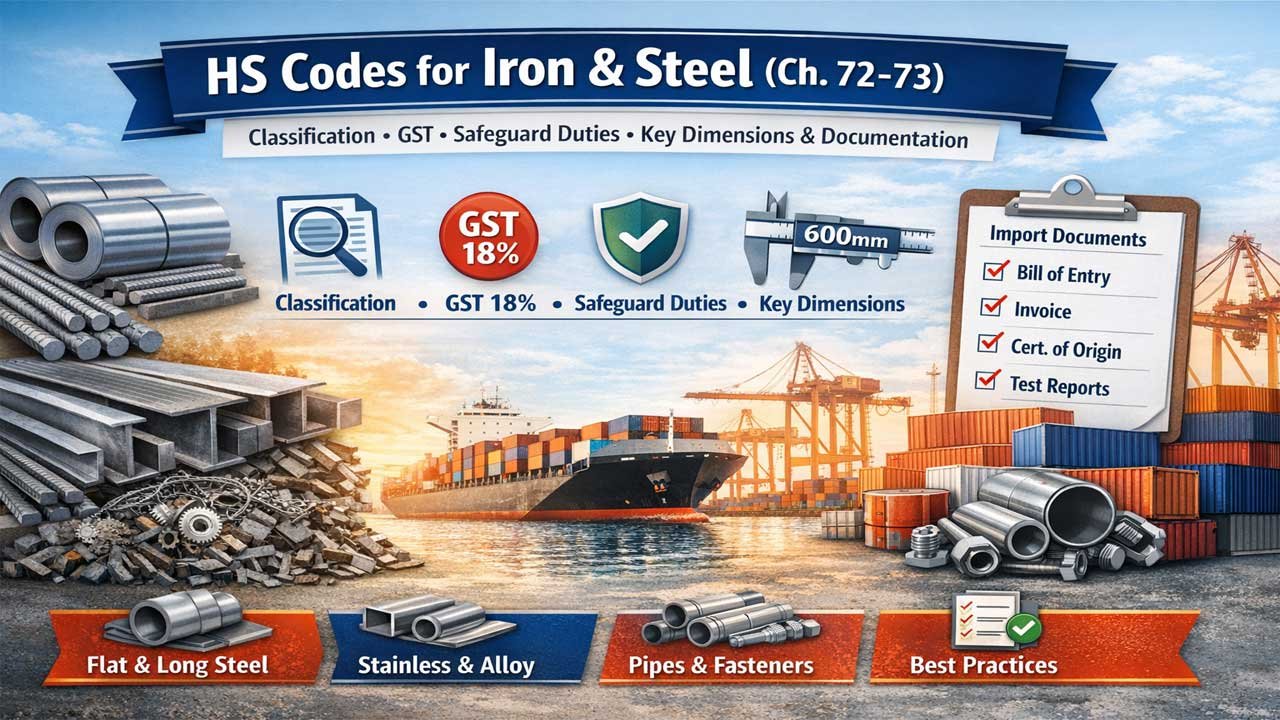

This guide explains how HS (Harmonized System) codes classify iron and steel products for global trade, focusing on Chapters 72 (raw, semi-finished, flat, long, stainless, and alloy steel) and 73 (finished articles like pipes, structures, fasteners, and containers), which together determine customs duties, GST, compliance requirements, and eligibility for safeguard duties and exemptions.

It highlights why correct HS classification is critical to avoid penalties, reduce costs, access trade benefits, and prevent delays, with key distinctions based on material type (non-alloy, alloy, stainless), processing (hot-rolled, cold-rolled, coated), and especially dimensions such as the 600mm width threshold and thickness ranges.

The guide also outlines India’s standard 18% GST, current safeguard duties on selected flat steel products, required import documentation, common classification mistakes, and best practices to ensure accurate declarations, regulatory compliance, and cost-efficient import-export operations.

HS Code for Iron and Steel: Complete Guide to Import, Export & Classification

HS code means Harmonized System code. It is an international classification system. It identifies products for customs purposes. HS codes for iron and steel fall under Chapter 72 and 73. These codes determine import duties. They also set export taxes. Understanding HS codes saves money on customs. It prevents legal issues during shipping. It helps businesses comply with regulations.

Why HS Codes Matter for Iron and Steel

HS codes are critical for: Calculating customs duties correctly. Reducing delays at borders. Accessing preferential trade agreements. Filing accurate import-export documentation. Meeting GST compliance in India. Avoiding penalties and confiscation. Getting accurate shipping quotes. Managing supply chain costs effectively.

Chapter 72: Iron and Steel (Raw Materials and Semi-Finished Products)

HS Code 7201: Pig Iron and Spiegeleisen

Definition: Pig iron comes from iron ore smelting. Spiegeleisen is pig iron with manganese. These are primary forms of iron.

Uses:

- Steel manufacturing feedstock

- Foundry applications

- Industrial alloy production

GST Rate: 18%

Import Duty: Varies by country of origin

HS Code 7202: Ferro Alloys

What it includes:

- Ferro-manganese

- Ferro-chromium

- Ferro-molybdenum

- Silicon-based alloys

Industrial Applications:

- Stainless steel production

- Tool steel manufacturing

- High-strength alloy creation

- Specialty metal industries

GST Rate: 18%

HS Code 7203: Spongy Ferrous Products

Products Covered:

- Direct reduced iron (DRI)

- Sponge iron lumps

- Sponge iron pellets

- Primary iron forms

Key Characteristics:

- Minimum 99.94% iron purity

- Used for steel melting

- High-grade iron production

- Low phosphorus content

GST Rate: 18%

HS Code 7204: Ferrous Waste and Scrap

Classification includes:

- Scrap iron and steel

- Cast iron waste

- Stainless steel scrap

- Remelting ingot scraps

- Metal turnings and shavings

- Stamps and trimmings

Market Importance:

- Crucial for recycling industry

- Reduces raw material costs

- Supports circular economy

- Lowers production expenses

GST Rate: 18%[1]

HS Code 7205: Iron and Steel Powders

Forms Covered:

- Iron powder

- Steel powder granules

- Atomized particles

- Powder metallurgy applications

Uses:

- Additive manufacturing

- Surface coating applications

- Magnetic material production

- Chemical industry feedstock

GST Rate: 18%

HS Code 7206-7207: Semi-Finished Steel Products

HS 7206 includes:

- Non-alloy steel ingots

- Steel blooms and billets

- Steel slabs and blanks

HS 7207 includes:

- Semi-finished iron steel

- Continuous cast products

- Hot-rolled primary shapes

Common Dimensions:

- Various cross-sections

- Different thicknesses

- Multiple weight ranges

- Customizable specifications

GST Rate: 18%

Chapter 72: Flat-Rolled Steel Products

HS Code 7208-7209: Hot and Cold Rolled Steel

HS 7208: Hot-Rolled Flat Products

- Width exceeding 600mm

- Coiled or non-coiled forms

- Various thickness ranges

HS 7209: Cold-Rolled Flat Products

- Width of 600mm or more

- Superior surface finish

- Tighter tolerances

Current Tariff Alert (2026):

- 12% safeguard duty applies

- Duration: April 21, 2025 to April 20, 2028

- Year 1: 12%, Year 2: 11.5%, Year 3: 11%

- Exemptions for stainless and electrical steel

- China, Vietnam, Nepal subject to duty

- Price thresholds protect higher-value imports

GST Rate: 18%

HS Code 7210-7212: Coated and Plated Sheets

HS 7210: Clad, Plated, or Coated Sheets

- Tin-plated products

- Zinc coated materials

- Paint-coated sheets

- Chrome-plated varieties

HS 7211: Narrow Flat Products

- Width less than 600mm

- Hot or cold-rolled

- Various surface treatments

- Industrial applications

HS 7212: Narrow Coated Products

- Width under 600mm

- Clad or plated surfaces

- Specialized coatings

- Protective finishes

GST Rate: 18%

Long Products: Bars, Rods, and Wire

HS Code 7213: Hot-Rolled Bars and Rods

Characteristics:

- Coiled in irregularly wound coils

- Non-alloy steel composition

- Hot-rolled only processing

- Standard grades available

Sizes Available:

- Various diameters

- Customizable lengths

- Different surface conditions

- Strength specifications

GST Rate: 18%

HS Code 7214: Other Bars and Rods

Product Range:

- Forged bars

- Hot-drawn bars

- Hot-extruded products

- Bar-twisted varieties

- Spring steel bars

- Free-cutting grades

Quality Grades:

- Spring steel quality

- Standard carbon steel

- Free-cutting steel

- Specialty alloys

GST Rate: 18%[1]

HS Code 7215: Other Processed Bars and Rods

Processing Options:

- Cold-finished bars

- Polished rods

- Ground surfaces

- Turned and finished

- Further processed

Applications:

- Mechanical engineering

- Precision components

- Tool manufacturing

- Automotive parts

GST Rate: 18%

HS Code 7216: Angles, Shapes, and Sections

Product Types:

- Angle sections

- Channel sections

- I-beams and H-beams

- T-sections

- L-angles

- Structural shapes

Dimensions:

- Height specifications

- Different thicknesses

- Various material grades

- Standardized sizes

Building Applications:

- Construction frameworks

- Structural support

- Infrastructure projects

- Industrial structures

GST Rate: 18%

HS Code 7217: Wire of Iron and Steel

Wire Types:

- Plain wire

- Drawn wire

- Galvanized wire

- Coated varieties

- Special grades

Sizes Available:

- Various gauges

- Different thicknesses

- Multiple lengths

- Coil or spool forms

GST Rate: 18%

Stainless Steel Products (Premium Category)

HS Code 7218: Stainless Steel Ingots and Semi-Finished Products

Product Categories:

7218.10: Ingots and Primary Forms

- Stainless steel ingots

- Blooms and billets

- Slabs and blanks

- Primary cast forms

7218.91-99: Semi-Finished Products

- Rectangular cross-sections

- Round billets

- Various shapes

- Intermediate forms

Key Grades Available:

- 304 stainless steel

- 316 stainless steel

- 430 stainless steel

- Duplex grades

- Super-duplex varieties

End Applications:

- Construction materials

- Automotive components

- Kitchenware production

- Petrochemical equipment

- Medical device manufacturing

GST Rate: 18%

HS Code 7219: Flat-Rolled Stainless Steel (≥600mm Width)

Product Forms:

Hot-Rolled Stainless Steel

- Coiled forms

- Non-coiled sheets and plates

- Various thicknesses

- Surface finishes

Cold-Rolled Stainless Steel

- Superior finish quality

- Tighter tolerances

- Enhanced appearance

- Precise dimensions

Thickness Classifications:

| HS Code | Thickness Range | Application |

|---|---|---|

| 7219.32 | >4.75mm to ≤10mm | Structural, heavy-duty applications |

| 7219.33 | >3mm to ≤4.75mm | Standard industrial use |

| 7219.34 | >1mm to ≤3mm | Precision components |

| 7219.35 | <1mm | Thin foil and decorative |

GST Rate: 18%

HS Code 7220: Flat-Rolled Stainless Steel (<600mm Width)

Narrow Strip Products

- Width under 600mm

- Hot or cold-rolled

- Various thicknesses

- Specialized grades

Industrial Uses:

- Precision strips

- Automotive applications

- Medical components

- Electrical equipment

GST Rate: 18%

HS Code 7221-7223: Stainless Steel Bars, Rods, and Wire

HS 7221: Hot-Rolled Bars

- Coiled irregular forms

- Standard stainless grades

- Various diameters

HS 7222: Other Stainless Bars and Rods

- Hot-drawn varieties

- Hot-extruded products

- Angles and sections

- Cold-finished options

HS 7223: Stainless Steel Wire

- Plain wire

- Polished finishes

- Various gauges

- Coil or spool form

GST Rate: 18%

HS Code 7224-7229: Alloy Steel Products

Product Coverage:

- High-strength alloy steel

- Tool steel ingots

- Special alloy compositions

- Superalloys

HS 7225-7226: Alloy Flat Products

- Silicon-electrical steel

- Flat-rolled alloy sheets

- Various thicknesses

- Width specifications

HS 7227-7229: Alloy Bars, Rods, and Wire

- Tool steel bars

- High-speed steel rods

- Specialized alloy wire

- Premium grades

GST Rate: 18%

Chapter 73: Articles of Iron and Steel (Finished Products)

HS Code 7301: Sheet Piling and Welded Sections

Product Types:

- Sheet piling materials

- Welded angles

- Welded channels

- Welded structural shapes

- Building elements

Construction Uses:

- Retaining walls

- Dam structures

- Waterfront projects

- Infrastructure development

GST Rate: 18%

HS Code 7302: Railway and Tramway Track Materials

Components Included:

- Railway rails

- Check-rails and rack rails

- Switch blades

- Crossing frogs

- Point rods

- Sleepers (cross-ties)

- Fish-plates

- Chair elements

- Sole plates

Strategic Importance:

- Railway network expansion

- Transportation infrastructure

- Government procurement

- Large-scale projects

GST Rate: 18%

HS Code 7303-7306: Tubes and Pipes

HS 7303: Cast Iron Tubes

- Rain water pipes

- Soil pipes

- Spun pipes

- Industrial applications

HS 7304: Seamless Steel Pipes

- Oil and gas pipelines

- Drill pipes

- Casing tubes

- High-pressure applications

- Stainless steel varieties

HS 7305-7306: Welded Pipes

- Large diameter pipes (>406.4mm external)

- Longitudinally welded tubes

- Welded fittings

- Line pipe for oil/gas

- ERW precision tubes

Applications:

- Petroleum industry

- Plumbing systems

- HVAC installations

- Structural support

- Water distribution

- Gas transmission

GST Rate: 18%

HS Code 7307: Tube and Pipe Fittings

Fitting Types:

- Couplings

- Elbows and bends

- Sleeves

- Flanges

- Threaded fittings

- Welding fittings

- Cast fittings

- Stainless steel fittings

Connection Methods:

- Threaded connections

- Welded joints

- Flanged assemblies

- Butt-welded fittings

- Socket fittings

Industrial Usage:

- Plumbing systems

- Industrial piping networks

- Equipment assembly

- Mechanical installations

- Oil and gas operations

GST Rate: 18%

HS Code 7308: Steel Structures and Building Elements

Products Covered:

- Bridges and bridge sections

- Lock gates

- Towers and lattice masts

- Roofing frameworks

- Doors and windows

- Door and window frames

- Thresholds

- Prefabricated components

- Escalator parts

- Structural assemblies

Construction Applications:

- High-rise buildings

- Bridges

- Industrial plants

- Infrastructure projects

- Commercial structures

GST Rate: 18%

HS Code 7309-7311: Containers and Tanks

HS 7309: Large Containers (>300 liters)

- Reservoirs

- Large tanks

- Vats

- Industrial containers

- Storage vessels

HS 7310: Medium Containers (≤300 liters)

- 50L+ capacity drums

- Soldering-type cans

- Boxes and cases

- Packaging containers

- Portable tanks

HS 7311: Compressed Gas Containers

- LPG cylinders

- Oxygen bottles

- Nitrogen cylinders

- High-pressure vessels

- Low-pressure containers

GST Rate: 18%

HS Code 7312-7326: Wire Products, Fasteners, and Household Articles

HS 7312: Wire Products

- Stranded wire

- Wire ropes (black, galvanized)

- Cables

- Plaited bands

- Slings and assemblies

HS 7313: Barbed Wire and Fencing Wire

- Barbed wire

- Twisted hoop wire

- Single flat wire

- Fencing materials

HS 7314-7318: Nails, Screws, and Fasteners

- Nails of all types

- Screws

- Bolts and nuts

- Rivets and fasteners

- Washers

HS 7319-7326: Household Articles and Tools

- Kitchen utensils

- Household goods

- Hand tools

- Agricultural implements

- Miscellaneous articles

GST Rate: 18%

GST and Duty Structure for Iron and Steel

Goods and Services Tax (GST) Rates

Standard GST Rate: 18% on most iron and steel products

Applicable to:

- Raw materials (Chapter 72)

- Semi-finished products

- Finished articles (Chapter 73)

- Processed and coated varieties

No GST Cess: No additional cess on iron and steel products

Import Duties and Tariffs (2026)

Current Safeguard Duty (Effective January 2026):

Flat Steel Products Affected:

- HS 7208: Hot-rolled flat products

- HS 7209: Cold-rolled flat products

- HS 7210: Clad and plated sheets

- HS 7211: Narrow flat products

- HS 7212: Narrow coated products

- HS 7225: Alloy flat products (wide)

- HS 7226: Alloy flat products (narrow)

Duty Rates:

- Year 1 (April 2025-2026): 12%

- Year 2 (April 2026-2027): 11.5%

- Year 3 (April 2027-2028): 11%

Countries Affected:

- China: Subject to duty

- Vietnam: Subject to duty

- Nepal: Subject to duty

- Developed countries: Exempted

- LDCs: Exempted

Exemptions from Safeguard Duty:

- Stainless steel products

- Electrical steel

- Tinplate

- Cold-rolled electrical steel

- Special grades above price thresholds

Price Thresholds (Imports above these are exempted):

- Hot-rolled coil (HRC): $675/t CIF

- Hot-rolled plate mill plates: $695/t

- Cold-rolled coils: $824/t

- Metallic coated coils: $861/t

- Colour coated coils: $964/t

Market Impact:

- Domestic HRC price: ₹47,250/t ex-Mumbai (excluding GST)

- Strong local industry protection

- Price support for domestic producers

- Competitiveness maintained

How to Classify Iron and Steel Products

Step-by-Step Classification Process

Step 1: Identify Product Category

- Raw/primary form (HS 72XX)

- Semi-finished products (HS 720X-721X)

- Flat products (HS 7208-7212, 7219-7220)

- Long products (HS 7213-7223)

- Articles/finished goods (HS 73XX)

Step 2: Check Material Type

- Non-alloy steel

- Alloy steel

- Stainless steel

- Tool steel

- Special grades

Step 3: Measure Product Dimensions

- Width (especially 600mm threshold)

- Thickness or diameter

- Length if applicable

- Weight specifications

Step 4: Assess Processing

- Hot-rolled vs. cold-rolled

- Coated or uncoated

- Clad or plated

- Finished or semi-finished

Step 5: Determine Surface Condition

- Bright or pickled

- Galvanized or zinc-coated

- Tin-plated

- Chrome-plated

- Painted or enameled

Step 6: Verify with Official Tariff

- Consult national customs authority

- Check WCO HS guidelines

- Review trade agreements

- Confirm applicable duty rates

Key Distinctions in HS Code Classification

Width Matters: 600mm Threshold

Products ≥600mm Width:

- HS 7208-7209: Flat-rolled products

- HS 7219: Stainless flat products

- HS 7225-7226: Alloy flat products (wide)

Products <600mm Width:

- HS 7211: Narrow flat products

- HS 7220: Narrow stainless products

- HS 7226: Narrow alloy products

Impact: Different classification, duties, and pricing.

Thickness Ranges in Stainless Steel (HS 7219)

Ultra-Thin (HS 7219.35): <1mm thickness

- Decorative applications

- Specialty foil

- Precision components

Thin (HS 7219.34): >1mm to ≤3mm

- Precision engineering

- Medical devices

- Fine components

Medium (HS 7219.33): >3mm to ≤4.75mm

- General industrial use

- Construction

- Automotive

Thick (HS 7219.32): >4.75mm to ≤10mm

- Structural applications

- Heavy-duty equipment

- Infrastructure

Extra-Thick (HS 7219.91-99): >10mm

- Massive structures

- Heavy-load applications

- Industrial equipment

Documentation Required for Iron and Steel Imports

Essential Import Documents

Commercial Documents:

- Purchase order or contract

- Proforma invoice

- Final invoice

- Packing list

- Certificate of origin

Shipping Documents:

- Bill of lading

- Airway bill (if applicable)

- Container numbers

- Weight certificates

- Dimensions documentation

Quality and Compliance:

- Mill test certificate

- Material composition report

- Dimensional verification

- Quality inspection report

- Supplier certification

For Stainless Steel (Special Requirements):

- Manufacturer’s invoice

- Mill test certificate

- Positive material identification (PMI) test report

- Manufacturer’s declaration

- Grade specification

- Purchase order or contract

Customs Declaration:

- Bill of entry

- HS code classification

- Declared value

- Country of origin

- Quantity and unit of measurement

Common Mistakes in HS Code Classification

Mistake 1: Ignoring the 600mm Width Threshold

- Causes wrong HS code assignment

- Results in incorrect duties

- Creates customs delays

- May lead to penalties

Solution: Measure width accurately. Verify against 600mm. Document dimensions clearly.

Mistake 2: Confusing Alloy Types

- Non-alloy steel vs. alloy steel

- Stainless steel specifications

- Tool steel grades

- Special alloy varieties

Solution: Obtain material certificates. Verify composition. Check specifications.

Mistake 3: Wrong Processing Classification

- Hot-rolled vs. cold-rolled

- Coated vs. uncoated

- Clad vs. plated

- Surface treatment variations

Solution: Examine product carefully. Get supplier documentation. Verify processing method.

Mistake 4: Overlooking Safety and Quality Standards

- Indian Standards (IS codes)

- Quality control requirements

- BIS certification for some grades

- Compliance documentation

Solution: Check if BIS license required. Submit quality certificates. Verify compliance.

Mistake 5: Neglecting Trade Duty Changes

- Safeguard duties application

- Price threshold exemptions

- Country-specific duties

- Periodic rate changes

Solution: Monitor customs notices. Track duty updates. Verify current rates. Plan imports strategically.

Impact of Safeguard Duties on Business

Cost Implications

Import Price Increase:

- 12% duty adds to landed cost

- Affects competitiveness

- Impacts supply chain economics

- Influences pricing strategy

Exemption Opportunities:

- Stainless steel imports unaffected

- Products above price thresholds exempt

- Sourcing from exempt countries possible

- Alternative material specifications available

Business Strategy:

- Shift to stainless steel grades

- Source from exempt countries

- Increase price thresholds strategy

- Build local inventory

Best Practices for Iron and Steel Import-Export

1. Accurate Classification

- Always verify HS codes

- Consult classification guidelines

- Obtain expert confirmation

- Document the reasoning

2. Complete Documentation

- Prepare all required forms

- Gather quality certificates

- Maintain supplier documents

- Keep organized records

3. Current Duty Awareness

- Monitor tariff updates

- Track duty changes

- Plan imports strategically

- Budget for duties

4. Supplier Verification

- Confirm material specifications

- Request test certificates

- Verify quality standards

- Check BIS compliance

5. Customs Compliance

- File accurate declarations

- Report correct values

- Use proper HS codes

- Meet all deadlines

6. Trade Agreement Utilization

- Explore preferential rates

- Check country-of-origin rules

- Use free trade agreements

- Optimize tariff benefits

Frequently Asked Questions

Q1: What is the difference between HS 7204 and HS 7206?

HS 7204 covers scrap and waste iron/steel used for recycling. HS 7206 covers primary ingots and semi-finished new steel products. HS 7204 is for recycled material; HS 7206 is for virgin material.

Q2: Is stainless steel HS 7218 covered by safeguard duties?

No. Stainless steel products including HS 7218 are exempt from the current 12% safeguard duties. Only non-alloy and specific alloy products are affected.

Q3: How do I know if my steel needs GST at 18%?

Most iron and steel products under Chapter 72 and 73 have 18% GST. Verify with your tax professional. Check the applicable HSN codes for your specific product.

Q4: What’s the difference between HS 7219 and HS 7220?

HS 7219 covers stainless flat products ≥600mm width. HS 7220 covers stainless products <600mm width. Width is the determining factor.

Q5: Do I need BIS license to import stainless steel?

For certain HS codes and grades, yes. Check if your specific product falls under the Quality Control Order by Ministry of Steel. Obtain BIS certification if required. Consult customs authority.

Q6: What documents are mandatory for steel imports?

Bill of entry, invoice, packing list, certificate of origin, material test certificates, and shipping documents. For stainless steel, add PMI test reports and manufacturer’s declaration.

Conclusion

HS codes for iron and steel determine import duties, GST, and regulatory compliance. Chapter 72 covers raw and semi-finished steel. Chapter 73 covers finished articles.

Understanding these codes saves money. It prevents customs delays. It ensures legal compliance.

The 600mm width threshold and thickness ranges are critical. Stainless steel gets separate classification. Safeguard duties currently apply to specific products.

Stay updated on tariff changes. Maintain complete documentation. Verify classifications accurately.

Proper HS code classification protects your business. It optimizes costs. It ensures smooth international trade operations.

Additional Resources

- WCO Harmonized System: www.wcoomd.org

- Indian Customs: www.cbic.gov.in

- Ministry of Steel, India: www.steel.gov.in

- DGFT India: dgft.gov.in

- Customs Tariff Schedule: Check your country’s specific schedules

Last Updated: January 2026

Disclaimer: This article provides general information only. Consult customs authorities and tax professionals for specific classification and duty determinations. HS codes and tariffs are subject to change without notice.