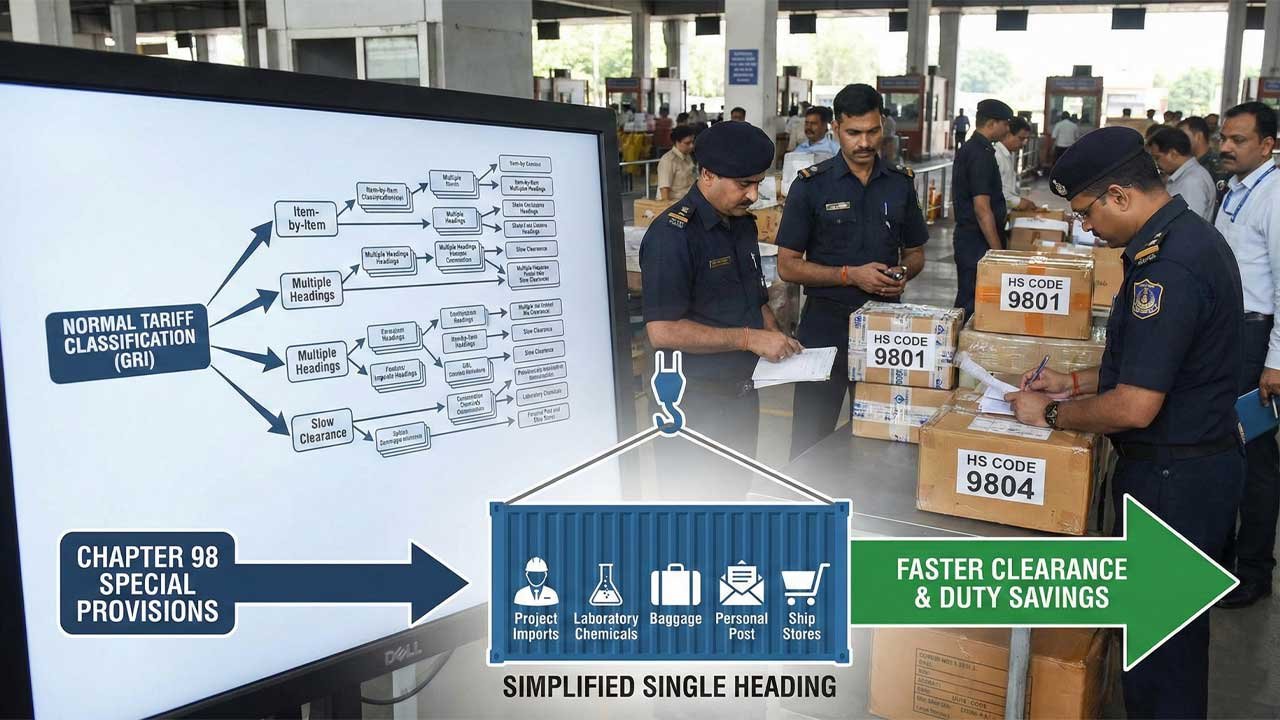

Special classification provisions under HS Codes, contained in Chapter 98 of India’s Customs Tariff, are special rules that override normal tariff classification to simplify customs assessment, apply a single flat duty rate, and enable faster clearance for specific categories of imports such as project imports (9801), laboratory chemicals in small packs (9802), passenger baggage (9803), personal-use goods imported by post or air (9804), and ship stores (9805).

Unlike normal classification based on the General Rules of Interpretation (GRI), which requires item-by-item analysis across multiple headings, Chapter 98 allows eligible goods to be assessed under one heading with simplified documentation, significantly reducing processing time, compliance complexity, and customs duty costs.

These provisions exist to promote efficiency, support key sectors like infrastructure, research, travel, healthcare, and maritime trade, and deliver substantial duty savings, provided strict eligibility conditions and documentation requirements are met.

What Are Special Classification Provisions in HS Codes?

Special classification provisions are unique rules. They simplify customs duty assessment. These rules apply to specific types of goods. They override normal tariff classifications. Chapter 98 contains all special provisions. This chapter exists in India’s customs tariff. It provides duty savings opportunities. It enables quick customs clearance. Businesses benefit from simplified compliance. This is why understanding Chapter 98 is critical.

The main goal is efficiency. Importers pay a single flat duty rate. They don’t need individual product assessment. This saves time. This saves money. The customs process becomes faster. Documentation becomes simpler.

The General Rules of Interpretation (GRI) Framework

Before understanding special classifications, you must know the General Interpretative Rules. There are six rules in total.

GRI 1 sets the foundation. Classification is determined by heading terms. It’s determined by section notes. It’s determined by chapter notes.

GRI 2 applies to incomplete goods. It applies to unassembled items. It applies to mixtures and combinations. Essential character principle determines classification.

GRI 3 applies when goods fit multiple headings. Part 3(a): Choose the most specific description. Part 3(b): Use essential character for mixed goods. Part 3(c): Use the last numerical heading.

GRI 4 covers goods unclassifiable by GRI 1-3. Classification follows similarity principles. It’s applied as a last resort.

GRI 5 governs packaging classification.

GRI 6 determines subheading classification. It’s applied within selected headings.

| General Rule | Application | Use |

|---|---|---|

| GRI 1 | Heading terms and notes | First priority |

| GRI 2 | Unfinished goods and mixtures | Incomplete articles |

| GRI 3 | Multiple applicable headings | Specificity and essential character |

| GRI 4 | No GRI 1-3 application | Default classification |

| GRI 5 | Packaging materials | Container assessment |

| GRI 6 | Subheading levels | Detailed classification |

HS Code Structure: Understanding the System

The Harmonized System organizes all products globally. Understanding its structure is essential.

The HS comprises 21 Sections. These cover broad product categories. 99 Chapters exist within these sections. Chapters group related products. There are 1,244 headings. Headings provide specific classifications. There are 5,224 subheadings. Subheadings offer detailed categorization.

The structure follows degree of manufacture. Raw materials appear first. Semi-finished goods follow. Finished products come last. This logical arrangement aids classification.

Code structure varies by country:

- First 6 digits: International HS code (identical worldwide)

- Digits 7-8: Regional extensions (EU uses TARIC codes)

- Digits 9-10: National extensions (USA uses HTS codes)

India’s system extends to 8 digits. The first six are universal. The last two are India-specific.

Chapter 98: Project Imports (Heading 9801)

Project imports represent the largest special classification category. This heading applies to industrial projects.

Eligible projects include:

- Industrial plant projects

- Irrigation plant projects

- Power generation projects

- Mining projects

- Oil and mineral exploration projects

- Government-notified public interest projects

What can be imported:

- All machinery and prime movers

- Instruments, apparatus, and appliances

- Control gear and transmission equipment

- Auxiliary equipment (R\&D, testing, quality control)

- Components (finished or unfinished)

- Raw materials for manufacturing

- Spare parts and consumable stores

Key benefit: Goods classified under 9801 cannot be classified elsewhere. This is unique. A single flat duty rate applies. Assessment becomes simplified. Duty savings become significant. This matters for high-value capital equipment.

Registration requirement: The contract must be registered with customs beforehand. This is mandatory. Assessment cannot proceed without registration.

Excluded entities: Hotels, hospitals, photographic studios, laundries, garages, and workshops don’t qualify. Single or composite machines don’t qualify. This is important to verify.

Chapter 98: Laboratory Chemicals (Heading 9802)

Laboratory chemicals enjoy special classification treatment. This is heading 9802.

Scope: All chemicals qualify. They can be organic or inorganic. They must be chemically defined or undefined. The packaging size matters. Packing must not exceed 500 grams. Packing must not exceed 500 millilitres.

Why this rule exists: Small pack laboratory chemicals face obstacles. Normal classification becomes impractical. Individual assessment adds costs. The special provision eliminates this burden. One flat duty rate applies to all qualifying chemicals.

Examples of qualifying items:

- Research chemicals

- Testing reagents

- Analytical standards

- Diagnostic chemicals

- Educational laboratory supplies

Duty advantage: This classification offers significant duty reduction. Compared to general chemical imports, savings are substantial.

Important note: The packing size rule is strict. Containers exceeding 500g or 500ml don’t qualify. They require normal classification.

Chapter 98: Passenger Baggage (Heading 9803)

Passenger baggage receives special treatment. This is heading 9803.

What qualifies:

- All dutiable articles

- Imported by passengers

- Imported by crew members

- Carried in personal baggage

Special benefit: All baggage items receive a single duty rate. Individual assessment is unnecessary. Customs clearance accelerates. No separate tariff classification is needed.

Exclusions apply:

- Motor vehicles

- Alcoholic drinks

- Goods imported through courier services

- Articles imported under import licenses

- Articles with customs clearance permits

Practical application: A passenger brings multiple items. Electronics, clothing, jewelry, gifts—all qualify. One assessment covers everything. This simplifies customs processes. Travelers benefit from faster processing.

Duty advantage: Baggage items often receive preferential duty rates. This is deliberate policy. Tourism and travel are encouraged.

Chapter 98: Personal Use Importations (Heading 9804)

Personal use goods imported by post or air get special classification. This is heading 9804.

What qualifies:

- Drugs and medicines for personal use

- Diagnostic test kits

- Specified formulations

- Braille watches

- Braille alarm clocks

- All dutiable articles for personal consumption

Key restriction: The aggregate value limit matters. Goods cannot exceed the prescribed fair retail value. This varies by region. The limit prevents commercial importation under personal use claims.

Postal imports: Goods imported by air or post qualify automatically. No import license needed. No customs clearance permit needed. This speeds up processing significantly.

Medical exemptions: Certain drugs receive special concessions. Diagnostic kits gain preferential treatment. Healthcare supplies are prioritized.

Compliance requirement: Personal use must be genuine. Goods cannot be for commercial purposes. The obligation to declare applies. The customs officer verifies claims.

Chapter 98: Ship Stores (Heading 9805)

Ship stores receive special classification. This is heading 9805.

What qualifies:

- Prepared or preserved meat

- Fish and vegetables

- Dairy products

- Soup and lard

- Fresh fruits

- All other consumable stores

- Excludes fuel and lubricating oils

- Excludes alcoholic drinks

- Excludes tobacco products

Purpose: These provisions support international maritime commerce. Vessels need supplies during voyages. Quick provisioning is essential. Special classification enables rapid supply.

Duty treatment: Consumable stores receive concessional duty rates. Some items are duty-free. This keeps maritime operations economical.

Declaration requirement: All ship stores must be declared. Manifest documentation is required. Customs inspection may occur. Verification ensures compliance.

Classification Method: The Special Provisions Advantage

How special classifications work:

First, determine if goods qualify. Second, verify the specific heading. Third, apply the appropriate duty rate. Fourth, complete documentation. Fifth, clear customs.

This differs from normal classification. Normal goods follow GRI 1 through GRI 6. They require item-by-item assessment. Multiple headings might apply. Duty rates vary individually. Assessment becomes complex. Time increases significantly.

Special provisions eliminate complexity. One heading applies. One duty rate applies. Assessment becomes standardized. Processing times shrink. Costs decrease. Compliance simplifies.

The note to Chapter 98 is critical:

“This Chapter is to be taken to apply to all goods which satisfy the conditions prescribed therein, even though they may be covered by a more specific heading elsewhere in this nomenclature.”

This means special provisions override specific classifications. Once goods qualify, standard headings don’t apply. The special heading takes precedence.

Practical Comparison: Special vs. Normal Classification

The difference is substantial. Consider these scenarios.

Scenario 1: Project Machinery

- Normal classification: Individual assessment of pumps, generators, pipes, valves, controls

- Each item gets separate heading

- Duty rates vary widely

- Assessment time: 20-30 days

- Documentation complexity: High

- Special classification (9801): All under one heading, one rate, 3-5 days, simple documentation

Scenario 2: Laboratory Chemicals

- Normal classification: Each chemical analyzed separately, potentially dozens of different codes

- Complex documentation required

- Higher duties applied

- Assessment time: 15-20 days

- Special classification (9802): All chemicals under one heading, one rate, 2-3 days, basic documentation

Scenario 3: Passenger Baggage

- Normal classification: Each item classified separately, creating huge processing burden

- Electronics, clothing, jewelry—different rates

- Assessment time: Days to weeks

- Documentation: Extensive

- Special classification (9803): Everything under one heading, one rate, same-day clearance

Scenario 4: Personal Use Goods

- Normal classification: Individual assessment required

- Value calculations complex

- Documentation heavy

- Assessment time: 10-15 days

- Special classification (9804): All items covered, one rate, postal goods auto-cleared, 1-2 days

| Classification Type | Assessment Time | Duty Rate | Documentation | Complexity |

|---|---|---|---|---|

| Normal (GRI-based) | 20-30 days | Variable | Extensive | High |

| Special 9801 | 3-5 days | Flat rate | Simple | Low |

| Special 9802 | 2-3 days | Flat rate | Basic | Low |

| Special 9803 | Same day | Flat rate | Minimal | Very low |

| Special 9804 | 1-2 days | Flat rate | Basic | Low |

| Special 9805 | 2-4 days | Flat rate | Standard | Low |

Compliance and Documentation Requirements

Proper documentation is essential. Missing documents delay clearance.

For project imports (9801):

- Contract must be registered with customs

- Registration happens before any clearance order

- Details include: parties, goods, quantities, values

- Payment evidence is required

- Specific project notification needed

- Government approval documentation

For laboratory chemicals (9802):

- Commercial invoice with packing details

- Packing verification (not exceeding 500g/500ml)

- Chemical composition details

- Use declaration (laboratory purposes)

For passenger baggage (9803):

- Passenger identification

- Baggage declaration form

- List of items with values

- Proof of personal use

For personal use goods (9804):

- Importer’s declaration

- Proof of personal use

- Value certification

- Importer’s identity proof

For ship stores (9805):

- Ship manifest

- Store list with quantities

- Import declaration

- Vessel documentation

Best practice: Organize documents systematically. Keep original receipts. Maintain clear records. Pre-clearance verification prevents delays.

Duty Rate Advantages and Savings

Duty savings make special classifications attractive. The flat rate approach delivers significant advantages.

Example calculation: Project imports (9801)

- Industrial equipment worth ₹50 lakhs

- Normal classification (scattered across chapters): 12-28% duty = ₹6-14 lakhs duty

- Special classification 9801: 5% flat duty = ₹2.5 lakhs duty

- Savings: ₹3.5-11.5 lakhs

Example calculation: Laboratory chemicals (9802)

- Mixed chemicals worth ₹10 lakhs

- Normal classification (scattered rates): 10-25% average duty = ₹1-2.5 lakhs

- Special classification 9802: 5-7% flat duty = ₹0.5-0.7 lakhs

- Savings: ₹0.3-1.8 lakhs

Example calculation: Passenger baggage (9803)

- Baggage worth ₹3 lakhs

- Normal classification (scattered rates): 20-40% average duty = ₹0.6-1.2 lakhs

- Special classification 9803: 10% flat duty = ₹0.3 lakhs

- Savings: ₹0.3-0.9 lakhs

These savings matter. For importers, they represent cost reduction. For project developers, they represent capital efficiency. For travelers, they represent affordability.

The duty savings calculator helps:

- Identify eligible goods

- Estimate normal duty rates

- Compare special classification rates

- Calculate potential savings

Professional advice helps optimize savings. Tax consultants specialize in tariff mitigation. Import specialists understand classification nuances. Their expertise delivers real financial benefits.

Key Takeaways for Importers and Exporters

Remember these critical points:

1. Chapter 98 applies to five specific categories: Project imports (9801), laboratory chemicals (9802), passenger baggage (9803), personal use goods (9804), and ship stores (9805).

2. One heading. One rate. Simplified assessment. This is the core benefit. No item-by-item classification. No duty rate variations.

3. Pre-clearance verification is mandatory. Documentation must be complete. Registration requirements vary by heading.

4. Significant duty savings occur. Flat rates replace variable rates. This reduces import costs substantially.

5. Eligibility criteria are strict. Not all goods qualify. Understanding limitations is essential. Professional verification prevents rejections.

6. Processing times accelerate dramatically. Compare 20-30 days (normal) to 1-5 days (special). This matters for time-sensitive imports.

7. Compliance penalties are real. Misclassification leads to fines. Shipments can be seized. Duties are doubled. Prevention is cheaper than remediation.

8. Professional guidance adds value. Tariff specialists provide expertise. They ensure proper classification. They maximize duty savings. They prevent costly errors.

Conclusion

Special classification provisions exist for good reasons. They encourage specific imports. They support economic development. They simplify customs administration. They benefit businesses. They benefit consumers.

Understanding Chapter 98 is essential knowledge. Eligibility determines duty rates. Documentation determines clearance speed. Compliance determines penalties. Knowledge prevents costly mistakes.

If your business involves project imports, laboratory chemicals, passenger goods, or maritime supplies—explore Chapter 98 thoroughly. Consult qualified customs brokers and tariff specialists. The duty savings and processing benefits are substantial. The compliance requirements are manageable. The rewards justify the effort.

Start your classification journey with proper research. Verify your goods’ eligibility. Organize your documentation. Engage professional support. Watch your customs processes accelerate. Experience your costs decline. Achieve your business efficiency goals.