Lead is a critical base metal. It powers global industries. Every lead shipment needs proper classification. This classification uses HS codes. HS codes determine tariffs. They ensure compliance. They unlock trade advantages.

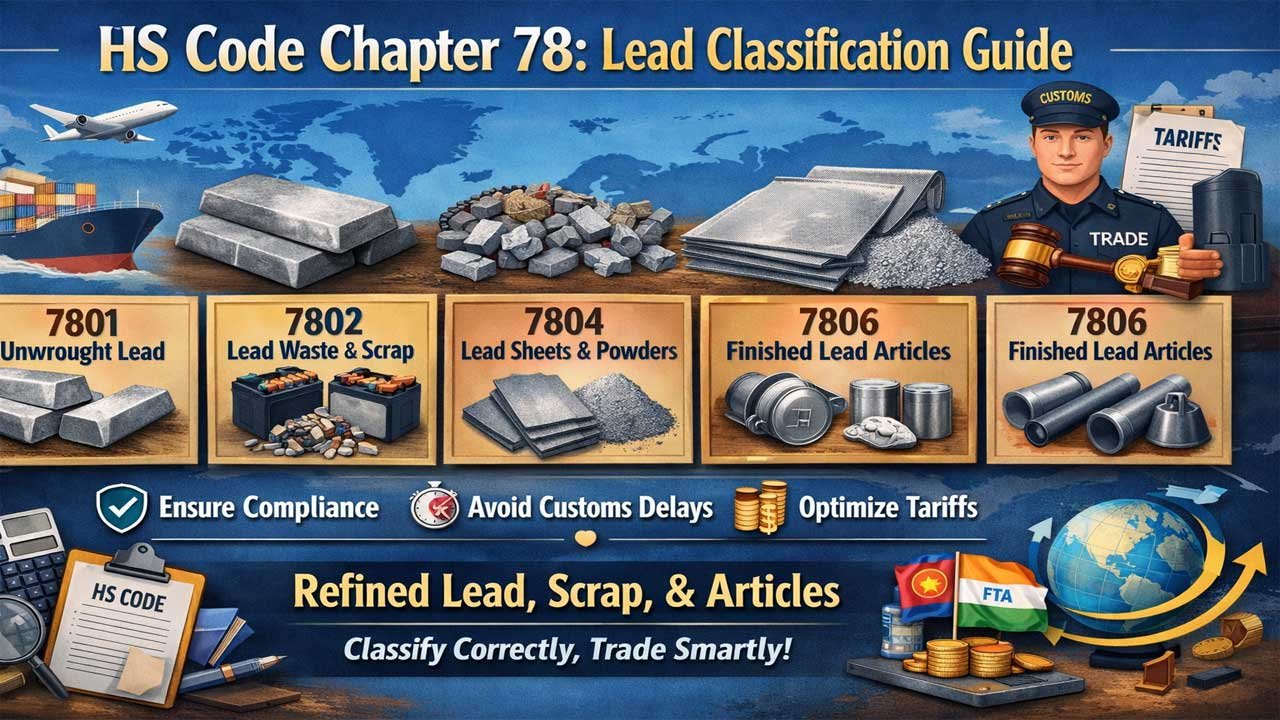

Chapter 78 covers all lead products. It includes unwrought lead. It covers lead waste and scrap. It encompasses lead sheets and articles. Understanding these codes saves money. It prevents customs delays. It protects your supply chain.

This guide explains lead classification. It covers all major HS codes. It details tariff rates. It shows industrial applications. Use this guide for import/export operations. Use it for tariff planning. Use it for compliance management.

What Is an HS Code?

HS stands for Harmonized System. It is the global trade language. Every product has a code. The code is six digits. It identifies what you trade.

The first two digits identify the chapter. Lead products fall under Chapter 78. The next two digits narrow the category. The last two digits specify the exact type.

HS codes are uniform globally. They are recognized by all customs authorities. They determine applicable duties. They control product eligibility. They affect import restrictions.

The World Customs Organization maintains the system. It updates codes every five years. The latest version is the 7th edition. New amendments reflect market changes. Traders must stay current.

Why does this matter? Misclassification costs money. Wrong codes trigger penalties. Correct classification unlocks savings. Accurate codes speed customs clearance. Proper codes enable duty relief.

HS Code Chapter 78: Lead and Articles Thereof

Chapter 78 is dedicated entirely to lead. It includes all lead forms. It covers lead alloys. It encompasses lead waste and scrap. It includes finished lead articles.

Four main headings organize this chapter:

Heading 7801 covers unwrought lead. This means pure lead metal. It includes refined and unrefined forms.

Heading 7802 covers lead waste and scrap. This includes recycled lead material. It covers lead from batteries. It includes manufacturing waste.

Heading 7804 covers lead plates and sheets. It includes lead strips and foils. It covers lead powders and flakes. These are semi-finished forms.

Heading 7806 covers finished lead articles. It includes sanitary fixtures. It covers lead seals and blanks. It encompasses miscellaneous products.

The chapter structure follows WCO guidelines. It uses General Rules of Interpretation. Each code narrows product description. The system ensures precise classification.

HS Code 7801: Unwrought Lead

Unwrought lead is the foundation category. It means lead in raw or raw-like form. It does not include shaped articles. It includes ingots and other primary forms.

HS Code 78011000: Refined Lead

Refined lead is the highest quality. It contains at least 99.9% lead by weight. Maximum allowed impurities are tightly controlled. Silver cannot exceed 0.02%. Arsenic cannot exceed 0.005%. Bismuth cannot exceed 0.05%. Copper cannot exceed 0.08%.

Product Forms Include:

- Lead ingots

- Lead blocks

- Lead pigs (castings)

- Refined lead anodes

- Refined lead cathodes

This code applies to pure lead. It covers remelted refined lead. It includes lead from recycled batteries. It applies when purity exceeds 99.9%.

Pricing Impact: Refined lead commands premium prices. Higher purity means higher value. Buyers pay more for guaranteed quality. This code attracts high-value shipments.

HS Code 78019100: Antimony-Lead Alloys

This code covers lead with antimony. Antimony must be the principal other element. It means antimony exceeds all other elements. Lead content remains below 99%.

Antimony strengthens lead. It improves hardness. It increases performance in applications. It reduces cost compared to pure lead.

Typical Compositions:

- 95-98% lead with 2-5% antimony

- Used in battery grids

- Applied in cable sheathing

- Employed in solder applications

- Used in bearing metals

This code requires antimony dominance. If another element exceeds antimony, use code 78019990 instead.

HS Code 78019910: Pig Lead

Pig lead is crude lead. It comes directly from smelting. It has not undergone refining. It contains various impurities. It is cheaper than refined lead.

“Pig” refers to the casting shape. Lead cools in large molds. This creates pig-shaped ingots. Hence the name “pig lead.”

Typical Impurities:

- Copper (0.5-1.5%)

- Silver (0.01-0.05%)

- Arsenic (0.05-0.2%)

- Tin (0.05-0.2%)

- Bismuth (0.01-0.1%)

Pig lead contains precious metals. Silver content adds value. Copper adds substantial value. Recyclers process pig lead for these metals.

Applications:

- Battery manufacturing (after refining)

- Solder production (after processing)

- Cable sheathing manufacture

- Glass manufacturing additives

- Coating operations

HS Code 78019920: Unrefined Lead

Unrefined lead has undergone partial processing. It exceeds pig lead quality. It falls below refined lead standards. It contains 99% lead or less.

This category covers intermediate products. It includes lead from specialized smelting. It encompasses partially purified material. It covers lead alloys under 99% purity.

Characteristics:

- Lead content: 95-99%

- Impurities: Similar to pig lead

- Processing: Some purification applied

- Quality: Inconsistent purity levels

Market Uses:

- Industrial battery plates

- Construction roofing materials

- Automotive components

- Heavy equipment manufacturing

- Radiation shielding production

HS Code 78019930: Unrefined Lead Alloys

This code covers alloy blends. The lead content is below 99%. No single element dominates (except lead). Multiple alloying elements are present.

Common alloy components include:

- Copper (strengthens the alloy)

- Tin (improves properties)

- Antimony (increases hardness)

- Arsenic (improves durability)

- Calcium (reduces corrosion)

Industrial Applications:

- Bearing alloys (important in machinery)

- Free-cutting alloys

- Solder compounds

- Cable sheaths

- Storage battery components

These alloys serve specific purposes. Each composition target delivers particular properties. Manufacturers customize alloys for applications. Cost considerations drive alloy selection.

HS Code 78019990: Other Unwrought Lead

This is the catch-all code. It covers unwrought lead not classified above. It includes mixed compositions. It encompasses experimental or unusual forms. It covers products of uncertain classification.

Examples Include:

- Lead in unusual physical forms

- Mixtures with uncertain composition

- Experimental lead products

- Special alloys

- Remelted mixed lead sources

This code serves as a fallback. Traders use it when specific codes don’t apply. It requires detailed product description. Customs may request specifications.

HS Code 7802: Lead Waste and Scrap

Lead is the most recycled metal. Over 99% of lead waste is recycled. This code covers all scrap sources. It encompasses battery waste. It includes manufacturing scrap. It covers demolition material.

HS Code 78020010: Lead Scrap

Lead scrap has specific definitions. The International Scrap Recycling Institute (ISRI) lists accepted forms.

ISRI Code Words Include:

Racks: Soft lead scrap from various sources.

Radio: Mixed hard or soft lead scrap.

Relay: Lead from covered copper cable.

Ropes: Wheel weights from vehicles.

Roses: Mixed common babbit material.

Proper classification requires ISRI codes. These codes standardize the global trade. They ensure quality consistency. They facilitate sorting and processing.

Quality Grades:

- Pure scrap (minimal contamination)

- Mixed scrap (various sources)

- Dross (oxidized material)

- Slags (foundry byproducts)

Scrap lead commands lower prices than refined lead. The recovery process adds costs. But recycling remains economically viable. Environmental benefits drive regulations.

HS Code 78020090: Other Lead Waste

This code covers lead waste not listed above. It includes sweepings and dust. It covers sludges from refineries. It encompasses oxide waste.

Examples:

- Lead oxide powder from smelters

- Lead-contaminated soil (from operations)

- Lead paint chips (from removal)

- Battery paste (from disassembly)

- Dross and dust from foundries

This code requires detailed declarations. Customs needs composition information. Environmental specifications apply. Some material faces restrictions.

HS Code 7804: Lead Plates, Sheets, Strip and Foil

This code covers semi-finished forms. These are products in flat or powder form. They are not finished articles. They require further processing.

HS Code 78041110: Thin Sheets and Strip (≤0.2mm)

These are very thin products. Thickness does not exceed 0.2 millimeters. These products are typically for foil. They are used in specialized applications.

Characteristic Applications:

- Lead foil for packaging (pharmaceutical)

- Decorative foil for luxury goods

- Thermal barrier foil

- Radiation protection thin sheets

- X-ray room lining materials

Very thin lead is expensive to produce. Accuracy in thickness is critical. Higher prices reflect manufacturing precision.

HS Code 78041120: Foil (≤0.2mm)

Foil is extremely thin sheet lead. It is used in final consumer applications. It provides barrier properties. It offers radiation protection benefits.

Primary Uses:

- Pharmaceutical packaging

- Expensive chocolate wrapping (luxury items)

- Wine bottle covers (premium wines)

- Decorative applications

- Medical radiation protection

Foil production requires specialized equipment. Quality standards are strict. Defects cause rejection. Price reflects manufacturing challenges.

HS Code 78041910: Plates

Plates are thicker forms. Thickness exceeds 0.2 millimeters. They are used in construction. They serve radiation shielding purposes.

Common Applications:

- X-ray room protective panels

- Industrial radiation shielding

- Roofing components

- Tank linings

- Architectural panels

HS Code 78041990: Other Sheet Forms

This covers intermediate thicknesses. It includes unusual shapes. It encompasses specialized forms.

HS Code 78042000: Lead Powders and Flakes

These are particulate forms. They are used in specific applications. They serve specialized industrial purposes.

Applications Include:

- Lead oxide production (key for batteries)

- Paint pigments (limited use now)

- Polymer additives

- Cosmetic applications (limited)

- Industrial coating materials

Powder production requires milling. Flake production uses specialized processes. Particle size varies by application. Coarser materials cost less. Finer powders command premiums.

HS Code 7806: Other Articles of Lead

This code covers finished lead products. It includes articles beyond those listed above. It encompasses lead components. It covers manufactured items.

HS Code 78060010: Sanitary Fixtures

These are lead products for bathrooms. They include lead pipes. They cover lead fittings. They encompass lead fixtures for water systems.

Examples:

- Lead pipes for water systems

- Lead solder joints (for pipe connection)

- Lead pipe fittings

- Lead valves

- Lead connections and couplings

Important Note: Many countries restrict lead in drinking water systems. The U.S. EPA limited lead in water supplies. The EU restricted lead in certain applications. Always verify local regulations. Compliance requirements vary by country.

HS Code 78060020: Indian Lead Seals

These are custom Indian lead seals. They serve governmental purposes. They are used for customs sealing. They represent official marking. This code is specific to India.

The classification reflects official Indian requirements. These seals verify shipments. They prevent tampering during transit. They carry legal significance.

HS Code 78060030: Blanks

Lead blanks are unfinished articles. They require further processing. They are partially shaped components. They serve as intermediate products.

Examples:

- Blank plates for future shaping

- Stamping blanks for manufacturing

- Prefabricated components

- Semi-finished hardware

HS Code 78060090: Other Lead Articles

This is the catch-all code. It covers finished articles not classified above. It includes niche products. It encompasses specialized applications.

Examples May Include:

- Organ pipe lead (for musical instruments)

- Lead weights (for fishing or diving)

- Lead balancing weights (for vehicles)

- Radiation aprons (with lead)

- Medical shielding products

- Lead-lined doors and frames

Industrial Applications and Uses of Lead

Lead serves many critical industries. Understanding applications helps traders. It guides market analysis. It supports supply chain decisions.

Lead-Acid Batteries (80% of Lead Use)

Lead-acid batteries dominate lead consumption. This includes automotive batteries. It encompasses stationary batteries. It covers marine applications. It includes backup power systems.

Automotive Applications:

- Starter batteries (traditional vehicles)

- Hybrid vehicle batteries

- Electric vehicle reserve power

- Motorcycle and scooter batteries

- Heavy truck batteries

Stationary Applications:

- Uninterruptible power supply (UPS) systems

- Telecom backup power

- Data center power backup

- Renewable energy storage

- Grid stabilization

Battery production drives lead demand. India is a major battery manufacturer. Battery exports create steady lead demand. Recycling from batteries supplies significant material. This creates circular economy benefits.

Radiation Shielding Applications

Lead is exceptionally effective against radiation. Its high density provides protection. Its atomic structure absorbs radiation. Healthcare facilities use lead extensively. Industrial applications use lead protection.

Medical Applications:

- X-ray room protective barriers

- Lead aprons for personnel

- Thyroid shields (during X-rays)

- CT scan protection

- Radiotherapy facility construction

Industrial Applications:

- Nuclear facility shielding

- Airport security screening rooms

- High-energy physics laboratories

- Power transmission protection

- Aerospace shielding applications

Radiation protection drives specialized demand. Medical facilities require consistent supply. Regulatory compliance mandates lead use. This ensures stable market demand.

Construction and Roofing

Lead has been used in construction for centuries. Its corrosion resistance is unmatched. Its lifespan exceeds 100 years. Historic buildings use lead extensively.

Traditional Uses:

- Roof flashings (around chimneys)

- Roof valleys

- Gutter materials

- Window frames (in historic buildings)

- Architectural details

Modern Restrictions: Many countries have restricted lead in new construction. Environmental concerns drive restrictions. Health hazards from lead dust exist. Lead paint regulations are strict. Modern construction typically avoids lead.

Ammunition Production

Lead remains the primary ammunition material. Its density enables ballistic performance. Its workability simplifies manufacturing. It remains cost-effective.

Ammunition Uses:

- Small arms ammunition (bullets)

- Shotgun ammunition (pellets)

- Hunting ammunition

- Range ammunition

- Military ammunition

Ammunition demand is variable. It responds to security situations. Regulatory changes affect availability. Global tensions impact demand.

Alloy Manufacturing

Lead improves many alloys. It enhances material properties. It reduces overall cost. It enables specific applications.

Alloy Applications:

- Solder (for electronics assembly)

- Bearing metals (for machinery)

- Free-cutting steels

- Brass alloys (for fittings)

- Type metal (for printing)

Lead content varies by alloy. Compositions are carefully controlled. Exact specifications drive pricing. Material science guides formulation.

Cable Sheathing

Lead provides waterproof cable protection. It prevents moisture penetration. It offers superior protection duration. Many cables still use lead sheathing.

Cable Applications:

- High-voltage power cables

- Underground cables

- Submarine cables

- Telephone cables

- Fiber optic protective sheathing

Modern cables increasingly use alternatives. Environmental regulations reduce lead use. Cost pressures encourage substitutes. Yet lead remains preferred for some applications.

Shipbuilding Applications

Lead provides corrosion resistance at sea. Its durability exceeds steel. Its maintenance is minimal. Maritime applications value these properties.

Shipbuilding Uses:

- Ballast for stability

- Protective plating against corrosion

- Deck components

- Hull repair materials

- Equipment shielding

Nuclear Applications

Lead is essential in nuclear facilities. It absorbs neutron radiation. It provides thermal protection. It enables safe operations.

Nuclear Uses:

- Reactor shielding

- Spent fuel storage protection

- Transportation casks

- Facility construction

- Cooling systems

Nuclear demand is stable. It supports long-term supply relationships. Regulatory requirements ensure consistency.

Tariff Rates and Customs Duty

Understanding tariff rates is critical. Rates vary by country. Rates change by specific code. Rates affect total cost of goods.

India Customs Duty

India applies customs duties to lead imports. The rates vary by product type.

Basic Customs Duty (BCD):

- Rates vary from 0% to 25%

- Specific rates depend on HS code

- Rates apply to CIF value (Cost, Insurance, Freight)

- Rates change periodically

Recent Historical Rates:

- Copper, zinc, and lead duty: 25% (recent years)

- Previous rates: 35% (pre-2002)

- Tin duty: 15%

- Aluminum duty: 15%

Integrated Goods and Services Tax (IGST):

- IGST applies on most lead products

- Rate: Typically 5-18% depending on classification

- Rates vary by specific HS code

- Rate for 7801: 12% IGST

Social Welfare Surcharge:

- 10% of the duty value

- Applies to most imports

- Additional cost to consider

GST Classification in India

GST rates for lead products in India:

| HS Code | Product Description | GST Rate |

|---|---|---|

| 7801 | Unwrought Lead | 12% |

| 7802 | Lead Waste and Scrap | 5% |

| 7804 | Lead Sheets and Powders | 12% |

| 7806 | Other Lead Articles | 12% |

Calculation Example:

- Refined lead ingots: $100,000 CIF

- BCD at 25%: $25,000

- SWS (10% of duty): $2,500

- IGST (12% on total): $15,300

- Total duty cost: $42,800

- Effective cost: $142,800

Trade Agreements and Duty Relief

India has trade agreements providing duty relief:

Free Trade Agreements (FTAs):

- India-ASEAN FTA

- India-Japan CEPA

- India-South Korea CEPA

- India-UAE CEPA

- India-Sri Lanka FTA

Goods originating in FTA countries may qualify for preferential tariffs. Tariff reduction ranges from 25% to 100%. Rules of origin apply. Proper certification is required. Documentation must be precise.

Tariff Impact on Business

Tariff planning affects profitability. Lower duty rates reduce import costs. Duty savings improve margins. Proper classification ensures best rates. Misclassification costs money. Incorrect duties trigger penalties.

Compliance and Best Practices

Correct classification protects your business. Compliance avoids costly mistakes. Best practices ensure smooth operations.

Step 1: Gather Product Information

Document exact specifications:

- Product composition (percentage of each element)

- Physical form (ingots, powder, scrap, etc.)

- Thickness or dimensions

- Purity level or alloy composition

- Intended industrial use

- Country of origin

- Processing history

Detailed information enables accurate classification. Vague descriptions create confusion. Customs may request clarification. Documentation saves time.

Step 2: Consult Classification Guidelines

Reference official sources:

- WCO Harmonized System Notes

- India Customs Classification Manual

- Flexport HS Code Database

- Official Ministry of Commerce guidance

- Industry-specific classification guides

Official sources provide authoritative guidance. They reflect current interpretations. They explain edge cases. They answer complex questions.

Step 3: Research HS Code Rulings

Check customs rulings for similar products:

- U.S. CBP CROSS database

- Indian Customs Rulings

- EU TARIC database

- Precedent cases

Historical rulings guide decisions. They show how similar products were classified. They reveal decision logic. They anticipate customs perspectives.

Step 4: Verify with Customs Authority

Before major shipments, consider pre-classification:

- Submit sample to customs

- Request advance ruling

- Ask for written confirmation

- Document the response

- Keep records for future reference

Pre-classification prevents disputes. It provides certainty. It reduces clearance time. It demonstrates good faith compliance.

Step 5: Maintain Documentation

Keep detailed records:

- Product specifications

- Customs rulings

- Certificates of analysis

- Test reports

- Purchase orders

- Commercial invoices

- Bills of lading

Documentation supports your position. It proves compliance efforts. It assists in any disputes. It shows professional operations.

Step 6: Monitor Regulatory Changes

HS codes and tariffs change:

- Subscribe to tariff update notifications

- Monitor WCO amendments

- Track Indian customs updates

- Join industry associations

- Attend trade seminars

Staying current prevents compliance failures. Regulations change every five years. Trade agreements evolve. Duty rates shift. Proactive monitoring protects your interests.

Common Classification Mistakes

Mistake 1: Confusing Refined vs. Unrefined Lead

- Refined lead: 99.9% minimum purity (7801 10 00)

- Unrefined lead: Below 99% purity (7801 99 20)

- Test certificates prevent confusion

- Supplier documentation is critical

Mistake 2: Missing Alloy Element Requirements

- Antimony-lead must have antimony as principal element (7801 91 00)

- Other alloys use different code (7801 99 30)

- Composition testing is essential

- Supplier certifications prevent errors

Mistake 3: Misclassifying Waste and Scrap

- Refined scrap uses 7802 codes

- ISRI codes determine proper classification

- Quality standards define category

- Contamination changes classification

Mistake 4: Wrong Product Form Classification

- Unwrought vs. semi-finished distinction matters

- Powder and foil have specific codes

- Finished articles use 7806

- Physical form determines code

Mistake 5: Overlooking Free Trade Agreements

- FTA eligibility changes tariff rates

- Rules of origin must be satisfied

- Certification is required

- Savings can be substantial (up to 100%)

Tariff Planning Strategies

Smart businesses optimize tariffs. Strategic planning reduces costs. Proper planning improves competitiveness.

Strategy 1: Origin Optimization

Choose suppliers strategically:

- FTA countries offer lower tariffs

- Origin determines tariff eligibility

- Content requirements vary by agreement

- Supplier selection affects costs

- Supply chain design matters

Strategy 2: Product Form Selection

Consult with suppliers on form:

- Semi-finished vs. unwrought affects tariff

- Powder vs. ingots have different rates

- Form impacts industrial compatibility

- Cost-benefit analysis guides decisions

- Flexibility preserves options

Strategy 3: Advance Ruling Requests

Request official classification before import:

- Certainty prevents future disputes

- Documentation supports position

- Provides audit trail

- Demonstrates compliance commitment

- Reduces customs examination risk

Strategy 4: Customs Broker Partnership

Engage experienced customs brokers:

- Expertise prevents errors

- Relationships with officials help

- Current knowledge of regulations

- Experience with edge cases

- Professional representation

Strategy 5: Documentation Excellence

Maintain comprehensive records:

- Bills of lading

- Commercial invoices

- Test certificates

- Suppliers’ declarations

- Internal classification analyses

Strong documentation prevents disputes. It demonstrates good faith. It supports your position. It facilitates customs clearance.

Frequently Asked Questions (FAQ)

Q: What is the difference between refined and unrefined lead?

A: Refined lead contains at least 99.9% lead. Unrefined lead contains less than 99%. Impurities in refined lead are strictly controlled. Refined lead is more expensive. Higher purity ensures reliability. Unrefined lead is suitable for many industrial purposes. Cost difference drives selection.

Q: Can I use any HS code for lead scrap?

A: No. Lead scrap requires specific ISRI code words. Standard classifications exist for all scrap types. Proper coding ensures fair pricing. Misclassification reduces value. Verification of scrap grade is essential. Official documentation prevents disputes.

Q: Do I need duties on lead waste imports?

A: Yes, but rates are lower. Waste typically falls under 7802 codes. IGST rates are generally 5%. Basic customs duty varies. Duty rates reflect environmental policy. Recycling is encouraged through lower tariffs. Your supplier should specify applicable codes.

Q: What is the lead content requirement for alloys?

A: Lead must be the primary element. Lead content must exceed any other element. Statistical definitions apply. Maximum content limits exist for specific impurities. Test certificates prove composition. Supplier declarations document content. Official analysis prevents misclassification.

Q: How do I determine if my shipment qualifies for FTA benefits?

A: Check the Free Trade Agreement terms. Rules of origin apply. Sufficient domestic content is required. Percentage requirements vary by agreement. Certificate of origin is mandatory. Supplier documentation must specify origin. Customs may verify claims. Professional guidance is recommended.

Q: What happens if I misclassify lead?

A: Customs may assess higher duty. Penalties apply for intentional misclassification. Shipment may face detention. Reshipment costs are high. Fines can be substantial. Classification disputes delay operations. Professional classification prevents these problems.

Q: Are there restrictions on lead imports?

A: Yes, some restrictions exist. Lead in drinking water is restricted. Lead paint has limitations. Some applications face regulations. Environmental rules apply. Verification before shipment is essential. Country-specific regulations vary. Legal review is recommended.

Q: How often do HS codes change?

A: The WCO updates the system every five years. The 7th edition took effect January 2022. Next update expected 2027. Regular monitoring is essential. Your customs broker provides updates. Industry associations provide guidance. Supplier communication helps track changes.

Q: What documentation do I need for lead imports?

A: Detailed documentation includes:

- Commercial invoice

- Bill of lading or airway bill

- Test certificate or analysis

- Supplier declaration

- Packing list

- Certificate of origin (if applicable)

- Import license (if required)

- Customs entry form

Comprehensive documentation speeds clearance. Incomplete documentation causes delays. Professional assistance ensures compliance.

Q: How is lead valued for tariff purposes?

A: Lead is valued on CIF basis (Cost, Insurance, Freight). Pure lead value is lower. Alloys have different values. Scrap has reduced value. Market price influences value. Exchange rates affect calculations. Professional valuation is often required. Customs may verify valuations.

Conclusion

HS Code Chapter 78 comprehensively covers lead and articles. Understanding these classifications is essential. Correct classification saves money. It ensures compliance. It protects operations.

The major codes are:

- 7801: Unwrought lead (refined, unrefined, alloys)

- 7802: Lead waste and scrap

- 7804: Lead forms (sheets, powders, foils)

- 7806: Finished lead articles

Lead serves critical industries. Battery manufacturing dominates demand. Radiation shielding requires specialized applications. Construction uses persist. Industrial applications are diverse.

Tariff rates significantly impact costs. India applies 12-25% basic duty. IGST adds additional cost. Free trade agreements provide relief. Proper planning optimizes expenses.

Best practices prevent errors. Gather detailed specifications. Consult official sources. Request advance rulings. Maintain documentation. Monitor regulatory changes.

Lead classification requires attention. Mistakes are costly. Compliance protects business interests. Professional guidance ensures success.

Businesses trading lead benefit from specialized knowledge. Customs brokers provide expertise. Legal consultation addresses complex issues. Industry associations offer support. Investment in knowledge pays dividends.

Lead will remain a strategic commodity. Industrial demand continues. Recycling provides supply. Environmental benefits drive policy. Markets will evolve. Classifications will adapt.

Stay informed. Monitor changes. Maintain compliance. Optimize tariffs. Consult professionals. Protect your business. Success in lead trade demands precision. This guide provides the foundation.