In the complex landscape of Goods and Services Tax (GST), businesses often encounter situations where tax implications are unclear. Should you claim input tax credit on a specific purchase? How should your service be classified for GST purposes? Does your business activity require GST registration? These are precisely the scenarios where Form GST ARA-01—the Application for Advance Ruling—becomes invaluable.

An advance ruling is a formal, binding opinion issued by the Authority for Advance Ruling (AAR), providing certainty on GST matters before you conduct the transaction. This guide walks you through everything you need to know about Form GST ARA-01, from eligibility to filing procedures, helping you make informed tax decisions with confidence.

What is Form GST ARA-01?

Form GST ARA-01 is the official application form prescribed under Rule 104(1) of the CGST Rules, 2017, used to seek advance ruling from the Authority for Advance Ruling. Think of it as a formal request for pre-transaction tax clarity—you ask a specific question about a GST matter, and the AAR provides a legally binding answer before you proceed.

Unlike a general tax consultation or advice from a CA, an advance ruling carries statutory weight. The ruling issued by the AAR is binding on both the applicant and the jurisdictional tax officer, making it powerful protection against future disputes or reassessment.

Who Can File Form GST ARA-01?

The eligibility criteria for advance ruling is inclusive and flexible:

- Registered GST taxpayers: Any business already registered under GST can apply

- Prospective taxpayers: Individuals and businesses in the process of obtaining GST registration

- All business structures: Proprietors, partnerships, companies, NGOs, NRIs, and other legal entities

- Both registered and unregistered persons: If seeking registration, you can still apply

The key requirement is that your question must relate to a GST matter within the AAR’s jurisdiction.

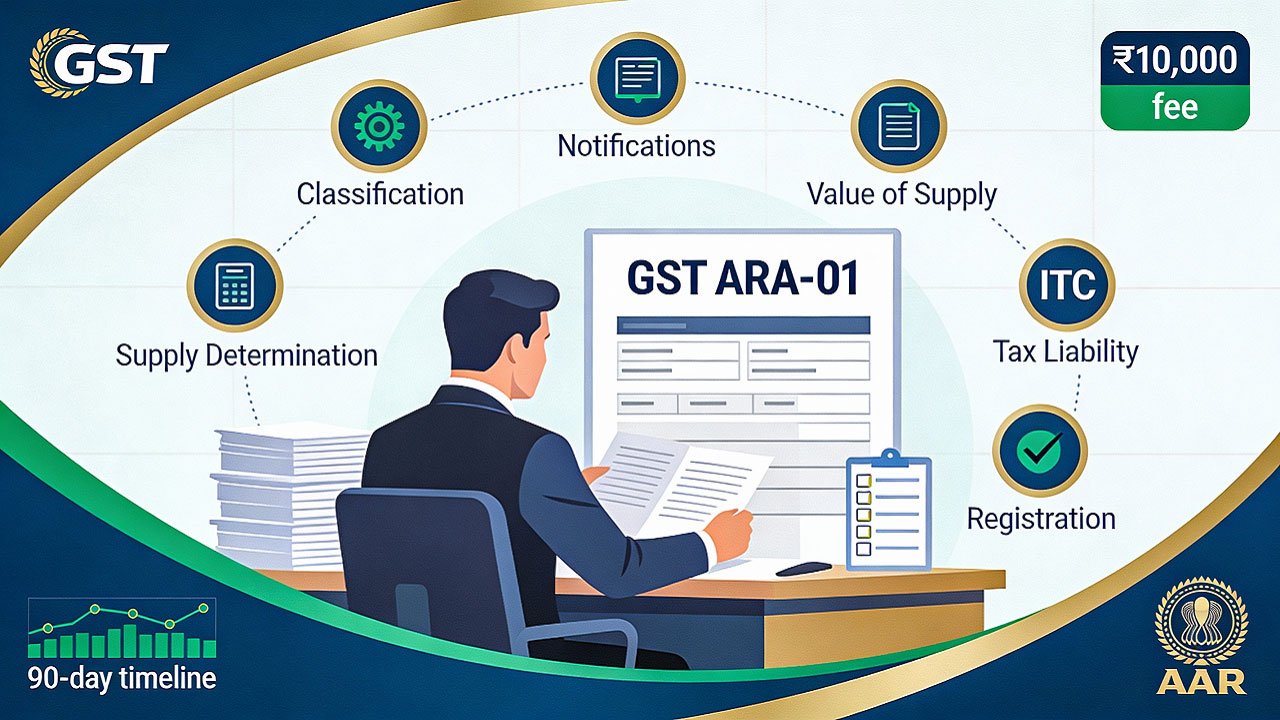

The Seven Key Issues Covered by Advance Ruling

Section 97(2) of the CGST Act specifies seven distinct issues on which you can seek an advance ruling:

1. Classification of Goods or Services

The correct HSN/SAC code for your products determines your tax rate. An advance ruling provides certainty here—essential if you manufacture innovative products with ambiguous classification.

2. Applicability of Notifications

GST notifications frequently provide exemptions or concessional rates. If you’re unsure whether a specific notification applies to your business activity, seek ruling.

3. Time and Value of Supply

For complex contracts involving performance milestones, bundled services, or advance payments, determining when supply occurs and its value can be complicated. An advance ruling clarifies these calculations.

4. Admissibility of Input Tax Credit (ITC)

This is one of the most frequently sought rulings. Questions like “Can we claim ITC on employee transportation?” or “Is ITC available on goods damaged in transit?” can be definitively answered.

5. Tax Liability Determination

When you’re uncertain about the tax rate applicable to your business or whether you’re even liable to pay tax, an advance ruling settles the matter.

6. Registration Requirement

Determining GST registration necessity—especially for mixed supplies, threshold exemptions, or special categories (EFSV, OIDAR)—is made clear through advance ruling.

7. Whether an Activity Amounts to Supply

Some activities straddle the line between supply and non-supply. For example, is a free product given with purchase a separate supply? An advance ruling provides clarity.

Step-by-Step Filing Procedure

Step 1: Prepare Your Documentation

Before filing, gather all materials:

- Details of the transaction or activity in question

- Copies of relevant contracts, agreements, or invoices

- Any correspondence with GST authorities

- Supporting documents (maximum 4 can be uploaded online; additional documents can be provided during hearing)

Pro Tip: Prepare a clear, concise write-up explaining the facts, your understanding of the law, and why you need the ruling. This preparation ensures your question is precise when filling the form.

Step 2: Access the GST Portal and Create Temporary User ID

For unregistered persons:

- Visit www.gst.gov.in

- Click on “New Registration”

- Enter basic details and generate a Temporary User ID via OTP verification on mobile and email

- Receive credentials via email

For registered taxpayers:

- Simply log in with your existing GST credentials

Step 3: Pay the Application Fee

The filing fee is ₹5,000 under CGST Act + ₹5,000 under SGST Act = ₹10,000 total per question. This fee is non-refundable.

Payment methods available on the GST portal:

- E-payment (net banking, debit/credit card)

- Over-the-counter at designated banks

- NEFT/RTGS via mandate form

Important: Generate a Challan (GST CMP-08) and note the Challan Identification Number (CIN)—you’ll need this when filing the form.

Step 4: Fill Form GST ARA-01

The form consists of 18 key sections:

| Section | Details Required |

|---|---|

| 1-3 | GSTIN/User ID, Legal Name, Trade Name |

| 4 | Applicant Status (Registered/Unregistered) |

| 5-6 | Registered Address & Correspondence Address |

| 7-9 | Contact Details (Mobile, Telephone, Email) |

| 10 | Jurisdictional Authority Details |

| 11 | Authorized Representative (Optional) |

| 12 | Nature of Activity (Category & Brief Description) |

| 13 | Issues for which ruling is sought (Tick applicable) |

| 14 | Specific Questions on Advance Ruling |

| 15-16 | Factual Background & Your Legal Interpretation |

| 17 | Declaration (Question not already pending/decided) |

| 18 | Payment Details (CIN from challan) |

Critical Fields to Complete Accurately:

- Question Section (Field 14): Frame your question clearly and specifically. Vague questions lead to rejection. Instead of “What is our tax liability?”, write “What is the applicable GST rate on specialized medical diagnostic services provided to corporate hospitals?”

- Factual Statement (Field 15): Provide all material facts affecting the question, including transaction details, parties involved, and financial implications.

- Legal Interpretation (Field 16): State your understanding of applicable law and why you believe your interpretation is correct.

Step 5: Upload Supporting Documents

- Download the Advance Ruling Template from the portal

- Fill it with detailed information

- Convert to PDF format (maximum 5 MB per file)

- Upload maximum 4 supporting documents online

- Note: Additional documents can be submitted in hard copy during the hearing

Step 6: Digital Signature and Submission

For companies and LLPs: Digital Signature Certificate (DSC) is mandatory.

For individuals and proprietorships: E-signature or EVC can be used.

Once verified, the fee is auto-debited from your cash ledger, and an Application Reference Number (ARN) is generated.

Critical Conditions and Limitations

Your application will NOT be admitted if:

- The same question has already been decided in your earlier case

- The same question is currently pending in any GST proceedings against you

- The question involves matters already pending in litigation

Your application MAY be rejected if:

- The question is not related to GST matters

- Supporting documents are incomplete or unclear

- The applicant lacks standing (not a taxpayer or prospective taxpayer)

The Authority will provide reasons in writing before rejecting any application.

Timeline and Process After Filing

Once your Form GST ARA-01 is filed, here’s what happens:

| Stage | Timeline | What Happens |

|---|---|---|

| Application Review | Within 30 days | AAR examines completeness and may request additional details |

| Notice to Jurisdiction Officer | Parallel to review | The jurisdiction officer may submit records and views |

| Personal Hearing | Scheduled by AAR | You can present arguments and clarify facts |

| Ruling Issuance | Within 90 days of complete application | AAR issues binding written order |

| Appeal (if dissatisfied) | Within 30 days of order | File Form GST ARA-02 before Appellate Authority (AAAR) |

| Appeal Decision | Within 90 days | AAAR issues final decision |

Key Point: The 90-day timeline starts from the date of complete application. If documents are incomplete, this clock pauses.

Benefits and Legal Value of Advance Ruling

Risk Mitigation

An advance ruling provides absolute certainty on your tax position. If you follow it, you’re protected from reassessment on that specific issue, even if the AAR’s interpretation differs from the tax department’s usual practice.

Operational Planning

Especially valuable for new business ventures, new product launches, or significant structural changes—you can plan confidently knowing your tax liability in advance.

Dispute Resolution

If auditors or tax officers challenge your interpretation later, your advance ruling becomes strong evidence in your favor, reducing audit time and litigation risk.

Evidence in Court

Advance rulings are admissible as evidence in judicial proceedings and carry significant persuasive value.

Common Mistakes to Avoid

1. Framing Vague Questions

❌ “What is our tax rate?”

✅ “What is the applicable GST rate on annual maintenance contracts (AMC) for IT software systems provided to manufacturing companies?”

2. Incomplete Factual Background

Provide dates, transaction values, party details, and any correspondence with tax authorities. Vague narratives invite rejection.

3. Filing When Matter is Already Pending

Verify through GST portal and with your tax advisor that no notice, appeal, or assessment proceeding is underway on the same issue.

4. Uploading Blurry or Incomplete Documents

Ensure all supporting documents are clear, complete, properly formatted (PDF), and under 5 MB each.

5. Missing Digital Signature (for Companies)

This is a mandatory requirement that causes application rejection if overlooked.

6. Underestimating Document Quality

Supporting documents should substantiate every factual claim. Contracts, invoices, agreements, and correspondence strengthen your case.

Real-World Examples

Example 1: Classification Question

A manufacturer of smart fitness bands was unsure whether they qualified as wearable technology (5% GST) or electronic devices (18% GST). Filing Form ARA-01 clarified the classification, allowing them to determine their pricing strategy with certainty.

Example 2: ITC Eligibility

A transportation company sought ruling on whether they could claim ITC on vehicle repair and maintenance expenses. The advance ruling provided clarity on what portion of expenses qualified, improving their cash flow planning.

Example 3: Registration Threshold

A digital marketing agency with services provided from overseas sought clarification on whether OIDAR (Online Information Database Access or Retrieval) services applied to them, determining if GST registration was necessary.

Cost-Benefit Analysis

| Aspect | Cost | Benefit |

|---|---|---|

| Filing Fee | ₹10,000 | Binding legal opinion |

| Preparation Time | 10-20 hours | Years of regulatory certainty |

| Professional Fees | ₹15,000-50,000 (CA support) | Dispute prevention worth lakhs |

| Processing Time | 90 days average | Peace of mind & compliance |

For businesses facing significant tax uncertainty—especially those with transaction values exceeding ₹10 lakhs—the advance ruling investment is easily justified.

Validity and Modification of Advance Ruling

An advance ruling remains valid unless:

- There’s a change in law—if tax rates or provisions are amended

- There’s a change in facts—if your business structure or transaction pattern changes substantially

- The ruling is modified on appeal—if either party appeals successfully

- It’s voided—if obtained through fraud, misrepresentation, or suppression of material facts

Alternative Options: When NOT to File ARA-01

You don’t need advance ruling if:

- Your question is clearly covered by existing GST notifications or clarifications from GST Council

- You have a current CA opinion that adequately addresses your concern

- The matter is routine and well-established (like basic goods classification)

However, if there’s genuine ambiguity or high financial stakes, advance ruling provides irreplaceable certainty.

Frequently Asked Questions

Q: Can both applicant and tax officer appeal if dissatisfied?

Yes. Either party can file Form ARA-02 to appeal before the Appellate Authority within 30 days.

Q: Is advance ruling applicable to all states?

Yes. The ruling issued by the AAR of your jurisdiction applies to the Central and State tax authorities in that state.

Q: Can I withdraw my application after filing?

Technically yes, but it’s generally not advisable unless circumstances change dramatically. Consult your tax advisor.

Q: How many questions can I ask in one application?

Each question requires a separate application and separate fee of ₹10,000.

Conclusion

Form GST ARA-01 is a powerful tool for businesses seeking certainty in complex GST matters. Whether you’re a registered taxpayer facing a specific tax uncertainty or a prospective business evaluating your tax position before entering a market, advance ruling provides binding clarity that protects your interests.

The process is transparent, time-bound, and accessible. With careful preparation—precise question framing, comprehensive factual documentation, and professional support if needed—you can obtain a ruling within 90 days that provides years of regulatory peace of mind.

In the evolving GST landscape, investing in advance ruling for material tax questions isn’t an expense—it’s strategic tax risk management.

Leave a Reply

You must be logged in to post a comment.