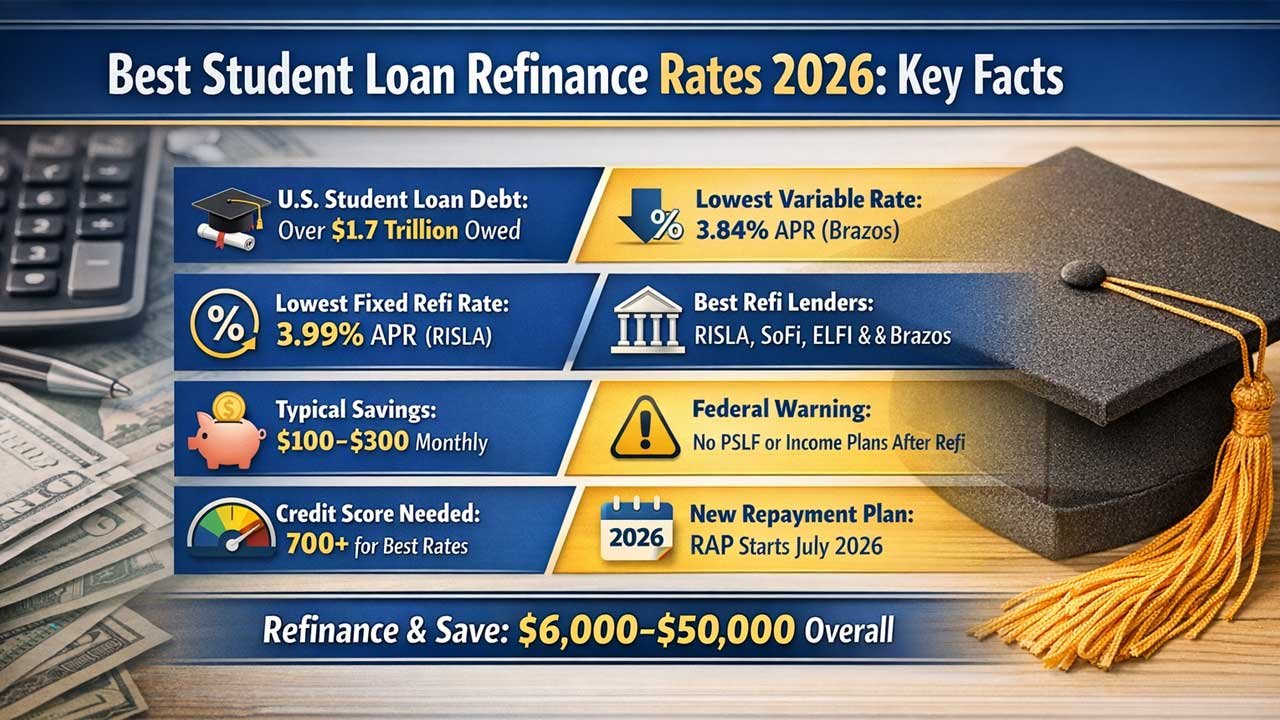

Student loan debt continues to burden millions of graduates worldwide, with U.S. borrowers owing over $1.7 trillion collectively. In 2026, however, falling refinance rates—starting as low as 3.99% fixed APR—present a rare opportunity to cut monthly payments by $100–$300 and save thousands in total interest.

This comprehensive guide outlines how borrowers can secure the lowest refinance rates, compare top lenders like RISLA, SoFi, and ELFI, and understand when refinancing makes sense versus federal consolidation. It also highlights new 2026 federal repayment rules, income-driven plan changes, and the critical trade-offs between fixed and variable rates. For those with strong credit and stable income, refinancing could significantly ease financial pressure and accelerate debt freedom.

| Category | Information (2026) |

|---|---|

| Total U.S. Student Loan Debt | Over $1.7 trillion owed collectively |

| Lowest Refinance Rate (Fixed APR) | 3.99% – offered by RISLA |

| Lowest Variable APR | 3.84% – offered by Brazos |

| Average Federal Loan Rate | 6–7% (before refinancing) |

| Typical Savings from Refinancing | $100–$300/month or $6,000–$50,000 total |

| Best Lenders (2026) | RISLA, SoFi, Brazos, ELFI, College Ave |

| Top Nonprofit Option | RISLA – fixed APR from 3.99%, income-based repayment available |

| Top for Professionals | SoFi – member perks, financial tools, skip-payment option |

| Top for High Loan Balances | ELFI – up to $500,000 loan amount, Parent PLUS eligible |

| Credit Score Needed for Best Rates | 700+ for top-tier APRs |

| Autopay Discount | -0.25% from most lenders |

| Refinancing Timeframe | 2–5 business days (average approval) |

| Federal Benefit Warning | Refinancing ends access to income-driven repayment and PSLF |

| Best Federal Alternative | Direct Consolidation Loan (keeps protections, no rate reduction) |

| New 2026 Repayment Plan | RAP (Repayment Assistance Plan) replaces SAVE, PAYE by July 2026 |

| Best Option for International Graduates | MPOWER Financing – cosigner-free, rates 2–4% lower than education loans |

Best Student Loan Refinance Rates 2026: How to Save Thousands on Your Education Debt

Student loan debt remains one of the largest financial burdens affecting millions of graduates worldwide, with American borrowers alone owing over $1.7 trillion in collective student loans. For many, the monthly payment feels overwhelming—whether you’re earning $30,000 or $150,000 annually, debt repayment can consume 10-20% of your income. However, 2026 brings unprecedented opportunities to reduce your financial stress through strategic refinancing and smarter repayment options.

If you’ve spent years making standard monthly payments without exploring alternatives, you could be leaving thousands of dollars on the table. This comprehensive guide reveals how to access the lowest student loan refinance rates available in 2026, understand which strategies actually reduce your monthly payments, and avoid costly mistakes that could extend your repayment timeline.

Key takeaway: Borrowers with solid credit can access refinance rates starting at 3.99% fixed APR—down from historical averages of 5-6%—potentially saving $100-300 monthly on a $50,000 loan balance.

Current Student Loan Refinance Rates in 2026

Interest Rate Landscape

As of January 2026, the student loan refinancing market offers the most competitive rates in recent years:

| Rate Type | Range | Best Available | Notes |

|---|---|---|---|

| Fixed APR | 3.99% – 10.15% | 3.99% (RISLA) | Depends on credit score, income, loan balance |

| Variable APR | 3.84% – 11.41% | 3.84% (Brazos) | Lower initial rates but can increase over time |

| Autopay Discount | -0.25% | Available most lenders | Small but meaningful savings |

Your actual rate depends on four critical factors: credit score, income level, debt-to-income ratio, and loan amount. A borrower with a 750+ credit score and stable income typically qualifies for rates in the 4-5% range, while those with credit scores below 680 may see rates of 7-9%.

Fixed vs. Variable Rates: Which Should You Choose?

Fixed rates lock in your interest rate for the entire repayment term—offering predictability and protection if market rates rise. Most borrowers refinancing in 2026 are choosing fixed rates, with options ranging from 4.24% to 9.99% depending on the lender and borrower profile.

Variable rates start lower (3.84%-4.39%) but fluctuate with market conditions. If rates climb to 7-8% within 2-3 years, your monthly payment could increase significantly. Variable rates make sense only if you plan to aggressively pay down the loan within 5-7 years.

Best Lenders Ranked by Rate and Features

Top 5 Student Loan Refinancing Lenders (2026)

1. RISLA (Rhode Island Student Loan Authority)

- Fixed APR: 3.99% – 8.57%

- Variable APR: Not available

- Best for: Borrowers prioritizing stability and flexible repayment options

- Unique feature: Nonprofit organization offering income-based repayment, extended forbearance up to 24 months, and flexible terms

- Minimum credit score: 680

- Loan range: $7,500 – $250,000

2. SoFi (Social Finance)

- Fixed APR: 4.24% – 9.99% (with all discounts)

- Variable APR: 4.39% – 15.99%

- Best for: Professionals seeking member perks and financial planning tools

- Unique features: No origination or prepayment fees, wealth advisor access, travel discounts, can skip one payment annually

- Minimum credit score: 650

- Loan range: $5,000 – full balance

- Terms: 5, 7, 10, 15, or 20 years

3. Brazos (Texas-Specific)

- Fixed APR: 4.39% – 7.14%

- Variable APR: 3.84% – 6.39%

- Best for: Texas residents seeking the absolute lowest rates

- Unique feature: Nonprofit lender with exceptionally low overhead; lowest variable rates in the market

- Minimum credit score: 720

- Loan range: $10,000 – $400,000

- Geographic limitation: Texas residents only

4. ELFI (Education Loan Finance)

- Fixed APR: 4.88% – 8.44%

- Variable APR: 4.74% – 8.24%

- Best for: Borrowers with high loan balances ($200,000+)

- Unique features: Allows Parent PLUS loan refinancing, 12 months forbearance, no cosigner required

- Minimum credit score: 680

- Loan range: $10,000 – $500,000

5. College Ave

- Fixed APR: 4.45% (with autopay)

- Variable APR: 5.88% (with autopay)

- Best for: Those wanting flexibility in repayment terms

- Unique features: Can refinance with incomplete degree, loan amounts up to $500,000, extended terms available

- Minimum credit score: Not disclosed

- Loan range: $5,000 – $500,000

How Refinancing Saves You Money: Real Calculations

Understanding the actual financial impact makes refinancing decisions clear. Let’s examine three scenarios:

Scenario 1: Recent Graduate with $50,000 Undergrad Debt

Original Loan Details:

- Principal: $50,000

- Original interest rate: 6.5% (typical for federal student loans)

- Term: 10 years

- Monthly payment: $528

After Refinancing:

- New rate: 4.5% (qualifying for mid-tier refinance rate)

- New term: 10 years (same as original)

- New monthly payment: $477

- Monthly savings: $51

- Total savings over 10 years: $6,120

This borrower saves over $6,000 by refinancing once, with no changes to their monthly budget commitment.

Scenario 2: Advanced Degree Holder with $120,000 in Loans

Original Loan Details:

- Principal: $120,000

- Original rate: 7.0% (graduate student loans average higher)

- Term: 10 years

- Monthly payment: $1,421

After Refinancing:

- New rate: 5.0% (strong credit profile)

- New term: 10 years

- New monthly payment: $1,273

- Monthly savings: $148

- Total savings: $17,760

Scenario 3: Using Extended Terms to Lower Monthly Payments

Many borrowers don’t need long-term savings—they need breathing room in monthly cash flow.

Original Loan Details:

- Principal: $75,000

- Original rate: 6.0%

- Term: 10 years

- Monthly payment: $797

Refinance Strategy: Lower Rate + Extended Term

- New rate: 4.5%

- New term: 15 years (extended from 10)

- New monthly payment: $558

- Monthly savings: $239 (30% reduction)

- Trade-off: Additional $5,700 in total interest over 15 vs. 10 years

This strategy is ideal for young professionals, entrepreneurs, or anyone with irregular income who needs cash flow relief while building career stability.

Federal vs. Private Refinancing: The Critical Distinction

This decision is often misunderstood, and choosing incorrectly could cost you access to essential protections.

Federal Student Loans: What You Must Know

Federal loans come with government-backed protections that private lenders cannot replicate:

- Income-driven repayment plans: Payments capped at 5-10% of discretionary income

- Public Service Loan Forgiveness (PSLF): Loan forgiveness after 10 years of public sector employment

- Disability discharge: Full loan forgiveness if you become permanently disabled

- Death discharge: Loans forgiven upon borrower death

- Forbearance and deferment: Pause payments during financial hardship for extended periods (up to 3 years with some plans)

The Refinancing Trade-Off

When you refinance federal loans with a private lender, you permanently lose these protections. Your federal loans become private loans, and once that conversion happens, there’s no reverting to federal status.

You should refinance federal loans only if:

- You have stable, reliable income ($70,000+)

- You’re not pursuing Public Service Loan Forgiveness

- You have excellent credit (700+)

- You’re confident you won’t face job loss, disability, or income reduction for 10+ years

- You want to be debt-free faster (private refinancing often enables shorter terms)

You should NOT refinance federal loans if:

- You work in public service (government, teaching, nonprofit)

- Your career is unstable or income is irregular

- Your credit score is below 700

- You’re uncertain about your financial future

- You’re counting on income-driven repayment to manage payments

Federal Consolidation (Alternative to Refinancing)

If you have multiple federal loans but want to keep federal protections, Direct Consolidation Loans allow you to combine them without losing benefits. However, consolidation does NOT lower your interest rate—your new rate becomes the weighted average of all consolidated loans, rounded up to the nearest 1/8th percent.

Consolidation makes sense if you’re juggling 5+ different loans and want simplicity, but it won’t save you money compared to original loan terms.

Income-Driven Repayment Plans: The Free Way to Lower Monthly Payments

Before refinancing, federal loan borrowers should understand that 2026 brings major changes to income-driven repayment options. This is critical because federal IDR plans can lower your monthly payment to nearly $0 if your income is low, without changing your interest rate or refinancing at all.

Current Plans (Available Until July 2026)

SAVE Plan (Saving on a Valuable Education)

- Payment: 5-10% of discretionary income above $35,000

- Forgiveness: After 25 years of payments

- Subsidized interest benefit: Unpaid interest doesn’t accrue

- Status: Being phased out July 1, 2026

PAYE (Pay As You Earn)

- Payment: 10% of discretionary income

- Forgiveness: After 20 years

- Eligibility: Limited to loans disbursed before 2026

Income-Based Repayment (IBR)

- Payment: 10-15% of discretionary income

- Forgiveness: After 20-25 years

- Status: Continuing after 2026 in modified form

The New Repayment Assistance Plan (RAP) – Effective July 1, 2026

Congress passed sweeping changes affecting federal loan repayment. Starting July 1, 2026, new federal loans will only have access to two options:

- Standard Repayment Plan (10-25 year fixed term)

- Repayment Assistance Plan (RAP)

RAP Details:

- Payment calculation: 1-10% of all adjusted gross income (no income protection)

- Minimum payment: $10/month

- Forgiveness: After 30 years

- Major changes: Eliminates unemployment deferment; forbearance capped at 9 months per 24-month period (vs. 36 months previously)

- Parent PLUS loans: NOT eligible for RAP

Example: A borrower earning $45,000 annually with $80,000 in federal loans might pay $125-225/month under RAP (1-10% of income), compared to standard 10-year payments of $950/month.

Critical action for current borrowers: If you’re on SAVE, PAYE, or ICR, you must choose IBR or RAP by July 1, 2028, or your servicer will auto-enroll you.

Consolidation vs. Refinancing: Which Strategy Wins?

Borrowers often conflate these options, but they serve different purposes. Here’s the breakdown:

Direct Consolidation (Federal)

What it does: Combines multiple federal loans into one Direct Consolidation Loan

| Aspect | Details |

|---|---|

| Interest rate | Weighted average of all loans (rounded up 1/8%) – NO SAVINGS |

| Monthly payment | Can decrease if you extend the term to 25 years |

| Federal benefits | PRESERVED – keep income-driven repayment, PSLF eligibility |

| Processing time | 4-6 weeks |

| Best for | Simplifying payments while keeping federal protections |

Private Refinancing

What it does: Replaces federal and/or private loans with a new private loan

| Aspect | Details |

|---|---|

| Interest rate | Based on creditworthiness – can be MUCH lower (4-5% vs. 6-7%) |

| Monthly payment | Usually decreases due to lower rate; can extend term further |

| Federal benefits | LOST – no income-driven repayment, no PSLF, no forgiveness |

| Processing time | 2-5 business days |

| Best for | Those with strong credit seeking lower rates and willing to lose federal benefits |

Decision Framework

Choose Consolidation if:

- You’re pursuing Public Service Loan Forgiveness

- You work in public service or nonprofits

- Your income is unstable

- You want the simplest path (one payment) while keeping federal safety nets

Choose Refinancing if:

- Your credit score is 700+

- You have stable, predictable income

- You won’t need income-driven repayment or PSLF

- You want the lowest possible interest rate and monthly payment

Step-by-Step Refinancing Process

Refinancing is faster and simpler than most borrowers expect. Here’s the complete journey:

Step 1: Check Your Credit Score and Eligibility

- Use free tools like Credit Karma or AnnualCreditReport.com

- Aim for 700+ for best rates; 650+ for approval

- Gather income documentation (past 2 years tax returns, current pay stubs)

- Review current loan details and total balance

Step 2: Compare Lenders and Prequalify

- Visit top lenders (SoFi, Earnest, ELFI, College Ave)

- Use their “Get My Rate” tools (soft credit check—doesn’t impact score)

- Compare fixed vs. variable rates, loan terms, and fees

- No origination or prepayment fees from most major lenders

Step 3: Choose Your Loan Terms

- Repayment term: 5-20 years (longer term = lower monthly payment but more interest)

- Interest type: Fixed for stability; variable for short-term borrowers

- Loan amount: Refinance all loans or specific ones (e.g., only federal loans)

Step 4: Submit Full Application

- Provide personal info, income, employment details

- Upload tax returns, pay stubs, loan statements

- Complete identity verification

- Processing: 2-5 business days

Step 5: Lock Your Rate and Receive Terms

- Lender provides final loan terms

- Review APR, monthly payment, total interest

- Decide whether to proceed

Step 6: Lender Pays Off Old Loans

- Upon approval, refinancing lender pays off your existing loans directly

- Old servicers close accounts

- You receive new loan account details

Step 7: Begin Repayment

- Make first payment within 30-45 days

- Set up autopay (usually gives 0.25% rate discount)

- Enjoy lower monthly payment

International Students and Graduates: Your Refinancing Options

One frequently overlooked opportunity: international graduates with U.S. degrees and work authorization can refinance student loans, opening access to significantly lower rates.

Who Qualifies?

To refinance as an international student/graduate, you typically need:

- Education: Degree from accredited U.S. or Canadian university

- Work authorization: Valid visa (H1-B, OPT, or approved status) with 2+ years remaining

- Work experience: Minimum 3-6 months of employment history

- Income: Stable, verifiable U.S. income

- Credit: U.S. credit history (challenging for international borrowers) or strong financial profile

Specialized Lenders for International Borrowers

MPOWER Financing

- Specializes in international student loan refinancing

- No cosigner or collateral required

- Refinance up to $100,000 of education loans

- Works with loans from ANY institution worldwide (including Indian education loans)

- Free immigration guidance and job placement assistance

- Eligible visa types: OPT, H1-B, and others

Process for MPOWER:

- Verify you graduated from U.S./Canadian university

- Confirm employment eligibility (OPT, H1-B, etc.)

- Complete online application with documentation upload

- MPOWER pays original lender

- Begin repayment on new, lower-rate loan

Estimated savings: International borrowers working in the U.S. can often reduce rates by 2-4% compared to original education loans, resulting in $100-400/month in savings on typical education loan balances.

Common Mistakes That Cost You Thousands

Mistake #1: Refinancing Without Checking Cosigner Release Requirements

If you have a cosigner, most lenders allow cosigner release after 24 consistent on-time payments. This is the golden opportunity to remove parental cosigners from your debt.

Cost of mistake: Keeping a cosigner indefinitely can affect their credit and limit their future borrowing capacity. This costs your parent an average of $5,000-$15,000 in denied credit opportunities or higher rates on mortgages/loans.

Mistake #2: Extending Loan Terms to Unsustainable Lengths

While a 20-year term dramatically lowers your monthly payment, you could pay $50,000-$100,000+ in additional interest compared to a 10-year term.

Better approach: Refinance for a shorter term (10-12 years) and budget for the payment. As your income grows, use raises or bonuses to pay down principal faster—most refinance loans have zero prepayment penalties.

Mistake #3: Refinancing Federal Loans Without Understanding Forgiveness Loss

If you work in public service or nonprofit sectors, refinancing federal loans eliminates your eligibility for PSLF (which forgives remaining balance after 10 years of qualified payments).

Cost of mistake: Losing PSLF can cost $50,000-$200,000+ depending on your loan balance. Always verify your PSLF eligibility before refinancing.

Mistake #4: Choosing Variable Rates Without Understanding Caps

Some variable-rate loans have “rate caps”—limits on how high rates can climb. However, unsecured loans may have no cap, meaning your rate could theoretically reach 12%+ if the market changes dramatically.

How to avoid: Always ask lenders: “What is the lifetime cap on this variable rate?” If they can’t provide a clear number, choose fixed rates instead.

Mistake #5: Ignoring Autopay Discounts

Most lenders offer 0.25% interest rate reductions for setting up automatic payments. On a $100,000 loan, this saves approximately $200-300 over the loan’s life.

Action: Enable autopay the moment your loan begins. It’s the easiest $200 you’ll earn.

Frequently Asked Questions

Q1: Will refinancing hurt my credit score?

A: Refinancing triggers a “hard inquiry,” which temporarily drops your score by 5-10 points. However, your score typically recovers within 3-6 months. The long-term benefit (lower interest, faster payoff) far outweighs this temporary dip.

Q2: Can I refinance federal loans and keep income-driven repayment?

A: No. Once you refinance federal loans with a private lender, they become private loans with no access to IDR plans. This is a permanent change, so only refinance if you’re certain you won’t need income-based payment flexibility.

Q3: What’s the difference between consolidation and refinancing?

A: Consolidation combines multiple federal loans into one federal loan (no rate reduction, preserves benefits). Refinancing replaces one or more loans with a new private loan (can lower rate, loses federal benefits).

Q4: How long does the refinancing process take?

A: From application to receiving funds: 2-5 business days with online lenders. Your old servicer may take an additional 1-2 weeks to close your original account. You’ll receive a first payment due date from your new lender.

Q5: Can I refinance if I have bad credit?

A: Most lenders require minimum credit scores of 650-680. If your credit is below 650, options include: (1) waiting 6-12 months and building credit, (2) adding a cosigner, or (3) exploring income-driven repayment for federal loans (no credit check required).

Q6: Should I refinance federal Parent PLUS loans?

A: PLUS loan refinancing is technically available, but be cautious: you’ll lose federal benefits and income-based repayment options. Parent PLUS loans are not eligible for the new Repayment Assistance Plan starting July 2026, making federal consolidation increasingly unattractive. Refinancing may be your best option if you can secure a rate below 5-6%.

Q7: How much can I save by refinancing?

A: Typical savings: $50-$300/month, totaling $6,000-$50,000 over the loan term. The actual amount depends on your current rate, new rate, loan balance, and repayment term.

Q8: What happens if I lose my job after refinancing?

A: Unlike federal loans with deferment and forbearance options, private lenders have fewer protections. Most offer limited forbearance (3-12 months). Before refinancing, ensure you have 6+ months of emergency savings or stable career prospects.

Q9: Can I pay off my refinanced loan early without penalties?

A: Yes. All major lenders offer zero prepayment penalties, meaning you can pay extra toward principal or pay off the entire loan early without fees.

Q10: Is refinancing worth it if I’m planning to pursue Public Service Loan Forgiveness?

A: Absolutely not. PSLF forgives remaining federal loan balance after 10 years of qualified payments in public service roles. Refinancing eliminates this benefit permanently. Stick with federal consolidation or income-driven repayment if PSLF is part of your strategy.

Conclusion: Your 2026 Refinancing Action Plan

The headline: Refinancing in 2026 offers the most favorable interest rate environment in recent years, with rates as low as 3.99% fixed APR available to qualified borrowers. For a $50,000 loan balance, this could translate to $6,000+ in savings—equivalent to a year of full-time income for many young professionals.

The decision: Refinancing is not a one-size-fits-all decision. If you have federal loans and are pursuing PSLF, work in public service, or have income uncertainty, prioritize federal consolidation or income-driven repayment instead. But if you have stable income, strong credit, and don’t need federal protections, refinancing can be transformative.

The next step: This week, visit two lenders (SoFi and ELFI, or RISLA if you prefer nonprofit options) and get prequalified using their “Get My Rate” tools. Prequalification takes 5 minutes and doesn’t impact your credit score. Compare rates, and if you find options 1-2% lower than your current rate, proceed with full applications.

For international graduates: If you’re working in the U.S. on valid visa status, explore MPOWER Financing—you may qualify for rates 2-4% lower than your current education loans, with specialized support for visa holders.

The guardrail: Only refinance if you meet three criteria: (1) credit score 700+, (2) stable income, and (3) certainty you won’t need federal loan benefits. Otherwise, wait, build credit, or explore federal consolidation and income-driven repayment first.

Your lower monthly payment is closer than you think—but only if you take action today.

Additional Resources

- Federal Student Aid: studentaid.gov/articles/faqs-idr-plan/ — Official federal IDR plan details and RAP changes

- Credible Rate Comparison Tool: Compare real offers from multiple lenders with soft credit check

- Nerd Wallet Student Loan Calculator: Estimate monthly payments and total interest across scenarios

- MPOWER Financing (International Graduates): International refinancing specialist with cosigner-free options

Leave a Reply

You must be logged in to post a comment.