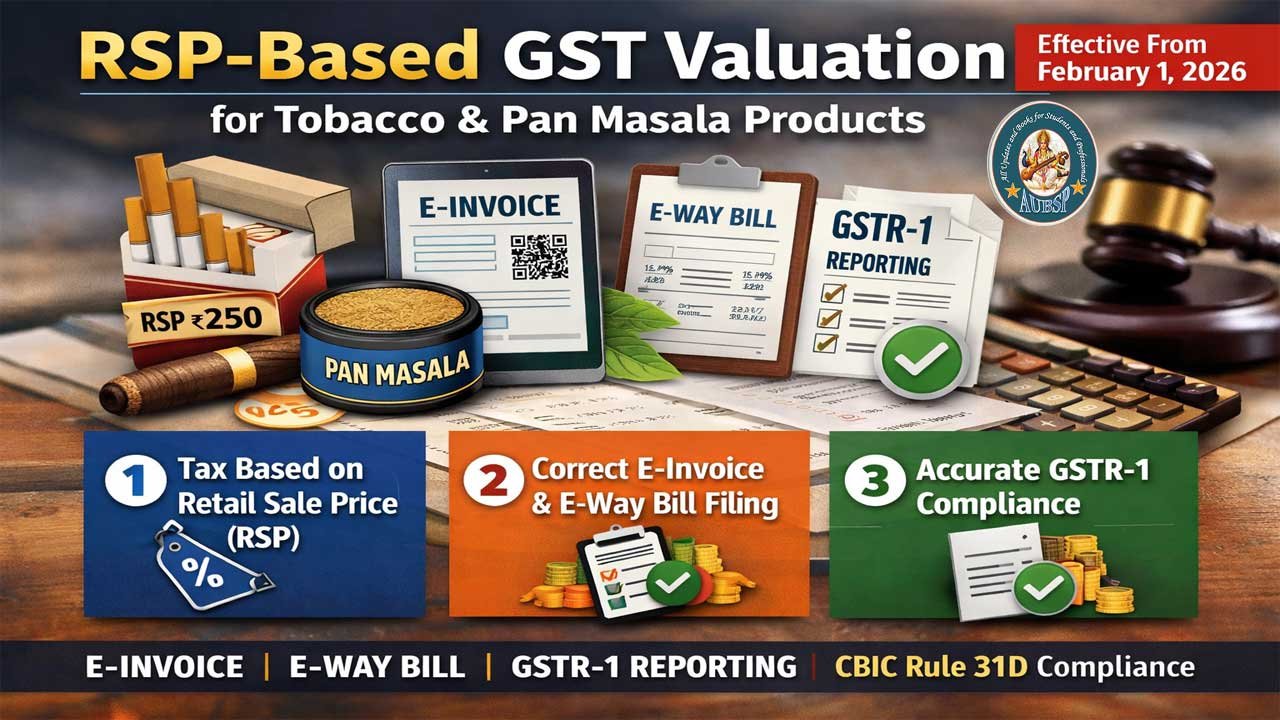

From 1 February 2026, GST valuation for specified tobacco, pan masala, and nicotine products shifts from transaction value to Retail Sale Price (RSP) under CBIC Notifications 19/2025 and 20/2025, with tax reverse-calculated as a tax-inclusive component of the printed RSP, regardless of discounts or actual sale price.

While GST liability must be computed strictly using the RSP-based formula prescribed under new Rule 31D, GSTN has clarified that to avoid system validation errors, taxpayers must report the net sale value (actual consideration) as the taxable value in e-Invoice, e-Way Bill, GSTR-1, GSTR-1A, and IFF, manually enter the RSP-based tax amount, and ensure the total invoice value equals the sum of these two fields. The deemed taxable value derived from RSP is only for internal verification and is never reported.

This regime significantly increases compliance responsibility for manufacturers, importers, and distributors, requiring ERP changes, manual overrides of system-calculated tax, meticulous verification, and strong documentation, as incorrect reporting can lead to rejections, under-payment risks, audits, and penalties.

| Aspect | Information |

|---|---|

| Legal Change | Introduction of RSP-based valuation under GST via CBIC Notifications 19/2025 & 20/2025 |

| Effective Date | 1 February 2026 |

| Applicable Law | Section 15(5) of CGST Act read with newly inserted Rule 31D of CGST Rules |

| Valuation Method | GST calculated on Retail Sale Price (RSP) printed on the package, not transaction value |

| Covered Products (HSN) | 2106 90 20 (Pan Masala), 2401, 2402, 2403, 2404 11 00, 2404 19 00 |

| GST Rate | 40% IGST or 20% CGST + 20% SGST |

| Tax Calculation Formula | Tax = (RSP × GST Rate) ÷ (100 + GST Rate) |

| Discount Impact | Discounts or wholesale price reductions do not reduce GST liability |

| Taxable Value to Report | Net sale value (actual commercial consideration) |

| Tax Amount to Report | Tax computed using the RSP-based reverse calculation formula |

| Deemed Taxable Value | RSP minus tax – for verification only, not to be reported |

| e-Invoice Reporting | Taxable value = net sale value; tax = RSP-based tax; total = sum of both |

| e-Way Bill Reporting | Same approach as e-Invoice; system updated to accept RSP-based entries |

| GSTR-1 / IFF Reporting | Taxable value = net sale value; tax manually edited to RSP-based amount |

| GSTR-1A (Amendments) | Same reporting logic applies for corrections |

| System Validation Rule | Taxable Value + Tax ≤ Total Invoice Value |

| Manual Override Allowed | Yes, GSTN permits editing system-calculated tax amounts |

| ITC Eligibility | ITC allowed on RSP-taxed purchases, subject to Rule 31D conditions |

| Compliance Risk | Under-reporting tax by using transaction value can lead to demand & penalties |

| Who Is Impacted Most | Tobacco & pan masala manufacturers, importers, distributors, GST professionals |

RSP-Based Valuation in GST: Complete Advisory on e-Invoice, e-Way Bill, and GSTR-1 Reporting for Tobacco Products

The Goods and Services Tax (GST) landscape in India is undergoing a significant transformation. On December 31, 2025, the Central Board of Indirect Taxes and Customs (CBIC) issued groundbreaking notifications (Nos. 19/2025 and 20/2025–Central Tax) that fundamentally change how specific goods are valued and taxed under GST. These new rules, effective from February 1, 2026, introduce Retail Sale Price (RSP)-based valuation—a departure from the traditional transaction-value model that has governed GST compliance since its inception.

The impact is substantial, particularly for manufacturers, importers, and distributors of tobacco products and pan masala. For GST professionals, accountants, and business owners managing these categories, understanding the nuances of RSP-based reporting in e-Invoice, e-Way Bill, and GSTR returns is no longer optional—it’s a critical compliance requirement.

This comprehensive advisory, based on the official guidance issued by the Goods and Services Tax Network (GSTN), explains everything you need to know about RSP-based valuation, how to calculate tax liability correctly, and most importantly, how to report these transactions without triggering system errors or compliance violations.

What Is RSP-Based Valuation Under GST?

Definition and Scope

RSP-based valuation refers to a special mechanism where the value of supply for notified goods is determined based on the Retail Sale Price (RSP) declared on the product package, rather than the actual commercial transaction value. This is a fundamental departure from standard GST valuation rules, which typically derive taxable value from the invoice price or consideration paid between the supplier and recipient.

Under RSP-based valuation, GST liability is computed using the declared retail price printed on the packaging, irrespective of discounts, promotional pricing, or the actual wholesale transaction value.

Which Products Are Covered Under RSP-Based Valuation?

The CBIC notifications specify the following HSN codes and product categories:

| S.No. | HSN Code | Product Description |

|---|---|---|

| 1 | 2106 90 20 | Pan masala |

| 2 | 2401 | Unmanufactured tobacco; tobacco refuse (other than tobacco leaves) |

| 3 | 2402 | Cigars, cheroots, cigarillos and cigarettes |

| 4 | 2403 | Other manufactured tobacco, homogenised or reconstituted tobacco |

| 5 | 2404 11 00 | Products containing tobacco intended for inhalation without combustion |

| 6 | 2404 19 00 | Products containing nicotine substitutes intended for inhalation without combustion |

Important Note: RSP-based valuation applies only to these notified HSN codes. If you deal with other products, standard GST valuation rules continue to apply.

How Is Tax Calculated Under RSP-Based Valuation?

The RSP-Based Valuation Formula

Unlike conventional GST calculations where tax is added to the invoice value, RSP-based valuation uses a reverse-calculation formula because RSP is treated as a tax-inclusive price. The formulas are as follows:

Tax Amount = (RSP × GST Rate %) / (100 + Sum of Applicable Tax Rates)

Deemed Taxable Value = RSP − Tax Amount

This reverse-calculation approach is critical to understand because it fundamentally differs from how GST is typically calculated. The tax is extracted from the RSP rather than added on top of the sale value.

Step-by-Step Calculation Example

Let’s walk through a practical example to clarify how RSP-based valuation works in real-world scenarios.

Given Information:

- Product HSN: 2403 (Manufactured tobacco)

- MRP/RSP per pack: ₹100

- Total number of packs sold: 1,000

- Total RSP value: ₹1,00,000

- Applicable tax rate: IGST @ 40%

Step 1: Calculate Total RSP

Total RSP = ₹100 × 1,000 = ₹1,00,000

Step 2: Calculate Tax Amount Using RSP Formula

Tax Amount = (₹1,00,000 × 40) / (100 + 40)

Tax Amount = ₹40,00,000 / 140

Tax Amount = ₹28,571.43

Step 3: Calculate Deemed Taxable Value

Deemed Taxable Value = ₹1,00,000 − ₹28,571.43

Deemed Taxable Value = ₹71,428.57

Key Insight: Even though you sold the goods at a commercial transaction value of, say, ₹60,000 (with discounts), the GST liability is calculated on ₹71,428.57 (the deemed taxable value derived from RSP). This ensures that higher tax revenue is collected on these specific products, preventing discount-driven tax arbitrage.

The System Validation Challenge: Why Reporting RSP-Based Values Creates Errors

Understanding the Conflict Between RSP Valuation and System Design

Here’s where it gets technically complex. The existing e-Invoice, e-Way Bill, and GSTR filing systems were designed around a transaction-value model. These systems enforce a fundamental validation rule:

Taxable Value + Tax Amount ≤ Total Invoice Value

This validation was designed to ensure data consistency—the sum of taxable value and tax should never exceed the total invoice amount, because tax is typically added on top of the goods’ value.

However, RSP-based valuation creates a scenario where this rule breaks down. Consider the following:

| Scenario | Amount (₹) |

|---|---|

| Commercial Transaction Value (Actual Sale Price) | 60,000.00 |

| Deemed Taxable Value (from RSP) | 71,428.57 |

| Tax Amount (from RSP Formula) | 28,571.43 |

| Sum of Taxable Value + Tax | 99,999.99 |

If you report the deemed taxable value of ₹71,428.57 along with the tax of ₹28,571.43, the sum is ₹99,999.99, which would exceed the total invoice value of ₹88,571.43 (₹60,000 + ₹28,571.43). The system would flag this as an error and reject the invoice.

This is the core technical challenge that the GSTN advisory addresses.

Official Reporting Guidance for RSP-Based Goods: The Solution

How to Report in e-Invoice and e-Way Bill Systems

To resolve the system validation conflict while maintaining legal compliance, the GSTN has provided specific guidance for reporting RSP-based goods in e-Invoice and e-Way Bill systems:

Field 1: Taxable Value

Report the Net Sale Value (actual commercial transaction value), NOT the deemed taxable value derived from RSP.

In the example above, report ₹60,000.00 in the taxable value field, even though the deemed taxable value is ₹71,428.57.

Field 2: Tax Amount

Compute and report the tax amount strictly in accordance with the RSP-based formula.

Report ₹28,571.43 as the tax amount, which is derived from the RSP formula using the deemed taxable value of ₹71,428.57.

Field 3: Total Invoice Value

Report the total invoice value as the sum of the net sale value and the tax amount.

Report ₹88,571.43 (₹60,000 + ₹28,571.43) as the total invoice value.

This approach ensures:

- Taxable Value (₹60,000) + Tax Amount (₹28,571.43) = ₹88,571.43 ≤ Total Invoice Value (₹88,571.43) ✓

- The system validation rule is satisfied

- Correct GST liability is computed on the RSP basis as per law

How to Report in GSTR-1, GSTR-1A, and IFF Forms

The same reporting logic applies to GST return forms. Here’s the step-by-step procedure:

Step 1: Taxable Value Field in GSTR-1

Report the net sale value (commercial consideration) in the taxable value field. In our example, report ₹60,000.00.

Step 2: Tax Amount Field in GSTR-1

Report the tax amount computed under the RSP-based formula, which is ₹28,571.43.

Important: If your accounting software or ERP system auto-calculates tax based on the reported taxable value, it may show a different figure. You must manually edit this field to reflect the correct RSP-based tax of ₹28,571.43. The advisory explicitly permits taxpayers to edit system-calculated tax amounts to report the correct tax leviable under RSP-based valuation.

Step 3: Total Invoice Value

Report the total invoice value as ₹88,571.43 (net sale value + RSP-based tax).

What About Amended Returns (GSTR-1A)?

If you file an amended return (GSTR-1A) to correct RSP-based entries, apply the same reporting methodology:

- Taxable Value = Net Sale Value

- Tax Amount = RSP-based formula result

- Total Invoice Value = Sum of the above two

The advisory clarifies that these amendments are permissible and necessary to correct system-generated entries that don’t reflect the statutory RSP-based tax liability.

Practical Step-by-Step Reporting Example for GST Professionals

Scenario: Tobacco Products Manufacturer with Mixed Pricing

Company: XYZ Tobacco Private Limited (GSTIN: 36ABCDE1234F1Z5)

Transaction Details:

- Product: Manufactured Cigarettes (HSN 2402)

- MRP/RSP per pack: ₹250

- Quantity sold: 500 packs

- Total RSP: ₹1,25,000

- Wholesale discount given: ₹20,000

- Net sale value (actual commercial consideration): ₹1,05,000

- Applicable tax: IGST @ 40%

Calculation:

Step 1: Tax Amount

Tax = (₹1,25,000 × 40) / (100 + 40) = ₹35,714.29

Step 2: Deemed Taxable Value (for verification only, don’t report)

= ₹1,25,000 − ₹35,714.29 = ₹89,285.71

Step 3: Total Invoice Value

= Net Sale Value + Tax = ₹1,05,000 + ₹35,714.29 = ₹1,40,714.29

What to Report in e-Invoice/GSTR-1:

| Field | Value |

|---|---|

| Taxable Value | ₹1,05,000.00 |

| Tax Amount (IGST) | ₹35,714.29 |

| Total Invoice Value | ₹1,40,714.29 |

| Validation Check | 1,05,000 + 35,714.29 = 1,40,714.29 ✓ |

This ensures compliance with both system validations and legal tax liability requirements.

Self-Assessment and Verification: Your Compliance Responsibility

What the Advisory Says About Taxpayer Responsibility

The GSTN advisory emphasizes that under the RSP-based reporting mechanism, taxpayers have enhanced responsibility for ensuring accuracy. Here’s what you must do:

1. Self-Assess All Three Fields

The taxable value, tax amount, and total invoice value must be self-assessed and self-calculated by the taxpayer. You cannot rely entirely on system defaults or automated calculations.

2. Verify Accuracy Before Submission

Before submitting the e-Invoice, e-Way Bill, or GSTR return, you must duly verify the accuracy of these three fields. This includes:

- Confirming the net sale value is correctly entered

- Verifying that tax is computed using the RSP formula, not the transaction value

- Ensuring the total invoice value matches the sum of the first two fields

3. Correct System-Based Computations

If your accounting software or the GST portal auto-calculates tax based on the taxable value you enter, and this calculation differs from the RSP-based formula result, you are required to manually correct the tax figure. The advisory explicitly permits this correction.

4. Maintain Proper Documentation

Keep detailed records of:

- The RSP declared on product packaging

- The actual transaction/commercial consideration

- The RSP-based tax calculation

- Any manual corrections made to system-generated figures

This documentation will be crucial if you’re selected for audit or scrutiny.

Critical Compliance Alerts and Common Mistakes to Avoid

Mistake #1: Reporting the Deemed Taxable Value Instead of Net Sale Value

Wrong Approach:

- Taxable Value Field: ₹71,428.57 (Deemed Taxable Value)

- Tax Amount: ₹28,571.43

- Result: System rejects the invoice (sum exceeds total invoice value)

Correct Approach:

- Taxable Value Field: ₹60,000.00 (Net Sale Value)

- Tax Amount: ₹28,571.43

- Result: System accepts the invoice ✓

Mistake #2: Using Transaction-Based Tax Calculation Instead of RSP Formula

Wrong Approach:

Tax = ₹60,000 × 40% = ₹24,000 (ignoring RSP)

Correct Approach:

Tax = (₹1,00,000 × 40) / (100 + 40) = ₹28,571.43 (using RSP)

The difference can be significant and will result in under-reporting of tax liability.

Mistake #3: Misclassifying Non-Notified Products

Common Error: Applying RSP-based valuation to products that are not in the notified HSN list.

Prevention: Always cross-check the product HSN against the official notification. RSP-based valuation applies only to the six specific product categories listed by CBIC.

Mistake #4: Failing to Adjust System-Calculated Tax in GSTR-1

Risk: If your ERP auto-calculates tax and you forget to edit it in GSTR-1, you’ll report incorrect tax liability.

Solution: After uploading or generating e-invoices, review each RSP-based entry in GSTR-1 and manually edit the tax field if needed.

Mistake #5: Mixing RSP and Non-RSP Products in the Same Invoice

Guideline: It’s permissible to have both RSP-based and non-RSP products in a single invoice, but each item must be calculated and reported according to its applicable valuation method. Ensure your invoicing system can handle this dual-track approach.

Detailed e-Invoice System Requirements

What You Need to Know About e-Invoice Compliance

Effective Date for 40% Threshold: From April 1, 2025, all taxpayers with an aggregate annual turnover (AATO) exceeding ₹10 crores must report their e-invoices to the Invoicing Portal within 30 days of invoice issuance.

For RSP-Based Goods:

- Generate e-invoices using the prescribed format (FORM GST INV-01)

- Ensure the taxable value field reflects net sale value, not deemed taxable value

- Calculate and enter the RSP-based tax amount

- Verify the total invoice value before submission

- Once generated, the e-invoice details auto-populate in your GSTR-1

QR Code Inclusion: The e-invoice includes a QR code with key details such as GSTIN, invoice number, date, and gross value. Ensure this is printed clearly on the physical invoice.

e-Way Bill Reporting: Step-by-Step Instructions

When Is e-Way Bill Required for RSP-Based Products?

An e-Way Bill is required whenever you move goods with a value exceeding ₹50,000 across state lines or within state (for certain categories). This includes RSP-based tobacco products.

How to Report in e-Way Bill System

Field 1: Taxable Value

Enter the net sale value (actual commercial consideration), not the deemed taxable value.

Field 2: Tax Amount

Enter the tax computed using the RSP-based formula.

Field 3: Total Value

Enter the sum of taxable value and tax amount.

No System Changes Required: Unlike some initial concerns, the e-Way Bill system has been updated to accept RSP-based reporting without errors. Your net sale value + RSP tax = total value will be validated correctly.

GSTR-1 Reporting: Detailed Instructions for Quarterly and Monthly Filers

Reporting for B2B Supplies (Table 4A)

For business-to-business supplies of RSP-based goods to other registered persons, report in Table 4A (Supplies Other Than Reverse Charge):

| GSTR-1 Column | Value to Report |

|---|---|

| Taxable Value | ₹60,000.00 (Net Sale Value) |

| IGST | ₹28,571.43 (RSP-based tax) |

| CGST (if applicable) | Applicable portion |

| SGST (if applicable) | Applicable portion |

| Invoice Value | ₹88,571.43 |

Important: If your invoice shows IGST, CGST, and SGST collectively, ensure they are correctly split across the appropriate columns.

Reporting for B2C Supplies (Table 5A)

For business-to-consumer supplies (unregistered buyers) or supplies through e-commerce operators, report in Table 5A (B2C Supplies), rate-wise:

| Detail | Instruction |

|---|---|

| Number of Invoices | Count of unique invoices for the period |

| Total Taxable Value | Sum of net sale values |

| IGST/CGST/SGST | RSP-based tax for the rate slab |

| Total Invoice Value | Sum of taxable value and tax |

Auto-Population from e-Invoices

If you’ve generated e-invoices, the system will auto-populate GSTR-1 tables with the data (including RSP-based values you’ve entered). Review these auto-populated records carefully, as the system cannot distinguish between transaction-based and RSP-based calculations. You must verify that the taxable value and tax figures are correct.

Editing Entries in GSTR-1

If you need to amend an entry or if the auto-populated data shows incorrect tax amounts:

- Click on the entry to edit

- Modify the taxable value (if needed) to show net sale value

- Crucially, modify the tax amount to show the RSP-based formula result

- Ensure the total invoice value = taxable value + tax

- Save and re-verify

The advisory explicitly states that taxpayers can and should edit system-generated entries to reflect correct RSP-based tax.

GSTR-1A (Amended Return) Instructions

When and Why You Might File GSTR-1A

You would file an amended return (GSTR-1A) if you discover errors in your original GSTR-1, such as:

- Incorrect classification (reporting as RSP-based when not applicable, or vice versa)

- Wrong net sale value reported

- Incorrect RSP-based tax calculation

How to Report in GSTR-1A

Use the same three-field reporting approach:

- Taxable Value = Net Sale Value

- Tax Amount = RSP-based formula result

- Total Invoice Value = Sum of the above

Amended returns are processed similarly to original returns, and the corrected figures will be reflected in subsequent GSTR-3B filings.

IFF (Invoice Furnishing Facility) Reporting

What Is IFF and When Is It Used?

IFF is an optional facility that allows suppliers to furnish invoices to the GST portal instead of relying on auto-population from e-invoices or manual GSTR filing. IFF applies when:

- You’re a large-volume supplier with many transactions

- You want centralized invoice management

- Your accounting system supports bulk uploads

RSP-Based Reporting in IFF

When uploading RSP-based invoices through IFF:

- Ensure your upload file includes:

- HSN code of the product (to identify RSP-notified goods)

- Taxable Value (net sale value)

- Tax Amount (RSP-based calculation)

- Total Invoice Value

- System validation: The IFF system, like e-Invoice and GSTR systems, will validate that Taxable Value + Tax ≤ Total Invoice Value. Your RSP-based entries should pass this validation with the correct reporting format.

- Data accuracy: Double-check your bulk upload file before submission to avoid rejection or manual corrections later.

Tax Liability Example: A Complete Walkthrough

Real-World Scenario: Pan Masala Distributor

Company Details:

- Business: Wholesale distributor of pan masala (HSN 2106 90 20)

- GSTIN: 27XYZABC1234D1Z9

- State: Karnataka

- IGST applicable: Yes (40% combined rate)

Transaction 1: Sold to retailer in Kerala (Interstate)

| Detail | Amount |

|---|---|

| MRP/RSP per pack | ₹50 |

| Quantity (packs) | 2,000 |

| Total RSP | ₹1,00,000 |

| Wholesale discount offered | ₹15,000 |

| Net sale value (actual consideration) | ₹85,000 |

Tax Calculation:

Tax = (₹1,00,000 × 40) / (100 + 40) = ₹28,571.43

Deemed Taxable Value = ₹1,00,000 − ₹28,571.43 = ₹71,428.57 (for verification only)

GSTR-1 Reporting (Table 4A – B2B to Registered Persons):

- Taxable Value: ₹85,000.00

- IGST @ 40%: ₹28,571.43

- Total Invoice Value: ₹1,13,571.43

Transaction 2: Sold to small retailers across Karnataka (Intra-State)

| Detail | Amount |

|---|---|

| MRP/RSP (various packs) | ₹3,20,000 (aggregate) |

| Discount | ₹35,000 |

| Net sale value | ₹2,85,000 |

Tax Calculation:

Tax = (₹3,20,000 × 40) / (100 + 40) = ₹91,428.57

GSTR-1 Reporting (Intra-State Supply):

- Taxable Value: ₹2,85,000.00

- CGST @ 20%: ₹45,714.29

- SGST @ 20%: ₹45,714.29

- Total Invoice Value: ₹3,76,428.57

Key Takeaway: Even though you offered substantial discounts (₹15,000 and ₹35,000 respectively), the GST liability is computed on the RSP basis, ensuring higher tax collection and eliminating discount-driven tax arbitrage.

Regulatory Framework: Legal Basis for RSP-Based Valuation

CBIC Notifications and Rule Amendments

Notification No. 19/2025–Central Tax (dated December 31, 2025)

- Amends Notification No. 49/2023–CT under Section 15(5) of the CGST Act, 2017

- Introduces special valuation provisions for notified tobacco and pan masala products

- Effective date: February 1, 2026

Notification No. 20/2025–Central Tax (dated December 31, 2025)

- Mirrors the central tax notification for SGST purposes

- Applicable to intra-state supplies

CGST Rules Amendment: Insertion of Rule 31D

- Rule 31D of the CGST Rules, 2017, newly inserted, provides the statutory framework for RSP-based valuation

- Specifies the formula and methodology for computing deemed taxable value and tax

GSTR-1 Amendments:

- Systems updated to accommodate net sale value reporting alongside RSP-based tax calculation

- GSTR-1, GSTR-1A, and IFF systems enhanced to prevent validation errors for RSP-based entries

Legal Basis for Reporting Guidance

The GSTN advisory (issued Jan 23rd, 2026 based on the above notifications) provides administrative clarification on how to report RSP-based transactions in systems designed for transaction-value models. While the advisory is not law, it represents the official interpretation by the tax authority and is binding for compliance purposes.

Implications for Different Stakeholder Groups

For Tobacco and Pan Masala Manufacturers

Key Impacts:

- Higher tax liability on RSP rather than discounted selling prices

- No input tax credit benefits if purchased goods were also valued on RSP basis (subject to Rule 31D amendments)

- Required system updates to ensure accurate RSP-based calculations in invoicing and GST software

- Compliance burden to self-assess and verify all three reporting fields

Action Items:

- Update ERP systems to handle RSP-based reverse calculations

- Train finance teams on the new reporting methodology

- Implement controls to prevent errors in system calculations

- Maintain detailed documentation of RSP values and discounts for audit purposes

For Importers of Notified Goods

Key Impacts:

- Tax liability is based on RSP printed on imported goods, not the import price

- Customs value vs. RSP value: You’ll need to track both for different purposes

- Invoicing compliance when supplying downstream: Must apply RSP-based valuation

Action Items:

- Identify RSP values for all imported notified goods

- Recalculate tax liabilities using RSP formula

- Adjust invoicing software to report net consideration in taxable value field

- Coordinate with logistics and customs teams on RSP documentation

For Distributors and Wholesalers

Key Impacts:

- Tax liability depends on RSP of notified goods you’re distributing

- Multi-tier supply chains: Each distributor calculates based on RSP, not the price they purchased at

- Margin compression: Since tax is based on RSP, not cost, wholesalers may see margin pressure

- Inter-state supply complexity: E-Way Bills must reflect RSP-based valuation

Action Items:

- Audit current pricing and discount structures

- Recalculate margins assuming RSP-based tax liability

- Update GST compliance calendars to ensure GSTR-1 amendments reflect RSP-based figures

- Test invoicing and billing systems with RSP-based scenarios before February 1, 2026

For GST Professionals and Consultants

Responsibility Areas:

- Client advisory: Help clients understand RSP-based valuation implications for their business

- System configuration: Ensure invoicing and GST software correctly handles RSP-based calculations

- Return filing: Prepare and review GSTR submissions with correct RSP-based reporting

- Documentation: Maintain audit trails showing RSP values, calculations, and manual corrections to system entries

- Continuing education: Stay updated on GSTN announcements regarding further clarifications or system updates

Best Practice:

Implement a checklist before filing GSTR-1 for RSP-based supplies:

- [ ] Are all RSP values correctly identified from product packaging?

- [ ] Is the net sale value (actual commercial consideration) correctly calculated?

- [ ] Is the tax amount computed using the RSP formula, not the net sale value percentage?

- [ ] Does the total invoice value equal net sale value + RSP-based tax?

- [ ] Have I verified that this product’s HSN is in the notified list?

- [ ] Have I reviewed system-calculated figures and corrected them if needed?

- [ ] Is proper documentation maintained for audit purposes?

Frequently Asked Questions (FAQs) on RSP-Based Valuation

Q1: Do I need to report the Deemed Taxable Value in any field of e-Invoice or GSTR-1?

Answer: No. The deemed taxable value (RSP minus tax) is calculated for the purpose of verifying that your tax computation is correct, but it is never reported in any field. You report only the net sale value (actual commercial consideration) in the taxable value field.

Q2: If I offer a discount of ₹20,000 on goods with RSP of ₹1,00,000, what is my tax liability?

Answer: Your tax liability is still calculated on the RSP of ₹1,00,000, not on the discounted price of ₹80,000. The discount does not reduce GST liability under RSP-based valuation. Tax = (₹1,00,000 × Rate) / (100 + Rate).

Q3: What if my billing/invoicing software automatically calculates tax based on the taxable value I enter?

Answer: You must manually edit the tax amount in GSTR-1 (or the invoice) to reflect the RSP-based calculation. The advisory explicitly permits this correction. Update your system configuration if possible to prevent the auto-calculation from overriding your manual entry.

Q4: Are there any ITC (Input Tax Credit) implications for RSP-based valuation?

Answer: Yes. Rule 31D amendments provide that dealers who purchase RSP-based notified goods (where the supplier has paid tax on RSP) can claim ITC on such purchases. However, if you’re purchasing non-notified goods, standard ITC rules apply. Consult with a tax professional for your specific situation.

Q5: What happens if I report the transaction value instead of the RSP-based tax to GST authorities?

Answer: This would constitute under-reporting of tax liability, which is a compliance violation. The GST department can demand the difference and impose penalties under Section 122 of the CGST Act. Maintain proper documentation to prove you’ve paid tax correctly on an RSP basis.

Q6: Do I need to issue separate invoices for RSP-based and non-RSP products?

Answer: No. You can issue a combined invoice with mixed products. However, ensure that each line item is calculated and reported according to its applicable valuation method. RSP-based line items should show the correct formula-based tax.

Q7: When does the RSP-based valuation regime start, and is there any grace period?

Answer: The regime is effective from February 1, 2026. There is no official grace period announced. Ensure your systems and processes are ready by this date.

Q8: Are HSN 2402 cigarettes and HSN 2403 other tobacco products taxed at the same rate under RSP-based valuation?

Answer: All notified HSN codes under RSP-based valuation are taxed at 40% (IGST) or 20% each CGST/SGST for intra-state supplies, unless there are specific exemptions. Always verify the applicable rate from the notification.

Q9: If I make a supply on credit with deferred payment, when should I compute the RSP-based tax—at the time of invoice or at the time of payment?

Answer: RSP-based tax should be computed at the time of invoice, regardless of payment terms. The tax liability is triggered upon supply, not upon receipt of consideration.

Q10: Do I need to file GSTR-1A if I made mistakes in my first GSTR-1 filing for RSP-based supplies?

Answer: Yes, you should file GSTR-1A to correct any errors in RSP-based reporting, such as incorrect net sale values or tax calculations. Amendments can be filed within the extended timeline under GST rules.

Future Outlook: What’s Next for Tobacco and Pan Masala Taxation?

Potential System Updates

The GSTN is actively monitoring e-Invoice, e-Way Bill, and GSTR system performance during the RSP-based transition. Watch for:

- Automated validation improvements to eliminate manual entry errors

- Bulk upload features for high-volume suppliers

- Real-time error flagging for RSP-based entries

Possible Notification Amendments

The government may issue further notifications to:

- Extend RSP-based valuation to other product categories (e.g., alcohol, petroleum products)

- Clarify edge cases or provide additional interpretive guidance

- Amend rules regarding ITC and downstream dealer benefits

Compliance Best Practices Going Forward

To stay ahead of compliance requirements:

- Download updated GST eBook by AUBSP

- Subscribe to GSTN notifications and advisories

- Maintain membership in professional bodies (e.g., Institute of Cost Accountants, ICAI) for timely updates

- Conduct quarterly system audits to ensure RSP-based reporting accuracy

- Budget for system upgrades and staff training

Conclusion

The transition to RSP-based valuation for tobacco and pan masala products represents one of the most significant changes to GST compliance since the tax regime’s inception. Unlike traditional GST, where tax is calculated on transaction values, RSP-based valuation breaks that mold by deriving tax liability from the retail price printed on the package.

For taxpayers in the tobacco and pan masala industries, this shift necessitates:

- Accurate understanding of the RSP formula and its application

- Careful system configuration to report net sale value in the taxable value field while computing tax on the RSP basis

- Meticulous verification before submitting e-Invoices, e-Way Bills, and GSTR returns

- Robust documentation to support your compliance stance in the event of audits

The good news is that the GSTN advisory provides clear, implementable guidance. By following the reporting methodology outlined in this guide—reporting net sale value as taxable value, computing tax using the RSP formula, and ensuring the total invoice value equals the sum of the first two—you can navigate the system validation challenges without compromising legal compliance.

As of February 1, 2026, the regime goes live. Ensure your finance teams, ERP systems, and GST compliance processes are ready. The stakes are high: incorrect reporting can trigger audits, penalties, and credit blocks. With proper planning and adherence to the guidance outlined here, you can achieve seamless compliance and avoid these pitfalls.

Final Compliance Checklist

Before submitting any e-Invoice, e-Way Bill, or GSTR return for RSP-based goods, verify:

- [ ] Product HSN is in the official list of notified goods (2106 90 20, 2401, 2402, 2403, 2404 11 00, 2404 19 00)

- [ ] RSP is correctly identified from product packaging

- [ ] Net sale value (actual commercial consideration) is accurately calculated

- [ ] Tax amount is computed using the RSP formula: (RSP × Rate) / (100 + Rate)

- [ ] Total invoice value = Net Sale Value + RSP-based Tax

- [ ] System validation passes: Taxable Value + Tax ≤ Total Invoice Value

- [ ] All system-generated figures have been reviewed and corrected if necessary

- [ ] Documentation (invoices, supporting calculations) is retained for audit purposes

- [ ] No RSP-based valuation has been mistakenly applied to non-notified products

Disclaimer: This advisory is based on the official GSTN guidance and CBIC notifications issued as of 23rd January 2026. Taxpayers are advised to consult current legal provisions and seek professional tax advice for their specific circumstances. This article is for informational and educational purposes and does not constitute legal advice.

For Official Guidance: Refer to Notifications No. 19/2025–Central Tax and 20/2025–Central Tax, issued December 31, 2025, and the official GSTN advisory on RSP-based valuation.

Leave a Reply

You must be logged in to post a comment.