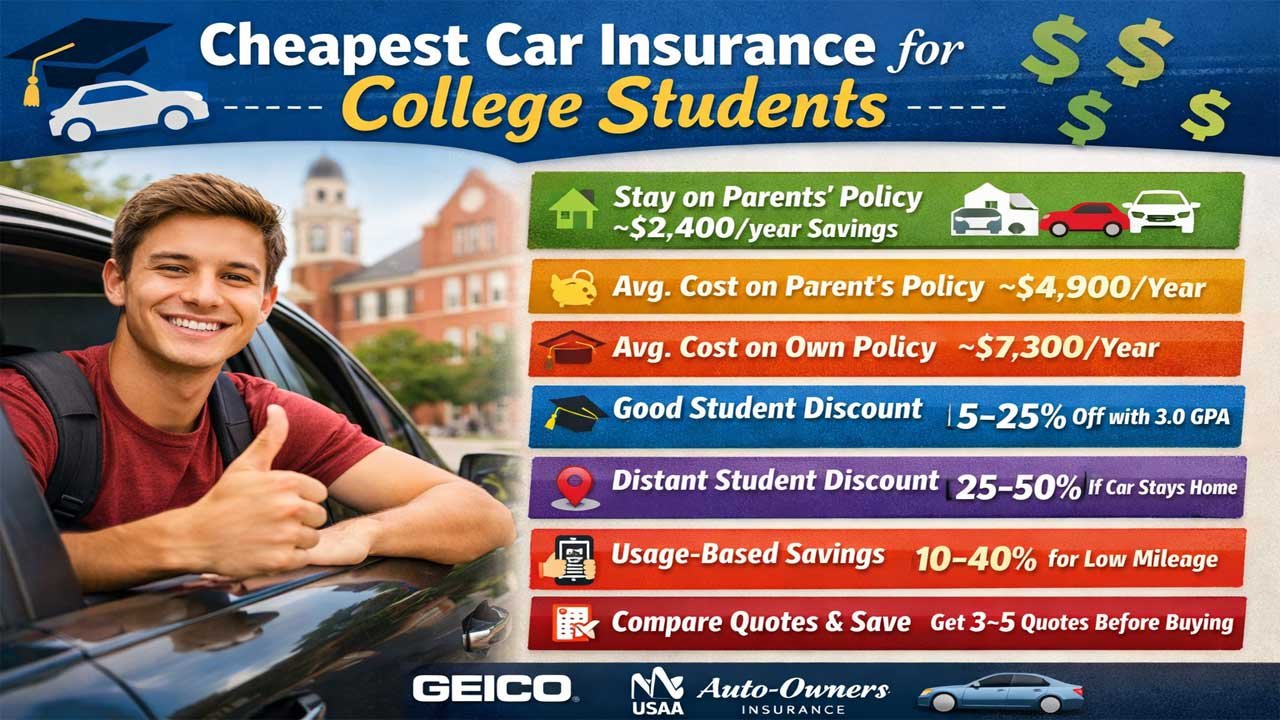

College students face high car insurance costs, but significant savings are possible by making smart choices: staying on a parent’s policy can save about $2,400 per year compared to a standalone policy, while good student, distant student, safe driver, usage-based, and membership discounts can reduce premiums by 10–50% when combined.

Among the best-value insurers for students are GEICO, Auto-Owners, State Farm, USAA (for military families), and Nationwide, with rates varying widely by provider, location, and eligibility. Choosing a used car with strong safety features, increasing deductibles, bundling policies, driving fewer miles, and consistently comparing quotes can further lower costs.

Overall, by shopping around, maximizing discounts, and maintaining a clean driving record, college students can cut their annual car insurance expenses by $1,500–$2,500 despite generally higher youth rates.

| Category | Info |

|---|---|

| Cheapest option | Staying on a parent’s policy (avg. saves ~$2,400/year) |

| Avg. cost (parent policy) | ~$4,900/year for an 18-year-old |

| Avg. cost (standalone) | ~$7,300/year for an 18-year-old |

| Best overall insurer | GEICO (strong discounts + digital tools) |

| Lowest rates (regional) | PEMCO, Auto-Owners, Countryway (availability varies) |

| Best military option | USAA |

| Good student discount | 5–25% off with ~3.0 GPA |

| Distant student discount | Up to 25–50% if car stays at home |

| Usage-based savings | 10–40% for low-mileage drivers |

| Biggest money saver | Comparing 3–5 quotes before buying |

Cheapest Car Insurance for College Students: Top Discounts & Quotes Compared [Updated 2026]

College is expensive. Between tuition, textbooks, and room and board, finding ways to save money on essentials like car insurance can make a real difference in a student’s budget. If you’re a college student who drives—whether commuting to campus, traveling home for breaks, or using your car to explore your college town—you’ve probably wondered about getting affordable car insurance.

The good news? College students have more insurance options than ever, and many can significantly reduce their premiums through smart shopping and leveraging student-specific discounts.

In this comprehensive guide, we’ll break down the cheapest car insurance options for college students, show you real pricing from top providers, explain how to maximize student discounts, and help you understand whether staying on your parent’s policy or getting your own coverage makes the most financial sense.

The Cheapest Car Insurance for College Students: Real 2026 Rates

Finding the absolute cheapest car insurance depends on your situation—specifically, whether you’re added to your parents’ policy or getting standalone coverage. Let’s look at actual premium data from November 2025.

Cheapest Rates on Parents’ Policy (Age 18-22)

| Provider | Annual Cost | Monthly Cost |

|---|---|---|

| PEMCO | $696 | $58 |

| Countryway | $1,330 | $111 |

| American National | $1,611 | $134 |

| Island | $1,735 | $145 |

| MMG | $1,792 | $149 |

| Integrity Insurance | $1,905 | $159 |

| Nodak | $1,914 | $160 |

| Mutual of Enumclaw | $2,148 | $179 |

| Central Mutual | $2,153 | $179 |

| Encova | $2,195 | $183 |

Important note: Many of these regional carriers don’t operate nationwide. If you can’t access these specialized insurers, the next tier of “cheapest” options includes GEICO ($3,996/year with good student discount), Nationwide ($3,419/year), and Auto-Owners ($3,167/year).

Cheapest Standalone Policies (Age 18, on their own policy)

If you need your own policy instead of staying on your parents’ coverage, expect to pay significantly more. The average 18-year-old on a standalone policy pays approximately $7,355 per year compared to $4,941 per year on their parents’ policy—a difference of $2,390 annually or $199 per month.

This is why insurance experts consistently recommend staying on a parent’s policy through college when possible. You’ll save an average of $2,390 per year.

Best Car Insurance Companies for College Students: Our Top 5

While the absolute cheapest isn’t always the best value, these five providers balance affordability with quality service, digital tools, and extensive student discounts.

1. GEICO — Best Overall for Tech-Savvy Students

Best for: Students who prefer app-based management and multiple discount opportunities

Why it ranks #1: GEICO offers among the lowest rates for college students on parents’ policies and provides exceptional digital tools that appeal to younger drivers. You can manage your policy entirely through your smartphone, file claims with photos, and access roadside assistance 24/7.

Rates for 18-year-olds:

- With good student discount: $3,996/year on parent’s policy

- Without discount: $5,947/year standalone

- With fraternity/sorority discount: Additional 5-15% savings

Available Discounts:

- Good student discount (15% max)

- Good driver discount (no accidents in 5 years)

- Membership discounts (fraternities, sororities, honor societies, alumni organizations)

- Defensive driving course discount

- Bundling discounts

Pros:

- Nationally available

- Highly-rated mobile app

- Multiple discount opportunities

- 24/7 digital support

Cons:

- No 24/7 phone support (online assistant only)

- Limited endorsement options

2. Auto-Owners — Best for Local Agent Preference

Best for: Students whose families prefer personalized service from local agents

Why it ranks here: Auto-Owners won the Bankrate Award for Best Auto Insurance Company for Young Drivers. The company consistently offers the lowest rates for first and second-year college students, especially through independent agents who understand student drivers’ needs.

Rates for 18-year-olds: $3,167/year on parent’s policy

Available Discounts:

- Teen Driver Monitoring discount

- Good student discount

- Bundling discounts

- Safety feature discounts

Pros:

- Lowest average rates for young drivers

- Wide network of local agents

- Personalized coverage options

- Additional expense coverage available

- Diminishing deductibles program

Cons:

- Only available in 26 states

- Below-average J.D. Power satisfaction scores for customer service

- Limited online policy management compared to GEICO

3. State Farm — Best for Overall Value and Extra Programs

Best for: Students wanting the cheapest rates combined with safety incentive programs

Why it ranks here: State Farm offers competitive rates and two dedicated programs to help young drivers save money: Steer Clear (a telematics program that rewards safe driving) and a Distant Student discount for students far from home.

Rates for 18-year-olds: $4,738/year on parent’s policy with good student discount

Available Discounts:

- Good student discount (up to 25%)

- Distant student discount

- Steer Clear safe driving program (additional 10-30% savings possible)

- Bundling discounts

Pros:

- Excellent online policy management

- Two dedicated young driver savings programs

- Distant student discount options

- Nationwide availability

- Strong financial stability ratings

Cons:

- Rates are higher than some competitors even with discounts

- Customer service not available 24/7

- Accident forgiveness must be earned, not purchased

4. USAA — Best for Military Families

Best for: College students whose parents are military members or veterans

Why it ranks here: USAA offers some of the lowest rates for college students (whether on parent’s policy or standalone) and is restricted to military families, making it highly specialized. The company provides military-focused financial services beyond insurance.

Rates for 18-year-olds:

- On parent’s policy: $3,046/year

- Standalone: $4,367/year

Available Discounts:

- Military member/veteran discounts

- Good student discount

- College student on parent’s policy discount

- Safe driver discounts

Pros:

- Below-average rates for both dependent and standalone policies

- Excellent customer satisfaction (top 5 nationally)

- Additional military family financial services

- 24/7 customer support

- No brick-and-mortar offices (all digital/phone)

Cons:

- Restricted to military community members only

- Limited to military families

- May not be an option if parents aren’t military-affiliated

5. Nationwide — Best for Usage-Based Discounts

Best for: Students who don’t drive frequently and want pay-as-you-go options

Why it ranks here: Nationwide offers competitive rates for young drivers plus unique telematics programs (SmartRide and SmartMiles) that can provide significant additional savings if you drive safely and infrequently.

Rates for 18-year-olds: $3,419/year on parent’s policy

Available Discounts:

- Good grades discount

- Safe driving discount

- SmartRide telematics program

- SmartMiles pay-per-mile insurance (available in 44 states)

- Autopay discount

Pros:

- Competitive rates for college-aged drivers

- Robust coverage options

- Multiple usage-based discount programs

- Available in most states

Cons:

- Usage-based programs depend on driving behavior

- Below-average J.D. Power satisfaction scores for claims handling

- Not available in all states

How Much Can College Students Save With Student Discounts?

Understanding student discounts is crucial to maximizing your savings. Let’s break down what these discounts actually mean for your wallet.

The Good Student Discount: Your Grades Can Save You Money

The most common student discount is the “good student” or “academic” discount. Insurance companies offer this because they believe good grades correlate with responsibility and safer driving habits. The data supports this: insurers find that students with good academic records file fewer claims.

Good Student Discount Details:

- Eligibility: Full-time student status, typically 3.0 GPA or B average, usually under age 23-25

- Discount range: 5-25% off total premium (varies by company)

- Average savings: 10-15% reduction

- Real-world impact: A 16-year-old on their parents’ policy saves an average of $546 per year, or $45.51 per month, by qualifying for this discount

Discount by Provider:

- Allstate: 20% (largest discount)

- American Family: 19%

- State Farm: up to 25%

- Nationwide: 15%

- Farmers: 15%

- Progressive: 5%

- Geico: 15%

- USAA: 5%

How to qualify and maintain the discount:

- Maintain a 3.0 GPA (or B average, or top 20% class rank)

- Provide proof of enrollment as a full-time student

- Submit report cards or transcripts annually

- Age restrictions may apply (discount typically ends at age 23-25)

Other College Student Discounts

Beyond good grades, here are additional ways college students can reduce their car insurance premiums:

Distant Student Discount (25-50% savings possible)

- Available when attending college 100+ miles from home

- Vehicle must be kept at home (not at school)

- Discount reflects reduced driving

- Available from most major carriers

- Can be combined with other discounts

Resident Student Discount

- For college students living on campus

- Indicates reduced vehicle usage

- Similar to distant student discount but for those staying at college

Safe Driver Discount

- Available to drivers with clean driving records (no accidents or violations)

- Can range from 5-15% depending on provider

- Combine with good student discount for maximum savings

Membership/Affiliation Discounts

- Fraternities and sororities

- Honor societies

- University alumni associations

- Student organizations

- GEICO actively promotes these (5-15% discounts available)

Driver Education Course Discount

- Complete approved defensive driving course (online options available)

- Typically 5-10% discount

- Can be combined with other discounts

- Some insurers require this for teen drivers

Usage-Based Insurance (Telematics Programs)

- Nationwide SmartRide and SmartMiles

- State Farm Steer Clear

- Allstate Drivewise

- Discounts based on safe driving habits and low mileage

- Potential for additional 10-30% savings

Parent’s Policy vs. Standalone Policy: The Financial Reality

One of the most important decisions facing college students is whether to stay on their parent’s insurance policy or get their own coverage. The numbers strongly favor staying on your parents’ policy.

Cost Comparison by Age

| Age | Parent’s Policy Average | Standalone Policy Average | Difference |

|---|---|---|---|

| 18 | $4,941/year | $7,355/year | +$2,414 |

| 19 | $4,304/year | $5,939/year | +$1,635 |

| 20 | $4,067/year | $5,448/year | +$1,381 |

| 21 | $3,728/year | $4,543/year | +$815 |

Key insight: The difference shrinks as you age, but 18-year-olds see nearly $2,400 in annual savings by staying on their parents’ policy.

When to Stay on Your Parents’ Policy

- ✓ You attend college within 100 miles of home

- ✓ You bring the family car or a car titled to your parents

- ✓ You don’t drive for work or commercial services

- ✓ Your parents’ insurance allows dependent coverage

- ✓ You have a clean driving record

When to Get Your Own Policy

- ✓ You own the car in your name

- ✓ You drive for Uber, Lyft, or food delivery services

- ✓ Your parents’ policy doesn’t cover dependent drivers

- ✓ You attend college more than 100 miles away and want a fresh start

- ✓ You live off-campus year-round (not home during breaks)

Beyond Discounts: 5 Ways to Lower Your College Student Car Insurance Premiums

1. Compare Quotes from Multiple Providers (Potential savings: $300-$1,000/year)

Insurance rates vary dramatically between companies, even for identical coverage. The same 18-year-old driver might get quotes ranging from $3,000 to $6,000+ annually from different insurers.

How to compare effectively:

- Get quotes from at least 3-5 providers

- Use online comparison tools (Experian, Coverage.com)

- Get quotes directly from provider websites

- Use the same coverage levels for all quotes

- Include all available student discounts

- Compare annual and semi-annual payment options

Providers with quality comparison tools:

- Experian: Compares 30+ insurers in one place

- Coverage.com: Free quotes, powered by licensed agents

- Individual provider websites: Direct quotes from GEICO, State Farm, Progressive, etc.

2. Choose a Used Car with Safety Features (Potential savings: $20-$50/month)

What you drive significantly impacts your insurance rate. Here’s what matters:

Higher insurance rates for:

- New/luxury cars (expensive to repair)

- High-performance vehicles (higher accident rates)

- Vehicles without safety features

Lower insurance rates for:

- Used cars (5-10 years old)

- Vehicles with automatic emergency braking

- Cars with forward-collision warnings

- Vehicles with anti-lock brakes and electronic stability control

- Cars rated “safe” by Insurance Institute for Highway Safety (IIHS)

Insurance Industry for Highway Safety (IIHS) publishes annual lists of safest vehicles for teens. These cars typically carry 10-25% lower insurance premiums than flashy or high-performance alternatives.

3. Increase Your Deductible (Potential savings: $15-$30/month)

A deductible is the amount you pay out-of-pocket before insurance coverage kicks in. Increasing your deductible from $500 to $1,000 typically reduces your monthly premium by 15-25%.

Trade-off analysis:

- $500 deductible: Higher monthly payment, lower out-of-pocket if accident occurs

- $1,000 deductible: Lower monthly payment, higher out-of-pocket if accident occurs

Strategy for students: If you drive cautiously and have some emergency savings, increasing your deductible can reduce your monthly payment by $15-30. However, ensure you can actually afford to pay $1,000 if an accident happens.

4. Use Pay-Per-Mile Insurance if You Don’t Drive Much (Potential savings: 20-40%)

Pay-per-mile insurance is perfect for college students who have a car on campus but don’t drive frequently. Here’s how it works:

- You pay a base rate plus a per-mile fee (typically $0.10-$0.25 per mile)

- You install a small device that tracks your mileage

- Your premium is calculated based on actual miles driven

Best for: College students who drive fewer than 10,000 miles annually

Available through:

- Nationwide SmartMiles (44 states)

- Other specialized providers

Example savings: If you normally pay $100/month but only drive 5,000 miles in a semester, you could save 50-70% during that period.

5. Bundle Your Policies (Potential savings: 10-25%)

If your parents have home or renters insurance, bundling auto and home insurance with the same provider typically saves 10-25% on total premiums.

Coverage to potentially bundle:

- Auto insurance

- Renters insurance (if living off-campus)

- Home insurance (if you’re on parents’ policy)

Example: $100/month auto insurance + $15/month renters insurance = 15% bundle discount on both policies

FAQ: College Student Car Insurance Questions Answered

Do I need to tell my insurance company I’m in college?

Yes. Let your insurance provider know immediately when you start college, even if you’re staying on your parents’ policy. You may qualify for a “student discount” that reduces your rate. Conversely, removing yourself or failing to report your student status could result in coverage gaps that cause problems (and higher rates) later.

What if I need to drive for work or food delivery?

Your standard car insurance likely won’t cover you if you drive for Uber, Lyft, DoorDash, or other commercial services. You’ll need to add:

- Rideshare insurance coverage

- Commercial car insurance

- Gig economy coverage

Speak with your insurer about options. Many offer affordable add-ons for these activities.

Can my roommate drive my car if I have car insurance?

This depends on your specific policy. Generally:

- If your roommate is listed on the policy, they’re covered

- If they’re not listed, they’re not covered (but the insurer may cover them as a “permissive user”)

- Regular sharing with the same person should be reported to your insurer

Always disclose if someone else regularly drives your car.

Does car insurance cover me in my parents’ states if they live elsewhere?

Yes, your coverage typically follows the vehicle, not the location. However, some discounts may be based on your “garaging address” (where the car is usually parked). If you attend college far from home, clarify where your car is garaged to ensure accurate rating.

What happens to my rate after I graduate?

Your rate typically decreases as you age (20s, 30s). Once you graduate and establish a stable address and job, your rate will drop significantly from your college years. The good news: college is your most expensive insurance period—it improves from there.

Can I drop collision/comprehensive insurance to save money?

Technically yes, but it’s usually a mistake. Here’s why:

- If your car has a loan/lease: Your lender requires comprehensive and collision coverage

- If your car is worth $10,000+: Dropping these coverages saves maybe $50/month but risks $10,000+ in damage

- If your car is older (worth <$3,000): You might drop these coverages, but you’d still be liable for others’ damages

Better option: Increase your deductible instead of dropping coverage entirely.

How do I prove good grades for the student discount?

Most insurers require:

- Official transcript from college

- Recent report card

- Letter from registrar’s office

- Copy of your student ID

You typically provide this once when you first qualify, then annually or when requested. Some insurers accept unofficial transcripts sent digitally.

Does my driving record affect my college student rates?

Absolutely. A driving record includes:

- Accidents (especially at-fault accidents)

- Traffic violations

- DUIs/DWIs

- Suspensions or revocations

Even one accident can increase your rate by 50-100%. This is why safe driving is literally the best discount—avoiding claims saves far more than any discount percentage.

Key Takeaways: How to Get the Cheapest Car Insurance as a College Student

- Stay on your parents’ policy if possible—you’ll save $2,400+ annually compared to a standalone policy

- Shop around—compare quotes from at least 3-5 providers; rates vary wildly

- Maximize your good student discount—maintain a 3.0+ GPA to save 10-25% annually

- Look for additional discounts—distant student, safe driver, and membership discounts stack

- Choose the right vehicle—used cars with safety features cost far less to insure

- Consider your usage—pay-per-mile insurance can save 20-40% if you drive infrequently

- Get online quotes—use free comparison tools like Experian or Coverage.com

- Report to your insurer—let them know you’re a student to ensure proper coverage and discounts

- Maintain a clean driving record—one accident increases rates by 50%+ and erases all discount savings

- Increase your deductible—moving from $500 to $1,000 reduces your monthly payment 15-25%

Final Thoughts

Car insurance is expensive for college students—there’s no way around that. But with strategic choices, smart shopping, and maximizing every available discount, you can reduce your premium significantly. For many students, the combination of staying on their parents’ policy, maintaining good grades, and getting quotes from multiple providers can reduce annual car insurance costs by $1,500-$2,500.

That’s money you can put toward tuition, textbooks, or weekend road trips—the experiences that actually make college memorable.

Leave a Reply

You must be logged in to post a comment.