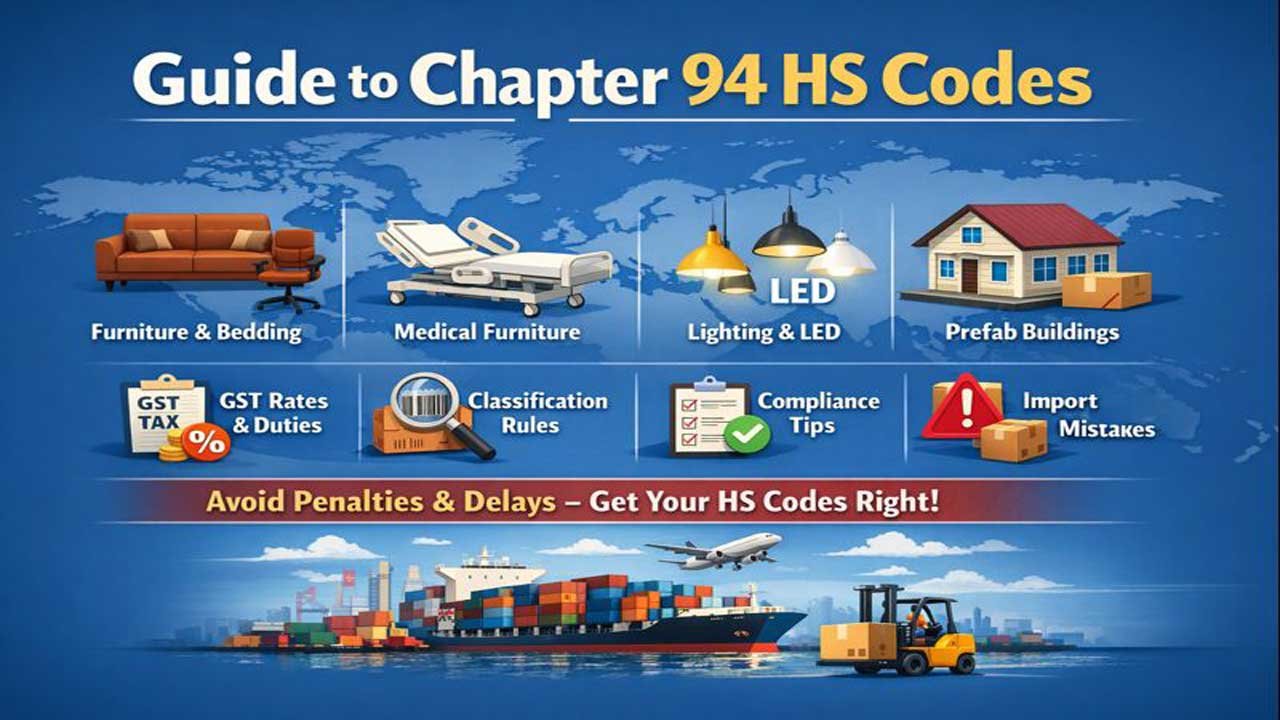

Are you importing furniture? Do you need the correct HS Code for your products? This guide explains everything about Chapter 94 HS codes. Understanding these codes is essential. It helps with customs clearance. It also ensures GST compliance. Business owners must know this information. Traders depend on accurate classification. Let’s explore what you need to know.

What Is an HS Code?

An HS Code is a standardized number system. It identifies different products globally. HS stands for “Harmonized System.” Every product has its own code. The code is typically 6, 8, or 10 digits long. It determines import and export duties. It also affects GST rates. Accurate classification is critical for compliance. Wrong codes can result in penalties. You must use the correct code for your goods.

Understanding Chapter 94

Chapter 94 covers six main product categories:

1. Furniture and Seating Products

2. Medical and Special Furniture

3. Bedding and Mattresses

4. Lighting Fixtures and Lamps

5. Illuminated Signs and Name-Plates

6. Prefabricated Buildings

This chapter is vital for importers. It handles miscellaneous manufactured articles. Chapter 94 falls under Section XX of the HS system. Section XX includes chapters 94 through 96. Understanding your product category is crucial. Misclassification creates compliance issues. It can delay your shipment at customs.

Category 1: Furniture and Seating (HS Codes 9401-9403)

Heading 9401 – Seats and Chairs

This heading covers general seating products. It includes chairs without mechanical features. Sofas and couches fall here too. Armchairs with basic features are included. Non-medical rotating chairs are classified here.

Key HS Code Examples:

- 9401 10: Seats with wooden frames

- 9401 20: Seats with metal frames

- 9401 30: Seats with other materials

GST Rate on Seats: 18% in India

Important Note: Medical chairs and dental chairs are excluded. They go under heading 9402 instead.

Heading 9402 – Medical and Special Furniture

This heading covers specialized furniture only. Hospital beds with mechanical features are included. Operating tables belong here. Dental chairs and dentist furniture are classified here. Barber chairs with rotating functions fit this category.

Key HS Code Examples:

- 9402 10: Medical, surgical, and dental furniture

- 9402 90: Other specialized seating

GST Rate on Medical Furniture: 5% in India

Medical furniture has lower GST rates. This reflects the health sector’s importance. Buyers benefit from reduced taxation. Exporters must provide proper documentation.

Heading 9403 – Other Furniture and Parts

This is the broadest furniture category. Most office furniture goes here. Bedroom furniture is classified here. Kitchen furniture belongs in this heading. Storage solutions like cabinets and shelves fit here.

Key HS Code Examples:

- 9403 10: Bamboo furniture (special classification)

- 9403 20: Office furniture

- 9403 30: Kitchen furniture

- 9403 90: Other furniture and parts

GST Rate on General Furniture: 18% in India

Important Note: Bamboo furniture has a separate rate of 5%. This provides incentive for traditional products.

Category 2: Bedding Products and Mattresses (HS Code 9404)

Understanding Heading 9404

This heading covers all bedding items. Mattresses with springs are included. Foam mattresses and rubber mattresses fit here. Pillows, quilts, and eiderdowns are classified here. Cushions and pouffes belong in this heading.

Key HS Code Examples:

- 9404 10: Mattress supports (bed bases)

- 9404 20: Mattresses with springs or foam

- 9404 30: Pillows and cushions

- 9404 90: Other bedding articles

Types of Mattresses and Classification

Spring Mattresses: HS Code 9404 20 10

- These have internal coil springs

- Steel springs provide support

- This category has the highest demand

Foam Mattresses: HS Code 9404 20 20

- Made with cellular rubber

- Memory foam is included

- High-density foam qualifies here

Cotton Products: HS Code 9404 20 30

- Traditional cotton-filled mattresses

- Cotton quilts and pillows

- These are lower-priced options

Mixed Materials: HS Code 9404 20 90

- Combination of different materials

- Hybrid designs fit here

- Most modern mattresses fall in this category

GST Rates on Bedding Products

| Product Type | GST Rate | Notes |

|---|---|---|

| Coir Mattresses | 5% | Eco-friendly option |

| Cotton Pillows | 5% | Natural material |

| Spring Mattresses | 18% | Standard rate |

| Foam Mattresses | 18% | Standard rate |

| Quilts \& Quilted Items | 5% | Made with quilted textile |

Key Insight: Natural fiber products have lower GST. This encourages sustainable manufacturing. Importers benefit from cost savings on eco-friendly bedding.

Category 3: Lighting Fixtures and Luminaires (HS Code 9405)

Understanding Heading 9405

This heading covers all lighting products. LED lights and fixtures are included. Traditional luminaires with fixed light sources fit here. Searchlights and spotlights are classified here. Illuminated signs and nameplate lights belong in this category.

Key HS Code Examples:

- 9405 10: Chandeliers and ceiling lights

- 9405 20: Wall lights and sconces

- 9405 30: Table and desk lamps

- 9405 40: Street lighting equipment

- 9405 50: Other electric luminaires

- 9405 90: Parts of lighting fixtures

LED Lights – Special Classification

LED technology has revolutionized lighting. LED lights have their own special rates. LED fixtures and lamps get a separate HS Code. LED drivers and circuit boards are also separate. This reflects the growing demand for energy-efficient lighting.

LED-Specific HS Codes:

- 9405 10 30: LED chandeliers

- 9405 20 20: LED wall lights

- 9405 40 20: LED street lights

- LED drivers: Often classified separately

GST Rate on Lighting: 5% for LED lights, 5-28% for others

LED products have preferential GST rates. This encourages energy efficiency. Businesses can save on import costs with LED products. The government supports green energy initiatives.

Searchlights and Spotlights

Specialized lighting equipment fits this category. Searchlights have fixed light sources. Spotlights are included too. These are industrial lighting products. High-power lighting fixtures fall here. This category serves industrial and commercial sectors.

Category 4: Illuminated Signs and Name-Plates (HS Code 9405)

Understanding Illuminated Signs

These are signs with built-in light sources. Neon signs are common examples. LED signs are increasingly popular. Illuminated nameplate lights fit here. These signs have permanently fixed light sources. The light source is integral to the sign itself.

Key HS Code Examples:

- 9405 40 10: With fluorescent tubes

- 9405 40 20: With LED sources

- 9405 40 90: With other light sources

Why This Classification Matters

Illuminated signs serve commercial purposes. Shops use them for advertising. Hotels use them for wayfinding. Banks and offices use illuminated nameplates. Hospitals display illuminated directional signs. The light source’s permanence is crucial. Removable lights don’t qualify here.

GST Rate on Illuminated Signs: 5-28% depending on construction

The classification affects customs duties heavily. Importers must provide proper documentation. Light source types influence the rate. Material composition also matters. Professional classification ensures smooth customs clearance.

Category 5: Prefabricated Buildings (HS Code 9406)

What Are Prefabricated Buildings?

Prefabricated buildings are pre-manufactured structures. They arrive ready for assembly. Some come fully assembled. Others require partial assembly. These buildings have industrial construction methods. They offer quick deployment solutions.

Common Types of Prefab Buildings:

- Greenhouses

- Cold storage units

- Office buildings

- Residential modules

- Industrial sheds

- Agricultural storage

HS Code Classifications for Prefab Buildings

Heading 9406 10 – Wooden Prefabricated Buildings

- Structures with wooden frames

- Wood exterior walls

- Wooden floor construction

- These are most common

Key HS Code Examples:

- 9406 10 10: Greenhouses made of wood

- 9406 10 20: Cold storage units in wood

- 9406 10 30: Silos for ensilage storage

- 9406 10 90: Other wooden buildings

Heading 9406 20 – Steel Modular Units

- Structures with steel frames

- Industrial workshop buildings

- Metal-based modular units

- These are pre-fitted internally

Key HS Code Examples:

- 9406 20 10: Steel greenhouses

- 9406 20 20: Cold storage with steel

- 9406 20 90: Other steel modules

Heading 9406 90 – Other Prefabricated Buildings

- Structures made from other materials

- Plastic and composite buildings

- Mixed material construction

- Non-standard buildings

Custom Duty Rates on Prefabricated Buildings

| Building Type | HS Code | Custom Duty | IGST |

|---|---|---|---|

| Wooden Greenhouse | 9406 10 10 | 10% | 18% |

| Steel Warehouse | 9406 20 90 | 10% | 18% |

| Other Prefab | 9406 90 90 | 10% | 18% |

Important Note: Social welfare surcharge is 10% on all prefabricated buildings. This is in addition to basic and integrated GST.

Prefab Building Assembly and Import

Prefabricated buildings must maintain structural integrity. Partial assembly is permitted in classification. Pre-cut elements are acceptable. Random-length materials for on-site cutting qualify. The building must be recognizable as a complete structure. Incomplete buildings with essential features qualify.

GST Compliance and Custom Duty Information

GST Rates for Chapter 94 Products

Understanding GST is critical for importers. Different products have different rates. The rate depends on product classification. Material composition also affects the rate.

Standard GST Rates:

- 5% GST: LED lights, natural fiber products (coir, cotton), medical furniture

- 18% GST: Most furniture, spring mattresses, foam mattresses, general lighting

- 28% GST: Selected lighting fixtures, specific specialized products

Basic Custom Duty (BCD)

Basic Custom Duty is applied on imports. Most Chapter 94 products face 10% BCD. Some products have different rates. You must check specific product classifications. BCD is calculated on the CIF value. CIF means Cost, Insurance, and Freight.

Integrated Goods and Services Tax (IGST)

IGST is applied after BCD. It’s the most important tax for importers. IGST = Basic Duty + GST + Social Welfare Surcharge. Calculating correct IGST is essential. Wrong calculations lead to payment delays. Professional help is often necessary for complex products.

Social Welfare Surcharge

This surcharge applies to specific products. Prefabricated buildings face 10% surcharge. Some lighting products are also affected. The surcharge is calculated on the basic customs duty. This adds to the overall import cost.

Formula for Total Import Cost:

- Add BCD to invoice value

- Calculate IGST on (BCD + Invoice Value)

- Add Social Welfare Surcharge if applicable

- Total Cost = Invoice + BCD + IGST + Surcharge

Import-Export Data and Market Insights

Market Trends for Chapter 94 Products

The furniture and bedding market is growing rapidly. E-commerce has boosted demand significantly. International trade in these products is increasing. India is both a major exporter and importer.

Export Markets for Indian Products:

- United States (furniture, textiles)

- European Union (lighting fixtures)

- Gulf Countries (all categories)

- South-East Asian markets

Import Sources:

- China (furniture, lighting, prefab buildings)

- Vietnam (furniture)

- Malaysia (wood products)

- Bangladesh (textiles and bedding)

Importance of Accurate HS Codes for Trade

Correct codes ensure faster customs clearance. Wrong codes cause shipping delays. Penalties can reach 25% of product value. Compliance protects your business reputation. Many traders use professional classification services. These services ensure accurate documentation.

Frequently Asked Questions About Chapter 94

Q1: What is the difference between 9403 and 9404?

Heading 9403 covers furniture frames and structures. Heading 9404 covers soft furnishings and bedding. A sofa frame goes to 9403. A sofa mattress goes to 9404. This distinction is important for importers. Different duty rates apply to each category.

Q2: Can I import medical furniture under regular rates?

No. Medical furniture has special classification under 9402. It qualifies for lower GST rates (5%). Medical furniture requires proper documentation. You must declare it as medical furniture. Regular furniture rates do not apply to medical items.

Q3: How do I classify a mattress?

Mattress classification depends on its construction. Spring mattresses go to 9404 20 10. Foam mattresses go to 9404 20 20. Cotton-based mattresses go to 9404 20 30. Material composition determines the specific code. You should check the product specifications. Professional classification helps avoid mistakes.

Q4: What is the GST on LED lighting products?

LED lights have preferential GST rates of 5%. This encourages energy-efficient lighting adoption. The rate applies to LED fixtures and bulbs. LED drivers may be classified differently. Check with the tax authority for complex LED products.

Q5: Are prefabricated buildings exempt from duties?

No. Prefabricated buildings face standard custom duties. The rate is typically 10% BCD. IGST is also applied. Social welfare surcharge adds 10% to the duty. Material type (wood, steel, other) affects classification. Each type has its own HS code.

Q6: How is custom duty calculated for imports?

Custom duty calculation involves multiple steps. First, determine the HS code correctly. Add the BCD to the invoice value. Calculate IGST on this combined amount. Add social welfare surcharge if applicable. The total becomes your import cost. Professional customs brokers can assist here.

Q7: What documents are needed for HS code classification?

You need detailed product specifications. Include material composition information. Provide product photographs or samples. Commercial invoices are essential. Technical specifications help confirm classification. Some products need lab reports. Incomplete documentation causes delays.

Q8: Can I appeal if my HS code is rejected?

Yes. The customs authority allows appeals. You can provide additional documentation. Technical experts can support your appeal. Professional customs consultants assist with appeals. The process can take several months. Having proper documentation from the start is better.

Q9: What’s the difference between Chapter 94 and other furniture chapters?

Chapter 94 covers most modern furniture. Chapter 71 covers specialized jewelry furniture. Chapter 39 covers plastic furniture. Chapter 87 covers mobile home furniture. Each chapter has different duty rates. Correct chapter selection is critical. Misclassification affects your entire import duty calculation.

Q10: How often do HS codes change?

HS codes are updated regularly by the World Customs Organization. India updates its classification annually. New products may require new codes. Material changes can affect classification. You should monitor official notifications. Subscribe to customs authority updates. Professional consultants track these changes.

Tips for Successful Import-Export of Chapter 94 Products

1. Use Professional Customs Brokers

Customs brokers understand HS code classification. They have access to updated databases. They monitor regulatory changes constantly. Professional brokers reduce compliance risks. They handle documentation efficiently. Their fees are often worth the saved time and penalties avoided.

2. Maintain Detailed Product Records

Keep comprehensive product documentation. Include material composition details. Store photographs and technical specifications. Maintain supplier certificates. Document manufacturing processes if needed. Good records prevent classification disputes. They support appeal processes if necessary.

3. Verify HS Codes Before Ordering

Contact the customs authority before importing. Use official HS code databases. Consult with experienced importers. Verify your classification in writing if possible. Some authorities issue advance rulings. These rulings protect you from duty changes later.

4. Monitor GST and Duty Updates

Follow CBIC notifications regularly. Join industry associations for updates. Subscribe to customs authority newsletters. Track changes in tax rates. Budget for potential duty changes. Advance warning helps financial planning.

5. Ensure Proper Labeling and Documentation

Label products with their HS codes clearly. Include material composition on invoices. Provide technical specifications with shipments. Document all manufacturing details. Clear labeling speeds up customs clearance. It reduces inspection requirements.

6. Use Trade Agreements to Your Advantage

India has trade agreements with multiple countries. These agreements affect duty rates significantly. Some countries have preferential rates. Check if your supplier’s country qualifies. Trade agreement benefits can reduce costs substantially.

Regulatory Compliance Checklist

Before importing Chapter 94 products, verify:

- ✓ Correct HS code classification confirmed

- ✓ GST rate applicable to your product

- ✓ Custom duty amount calculated

- ✓ Social welfare surcharge identified

- ✓ Required certifications obtained

- ✓ All documentation complete

- ✓ Supplier country verified

- ✓ Trade agreement benefits checked

- ✓ Quality standards confirmed

- ✓ Insurance coverage arranged

Common Classification Mistakes to Avoid

Mistake 1: Classifying cushions as furniture

- Cushions go to 9404, not 9403

- This affects GST rates

Mistake 2: Mixing medical and non-medical furniture

- Medical furniture gets special rates

- Documentation must be clear

- Mixing causes severe penalties

Mistake 3: Ignoring material composition

- Material type determines the code

- Wood, metal, and plastic are different

- This affects duty rates

Mistake 4: Not accounting for light source types

- LED lights have different rates than fluorescent

- Permanent vs. removable sources differ

- This impacts GST significantly

Mistake 5: Misclassifying prefab building materials

- Steel and wood are classified separately

- Assembly status matters

- Completeness affects the code

Conclusion

Chapter 94 covers important product categories. Furniture, bedding, lighting, and prefab buildings all belong here. Correct classification is critical for business success. Wrong codes create compliance issues. They also result in significant penalties.

Understanding HS codes requires expertise. Professional guidance is often necessary. Keep accurate records of all products. Monitor regulatory updates constantly. Maintain relationships with trusted customs brokers.

The investment in proper classification pays off. Faster customs clearance saves time and money. Compliance protects your business reputation. Accurate documentation prevents disputes. Professional handling reduces overall import costs.

If you import these products, invest in professional classification. It’s one of your best business decisions. Proper documentation ensures smooth operations. Compliance protects your bottom line.