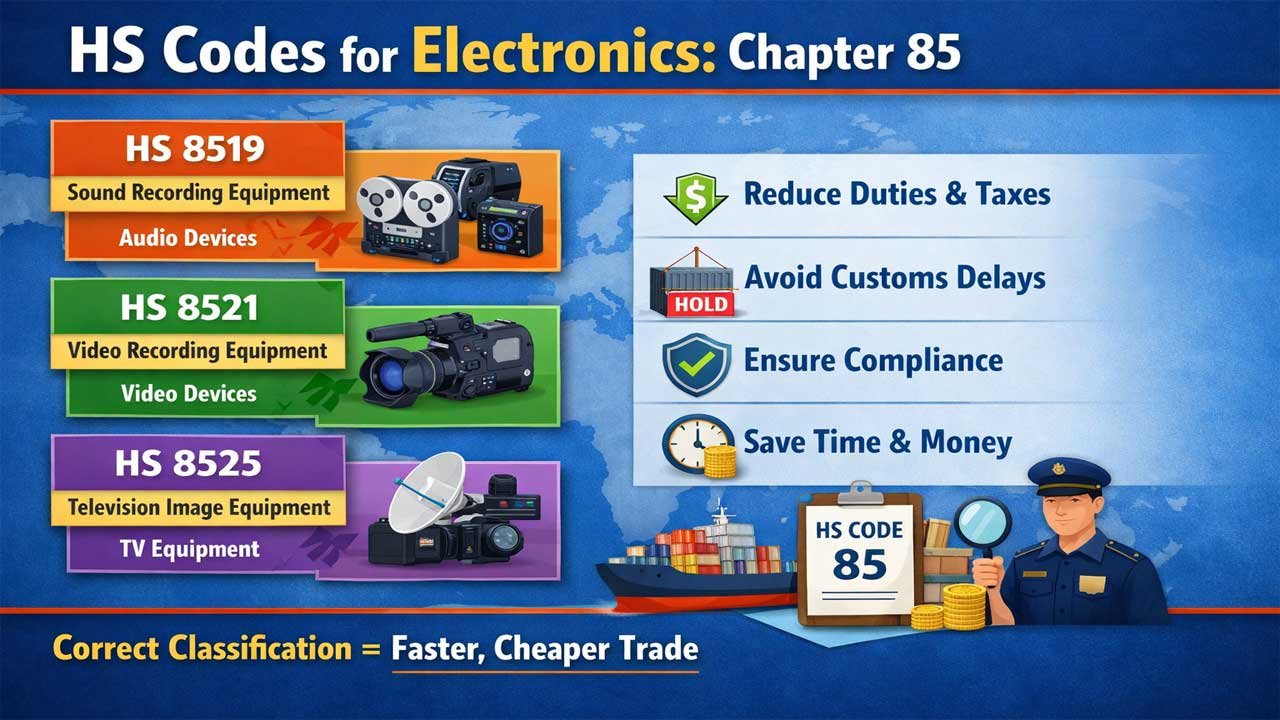

Chapter 85 covers electrical machinery. It includes sound recorders and reproducers. It also covers television image equipment. These products need proper classification for import and export.

The Harmonized System (HS) is an international standard. It ensures smooth customs clearance worldwide. It determines tariff rates and duties. Correct classification saves money and time.

Why HS Codes Matter for Your Business

Accurate HS codes prevent costly delays. Wrong classification leads to customs holds. Your shipment gets stuck at the border. Re-classification takes weeks or months.

Correct codes reduce duties and taxes. Different codes have different duty rates. Lower tariffs increase profit margins. Higher duty classifications waste your money.

Compliance keeps your business safe. Wrong codes trigger penalties and fines. Customs audits become expensive and time-consuming. Legal issues damage your reputation. Proper classification ensures peace of mind.

HS Code Structure Explained

Every HS code has six digits. The first two digits identify the chapter. The next two digits show the heading. The last two digits represent the subheading.

Example: HS Code 8519.81

- 85 = Chapter (Electrical machinery)

- 19 = Heading (Sound recording apparatus)

- 81 = Subheading (Optical media recorders)

This structure applies globally. All countries use the same system. It simplifies international trade significantly.

Sound Recording and Reproducing Apparatus (HS 8519)

What Products Fall Under HS 8519?

Sound recorders capture and reproduce audio. These include tape recorders and digital devices. Turntables and record players are included. Modern solid-state recorders also fit here.

HS Code 8519 applies to recording apparatus only. The equipment must function as a primary purpose. If recording is secondary, use a different code.

Detailed HS 8519 Subheadings

| HS Code | Product Type | Description |

|---|---|---|

| 8519.20 | Magnetic tape recorders | Audio cassette machines, reel-to-reel recorders |

| 8519.30 | Turntables and record players | Vinyl record players, phonographs |

| 8519.81 | Optical media recorders | CD/DVD recorders, Blu-ray recorders |

| 8519.89 | Other sound recorders | Solid-state, flash memory recorders |

| 8519.99 | Parts and accessories | Replacement components, spare parts |

Key Point: Battery-powered recorders fall under 8519. Standalone batteries may classify under HS 8507 if separable.

Magnetic Tape Sound Recorders (HS 8519.20)

These recorders use magnetic tape technology. Audio cassette recorders are common examples. Reel-to-reel recorders also use magnetic media.

The tape stores electrical signals. Sound quality depends on tape grade. Professional models use higher quality tape. Consumer models use standard cassette tapes.

Import duties on magnetic recorders vary by country. The US typically charges low tariffs. EU countries may have different rates. Always check your target market.

Optical Media Sound Recorders (HS 8519.81)

Optical media uses CDs, DVDs, and Blu-ray discs. These recorders write data to optical discs. CD recorders became popular in the 1990s. DVD recorders followed soon after.

Optical media offers better durability than tape. It provides larger storage capacity. Disc lifespan exceeds 20 years in most cases. This makes optical media popular for archives.

These products face moderate import duties globally. Many countries encourage digital technology imports. Lower tariffs support tech adoption worldwide.

Solid-State Sound Recorders (HS 8519.89)

Modern recorders use flash memory and hard drives. These solid-state devices store audio digitally. Smartphones and tablets have built-in recorders. Professional voice recorders are also common.

This category includes:

- USB flash recorders

- Portable digital voice recorders

- Audio editing workstations

- Professional studio equipment

Tariff rates vary significantly by market. Advanced economies often offer tariff-free treatment. Developing nations may impose higher duties. Check specific tariff schedules before importing.

Video Recording and Reproducing Apparatus (HS 8521)

Understanding HS Code 8521

This code applies to video recording devices. It includes equipment that records or reproduces video. Video tuners are not required for classification here.

Examples include:

- VHS video recorders (older technology)

- Video cassette recorders

- DVD players and recorders

- Digital video recorders (DVRs)

- Video cameras with recording capability

Important: Cameras primarily designed for still images use different codes. Hybrid devices require careful analysis. Consult customs officials when uncertain.

Key HS 8521 Subheadings

| HS Code | Product Category | Technical Details |

|---|---|---|

| 852110 | Magnetic tape video recorders | VHS, Betacam, S-VHS formats |

| 85211011 | Professional tape recorders | ¾” or 1″ tape format |

| 85211012 | Digital video recorders | Betacam SP, digital S formats |

| 852190 | Other video apparatus | DVD recorders, digital devices |

| 85219010 | Video duplicating systems | Master and slave control units |

| 85219020 | DVD players | Standalone DVD playback devices |

| 85219090 | Other video devices | Unlisted video recording equipment |

Tariff Considerations: Video recording equipment faces moderate import duties. Many countries offer preferential rates for tech products. Trade agreements like USMCA provide tariff benefits. Check bilateral agreements with your trading partner.

Television Image Recording Equipment (HS 8525)

What Is HS Code 8525?

This code covers television cameras and image recorders. It includes digital still image cameras. Video camera recorders also fall here.

Products classified under 8525 include:

- Television broadcast cameras

- High-definition video cameras

- Digital cinema cameras

- Professional video recording equipment

- Specialized imaging cameras

This is one of the most complex HS codes. Many products have similar features. Proper classification requires detailed product analysis.

Detailed HS 8525 Subheadings

| HS Code | Product Type | Specifications |

|---|---|---|

| 852550 | Transmission apparatus | Broadcast transmitters, radio equipment |

| 85255010 | Radio broadcast transmitters | AM/FM transmission equipment |

| 85255020 | TV broadcast transmitters | Television transmission apparatus |

| 85255050 | Wireless microphones | Broadcast-grade audio equipment |

| 852560 | Two-way radio equipment | Walkie-talkies, communication devices |

| 852580 | Television and video cameras | Professional imaging equipment |

| 85258010 | Television cameras | Broadcast studio cameras |

| 85258020 | Digital still cameras | DSLR, mirrorless cameras |

| 85258030 | Video camera recorders | Camcorders and professional recorders |

Export Restrictions: Some television equipment faces export controls. Military-grade cameras may require permits. Check your country’s export regulations before shipping.

Professional Television Cameras (HS 85258010)

These cameras capture broadcast-quality images. They use advanced sensor technology. Resolution typically exceeds 4K specifications. Professional models cost thousands of dollars.

Applications include:

- Television studio production

- Broadcast news gathering

- Sports event coverage

- Live streaming services

- Professional cinematography

Import duties vary by destination country. Advanced economies often encourage tech imports. Developing nations may restrict professional equipment. Check import regulations for your target market.

Digital Still Image Cameras (HS 85258020)

This category includes DSLRs and mirrorless cameras. Smartphones with dedicated image sensors may qualify. High-end digital cameras are included here.

Key Features:

- Interchangeable lens systems

- Manual control settings

- High-resolution sensors

- Professional color accuracy

Important Note: Some smartphones classify under different codes. The primary function determines classification. Devices primarily for communication use different codes. Audio-visual devices have yet another classification.

Tariff rates on digital cameras are generally low. Most developed countries offer duty-free treatment. This encourages consumer electronics imports. Tariff rates typically range from 0-5% globally.

Video Camera Recorders (HS 85258030)

Video camera recorders combine recording and playback. These include camcorders and professional recorders. Hybrid devices mixing still and video imaging fit here.

Categories include:

- Consumer camcorders

- Professional broadcast recorders

- 4K video cameras

- Action cameras

- Drone-mounted cameras

Tariff treatment is generally favorable. Many countries eliminated duties on video equipment. Trade agreements provide additional tariff reductions. Average import duty rates stay below 5%.

Related HS Codes for Electrical Machinery

HS Code 8528: Television Reception Apparatus

Code 8528 covers television receivers and monitors. It includes video projectors and display devices. This code is separate from recording equipment.

Understanding the distinction matters for:

- Correct tariff classification

- Accurate customs documentation

- Compliance with import regulations

- Calculation of duties and taxes

HS Code 8531: Sound and Visual Signalling Apparatus

This code covers alarm systems and signal devices. It includes doorbells, sirens, and warning systems. Sound recording is not the primary function here.

Key difference: Recording vs. playback/signalling. Recording devices use HS 8519 or 8521. Playback-only or signalling devices use HS 8531.

Step-by-Step Guide to Classifying Your Product

Step 1: Identify the Primary Function

Ask yourself these questions:

- What is the main purpose of the product?

- Does it primarily record audio? (Sound recorder)

- Does it primarily record video? (Video apparatus)

- Does it record television images? (Television equipment)

- Does it perform multiple functions? (Hybrid device)

The principal use rule determines classification. The main function takes precedence. Secondary features don’t change the code.

Step 2: Research Your Specific Product Type

Create a detailed product description including:

- Technology type (magnetic, optical, solid-state)

- Professional or consumer grade

- Recording and/or playback capability

- Media format (tape, disc, digital)

- Specialized features

Compare your product against HS code definitions. Most products fit clearly into one category. Some edge cases require expert consultation.

Step 3: Verify Using Official Resources

Consult official HS classification guides from:

- Your country’s customs authority

- The WCO (World Customs Organization)

- USITC (US International Trade Commission)

- Your target country’s tariff website

Search online HS code databases freely available. Many customs agencies offer lookup tools. Some provide detailed classification notes.

Step 4: Confirm with Customs Experts

When uncertain, contact customs brokers or consultants. They have deep knowledge of local regulations. They stay updated on recent changes. Professional guidance costs less than classification errors.

Request advance rulings from customs authorities. Most countries offer this service. It provides official confirmation before importing. This eliminates future disputes and penalties.

Tariff and Duty Considerations

How Import Duties Affect Your Business

Import duties add significant costs. They reduce profit margins immediately. Correct classification minimizes these expenses.

Example Scenario:

- Product value: $10,000 USD

- Tariff rate: 8% = $800 in duties

- Wrong code tariff: 15% = $1,500 in duties

- Extra cost from misclassification: $700 per shipment

For high-volume imports, this compounds quickly. Saving on tariffs directly increases profitability.

Tariff Rates by Country and Code

| Region | HS 8519 | HS 8521 | HS 8525 | Notes |

|---|---|---|---|---|

| USA | 0-5% | 0-5% | 0-5% | Often duty-free for tech goods |

| EU | 0-6% | 0-6% | 0-6% | Variable by specific code |

| India | 5-15% | 5-15% | 10-20% | Higher rates, trade agreement variations |

| Japan | 0-5% | 0-5% | 0-5% | Low tariff environment |

| China | Varies | Varies | Varies | Restricted imports for sensitive equipment |

Note: Tariff rates change frequently. Check current rates before making import decisions. Trade agreements provide preferential rates. Reciprocal tariffs may apply to certain origins.

Trade Agreements and Preferential Rates

Major trade agreements affecting electrical equipment:

- USMCA (US, Mexico, Canada)

- CPTPP (Trans-Pacific Partnership)

- EU Trade Agreements

- India-ASEAN FTA

- Bilateral agreements between countries

Meeting rules of origin requirements unlocks tariff benefits. Products must meet local content thresholds. Documentation must prove compliance. These benefits significantly reduce import costs.

Common HS Code Classification Errors

Mistake #1: Wrong Equipment Category

Problem: Classifying a video camera as sound equipment.

Impact: Incorrect duty rates, customs delays, penalties.

Solution: Identify the primary function clearly. Video cameras record images, not audio. Use HS 8525, not HS 8519.

Mistake #2: Ignoring Technology Type

Problem: Treating all sound recorders the same.

Impact: Incorrect subheading, potential tariff mismatches.

Solution: Distinguish between:

- Magnetic tape (8519.20)

- Optical media (8519.81)

- Solid-state (8519.89)

Each has different duty rates in some countries.

Mistake #3: Overlooking Hybrid Products

Problem: A device records both audio and video.

Impact: Incorrect classification, compliance issues.

Solution: Apply the “essential character” rule. Which function is primary? That determines the code. Consult customs if unsure.

Mistake #4: Missing Special Equipment Features

Problem: Professional equipment vs. consumer equipment.

Impact: Different tariff rates, special certifications required.

Solution: Review technical specifications carefully. Professional broadcast equipment may face export controls. Check your country’s regulations.

Customs Documentation for HS Code 85 Products

Required Documents for Import

Before clearing customs, prepare:

- Commercial Invoice – includes HS code

- Packing List – detailed product descriptions

- Bill of Lading – shipping documentation

- Certificate of Origin – proves country of origin

- Product Specifications – technical details

- Safety Certifications – CE mark, UL, etc.

What to Include in Your Declaration

Product description must be detailed:

- Manufacturer name and model

- Technical specifications

- Quantity and unit price

- Currency and total value

- HS code (6-digit minimum)

Vague descriptions delay customs clearance. Specific details speed up processing. Include photos when possible. Professional documentation prevents issues.

Common Customs Clearance Issues

| Issue | Cause | Prevention |

|---|---|---|

| Code mismatch | Incorrect classification | Use official references |

| Undervaluation | Low declared value | Use fair market prices |

| Missing documentation | Incomplete paperwork | Prepare all documents |

| Safety certificate lacking | No compliance proof | Include all certifications |

| Origin dispute | Unclear country source | Get certificates of origin |

Best Practices for Importing HS Code 85 Products

Partner with Experienced Customs Brokers

Brokers know regulations inside out. They handle documentation professionally. They prevent costly errors. Their fees pay for themselves through tariff savings.

Use HS Code Lookup Tools

Free online tools speed up classification:

- WCO HS Code Database

- USITC HTS Code Search

- EU TARIC Database

- India Customs HS Code Portal

- Your country’s customs website

These tools provide official guidance. They reference updated codes. They explain classification notes clearly.

Request Advance Tariff Rulings

Most customs agencies offer pre-import rulings. Submit product samples and specs. Get official confirmation of the HS code. Eliminate risk before importing.

Stay Updated on Tariff Changes

Tariff rates change annually. Trade policies shift frequently. New technology requires code updates. Subscribe to customs authority notifications. Your broker can alert you to changes.

Maintain Detailed Records

Keep documentation for at least 5 years. Track all import transactions. Record HS codes used. Document any disputes or questions.

This helps with:

- Customs audits and verification

- Pattern analysis for compliance

- Cost tracking and optimization

- Future reference for similar products

Summary

HS Code Chapter 85 covers electrical machinery. Sound recording apparatus uses HS 8519. Video recording apparatus uses HS 8521. Television image equipment uses HS 8525.

Correct classification saves money and prevents problems. Wrong codes trigger delays and penalties. Tariff differences can cost thousands per shipment. Professional classification ensures compliance.

Document everything carefully for customs. Detailed product descriptions prevent disputes. Safety certifications must be included. Origin documentation proves country of manufacture.

Use official resources for accurate information. Government customs databases provide definitive guidance. Trade agreements unlock preferential tariff rates. Advance rulings eliminate classification uncertainty.

Work with experienced professionals when needed. Customs brokers provide invaluable expertise. Complex products warrant expert consultation. The investment prevents expensive mistakes.

Frequently Asked Questions

Q: How often do HS codes change?

A: HS codes update periodically through the WCO. Major changes happen every 5-6 years. Individual countries may add changes annually. Always verify current codes before importing.

Q: Can I use different HS codes for the same product?

A: No. Each product has one correct classification. Using wrong codes violates customs regulations. Penalties include fines and potential legal action. Advance rulings provide official confirmation.

Q: What’s the difference between HS and HTS codes?

A: HS codes are 6 digits and international. HTS codes are 10 digits and country-specific. Both follow the same classification hierarchy. The first 6 digits of HTS match the HS code.

Q: Do trade agreements really reduce tariffs?

A: Yes, significantly. USMCA members enjoy preferential rates. Products meeting rules of origin get benefits. These can save 5-15% on import costs. Proper documentation is essential to qualify.

Q: How do I know if my camera is HS 8525 or something else?

A: Identify the primary function. Does it primarily record images? Then it’s likely HS 8525. Does it primarily record sound? It might be HS 8519. When in doubt, consult customs authorities.

Q: Are video camera recorders always HS 8525.30?

A: No, they’re HS 85258030 (8-digit code). The HS code is 852580 with subheading 30. This distinction matters for tariff calculations. Always use the full applicable subheading when importing.