What is HS Code?

The HS Code is a standard system. It’s used worldwide. HS stands for Harmonized System. It classifies products into specific codes. These codes matter for import and export. They determine duty rates. They affect tax calculations. Companies need accurate codes for compliance.

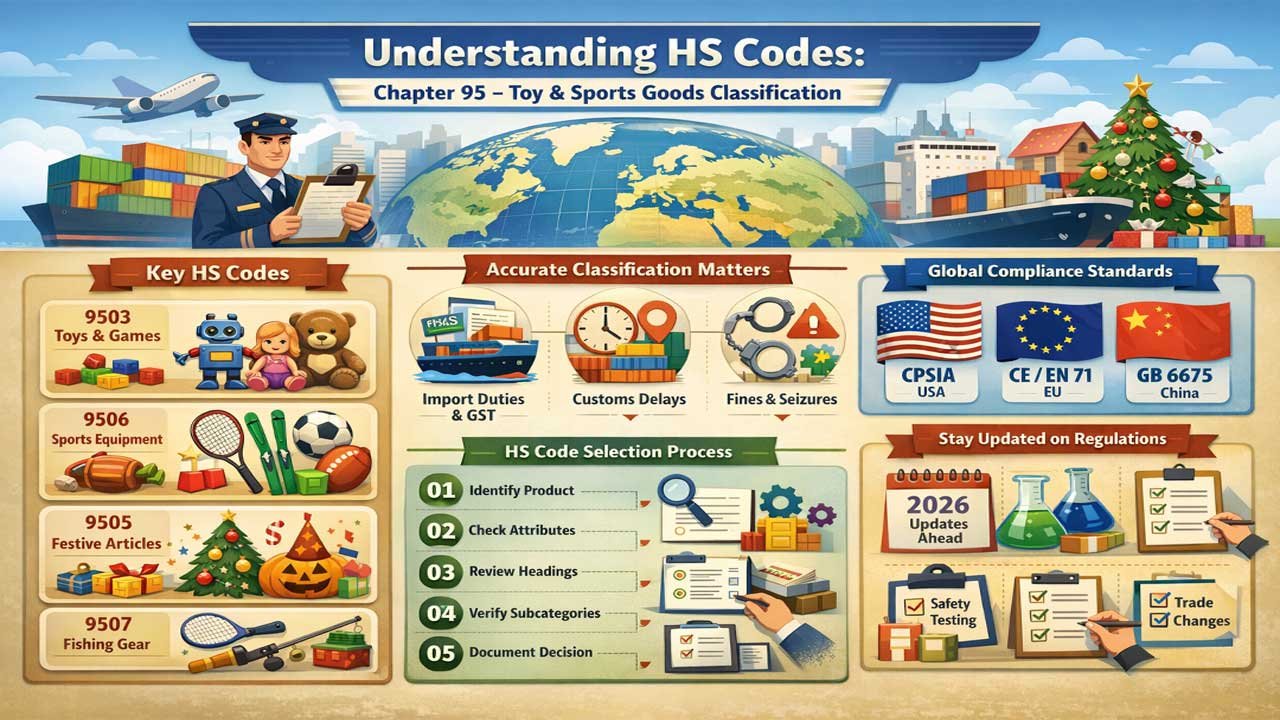

Chapter 95: Understanding Toy Classifications

Chapter 95 covers toys globally. It includes games and sports requisites. Parts and accessories are included too. This chapter has eight main headings. Each heading covers different product types. Accurate classification is critical. Misclassification causes delays. It can lead to fines.

| HS Code | Product Category | Examples |

|---|---|---|

| 9501 | Wheeled toys for children | Tricycles, scooters, pedal cars |

| 9502 | Dolls representing humans | Play dolls, fashion dolls |

| 9503 | Other toys & models | Building sets, electronic toys, puzzles |

| 9504 | Games & gaming equipment | Billiards, table games, casino equipment |

| 9505 | Festive & entertainment articles | Christmas decorations, novelty jokes |

| 9506 | Sports equipment & athletic gear | Tennis rackets, balls, gym equipment |

| 9507 | Fishing equipment | Fishing rods, nets, tackle |

| 9508 | Fairground & amusement equipment | Roundabouts, swings, shooting galleries |

HS Code 9503: Detailed Classification for Toys

Code 9503 is the largest category. It covers most toys sold globally. Understanding this code is essential. It includes multiple subcategories. Each has specific requirements.

Main Subcategories Under 9503

Tricycles, scooters, and pedal cars fall under 9503.00.10. Dolls’ carriages are included. These wheeled toys must be designed for children. They must be safe for riding.

Dolls are classified in 9503.00.20. Stuffed animals belong here too. Plush toys of all kinds qualify. These represent human or animal forms. They’re designed for amusement and play.

Construction sets and models use code 9503.00.30. Electric trains are included. Scale models fit here. Building kits are covered. These items promote learning and creativity.

Electric and battery-operated toys use 9503.00.40. Remote-controlled vehicles belong here. Motorized toys qualify. Electronic gaming devices are included. Safety testing is mandatory for these items.

Puzzles and brain games use 9503.00.60. All types of puzzles qualify. Logic games are covered. Educational brain teasers fit here.

Toy sets and combinations use 9503.00.70 and 9503.00.80. Sets with multiple pieces are classified here. Outfit combinations qualify. The essential character determines placement.

Parts and accessories use 9503.00.99. This is crucial for suppliers. Doll parts are covered. Toy replacement parts qualify. Accessory packs fit here. Understanding this subcategory prevents misclassification.

HS Code 9506: Sports Equipment & Athletic Gear

Sports equipment has specific requirements. Code 9506 covers athletic goods. Understanding this code matters for sports businesses.

Main Sports Equipment Classifications

Snow sports equipment use codes 950611-950619. Skis are 9506.11. Ski bindings are 9506.12. Winter sports accessories fit here.

Water sports equipment use codes 950621-950629. Sailboards are 9506.21. Surfboards fall here. Water sports accessories qualify.

Golf equipment use codes 950631-950639. Complete golf sets are 9506.31. Golf balls are 9506.32. Golf club parts are 9506.39.

Table tennis equipment use code 9506.40. Ping-pong tables qualify. Paddles and balls are included. Nets and accessories fit here.

Tennis and badminton equipment use codes 950651-950659. Tennis rackets are 9506.51. Badminton equipment is 9506.59. Strung and unstrung rackets differ. Balls are separate codes.

Balls for sports use codes 950661-950669. Tennis balls are 9506.61. Inflatable balls are 9506.62. Soccer, volleyball, and basketballs qualify. Cricket and golf balls have specific codes.

Skating equipment use code 9506.70. Ice skates qualify. Roller skates are covered. Skating boots with attached skates fit here.

Fitness and athletic equipment use codes 950691-950699. Gym equipment qualifies. Boxing equipment is 9506.91. Protective gear is 9506.98. Hand grips and exercise apparatus fit here.

HS Code 9505: Festive Articles & Entertainment Products

Code 9505 covers special occasions. It includes celebration items. Entertainment products are covered.

Festive Article Classifications

Christmas items use code 9505.10. Christmas decorations qualify. Tree ornaments are covered. Festive lights and tinsel fit here. Christmas-specific products belong here.

Other festive articles use code 9505.90. Easter decorations qualify. Halloween items are covered. Valentine’s Day products fit here. Birthday party supplies qualify. Carnival costumes are included.

Conjuring tricks and novelty jokes use code 9505.90. Magic trick sets qualify. Novelty joke items fit here. Entertainment gimmicks are covered.

Parts & Accessories: Critical Classification (HS Code 9503.00.99)

Understanding parts and accessories is vital. They’re classified under the complete product code. This rule applies to all toys. Parts cannot use a different heading.

What Qualifies as Parts and Accessories?

Replacement toy parts qualify. Doll parts are common. Broken arm or leg pieces fit here. Vehicle parts for toy cars fit here. Battery compartment covers are included. Wheel replacements for toy vehicles qualify.

Toy clothing and outfits fit here. Doll shoes and accessories qualify. Outfit sets for action figures qualify. Additional clothing pieces fit here.

Accessory packs matter. Extra wheels for skateboards qualify. Additional building blocks fit here. Replacement batteries don’t qualify. Batteries follow separate codes.

Why Accurate Classification Matters

Incorrect classification causes customs delays. Fines are substantial. Duty rates differ significantly. Tax calculations change. Product can be seized. Shipments get detained. Export licenses may be denied. Documentation becomes difficult.

Regulatory Compliance: Safety Standards & Certifications

Toys are highly regulated products. Multiple countries enforce strict standards. Compliance is mandatory. Non-compliance carries severe penalties.

United States: CPSIA & CPSC Requirements

The CPSIA is mandatory federal law. It applies to all toys sold in the U.S. CPSC (Consumer Product Safety Commission) enforces it. Third-party testing is required. Costs range from $500-$1,200. Testing takes 5-7 business days.

ASTM F963 Standard is the main requirement. Physical testing is required. Chemical composition testing matters. Lead content must be tested. Phthalates testing is required. Small parts choking hazard testing applies. Sharp edge testing is mandatory. The Children’s Product Certificate (CPC) is required. CPC certification is mandatory for Amazon sales in the U.S.

European Union: CE Mark & EN 71 Standard

CE marking is mandatory in the EU. EN 71 is the primary safety standard. It covers mechanical safety. Chemical safety requirements apply. Flammability testing is required. Age-appropriate design matters. Instructions in local languages are required. Technical documentation must be maintained for 10 years.

China: GB 6675-2024 Standard

China updated its standards in 2024. GB 6675-2024 is now mandatory. Heavy metal migration limits tightened. Phthalate restrictions are stricter. Local testing is required. Digital product passports are new. Tracking requirements increased. Non-compliance fines are substantial.

India: ISI Marking & BIS Standards

ISI marking is mandatory in India. Bureau of Indian Standards (BIS) oversees compliance. Local laboratory testing required. ISI mark must be visible. Import documentation must include BIS approval. Testing costs vary by product type.

GST Rates in India (HSN Code 95 Products)

GST classification varies by product. Most toys are 12% GST. Some electronic toys are 18% GST. Sports equipment is typically 5% or 12% GST. Accurate HSN code ensures correct GST calculation.

| Product Category | HSN Code | GST Rate |

|---|---|---|

| Basic toys (plastic, rubber) | 9503.00 | 12-18% |

| Sports balls | 9506.66 | 5% |

| Fishing equipment | 9507.00 | 5% |

| Athletic wear | 6201-6204 | 5% |

| Sports footwear | 6403-6404 | 5% |

Import-Export Compliance: Essential Requirements

Proper documentation is critical. Mistakes are costly. Each market has unique requirements.

Required Documentation for Toy Imports/Exports

Commercial invoices are mandatory. They must be detailed and accurate. Packing lists matter. They verify product count and weights. Certificates of Origin affect tariff rates. Preferential CoO forms reduce duties. Health and safety certificates are required. Test reports must accompany shipments. Bills of lading prove shipment details.

Quality Control Standards

Product testing is mandatory before export. Third-party lab testing required. Safety inspection reports needed. Batch testing procedures matter. Documentation must be complete. Records must be maintained for 5+ years. Audit trails are important. Supplier verification is essential.

Tariff and Duty Information

Import duties vary by country. EU averages 0-6.8% duty on toys. U.S. duty rates vary. Some toys are duty-free. Negotiated trade agreements reduce rates. India applies 0-10% duty. China applies varying rates. Accurate HS codes determine duties.

Step-by-Step HS Code Selection Guide

Choosing the right code is critical. Follow this systematic approach.

Step 1: Identify Product Category. First, understand what you’re classifying. Is it a toy or sports equipment? Is it a game or festive article? Category determines chapter.

Step 2: Check Key Characteristics. Materials matter. Functionality is important. Intended use determines placement. Age appropriateness affects classification. Mechanism type matters. Electronic vs. non-electronic is crucial.

Step 3: Review Chapter 95 Headings. Start with heading 9501. Move through 9508 systematically. Read descriptions carefully. Note exclusions. Understand what belongs where.

Step 4: Examine Detailed Subcategories. Read all applicable subheadings. Material composition may change the code. Manufacturing method matters. Origin of raw materials can affect classification. Check notes carefully.

Step 5: Consult Official Resources. Check your country’s tariff schedule. Use official HS code databases. Verify with customs brokers. Request advance rulings if uncertain. Official guidance prevents errors.

Step 6: Document Your Decision. Keep detailed records. Explain your classification rationale. File supporting documentation. This protects against future disputes.

Common Misclassification Errors

Traders often make costly mistakes. Understanding common errors helps prevention.

Error 1: Mixing Electronic and Non-Electronic Toys. Electronic toys may have different codes. Battery operation changes classification. Remote control features matter. Motor functionality affects placement.

Error 2: Confusing Parts with Complete Products. Parts belong under the complete product code. Replacement parts don’t change classification. Sets and components differ. Assembly kits have specific codes.

Error 3: Misidentifying Toy vs. Sporting Equipment. A bicycle is transportation, not a toy. Sporting equipment differs from toys. Children’s toys are specific. Adult sports equipment uses different codes.

Error 4: Overlooking Material Composition. Plastic toys differ from wooden toys. Metal toys have different codes. Material type determines placement. Mixed-material items are complex.

Error 5: Ignoring Age-Appropriateness Rules. Baby toys have specific codes. Children’s toys (3+) differ. Adult games have different classifications. Age grouping matters legally.

Import Costs & Budgeting

Understanding total costs is essential. Tariffs are only one part.

Testing Costs range from $500-$2,000 per product. CPSC testing averages $800-$1,200. EU CE mark testing costs €500-€1,500. Batch testing reduces per-unit costs. Testing takes 2-4 weeks typically.

Certification Fees average $300-$1,000. CPC certificate cost is minimal. CE marking administrative fees apply. ISI marking registration fees vary. Document translation costs apply.

Customs Clearance Costs range from $200-$500. Broker fees apply. Documentation fees are typical. Inspection fees may apply. Delays cost money daily.

Tariff Duties vary by country and product. U.S. duties: 0-10% typically. EU duties: 0-6.8% typically. India duties: 0-10% typically. China duties: variable rates. Trade agreements reduce rates.

Future Changes & 2026 Updates

The toy industry constantly evolves. New regulations emerge. Standards tighten regularly.

2025 GB 6675 Changes in China include tighter heavy metal limits. Phthalate restrictions increased. Digital tracking mandatory. Non-compliance fines doubled. Effective date is now enforced.

EU Digital Product Passport Initiative requires new tracking. Implementation timeline: 2026-2028. Tracking increases costs slightly. Compliance is mandatory. Documentation requirements expand.

U.S. CPSIA Revisions monitor regulatory changes. Standards may tighten further. Compliance budgets should increase. Planning ahead is essential.

India ISI Updating occurs regularly. BIS standards strengthen. New product categories emerge. Compliance costs may increase.

Conclusion

Understanding HS codes is fundamental to toy trade. Correct classification prevents costly errors. Safety regulations are non-negotiable. Compliance protects children. Multiple certifications are often required. Planning budgets for testing is essential. Documentation must be meticulous. Staying updated on regulations is critical. Working with customs brokers helps. Advance rulings prevent problems.

The toy industry offers profitable opportunities. Proper classification ensures success. Regulatory compliance is non-negotiable. Success requires attention to detail. Professional guidance prevents expensive mistakes. Investment in compliance pays dividends. Global toy trade continues growing. Understanding these fundamentals ensures success.