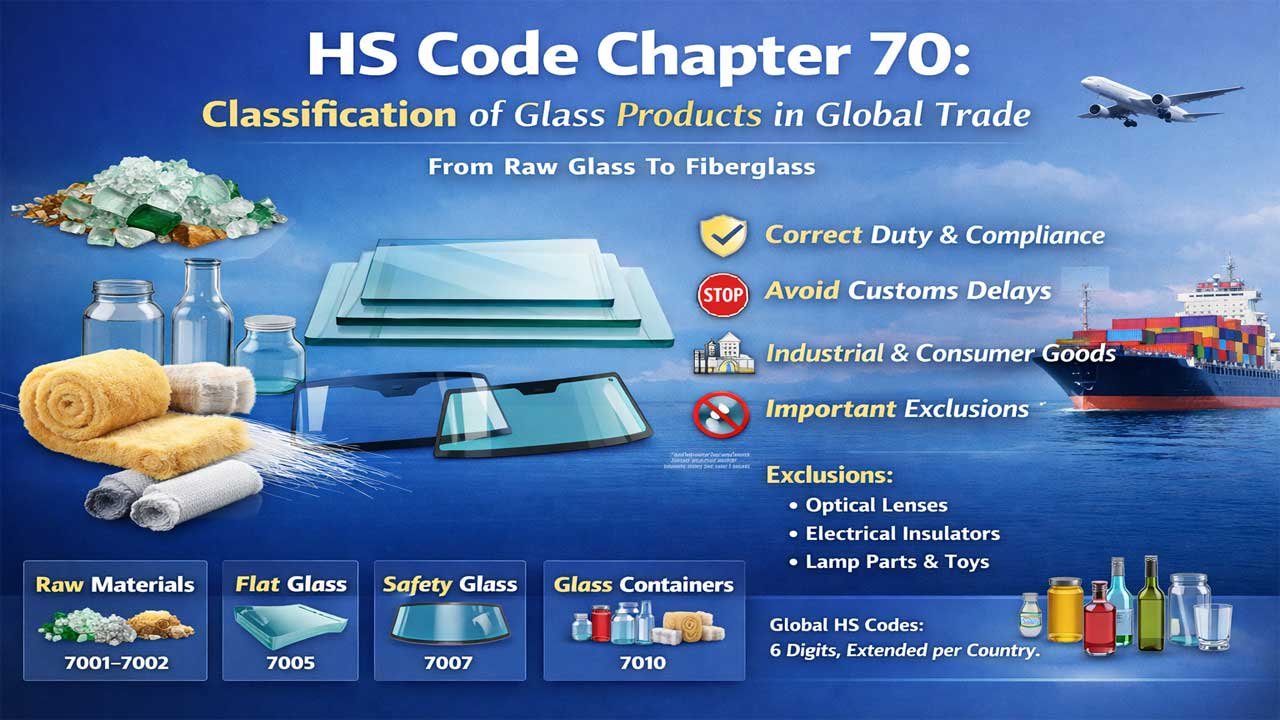

HS Code Chapter 70 is the global standard for classifying glass products in international trade. It covers the entire lifecycle of glass, from raw cullet to high-tech fiberglass.

Accurate classification is critical. It ensures you pay the correct customs duty, avoid border delays, and comply with export regulations.

This guide provides a detailed breakdown of the Harmonized System (HS) codes for glass to help you streamline your shipping documents.

How Chapter 70 is Structured

The chapter is organized by the complexity of the product. It moves from raw materials to finished consumer goods.

- Raw Materials (7001–7002): Waste glass and basic shapes (balls, rods).

- Basic Sheets (7003–7005): Flat glass used in construction before processing.

- Processed Glass (7006–7009): Glass that has been bent, drilled, or silvered (mirrors).

- Finished Products (7010–7020): Bottles, drinking glasses, lab equipment, and fiberglass.

Deep Dive: High-Volume HS Codes

Float Glass and Surface Ground Glass (HS 7005)

This is the standard glass used in modern windows and architecture. It is a high-traffic keyword for the construction industry.

- 7005.10: Non-wired glass, having an absorbent, reflecting, or non-reflecting layer.

- 7005.21: Other non-wired glass, colored throughout the mass (body tinted), opacified, flashed, or merely surface ground.

- 7005.29: Other non-wired glass (clear float glass).

- 7005.30: Wired glass.

Safety Glass (HS 7007)

Safety glass is mandatory for the automotive and aerospace sectors.

- Difference:

- Toughened (Tempered) Glass: Crumbles into small chunks when broken. Used in side windows.

- Laminated Glass: Stays together when shattered. Used in windshields.

- 7007.11: Toughened safety glass for vehicles, aircraft, or spacecraft.

- 7007.21: Laminated safety glass for vehicles.

Glass Containers and Packaging (HS 7010)

This section is vital for FMCG, food and beverage, and pharmaceutical importers.

- 7010.10: Ampoules (used for injections/medicine).

- 7010.20: Stoppers, lids, and closures of glass.

- 7010.90: Carboys, bottles, flasks, jars, pots, and phials.

Glass Fibers and Glass Wool (HS 7019)

Fiberglass is a high-value commodity used for insulation and reinforcement.

- 7019.11: Chopped strands (cut lengths).

- 7019.12: Rovings.

- 7019.71: Veils (thin mats).

- 7019.80: Glass wool and articles of glass wool (insulation mats).

Important Exclusions (What is NOT in Chapter 70)

Avoiding misclassification is just as important as finding the right code. Do not use Chapter 70 for the following items. These belong to other chapters:

- Optical Elements (Chapter 90): Lenses, prisms, and mirrors for optical instruments (cameras, telescopes) belong to Heading 9001 or 9002.

- Glass Insulators (Chapter 85): Electrical insulators made of glass fall under Heading 8546.

- Lamps and Lighting (Chapter 94): Glass parts specifically for lamps or light fittings often fall under Heading 9405.

- Toys and Games (Chapter 95): Glass marbles used as toys belong to Chapter 95.

- Buttons (Chapter 96): Glass buttons used for clothing fall under Heading 9606.

Global HS Code Variations

The first 6 digits of the HS Code are standard worldwide (WCO standard). However, the digits that follow vary by country to determine specific duty rates.

- United States (HTS): Uses a 10-digit code.

- Example: 7007.11.00.00

- European Union (CN): Uses an 8-digit code.

- Example: 7007.11.10

- India (ITC-HS): Uses an 8-digit code.

- Example: 7007.11.00

Tip: Always verify the full code with the specific country’s customs tariff schedule.

Checklist for Customs Clearance

To ensure smooth customs clearance for glass products, ensure your invoice describes the goods clearly:

- Type of Glass: Is it Borosilicate, Fused Quartz, or Soda-lime?

- Process: Is it Toughened, Laminated, or just Float?

- End Use: Is it for a car, a building, or a kitchen table?

- Dimensions: Thickness and size (especially for flat glass).

- Color/Opacity: Is it clear, tinted, or reflective?

FAQs

What is HS Code Chapter 70?

HS Code Chapter 70 is the international classification system used to categorize all types of glass and glass products in global trade, from raw glass materials to finished and high-tech glass goods.

Why is accurate classification under Chapter 70 important?

Accurate classification ensures the correct customs duty is paid, helps avoid shipment delays at borders, and ensures compliance with international trade and export regulations.

How is Chapter 70 structured?

The chapter is organized by product complexity, starting with raw glass waste and basic shapes, then flat sheets, processed glass, and finally finished consumer and industrial glass products.

Which HS codes cover raw glass materials?

Raw glass materials, such as waste glass and basic shapes like rods or balls, are classified under HS codes 7001 and 7002.

What types of glass fall under HS 7005?

HS 7005 covers float glass and surface-ground glass, including clear, tinted, reflective, and wired flat glass used primarily in construction and architecture.

What is the difference between HS 7005.10 and 7005.29?

HS 7005.10 refers to non-wired glass with layers for reflection or absorption, while 7005.29 refers to other types of clear non-wired float glass.

What does HS Code 7007 classify?

HS 7007 classifies safety glass, including toughened (tempered) and laminated glass, which is widely used in vehicles, aircraft, and buildings.

What is toughened safety glass used for?

Toughened safety glass is designed to shatter into small, less harmful pieces and is commonly used for vehicle side windows and doors.

What is laminated safety glass used for?

Laminated safety glass holds together when broken and is typically used for windshields and other protective glazing applications.

Which code applies to glass bottles and jars?

Glass bottles, flasks, jars, and similar containers are classified under HS 7010.90.

What is classified under HS 7010.10?

HS 7010.10 covers glass ampoules, which are primarily used for pharmaceutical and medical purposes.

Which HS code is used for glass stoppers and lids?

Glass stoppers, lids, and closures fall under HS 7010.20.

What does HS Code 7019 cover?

HS 7019 covers glass fibers and glass wool, including chopped strands, rovings, veils, and insulation materials made of fiberglass.

What is glass wool used for?

Glass wool is used mainly for insulation in buildings and industrial applications due to its thermal and acoustic properties.

Are optical glass elements included in Chapter 70?

No, optical elements like lenses and prisms are classified under Chapter 90, not Chapter 70.

Where are glass electrical insulators classified?

Glass insulators are classified under HS Heading 8546 in Chapter 85.

Are glass marbles included in Chapter 70?

No, glass marbles used as toys are classified under Chapter 95.

Are glass parts for lamps covered by Chapter 70?

No, glass parts specifically for lamps and lighting fittings are classified under Chapter 94.

Do all countries use the same HS codes for glass?

The first six digits are standardized worldwide, but countries may extend the code to 8 or 10 digits for more detailed tariff classifications.

How many digits does the United States use in its HS code?

The United States uses a 10-digit HTS code for glass products.

How many digits does the European Union use?

The European Union uses an 8-digit CN code for customs classification.

How many digits does India use for HS classification?

India uses an 8-digit ITC-HS code for classifying glass products.

What details should be on an invoice for glass products?

An invoice should clearly mention the glass type, processing method, end use, thickness, dimensions, and whether it is tinted, reflective, or clear.

What are the most traded glass HS codes?

The most common codes are 7005 for float glass, 7007 for safety glass, 7010 for containers, and 7019 for fiberglass.

Can fiberglass products be classified under Chapter 70?

Yes, fiberglass and glass fiber products are classified under HS 7019 in Chapter 70.

What is the purpose of the Harmonized System?

The Harmonized System provides a universal method for classifying traded goods so customs authorities worldwide can apply tariffs consistently.

Does Chapter 70 include both industrial and consumer glass?

Yes, it covers a wide range of glass products used in construction, automotive, packaging, household goods, and industrial manufacturing.

How can misclassification affect shipments?

Misclassification can lead to incorrect duty payments, customs penalties, shipment holds, or rejected imports and exports.

What is float glass?

Float glass is a flat, smooth glass sheet produced by floating molten glass on molten metal, widely used for windows and building facades.

What is wired glass?

Wired glass is reinforced with a wire mesh to improve fire resistance and safety, classified under HS 7005.30.

Are laboratory glass items included in Chapter 70?

Yes, laboratory glassware is covered under the finished goods section, typically within HS 7017 or related headings.

What is cullet in glass manufacturing?

Cullet refers to waste or recycled glass used as a raw material for producing new glass products.

Does Chapter 70 apply to all types of glass?

Yes, including soda-lime, borosilicate, fused quartz, and specialized industrial glass, unless excluded by specific headings.

Where should you verify HS codes for your shipment?

You should always check the official customs tariff schedule of the destination country for the full and updated HS code.