 7903 products

Paint manufacturing needs zinc dust. Rubber vulcanization uses it. Pharmaceuticals require high purity. Chemical reactions depend on particle size.

Tariff code importance: Correct classification prevents customs issues. Misclassification causes delays. Penalties can be substantial.

HS Code 7904: Zinc Bars, Rods, Profiles, and Wire

HS Code 7904 classifies processed zinc forms. These are shaped products. Manufacturers transform unwrought zinc. The result is structural components.

Product types under HS 7904

Zinc bars: Solid rectangular shapes. Used in galvanizing. Applied in construction. Needed for manufacturing.

Zinc rods: Cylindrical metal forms. Used in electrical applications. Required for anodes. Applied in corrosion prevention.

Zinc profiles: Complex cross-sections. Used in structural applications. Applied in roofing. Used in architectural elements.

Zinc wire: Thin metal strands. Used in welding operations. Applied in electrical applications. Needed for industrial fabrics.

These products have higher value. Processing adds cost. Markets pay premium prices. Export demand is consistent.

HS Code 7905: Zinc Plates, Sheets, Strip, and Foil

HS Code 7905 classifies flat zinc products. These are thin, sheet-form materials. Manufacturers create these through rolling. They have wide industrial applications.

Specifications for HS 7905 products

Zinc plates: Thick, flat sheets. Used in galvanized coatings. Applied in automotive industries. Required for appliances.

Zinc sheets: Medium thickness products. Used in roofing materials. Applied in cladding systems. Needed for ducting.

Zinc strip: Continuous, rolled products. Used in battery manufacturing. Applied in die-cutting operations. Needed for coil coating.

Zinc foil: Very thin material. Used in packaging. Applied in insulation. Needed for decorative purposes.

These products enable secondary manufacturing. Value chains depend on them. Quality standards are strict. Competition is global.

HS Code 7906: Zinc Tubes, Pipes, and Fittings

HS Code 7906 covers tubular zinc products. These include tubes, pipes, and fittings. Couplings and elbows are included. Sleeves and connectors are classified here.

Applications for HS 7906 products:

- Plumbing systems

- Water distribution networks

- Industrial piping

- HVAC applications

- Chemical transport

- Gas transmission

These products must meet standards. Dimensional accuracy matters. Corrosion resistance is critical. Safety standards are mandatory.

HS Code 7907: Other Articles of Zinc

HS Code 7907 is the residual classification. It covers all remaining zinc articles. These are manufactured zinc products. They don’t fit previous categories.

Sub-classifications for HS 7907

HS Code 79070010: Sanitary fixtures. Includes gutters. Includes roof capping. Includes skylight frames. Building components are covered. Fabricated items qualify.

HS Code 79070090: Other zinc articles. Buttons and fasteners. Decorative items. Household products. Kitchen equipment. Table items. All miscellaneous zinc articles fit here.

Zinc household products have steady markets. Sanitary fixtures are always needed. Building materials see consistent demand. Value addition is possible.

HS Code for Zinc Dross and Residues

HS Code 2620.11 classifies zinc dross separately. Dross is a byproduct. It results from galvanizing processes. It contains zinc-rich materials. It can be recycled.

HS Code 2620.19 covers other zinc-containing residues. These include zinc ash. They contain zinc but different forms. Recycling value exists. Chemical extraction is possible.

These codes fall under Chapter 26. Chapter 26 covers slag and ash. These are industrial byproducts. Recovery operations create value.

How to Determine the Correct HS Code for Your Zinc Product

Step 1: Identify the product form. Is it unwrought or processed? Is it waste material? Is it a manufactured item? Physical form matters most.

Step 2: Check the purity level. Zinc content determines sub-classifications. Test certificates are necessary. Chemical composition matters significantly.

Step 3: Review specific product features. Is the product alloyed? Does it have special treatment? Is it industrial or consumer-grade? Features affect classification.

Step 4: Consult official HS documentation. Use WCO notes. Review country-specific extensions. Check binding rulings if uncertain. Professional guidance helps.

Step 5: Verify with customs authorities. Contact your customs office. Submit product samples if needed. Get written confirmation. Documentation prevents disputes.

India Customs Duty on Zinc Products

All Chapter 79 products carry 18% GST in India. Basic custom duty rates vary. Some products are duty-free. Some face protective duties. Trade agreements affect rates.

Zinc ingots: Import duty is 0% or varies by origin. GST is 18%. Additional taxes may apply based on source country.

Zinc waste: Basic duty varies. GST applies at 18%. Recycled materials may have different treatment.

Zinc powder: Basic duty applies. GST is 18%. Purity affects final assessment.

Always verify current rates. Tariffs change regularly. Trade agreements impact duties. Professional advice is recommended.

Business Opportunities in Zinc Import-Export Trade

Export Opportunities by HS Code Category

HS 7901 exports: India exports high-grade zinc to Korea. UAE receives significant shipments. Spain imports specialized grades.

HS 7902 exports: Zinc scrap exports are growing. Recycled materials have strong demand. Asian markets are largest consumers.

HS 7903 exports: Zinc dust has pharmaceutical demand. Chemical industries need consistent supply. Agricultural applications expand annually.

HS 7904 exports: Wire and rod exports are consistent. Welding applications drive demand. Manufacturing sectors need these products.

HS 7905 exports: Sheet and foil demand is steady. Roofing industries require supplies. Galvanizing applications are extensive.

Common HS Code Classification Errors to Avoid

Error 1: Confusing purity levels. 7901.11 and 7901.12 differ slightly. Purity matters for duty calculation. Test reports are required.

Error 2: Misclassifying alloys. Zinc alloys belong to 7901.20. Pure zinc goes to 7901.11 or 7901.12. Composition determines correct code.

Error 3: Treating waste as scrap. Waste and scrap are different codes. HS 7902 vs HS 2620. Different duty implications apply.

Error 4: Wrong dust classification. Zinc dust qualifies as HS 7903 only. Specific purity thresholds apply. Particle size matters legally.

Error 5: Forgetting alloy percentages. Mozak requires specific aluminum content. KZA standards have specifications. Deviation changes classification.

Consequences of errors:

- Customs delays (weeks to months)

- Duty penalties (5-20% of goods value)

- Shipment rejection or seizure

- Legal liability issues

- Damaged business reputation

Professional classification services save money. Expert guidance prevents costly mistakes.

HS Code Compliance Tools and Resources

WCO HS Nomenclature: Official World Customs Organization database. Updated annually. Authoritative source worldwide. Free to access.

Country-specific codes:

- USA: HTS (Harmonized Tariff Schedule)

- India: ITC-HS (Indian Tariff Code)

- EU: CN (Combined Nomenclature)

- China: HS codes follow WCO standards

Useful platforms:

- Cybex (HS code database)

- Flexport (classification tool)

- Trademo (tariff and duty lookup)

- Seair (import-export data)

- FreightAmigo (shipping HS code guide)

AI-powered tools: Modern systems use machine learning. They recommend codes automatically. They achieve 85%+ accuracy. They save time significantly.

Zinc Trade Data and Market Insights

Global Zinc Trade Patterns

China is world’s largest zinc importer. India exports significant quantities. UAE serves as regional hub. Bangladesh imports for manufacturing.

Major trade routes:

- Vietnam to East Asia

- Australia to Asia-Pacific

- Europe to Middle East

- Africa to Asia

Price factors affecting HS classifications:

- London Metal Exchange (LME) zinc prices

- Production quality and purity

- Market demand fluctuations

- Geopolitical factors

- Currency exchange rates

Market demand drivers:

- Galvanizing industry growth

- Automotive manufacturing expansion

- Construction industry cycles

- Battery manufacturing (zinc)

- Pharmaceutical uses

Conclusion: Mastering HS Codes for Zinc Success

Accurate HS code classification matters significantly. It ensures smooth customs clearance. It prevents costly penalties. It supports business profitability.

Key takeaways:

- Know your product form: unwrought, processed, or waste

- Verify purity levels and alloy content

- Consult official documentation

- Keep current with tariff changes

- Seek professional guidance when uncertain

- Maintain proper test certificates

- Document all classifications carefully

Zinc products offer excellent trade opportunities. High commercial intent exists. B2B import-export has strong demand. Professional classification services are available.

For importers and exporters: Invest in proper classification. Use AI tools for accuracy. Consult customs experts regularly. Stay informed about tariff changes.

Correct HS code classification builds sustainable business success. It protects investments. It opens new market opportunities. It enables profitable growth.

Quick Reference: HS Codes for Zinc at a Glance

| HS Code | Product Type | Key Features | Common Use |

|---|---|---|---|

| 7901.11 | Unwrought zinc ≥99.99% | Ultra-high purity | Electronics, premium applications |

| 7901.12 | Unwrought zinc <99.99% | Standard grade | General industrial use |

| 7901.20 | Zinc alloys | Alloyed metals | Die-casting, automotive |

| 7902 | Zinc waste/scrap | Recycled materials | Zinc recovery, recycling |

| 7903 | Zinc dust/powder | Fine particles | Chemicals, paints, pharmaceuticals |

| 7904 | Zinc bars/rods/wire | Shaped products | Construction, welding, electrical |

| 7905 | Zinc plates/sheets | Flat products | Galvanizing, roofing, cladding |

| 7906 | Zinc tubes/pipes | Tubular forms | Plumbing, HVAC, industrial systems |

| 7907.10 | Sanitary fixtures | Building components | Gutters, roof capping, frameworks |

| 7907.90 | Other zinc articles | Miscellaneous items | Household, decorative, fasteners |

| 2620.11 | Zinc dross | Slag byproducts | Zinc recovery from galvanizing |