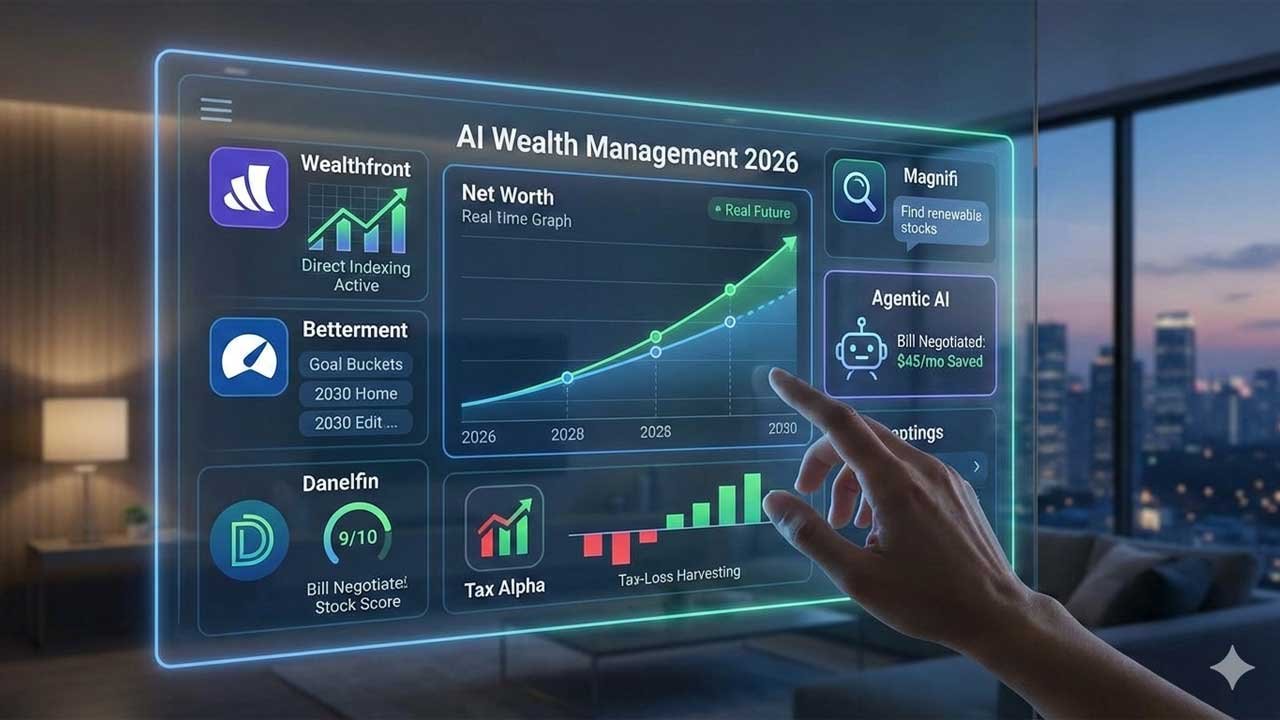

By 2026, personal finance is dominated by “Agentic AI” tools that not only suggest strategies but autonomously execute them—optimizing taxes, managing portfolios, negotiating bills, and forecasting finances in real time.

Wealthfront leads robo-advisors with direct indexing and powerful tax-loss harvesting for passive investors, while Betterment excels for beginners with goal-based automation and smart asset location. Active investors benefit from Magnifi’s natural-language financial research and Danelfin’s explainable AI stock scoring.

For financial organization, Empower offers unmatched net-worth visibility and hidden-fee detection, and Quicken Simplifi delivers forward-looking cash-flow projections. Ultimately, Wealthfront suits hands-off investors with larger portfolios, Empower is ideal for building a financial command center, and Magnifi or Danelfin support those seeking to actively beat the market.

Best AI Wealth Management Tools 2026: The Age of “Agentic” Finance

By 2026, the landscape of personal finance has shifted from simple automation to “Agentic AI”—systems that don’t just recommend actions but execute complex strategies on your behalf. The “set it and forget it” mentality has evolved; today’s best tools actively hunt for tax efficiencies, renegotiate your bills, and rebalance your portfolio in real-time using predictive analytics that were once the exclusive domain of hedge funds.

Whether you are a hands-off investor looking to grow a nest egg or a rigorous budgeter aiming to optimize every dollar, here is the definitive guide to the top AI wealth management tools for 2026.

1. The “Set It and Forget It” Titans

Best for: Passive investors, retirement planning, and tax optimization.

These platforms use sophisticated algorithms to manage your investment portfolio. In 2026, the differentiator is no longer just “low fees”—it is Tax Alpha (how much extra return the AI generates by saving you on taxes).

Wealthfront (Best Overall & Best for Tax Optimization)

Wealthfront remains the gold standard for automated investing. It stands out because of its “Self-Driving Money” vision and superior tax-loss harvesting capabilities.

- The 2026 Edge: Direct Indexing. For accounts over $100k, Wealthfront doesn’t just buy an S&P 500 ETF. It buys the individual stocks inside the index. This allows the AI to sell individual “loser” stocks (like if Apple dips while the rest of the market rises) to harvest tax losses while keeping your portfolio on track.

- Key Feature: The Path. The Path financial planner uses your real-time data to project net worth and retirement scenarios with frightening accuracy, adjusting for inflation, probable market shifts, and your savings rate.

- Fees: 0.25% management fee.

Betterment (Best for Beginners & Goal-Based Investing)

Betterment is ideal if you want automation but still crave the option of human oversight. It has refined its “Tax Coordination” feature, which acts as an asset location shield.

- The 2026 Edge: Smart Asset Location. Betterment automatically places high-tax assets (like bonds that pay interest) into your IRAs and lower-tax assets (like growth stocks) into your taxable accounts. This can increase after-tax returns by an estimated 0.48% annually without you lifting a finger.

- Key Feature: Goal Buckets. You can set up separate “buckets” (e.g., “2030 Down Payment,” “Safety Net”) with different risk profiles. The AI manages all of them simultaneously, ensuring your short-term cash isn’t exposed to high-risk stocks.

- Fees: 0.25% (Digital) or 0.40% (Premium with human advisor access).

2. The AI Co-Pilots for Active Investors

Best for: Stock pickers, researchers, and those who want to beat the market.

If you prefer to pick your own stocks, 2026 offers “Co-Pilot” tools that use Generative AI to sift through data faster than any human analyst could.

Magnifi (Best for Research & Natural Language Search)

Magnifi is the “ChatGPT of Finance.” It connects a generative AI interface to real-time financial data, allowing you to research complex ideas without spreadsheets.

- How it works: Instead of filtering for P/E ratios manually, you ask: “Show me a portfolio of renewable energy stocks that have outperformed the S&P 500 over the last 5 years with low volatility.” The AI builds the chart instantly.

- Who it’s for: The active investor who wants AI assistance to validate their thesis or find hidden gems.

Danelfin (Best AI Stock Picker)

Danelfin brings institutional-grade predictive analytics to retail traders. It uses “Explainable AI” to score stocks on a probability of beating the market.

- The 2026 Edge: The AI Score. Danelfin analyzes over 10,000 features per day (technical indicators, sentiment, fundamentals) to assign a score from 1 to 10 for thousands of stocks.

- Explainability: Unlike “black box” hedge funds, Danelfin tells you why a stock has a high score (e.g., “Strong insider buying combined with breaking bullish trend”).

3. The Financial Command Centers

Best for: Net worth tracking, budgeting, and debt management.

Empower (formerly Personal Capital) (Best for Net Worth Tracking)

Empower remains the best free tool for high-net-worth individuals to see their entire financial life in one place.

- The 2026 Edge: Fee Analyzer. The AI scans your linked 401(k) and investment accounts to uncover hidden mutual fund fees. It often reveals that you are paying 1-2% in fees you didn’t know about, which can cost you hundreds of thousands over a lifetime.

- Key Feature: The Dashboard. It aggregates bank accounts, real estate (Zillow integration), crypto, and investments into a single, real-time Net Worth figure.

Quicken Simplifi (Best for Spending Insights)

Simplifi has overtaken older competitors by offering a forward-looking view of your finances.

- The 2026 Edge: “Safe to Spend” Projections. Instead of just showing you what you did spend, it uses AI to project your balance for the rest of the month based on recurring bills and typical spending habits. It acts as a guardrail against overspending.

4. Key AI Concepts You Must Know in 2026

To choose the right tool, you need to understand the “hidden” tech powering them:

- Tax-Loss Harvesting (TLH): This is the “killer app” of robo-advisors. When an investment drops in value, the AI sells it to “harvest” the loss (which lowers your tax bill) and immediately buys a similar asset to keep you invested. In 2026, this happens daily/weekly, capturing micro-dips that humans would miss.

- Direct Indexing: As mentioned with Wealthfront, this allows you to own the ingredients of an ETF rather than the ETF itself. This unlocks massive tax-saving potential because you can write off the individual losers within a winning index.

- Agentic AI: The shift from “Chatbots” (that answer questions) to “Agents” (that do tasks). For example, Rocket Money’s AI agent can sit on hold with Comcast and negotiate your bill down without you being involved.

Summary Comparison Table

| Tool | Category | Best For | Key AI Feature | Fees (Approx.) |

|---|---|---|---|---|

| Wealthfront | Robo-Advisor | Passive Wealth | Direct Indexing (Tax Alpha) | 0.25% |

| Betterment | Robo-Advisor | Goal Setting | Tax Coordination & Buckets | 0.25% – 0.40% |

| Magnifi | AI Co-Pilot | Active Research | Natural Language Search | ~$14/mo |

| Danelfin | Stock Picker | Stock Picking | Predictive AI Scores (1-10) | Freemium / $19+ |

| Empower | Dashboard | Net Worth | Hidden Fee Analyzer | Free (Dashboard) |

| Simplifi | Budgeting | Cash Flow | “Safe to Spend” Projections | ~$4-6/mo |

Final Verdict: Which One Is For You?

- If you have >$100k to invest and want maximum returns with zero effort: Choose Wealthfront. The Direct Indexing feature alone pays for the fee.

- If you are building your “Financial Command Center”: Start with Empower. It is free and gives you the visibility you need before you start investing.

- If you want to beat the market yourself: Use Danelfin or Magnifi as your research assistant to sanity-check your trades.

Leave a Reply

You must be logged in to post a comment.