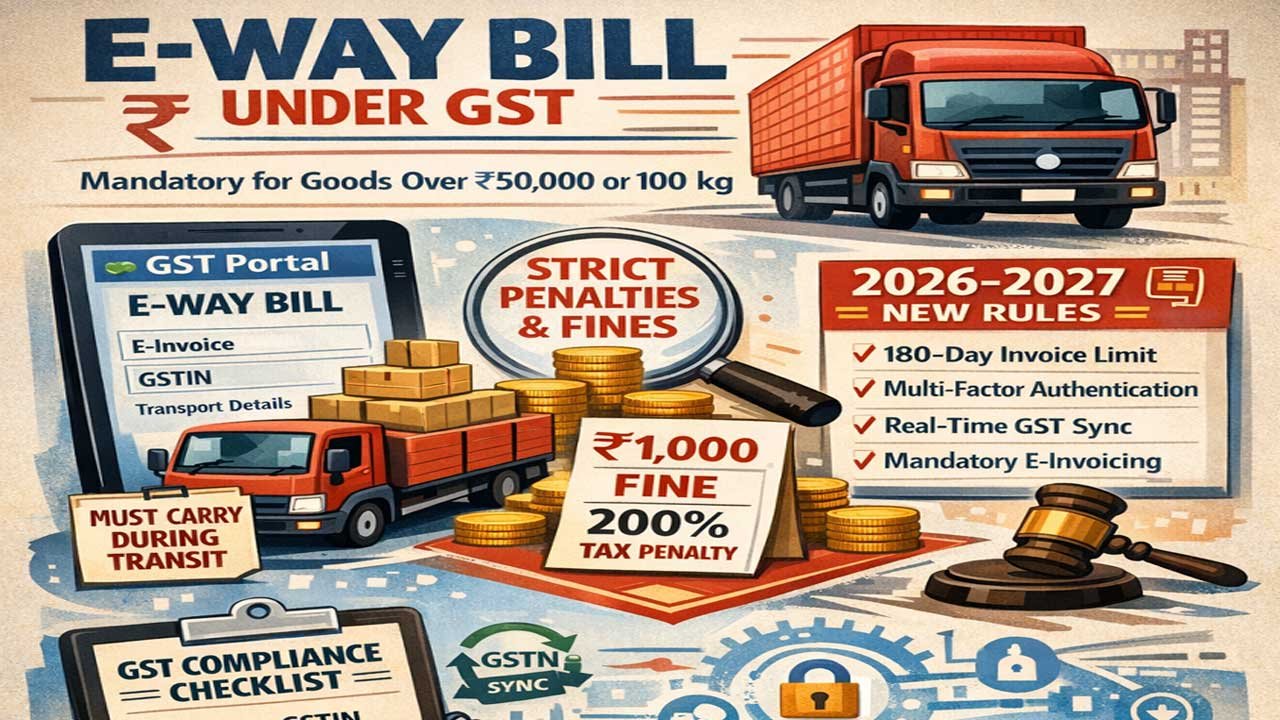

An E-Way Bill is a mandatory digital compliance document under India’s GST system that tracks the movement of goods and protects businesses from penalties, seizures, and revenue loss.

Required for most goods valued over ₹50,000 or exceeding 100 kg, it must be generated before transport via the GST portal and carried during transit, with strict penalties for missing, late, or incorrect details. The system is fast, transparent, and non-negotiable, with heightened enforcement under new 2026–27 rules such as a 180-day invoice limit, compulsory multi-factor authentication, real-time GSTN syncing, mandatory e-invoicing for eligible businesses, and tighter timelines for vehicle updates.

Common mistakes—like wrong GSTINs, delayed generation, ignoring invoice dates, or missing e-invoice IRNs—can lead to fines starting at ₹1,000 and escalating to 200% of tax due if goods are seized, making accurate data entry, timely updates, and a clear compliance checklist essential to avoid costly disruptions and stay GST-compliant in 2026.

E-Way Bill Compliance Guide 2026: Rules, Penalties & How to Generate Correctly

An E-Way Bill is mandatory. It protects your business. The GST system requires it. India tracks all goods movement. Compliance is non-negotiable.

What you’ll learn:

- How to generate an E-Way Bill correctly

- Penalties you must avoid

- New 2026-27 rules

- Common mistakes that cost money

- Compliance checklist for your business

What is an E-Way Bill?

An E-Way Bill is digital. It’s a compliance document. GST portal generates it. It tracks goods in transit. Every business needs one.

Simple definition: A digital permission slip. You generate it online. Tax authorities monitor it. It prevents tax evasion.

Why E-Way Bills Matter

Tax authorities monitor goods movement. Without an E-Way Bill, your shipment stops. Your goods get seized. Your business loses revenue. Penalties multiply daily.

The E-Way Bill system is:

- Fast (generates in seconds)

- Transparent (real-time tracking)

- Mandatory (no exceptions)

- Cost-effective (one document per shipment)

E-Way Bill Requirements: When Do You Need One?

The ₹50,000 Rule

Your goods exceed ₹50,000? You need an E-Way Bill.

Your goods weigh over 100 kg? You need an E-Way Bill.

Both conditions matter. Check both before shipping.

Types of Movement Requiring E-Way Bills

Interstate Movement: Goods crossing state borders need an E-Way Bill. This is mandatory. No exceptions exist.

Intra-state Movement: Goods moving within the same state. This also requires an E-Way Bill.

Job Work: Materials sent for processing need coverage. Generate an E-Way Bill before shipping.

Returns & Transfers: Returned goods need an E-Way Bill. Transferred inventory needs one too.

How to Generate an E-Way Bill: Step-by-Step Process

Step 1: Prepare Your Documents

You need these documents ready:

- Valid GST registration certificate

- Tax invoice or bill of supply

- Delivery challan (if applicable)

- Transporter ID or vehicle number

- Bank details on GST portal

Action: Upload documents to the GST portal. Verify all details. Match invoice numbers carefully.

Step 2: Access the E-Way Bill Portal

Login to ewaybillgst.gov.in. Your credentials: GSTIN and password. Two-factor authentication (2FA) is now mandatory from April 1, 2025.

New Rule (2025): Multi-factor authentication (MFA) is compulsory. Setup your 2FA today. Delays cause penalties.

Step 3: Enter Consignment Details

Input the following information:

- Consignor name and GSTIN

- Consignee name and GSTIN

- Item description and HSN code

- Taxable value (including tax)

- Vehicle number

- Expected date of delivery

Tip: Use exact invoice numbers. Mismatched data triggers audits.

Step 4: Review & Generate

The portal shows Part A (auto-filled from invoice). You complete Part B (transport details). Review everything twice. Generate your E-Way Bill.

Your E-Way Bill Number (EBN): 12 unique digits. Valid for a set period. Print or save digitally.

Step 5: Carry the E-Way Bill

Print the E-Way Bill. Give copies to your transporter. Keep one for your records. Tax officials check this at borders.

E-Way Bill Validity Period: How Long Is It Valid?

Your E-Way Bill expires based on distance:

| Distance (km) | Validity (Days) |

|---|---|

| Up to 100 | 1 |

| 101-200 | 2 |

| 201-500 | 3 |

| 501-1000 | 4 |

| Above 1000 | 5 |

Extension Available: You can extend validity for 360 days after initial generation.

New Rule (2025): Documents must be generated within 180 days of invoice date. Older invoices cannot generate E-Way Bills after January 1, 2025.

E-Way Bill Penalties: What You Must Avoid

Penalty for Missing E-Way Bill

You transported goods without an E-Way Bill? Penalty is ₹10,000 minimum. Or the entire tax amount you tried to evade. Whichever is higher.

Real Impact: ₹50,000 shipment without E-Way Bill = ₹10,000 penalty minimum. Goods seized. Business delayed.

Penalty for Minor Errors

Small mistakes cost ₹500 per error. Errors include:

- Wrong vehicle number (one or two digits)

- Typos in GST numbers

- Incorrect transporter ID

- Minor spelling mistakes

Under IGST Act: ₹1,000 total penalty for minor errors per consignment.

Penalty for Seizure (Owner Acknowledges Ownership)

Goods seized? Goods detained? Owner admits fault?

Penalty = 200% of tax due. For example:

- Goods value: ₹1,00,000

- GST (18%): ₹18,000

- Penalty: ₹36,000 (200% of tax)

For exempt goods: Penalty is 2% of goods value or ₹25,000. Whichever is lower.

Penalty If You Don’t Acknowledge Ownership

You refuse to claim the goods? Authorities can seize them permanently. They can auction goods. Auction proceeds pay the penalty. You lose both goods and money.

Daily Penalties for Late Updates

New in 2025: Delayed vehicle updates trigger automatic penalties. Update vehicle details within 4 hours of dispatch.

New E-Way Bill Rules 2026: Stay Updated

180-Day Document Rule (Effective January 1, 2025)

E-Way Bills can only be generated for invoices issued within the last 180 days.

Example: Today is January 18, 2026. You can only generate E-Way Bills for invoices from July 21, 2025 onwards. Older invoices are blocked.

Action: Check your invoice dates before generating. Older shipments need separate documentation.

Mandatory Multi-Factor Authentication (April 1, 2025)

2FA is now compulsory. Setup your MFA immediately. Login without 2FA will be rejected.

How to Setup:

- Go to your GST profile

- Enable 2FA in settings

- Verify with OTP

- Save backup codes

Real-Time GSTN Syncing

Your E-Way Bill data syncs with GSTN instantly. Mismatched data gets flagged. Tax officials receive notifications. Audits trigger automatically.

Implication: Data accuracy is critical. No tolerance for errors.

E-Invoicing Mandatory for E-Way Bill Generation (Part B)

E-Invoicing threshold lowered to ₹10 crore AATO (Aggregate Annual Turnover).

New Rule: Part B of E-Way Bill now requires e-invoice IRN (Invoice Reference Number). Without e-invoice, you cannot complete Part B.

ISD Registration (Multiple Branch Rule)

Businesses with multiple branches must register ISD (Integrated Services Desk). This is compulsory from April 1, 2025.

Who it affects: Multi-location businesses. Chain stores. Franchise operations.

Common E-Way Bill Mistakes That Trigger Penalties

Mistake #1: Generating E-Way Bill After Goods Move

The Error: Transporting goods first. Generating E-Way Bill later.

The Penalty: ₹10,000 or tax evasion amount.

Prevention: Generate BEFORE shipping. Always.

Mistake #2: Wrong GST Numbers

The Error: Typo in consignor or consignee GSTIN.

The Penalty: ₹500 per error. Data mismatch triggers audits.

Prevention: Copy-paste GSTIN from official documents. Verify twice.

Mistake #3: Incomplete Vehicle Details

The Error: Missing transporter ID. Wrong vehicle number. Incomplete registration.

The Penalty: ₹500-1000. Goods detained at checkpoints.

Prevention: Update vehicle details immediately. Within 4 hours mandatory.

Mistake #4: Ignoring Invoice Dates

The Error: Generating E-Way Bill for 180+ day old invoices.

The Penalty: E-Way Bill rejected. Goods seized. New penalties apply.

Prevention: Check 180-day rule. Generate timely.

Mistake #5: Not Using E-Invoice IRN

The Error: Completing Part B without e-invoice IRN.

The Penalty: E-Way Bill marked invalid. Goods cannot move.

Prevention: Generate e-invoice first. Then create E-Way Bill.

E-Way Bill Compliance Checklist

Use this checklist before every shipment:

Before Generating:

- [ ] Invoice date within 180 days? YES

- [ ] Goods value exceeds ₹50,000? YES or Weight >100kg?

- [ ] GSTIN numbers verified? Match official documents

- [ ] HSN codes correct? Cross-check tax rates

- [ ] Vehicle number ready? Transporter ID confirmed

- [ ] E-Invoice IRN generated? For Part A auto-fill

During Generation:

- [ ] Part A data auto-filled correctly? Review carefully

- [ ] Part B details entered accurately? No typos

- [ ] Distance and validity calculated? Match route

- [ ] All mandatory fields filled? Mark as complete

- [ ] Preview reviewed? No errors visible

After Generation:

- [ ] E-Way Bill Number (EBN) saved? Screenshot taken

- [ ] Document printed or saved digitally? Both copies ready

- [ ] Transporter received copy? Confirmed receipt

- [ ] Records filed properly? Organized by date

- [ ] Extension option noted? If longer journey needed

FAQs on E-Way Bill Compliance

Q1: Can I Generate E-Way Bill Without GST Registration?

A: No. You need active GST registration. Unregistered persons cannot generate E-Way Bills. They can only receive goods from registered suppliers.

Q2: What Happens If I Miss the E-Way Bill Deadline?

A: Goods get detained. Tax officials seize your shipment. Penalties apply immediately. Goods release takes days. Better to generate before moving.

Q3: Can E-Way Bills Be Cancelled?

A: Yes. Cancel BEFORE goods move. Once goods are in transit, cancellation is restricted. Cancellation does not avoid penalties if already transported.

Q4: How Do I Extend E-Way Bill Validity?

A: After initial generation, you can extend validity for 360 more days. Extension done on the portal. Cost varies by state.

Q5: Is E-Way Bill Required for Intra-state Movement?

A: Yes. Goods exceed ₹50,000? Moving within same state? E-Way Bill is mandatory.

Q6: What’s the New 180-Day Rule Impact?

A: You can only generate E-Way Bills for invoices from the last 180 days. Older invoices are blocked. Plan inventory movements accordingly.

Q7: When Does MFA Become Compulsory?

A: April 1, 2025. All users must enable multi-factor authentication. Login without 2FA will fail. Setup now.

Q8: Can Transporters Generate E-Way Bills?

A: Yes, if authorized by the supplier. GST law allows suppliers or transporters to generate. Ensure proper authorization documentation.

Q9: What If Vehicle Number Changes During Transit?

A: Update details within 4 hours. Delay triggers automatic penalties. Do not change vehicle numbers mid-journey without authorization.

Q10: How Much Do E-Way Bill Penalties Cost Overall?

A: Minor errors: ₹1,000. Seized goods: 200% tax + penalty. Total exposure: ₹10,000 to ₹50,000+. Compliance saves money.

How to Stay Compliant in 2026

Action #1: Setup 2FA Now

Enable multi-factor authentication immediately. April 1, 2025 deadline approaching. Setup takes 5 minutes.

Steps:

- Login to GST portal

- Go to Settings → Security

- Enable 2FA

- Verify with OTP

- Save backup codes

Action #2: Audit Your Process

Review current E-Way Bill process. Check for delays. Identify bottlenecks.

Questions to answer:

- How long does your team take to generate E-Way Bills?

- Are invoice dates tracked?

- Are vehicle details updated on time?

- Who approves shipments?

Action #3: Train Your Team

Staff must understand penalties. They must know the 180-day rule. They must update vehicle details promptly.

Training topics:

- When E-Way Bills are required

- How to generate correctly

- New 2025-2026 rules

- Penalty consequences

- Emergency procedures

Action #4: Use Portal Notifications

Enable email alerts on the GST portal. Receive warnings before deadlines. Get flagged issues early.

Action #5: Maintain Proper Records

Keep all E-Way Bill documents. Store digitally and physically. Organize by date and shipment.

What to store:

- E-Way Bill numbers

- Invoice copies

- Vehicle details

- Destination proof

- Tax payment receipts

Conclusion

E-Way Bill compliance is mandatory. Penalties are severe. Non-compliance costs ₹10,000 minimum. Seized goods cost more.

Your action plan:

- Generate E-Way Bills BEFORE moving goods

- Verify all data twice

- Update vehicle details within 4 hours

- Follow the 180-day document rule

- Enable 2FA by April 1, 2025

Stay compliant. Avoid penalties. Protect your business.

Start today. Generate your first E-Way Bill correctly. Make it a routine. Your tax authority compliance depends on it.

About E-Way Bill Compliance

This guide covers GST E-Way Bill rules effective January 2026. Rules may change. Check the official GST portal regularly. Consult a tax professional for complex situations.

Official sources:

- ewaybillgst.gov.in (Government portal)

- CGST Rules, Rule 138

- GST Council announcements

Leave a Reply

You must be logged in to post a comment.